Bitcoin CME gaps hold a significant role in guiding trader behavior. These gaps, appearing as weekend voids on the Chicago Mercantile Exchange (CME) Bitcoin futures chart, offer crucial insights into price.

- What Causes Bitcoin CME Gaps?

- Why Do Bitcoin CME Gaps Matter for Traders?

- How Do Bitcoin CME Gaps Influence Price Movements?

- What Do Recent Bitcoin CME Gaps Indicate?

- How Can Traders Identify and Trade Bitcoin CME Gaps?

- Additional Factors to Weigh When Trading Bitcoin CME Gaps

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin CME Gaps

Their influence makes them an essential focus for both retail traders and institutions. Traders watch these gaps closely to gain an edge in price action.

What Causes Bitcoin CME Gaps?

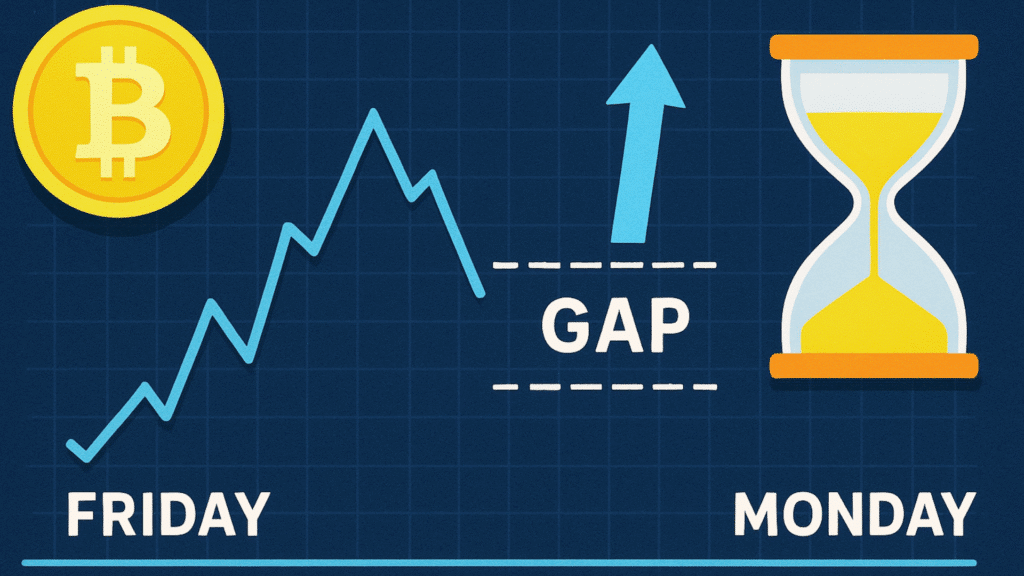

Bitcoin CME gaps occur due to the weekend closure of the CME exchange. While spot Bitcoin trading continues non-stop, CME’s Bitcoin futures trading halts from Friday evening to Monday morning. This pause creates the gaps on futures charts when price shifts happen over the weekend without any CME trades.

Here’s an example. Bitcoin closes Tuesday on CME at $97,600. Over the weekend, buying pushes the price higher. Since no CME trades happen during that time, Monday opens at $98,100, leaving a $500 Bitcoin CME gap on the charts.

The gap reflects the untraded price range between Friday’s close and Monday’s open. These gaps come in two types: gap-ups, where the Monday open is higher than the Friday close, indicating weekend buying strength; and gap-downs, where the Monday price opens lower, signaling selling pressure through the weekend.

The CME originally started in 1898 as the Chicago Butter and Egg Board before evolving into the exchange it is today in 1919.

Why Do Bitcoin CME Gaps Matter for Traders?

The significance of Bitcoin CME gaps goes beyond just chart anomalies. These futures markets are the primary access points for institutional participants such as hedge funds and pension funds. The CME provides a regulated environment with Commodity Futures Trading Commission (CFTC) oversight, giving legal certainty to these large players.

Unlike spot Bitcoin, CME Bitcoin futures are cash-settled, avoiding custody risks like private key management. This controlled setup, coupled with deep liquidity, ensures smooth execution of large trades, making CME gaps a reflection of institutional sentiment and activity. Notably, in October 2025, CME overtook Binance in open interest, securing over 23% share of the crypto futures market.

How Do Bitcoin CME Gaps Influence Price Movements?

Bitcoin’s price often gravitates toward filling these CME gaps once the market reopens. This happens because the liquidity returning to the market tends to correct price discontinuities created over the weekend. These gaps therefore act as key support or resistance zones where price can find temporary stability.

A quick gap fill typically limits short-term downside and suggests that the gap area can hold as support or resistance. However, if the price moves away from a gap without filling it, strong momentum in the opposite direction may be at play, signaling potential continuation of the trend.

