Crypto whales activity surges as market shifts, those holding tens or hundreds of millions in digital assets, can move markets with a single transaction. This week, between May 18 and May 24, 2025, some of the biggest whale wallets became active again, triggering speculation, trend shifts, and renewed volatility across Bitcoin, Ethereum, Dogecoin, and several altcoins.

- Key Takeaway: Smart Money Is Repositioning

- This Week’s Top Whales Transactions

- 1. BlackRock Adds $430.8M in Bitcoin

- 2. Dogecoin Whales Acquire 740 Million DOGE

- 3. Maker (MKR) Whale Activity Spikes 469%

- 4. $TRUMP Token Sees $1.45M Whale Inflows

- 5. Ethereum Whale Converts 60 WBTC to 3,151 ETH

- Crypto Whales Activity and Market Impact

- What Retail Investors Should Watch

- Most-Watched Wallets This Week

- Conclusion: Whales Are Whispering

- FAQs

- Glossary of Key Terms

Data from Whale Alert, Santiment, and top exchanges shows a noticeable spike in whale transfers, suggesting a mixture of accumulation and exit strategies ahead of June’s macroeconomic reports and regulatory updates.

Key Takeaway: Smart Money Is Repositioning

The Whale Activity Score, which tracks large-volume movements, hit a four-week high this Thursday, often a precursor to trend reversals or momentum bursts. Analysts believe we’re entering a “stealth repositioning phase”, where whales quietly prepare for larger moves.

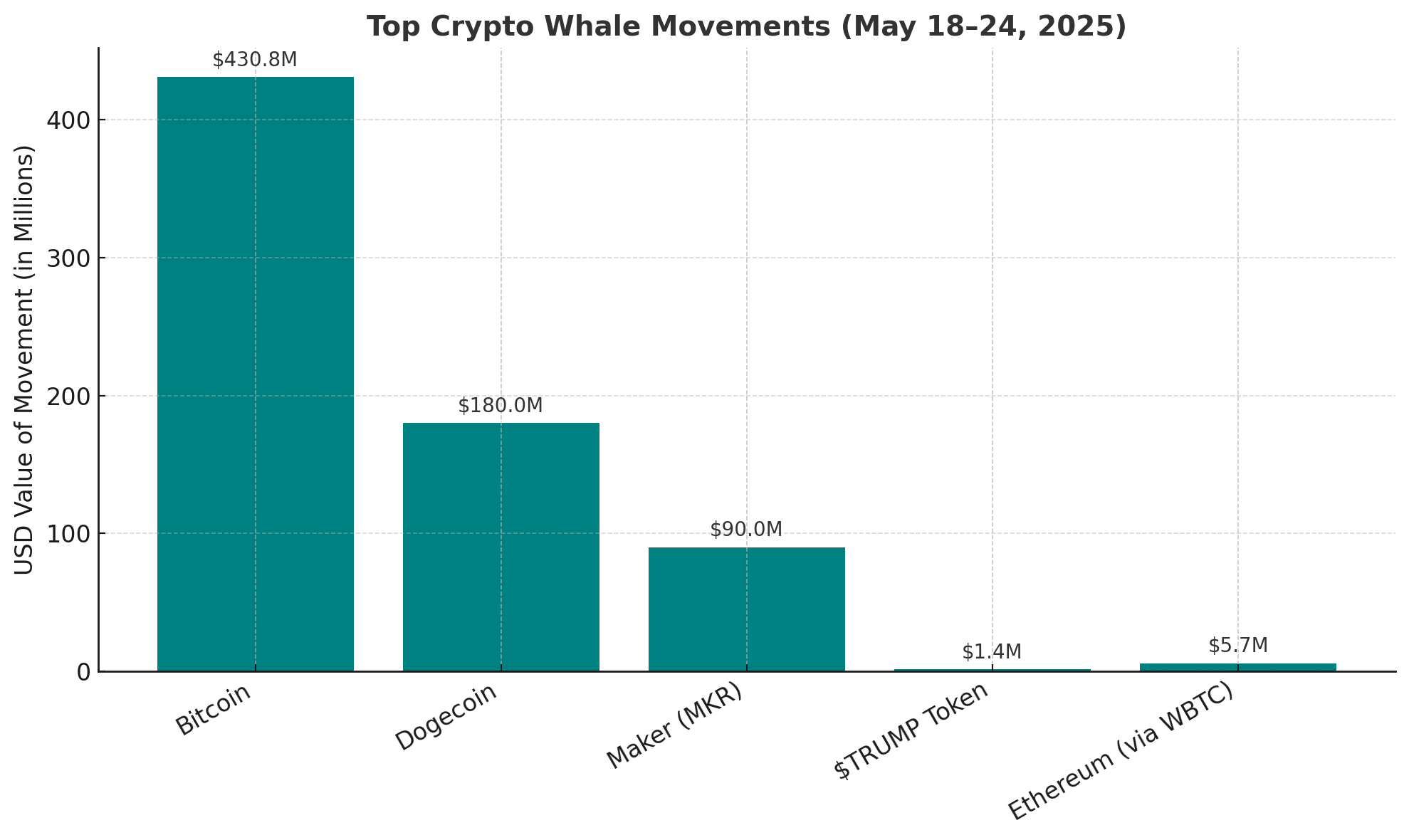

This Week’s Top Whales Transactions

1. BlackRock Adds $430.8M in Bitcoin

BlackRock has made headlines again, this time scooping up over $430 million worth of BTC into its ETF-tracking wallets. The move confirms continued institutional accumulation amid inflation fears and Fed policy uncertainty.

