Worldcoin (WLD) is one of the hottest new crypto projects, and many investors are looking for a WLD price prediction for 2025, 2026, and 2027. In this article, we provide a fact-based analysis of WLD’s outlook for 2025, 2026, and 2027.

- Worldcoin Overview and History

- Latest Updates and Ecosystem Developments (May 2025)

- Worldcoin Technical Analysis (RSI, MACD & Moving Averages)

- Worldcoin Price Predictions for 2025, 2026 and 2027

- Worldcoin Expert Price Predictions for 2025, 2026, 2027

- Short-Term vs. Long-Term Outlook

- Factors Impacting WLD’s Price

- Conclusion

- FAQs

- What is Worldcoin (WLD) and how does it work?

- What is World ID Biometrics Used to Prove?

- Can Worldcoin price go to $10 or higher?

- How can I get or buy Worldcoin (WLD)?

- Crypto Glossary

The article will cover Worldcoin’s history, latest updates as of May 2025, technical analysis (RSI, MACD, moving averages), expert predictions from multiple sources, price tables, short-term vs. long-term outlook, key stats, and the factors that will impact WLD’s price.

Worldcoin Overview and History

Worldcoin is a cryptocurrency and digital identity project co-founded by Sam Altman (CEO of OpenAI) and Alex Blania. It’s a “World ID”, a proof-of-personhood system where you scan your iris with a device called the Orb to prove you are human. In return for verifying your identity you get the Worldcoin token (WLD) as an incentive. The vision is to build a globally distributed, human verified crypto network that could enable applications like Universal Basic Income (UBI) in the age of AI.

After over three years of development Worldcoin officially launched on July 24, 2023. The token’s early price went crazy , WLD went from about $0.15 to nearly $2 in its first week of launch. By the end of 2023 Worldcoin hit an all time high of $4.70 on Dec 17, 2023 before the volatility set in.

The project also faced controversy and regulatory scrutiny due to privacy concerns around biometric data. Several countries, including Spain, temporarily banned Worldcoin’s operations pending data protection reviews. Despite these hurdles, Worldcoin continued to grow its user base. By October 2024 over 6.9 million people had their irises scanned to create World IDs.