Historical data shows over 98% of Bitcoin CME gaps eventually get filled, though timing varies widely. Some gaps close within hours, while others can take months. For example, the gap between $78,000 and $80,700 from November 2024 took nearly four months to be fully resolved.

What Do Recent Bitcoin CME Gaps Indicate?

Bitcoin CME gaps occur weekly, offering regular clues to market tone. On November 18, 2025, a $92,000 Bitcoin CME gap closed quickly. The fast fill suggested a support zone was established following a week of selling pressure, capping short-term downside risk.

In contrast, a $1,770 gap opened on July 25, 2025, and stayed unfilled for more than 16 hours. This rare delay caused uncertainty and put pressure on both institutional and retail traders. Such delays make the market feel riskier and can influence buying decisions.

These examples underline how Bitcoin CME gaps add complexity to market dynamics. Quick fills provide clarity, while slower ones introduce hesitation and heightened volatility.

How Can Traders Identify and Trade Bitcoin CME Gaps?

To capitalize on these gaps, traders first need to identify them by examining CME Bitcoin futures charts for weekend blanks where price jumps or drops occurred between Friday close and Monday open. These blanks mark the Bitcoin CME gaps.

When Bitcoin’s current price lies above a gap, traders watch for pullbacks toward that gap level. Conversely, if price sits below, the gap may represent upside potential as markets often attempt to “fill” these gaps over time. However, these tendencies are guidelines, not certainties, underscoring the need for disciplined risk management.

Key considerations include gap size, larger gaps often lead to greater price swings inside the gap, and trading volume, which confirms whether price moves are backed by strong participation or vulnerable to reversals. Market context matters as well; ranging markets see gaps fill more rapidly than strong trending environments, where gaps may persist longer.

Additional Factors to Weigh When Trading Bitcoin CME Gaps

Large Bitcoin CME gaps require cautious position sizing and wider stop losses due to the increased price range they encompass. High volume accompanying a gap enhances the reliability of the price move, reducing the chance of false signals.

Market conditions also influence gap behavior. More volatile or choppy markets tend to produce faster gap fills, whereas strong trending markets often sustain gaps causing them to remain unfilled for longer durations. Institutional activity further amplifies this effect, as shifts in open interest and trading volumes on CME futures impact gap dynamics heavily.

Therefore, many seasoned traders blend Bitcoin CME gap analysis with broader on-chain data and market sentiment indicators to inform trading decisions prudently.

Conclusion

Bitcoin CME gaps serve as valuable tools for understanding potential price directions. They synthesize weekend price rhythm with institutional flows, helping traders locate meaningful support and resistance zones.

Experts advise pairing gap observations with other analytic tools such as volume analysis and macroeconomic factors to build comprehensive market views. While over 98% of Bitcoin CME gaps eventually get filled, the timing can vary dramatically. Traders must remain patient and vigilant to manage risks effectively.

In short, Bitcoin CME gaps stand as persistent market markers. They anchor psychological price levels and give insight into the market’s ebb and flow, proving indispensable for anyone navigating Bitcoin futures trading today.

Glossary

CME: A big U.S. marketplace where Bitcoin futures are traded under strict rules to keep things safe and fair.

CME Gap: A blank space on the price chart that happens because the CME market closes on weekends, but Bitcoin keeps trading nonstop everywhere else.

Gap Fill: This happens when Bitcoin’s price moves back to the area of the gap and covers that empty space on the chart.

Gap Up: When the market opens on Monday at a higher price than Friday’s close, showing big buyers were active over the weekend.

Gap Down: When the market opens lower on Monday than Friday’s close, meaning sellers dominated during the weekend.

Frequently Asked Questions About Bitcoin CME Gaps

Why do Bitcoin CME gaps happen?

CME Bitcoin futures stop trading from Friday evening to Monday morning, but spot Bitcoin trades all the time. This creates price gaps on Monday when the CME market opens at a new price different from Friday’s close.

Why are CME gaps important?

They show where big institutional traders are active. These gaps often act like invisible support or resistance zones, helping traders guess where Bitcoin’s price might pause or reverse.

Do these gaps usually get filled?

Yes, more than 98% get filled. This means Bitcoin’s price tends to return to the gap area eventually. The time this takes can be hours, days, or even months.

How do market conditions affect gap fills?

When the market moves sideways (ranges), gaps fill faster because prices go back and forth more. In strong trending markets, it can take longer for gaps to fill or they may stay open for a while.

What tools should traders use with CME gaps?

Traders combine gap analysis with other tools like trading volume, overall market trends, and sentiment indicators. Using these together gives a clearer picture and helps manage risk better.