“When BlackRock buys, it’s rarely about the short term,” said Adam Marcus, lead analyst at Bitwise. “They’re anchoring long-term conviction in crypto’s value proposition.”

2. Dogecoin Whales Acquire 740 Million DOGE

Over 740 million DOGE tokens (worth approx. $180M) have moved into cold wallets, mostly offloaded from Binance and Robinhood. This bulk accumulation aligns with rumors that X (formerly Twitter) may launch microtransactions using DOGE later this summer.

DOGE is currently trading at $0.245, up nearly 9% from last week.

3. Maker (MKR) Whale Activity Spikes 469%

The DeFi heavyweight Maker is back on whales’ radar. A 469% surge in whale netflow was recorded after its protocol TVL jumped 12% in three days. Several Ethereum-based whales transferred over $90 million in MKR to private custody wallets.

4. $TRUMP Token Sees $1.45M Whale Inflows

Amid media hype and political drama, whales funneled $1.45 million into the Official Trump token ($TRUMP). Analysts suggest speculative buying ahead of potential campaign-related promotions. The token is up 15.2% on the week.

5. Ethereum Whale Converts 60 WBTC to 3,151 ETH

A large holder converted 60.3 Wrapped Bitcoin (WBTC) (~$5.7M) into 3,151 ETH, indicating shifting trust from BTC to Ethereum ahead of ETF listing speculation.

Crypto Whales Activity and Market Impact

The timing of these moves is no coincidence. With the FOMC’s June statement, potential Ethereum ETF approval, and rising global tensions, whales are repositioning for volatility.

Accumulations like DOGE and MKR indicate bullish sentiment

Large exchange deposits (e.g., WBTC conversions) may suggest internal rebalancing or sector rotation

Trump token inflows hint at speculative political plays influencing crypto narratives

What Retail Investors Should Watch

Whales behavior is often an early indicator of market sentiment — but interpreting it correctly matters. Not every large transfer is bullish.

Bullish Signs:

Transfers from exchanges to cold wallets = accumulation

Stablecoins moving into exchanges = possible buy-side pressure

Multi-wallet accumulation across DeFi protocols

Bearish Signs:

Multiple large deposits into exchanges

Whales are converting volatile assets to USDT or USDC

Large sell-offs tied to ETF rebalancing or fear

“Watch what whales do, not what they say,” notes Santiment analyst Karen DuMont. “Their timing is almost always deliberate.”

Most-Watched Wallets This Week

| Wallet Alias | Activity | Asset | Movement |

|---|---|---|---|

| BlackRock Custody | Accumulation | BTC | +$430M |

| “DogeCommander” | Binance to Cold Wallet | DOGE | +$180M |

| MKR_Whale_902 | Exchange Withdrawals | MKR | +$90M |

| TrumpWhale52 | Decentralized Swap Aggregator | $TRUMP | +$1.45M |

Conclusion: Whales Are Whispering

This week’s whale activity paints a clear picture: the smart money is on the move, and it’s not waiting for the headlines to catch up. From BlackRock’s massive Bitcoin accumulation to surprise inflows into meme coins and DeFi tokens, whales are quietly reshaping the market landscape ahead of major catalysts.

For everyday investors, these movements are more than just numbers; they are signals. Whether it’s accumulation ahead of bullish momentum or strategic exits before volatility, staying tuned to whale behavior could be the edge that separates the informed from the reactive. In crypto, silence isn’t absence, it’s often a strategy.

FAQs

Why do whale movements matter?

Whales often drive liquidity and can trigger major trend shifts. Their behavior reflects insider confidence, caution, or short-term market intent.

Are whale inflows always bullish?

No. Inflows to exchanges can signal intent to sell. Outflows to wallets usually suggest accumulation or holding.

How can I track whale activity?

Use tools like Whale Alert, Santiment, and Etherscan to monitor high-volume wallet activity.

Glossary of Key Terms

Whale: An investor or institution holding a large volume of a cryptocurrency

Cold Wallet: Offline crypto storage often used for long-term holding

Smart Money: Capital controlled by institutional or highly informed investors

Netflow: The net amount of crypto entering or leaving exchanges

Wrapped BTC (WBTC): A tokenized form of Bitcoin on Ethereum