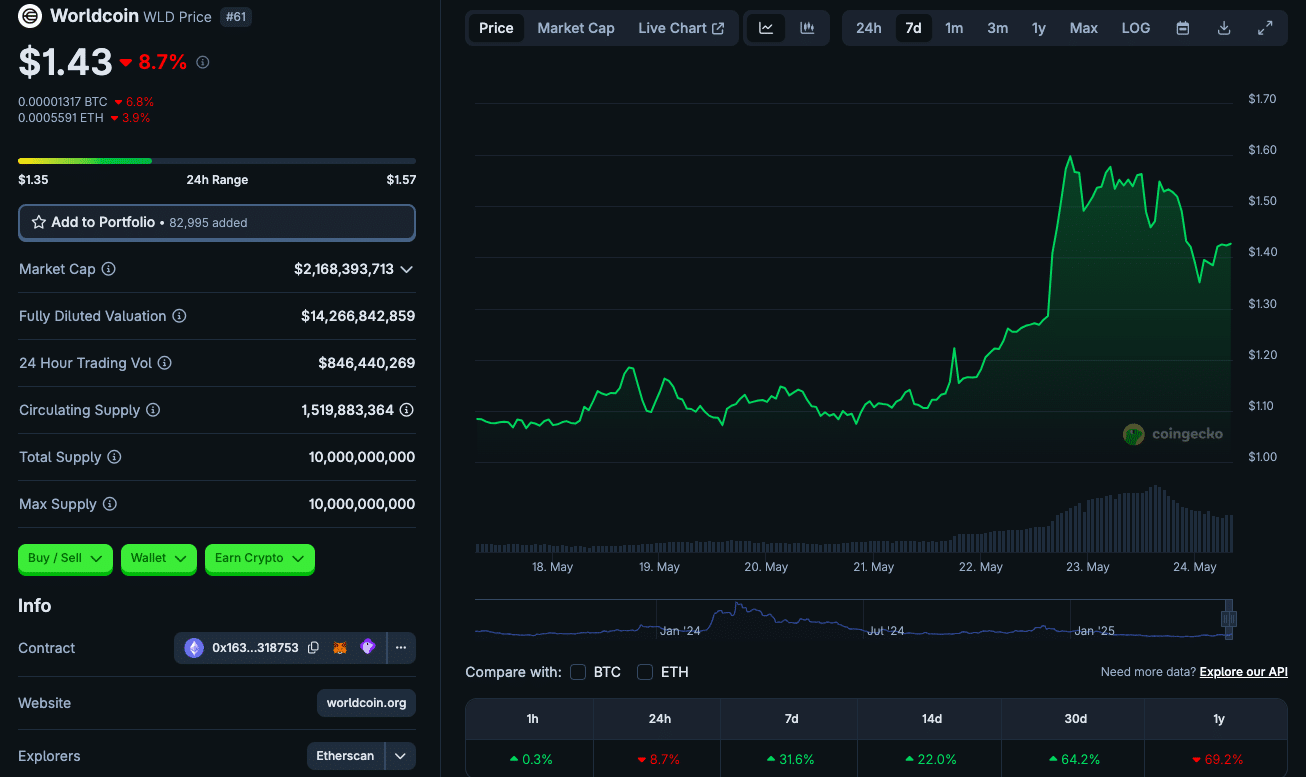

Fast forward to May 2025 and Worldcoin is a top cryptocurrency by market cap. As of May 24, 2025 WLD is trading at $1.43 with a market cap of $2.13 billion and 24 hour volume of $756 million. There are 1.52 billion WLD in circulation. This is way below its all-time high, due to the broader crypto bear market that set in 2024-2025. However, Worldcoin is still actively developing and updating its ecosystem which could impact its price in the future.

Latest Updates and Ecosystem Developments (May 2025)

Worldcoin has had some big developments in the first half of 2025 and some of them are highlighted below;

US Expansion: In May 2025 Worldcoin (rebranded as “World” in some comms) launched in the US. US users can now sign up and get their iris scanned at Orb locations in cities like Atlanta, Austin, Los Angeles, Miami, Nashville and San Francisco. New US users are getting 16 WLD for scanning their iris and the project is offering “pioneer grants” of 150 WLD (~$150+) to early adopters of the World App.

User Growth: The Worldcoin network is surging. As of May 2025, over 12 million iris scans have been completed worldwide, up from 7 million in late 2024. There are 894 Orbs in operation across dozens of countries, with plans to deploy 7,000+ Orbs at dedicated “World Space” centers and retail locations (including Razer store outlets) to reach even more users. This growing community means more distribution and global presence for WLD.

Funding: Worldcoin got funded. The Worldcoin Foundation raised $135 million in May 2025 from venture backers including a16z and Bain Capital Crypto. This will accelerate the global scaling of World ID and the Orb network, especially in the US and other key markets. The news sent WLD up 10%

Tech: The team released a new Orb with 5G and better privacy. They even teased an Orb Mini (a smaller, smartphone-like iris scanner) to make it easier for people to join the network.

Regulatory: The regulatory environment is mixed. Expansion into the US is a good sign (helped by the shift to more crypto friendly policies in 2025), but some regions are cautious. Spain’s data protection agency extended the ban on Worldcoin until the end of 2024 and other countries like Kenya and Nigeria are scrutinizing the project on privacy grounds. How regulators treat Worldcoin (as an ID system vs privacy risk) will be key going forward.

Overall, by May 2025 Worldcoin’s ecosystem is growing despite past issues. 12+ million users, $135 million in funding and tech improvements is the backdrop to evaluate WLD’s future price.

Worldcoin Technical Analysis (RSI, MACD & Moving Averages)

From a technical perspective, Worldcoin’s price in May 2025 is showing some interesting signs. WLD is trading at $1.43 at the moment, up from the 2025 low of $0.70 in March 2025 but still below the 200 day moving average:

Moving Averages: On the daily chart WLD is in a short term uptrend. The 50 day SMA is around $0.96 and the current price is above that (good sign). Even the 100 day SMA at $0.99 has been broken. But the 200 day SMA is higher at $1.48 and WLD has not broken above that yet. So WLD is bullish in the short term but still fighting to reclaim the long term trend. A move above $1.50 (the 200 day average and a resistance) could be a stronger trend reversal. The 200 day exponential moving average $1.71 is the longer term hurdle.

Relative Strength Index (RSI): WLD’s 14 day RSI is 71 as of late May. That’s right at the overbought zone (>70). An RSI in the low 70s means the recent rally has been strong and might be due for a pullback. In fact many oscillators are flashing caution: the Stochastic RSI is at 100 (overbought) and Williams %R is -19 (overbought) too. So traders are looking for bearish divergences or pullbacks.

MACD & Momentum: The MACD (12,26) for WLD is at the neutral line (MACD ~0.01) with a flat histogram, so momentum is balanced at the moment. The MACD hasn’t given a buy or sell signal in recent days. The Average Directional Index (ADX) is 31, which means the current trend has some strength (above 25 usually means a trend is present and here the ADX says the recent uptrend has some strength). Overall the momentum oscillators are bullish but also showing the rally might be losing steam in the very short term.

Support and Resistance Levels: Using pivot analysis, key support levels for WLD are $1.28 and $1.19, with stronger support at $1.03 (if a deep pullback happens). On the upside, immediate resistance is $1.52 (pivot R1), then $1.68, and $1.76 as higher resistance levels. These align with the technical observation that $1.50-$1.60 is a critical zone (also the 200 day MA area). A break above $1.68 could be the start of a move to $2.00, while failure to hold $1.19-$1.20 support could mean a retracement of the recent gains.

In summary, Worldcoin’s technicals are short-term bullish but long-term neutral. Price is above most short-term moving averages, and sentiment is positive (the crypto Fear & Greed Index is at 78 – “Extreme Greed”). But with RSI in overbought and heavy resistance above, there’s a risk of near term consolidation or correction.

Traders might wait for a breakout above $1.5-$1.7 or a dip to support levels to see the next big move. Now with the technicals in mind, let’s look at the expert price predictions for WLD in the coming years.

Worldcoin Price Predictions for 2025, 2026 and 2027

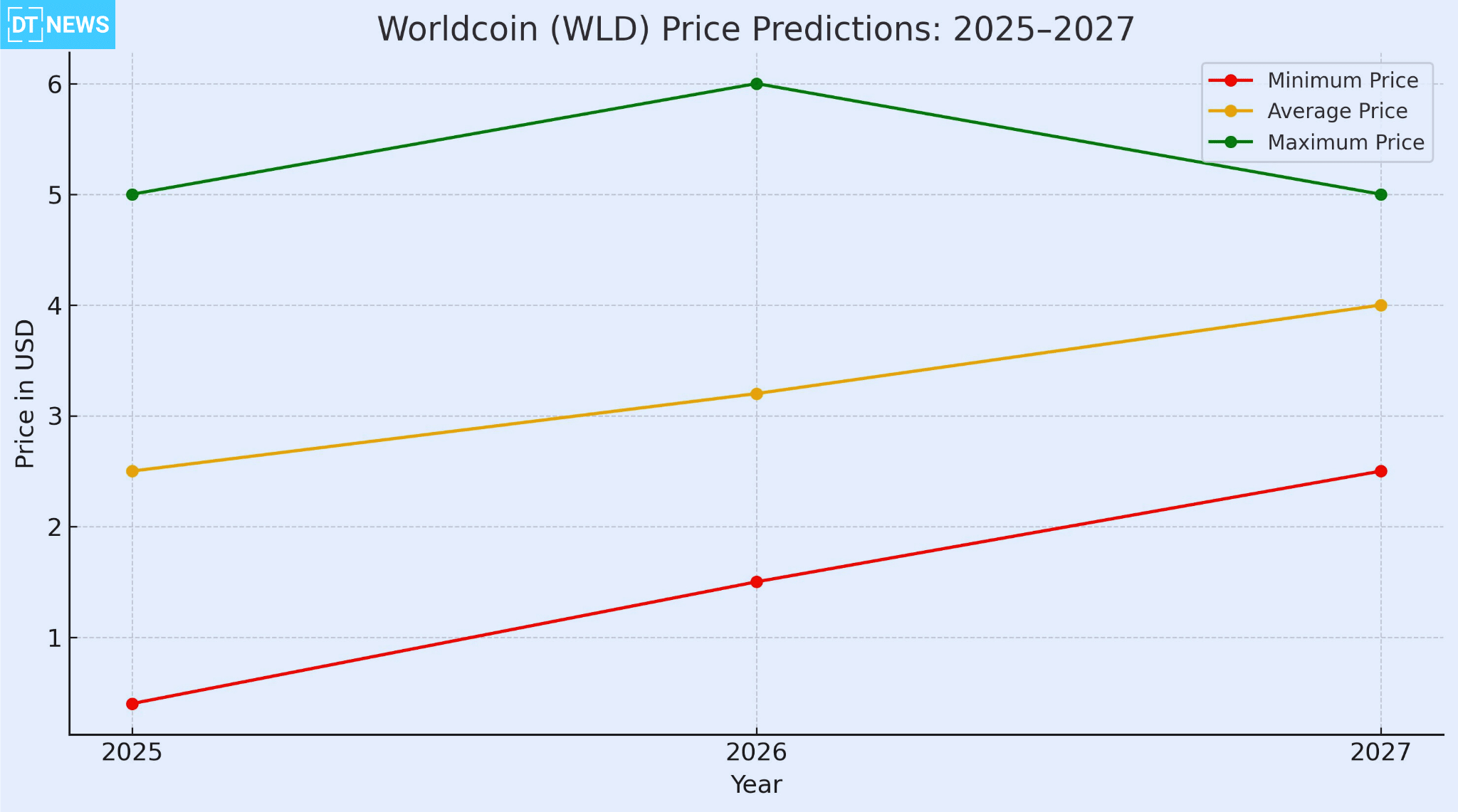

Taking all these into account, can summarize 2025 forecasts in a simple table:

| Years | Minimum Price | Average Price | Maximum Price |

| 2025 | $0.40 (bearish case) | $2.5 (mid-case consensus) | $5.0 (bullish case) |

| 2026 | $1.5 (bearish case) | $3.2 (moderate case) | $6.0 (bullish case) |

| 2027 | $2.5 – $3.0 (stagnant growth) | $4 (moderate adoption) | $5+ (strong adoption and bull market) |

Worldcoin Expert Price Predictions for 2025, 2026, 2027

Different analysts and forecasting platforms have produced a wide range of WLD price predictions. Below are insights from various expert sources – CoinCodex, Changelly, DigitalCoinPrice, Cryptopolitan, and others like TheNewsCrypto – to outline possible scenarios for Worldcoin’s price in 2025, 2026, 2027.

Please note these are speculative estimates, not guarantees. It can be presented to show the range of possibilities:

CoinCodex – 2025: $0.40–$1.39 | 2026: up to $6.05 | 2027: $0.40–$2.05

Changelly – 2025: $3.80–$5.20 | 2026: $6–$7 (projected trend)

DigitalCoinPrice – 2025: $2.11 | 2026: $3.01–$3.61 | 2027: $4.12–$4.85

Tim Draper – 2025/2026: $3.61

CCN – 2025: $0.35–$1.17

Cryptopolitan – 2025: $0.86–$2.11 | 2026: $2.06–$2.48 | 2027: $2.83–$3.33

Coinpedia – 2025: $1.10–$4.18

TheNewsCrypto – 2025: $1.25–$2.44 | 2027: $5.00+

WalletInvestor / TradingBeasts (via 3Commas) – 2026: $2.00–$2.50

These projections reflect a wide range of possibilities, with bullish forecasts suggesting Worldcoin could exceed $5 by 2027, while bearish scenarios point to sustained sub-$2 levels. While opinions diverge, most analysts agree that Worldcoin’s price trajectory will depend on actual adoption, token distribution management, and the broader macroeconomic environment. If Worldcoin fulfills its ambitious vision, then mid-single-digit prices by 2027 appear within reach.

Short-Term vs. Long-Term Outlook

Short-Term (2025): In the short term, Worldcoin’s price will be driven by technicals and news. As mentioned, some technical analysts expect volatility to be high in 2025 with possible dips due to overbought conditions or token unlocks. CoinCodex’s short term target of $0.74 by mid 2025 is cautious and any negative regulatory news could sour sentiment.

On the other hand, successful expansion (millions of new World ID sign ups or major partnerships) could be a catalyst. Watch the $1.50 level , if that breaks in 2025 it could be a trend change. Overall short term view on WLD is guarded optimistic with a lot of caveats: momentum is good right now but the coin is high risk and headline driven.

Long-Term (2026–2027 and beyond): If by 2027 Worldcoin becomes a widely used digital identity standard (dozens of apps or websites using World ID for human verification) demand for WLD could increase dramatically (as the token underpins the ecosystem). In this best case scenario some analysts think WLD could trade in the high single digits.

For example projections for 2030 from some models are $7–$8+ for WLD and Cryptopolitan expects WLD to hit $7 by 2031. Those numbers imply steady growth each year through the late 2020s. There are even ultra bullish outliers (e.g. community speculation of $20+ in a decade) but those assume Worldcoin goes massive global.

On the flip side long term risks are non negligible. Privacy concerns or government bans could limit Worldcoin’s reach. If user growth stalls or if the value proposition of WLD tokens is not clear beyond initial grants the price could stagnate. In a bearish long term scenario WLD could stick to the low dollar range or even fade if the project doesn’t gain traction.

Short term Worldcoin is volatile but leaning bullish on technicals, long term is all about Worldcoin executing on its vision. Many experts are cautiously optimistic WLD will be worth more in 2026–2027 than today but the magnitude of growth is unknown, could be moderate or a moonshot depending on adoption. Investors should consider these scenarios and the following factors that will impact WLD’s price.

Factors Impacting WLD’s Price

A number of fundamental factors will impact Worldcoin’s price over the next few years. Here are some to watch:

User Adoption & Growth: The number of World ID sign ups is arguably the most important metric. As of May 2025 it’s ~12 million and growing. If Worldcoin adds millions of users (especially in high value markets) demand for WLD tokens could increase – from new users getting tokens and from broader network effects if those users drive utility. Rapid user growth tends to support the token’s price (as seen when WLD rallied on new user milestones).

Utility and Ecosystem Development: Currently WLD’s utility is mainly as a governance token and an incentive for sign ups. Expansion of the Worldcoin ecosystem – merchants accepting WLD, apps using World ID (which might require holding or using WLD), Worldcoin based financial services, could create organic demand.

For example Worldcoin is launching a Worldcoin Visa debit card for spending WLD which could increase token usage. Any move towards DeFi integration or Layer-2 adoption (Worldcoin is on the Optimism stack) could also impact the price positively.

Regulatory and Legal Environment: Government regulations will have a big impact on Worldcoin. Positive regulatory news (clear approvals or endorsements of World ID for digital identity) would boost confidence in WLD. Negative regulatory news bans or investigations, e.g. data privacy probes in the EU or clampdown in major markets) can hurt the token.

Worldcoin’s approach to privacy and compliance will be watched closely; negative news in this area can cause big sell offs, while successful navigation of regulations can remove uncertainty.

Tokenomics and Supply Pressure: Worldcoin’s distribution method means continuous token issuance to new users. If hundreds of thousands of people claim 25 WLD every week that’s new supply hitting the market. Sell pressure from token grants or investor unlocks (if early backers or the foundation sell tokens to fund operations) could cap price rises.

On the other hand if a significant portion of WLD gets staked or held long term by participants (reducing circulating supply effectively) it could support the price. Keeping track of how many WLD are liquid versus held by long term holders is important.

Market Sentiment & Macro Trends: Like all cryptocurrencies overall market sentiment (Bitcoin’s cycle, interest rates, risk appetite) will impact WLD. In a bullish crypto market altcoins like WLD often outperform, in a bearish market even good news might not prevent price declines.

Currently the crypto Fear & Greed Index is in “greed” which helped WLD’s rebound. If sentiment turns or if a major incident occurs (e.g. a hack or exploit in the Worldcoin system, or a negative media report) it could move the price dramatically.

Competition and Technological Risks: Worldcoin is the first in the biometric-crypto space but that also means unknown risks. If a competitor launches a similar ID crypto without the perceived privacy issues it could draw interest away. Or if technical issues arise with the Orb or fraud in the system (e.g. fake identities) it could damage confidence.

Worldcoin must have a robust, secure network to justify its value. Additionally advancements in AI that reduce the need for such an identity system (or increase the need) will indirectly impact WLD’s relevance and price.

Conclusion

Worldcoin is a big and controversial idea at the intersection of cryptocurrency and biometric identity. Its price in the next few years (2025, 2026, 2027) will depend on whether it can onboard millions (eventually billions) of users and prove the utility of a global decentralized ID and currency.

At the time of writing, Worldcoin’s tech is looking good for the short term (bullish momentum, rising indicators), but it has hurdles ahead. Regulatory approval, public trust and user growth. Next year will be telling: by the end of 2025, to know if Worldcoin is on track, which should reflect in WLD’s price trending towards the higher end of predictions or hitting roadblocks, which could keep prices down.

As always in crypto, do your own research, stay updated and consider multiple scenarios when evaluating Worldcoin’s future.

FAQs

What is Worldcoin (WLD) and how does it work?

Worldcoin is a crypto project that combines a digital currency (WLD) with a global identity system. Co-founded by Sam Altman of OpenAI. Worldcoin uses a biometric device called the Orb to scan people’s irises and create a unique World ID for each person. This verifies you are a real human (not a bot) without revealing your identity.

What is World ID Biometrics Used to Prove?

In return for scanning your iris you get free WLD tokens. The World ID can then be used to prove personhood in online apps, while WLD is the network’s currency. The goal is to bootstrap a globally distributed, human verified crypto network that could enable UBI and fair airdrops in the future.

Can Worldcoin price go to $10 or higher?

It’s possible but would take a few years and the project to be very successful. $10 WLD would be roughly 7x from $1.40 in May 2025.

How can I get or buy Worldcoin (WLD)?

Two ways to get WLD is to Sign up through Orb Verification or physically visit a Worldcoin Orb and have your iris scanned. Buying on Exchanges, WLD is listed on several major cryptocurrency exchanges. You can buy Worldcoin on platforms like Coinbase, Binance, Huobi, OKX and others that support it.

Crypto Glossary

RSI (Relative Strength Index): technical indicator that measures the magnitude of recent price changes to determine if an asset is overbought or oversold.

MACD (Moving Average Convergence Divergence): trend following momentum indicator that shows the relationship between two moving averages of an asset’s price.

MA (Moving Average): moving average is a line on a price chart that smooths out price data by calculating an average price over a specific period.

Market Cap: total value of a cryptocurrency’s circulating supply.

Volatility: How much and how fast an asset’s price moves.

DeFi (Decentralized Finance): Financial applications built on blockchain networks without centralized intermediaries (like banks).

Circulating Supply: amount of a cryptocurrency that is publicly available and circulating in the market.

Bullish/Bearish: Market sentiment or trend. Bullish means price will go up (upward trend). Bearish means price will go down (downward trend).

Sources

Disclaimer: This forecast is for informational purposes only and should not be considered financial advice. Do your own research before investing.