This article was first published on Deythere.

- Whale Conversions Trigger Bitcoin to Ethereum Swaps

- Cross-Chain Protocols Power Large-Scale Swaps

- Global Whale Behavior and Aggregation Patterns

- Funds and Exchange Outflows Strengthen Ethereum Demand

- Market Context and Pricing Movements

- Conclusion

- Glossary

- Frequently Asked Questions About Bitcoin to Ethereum Swap

- What is Bitcoin to Ethereum swap?

- Why are whales exchanging BTC for ETH at this time?

- Do these trades impact the price of ETH?

- Are institutions accumulating $ETH?

- How is this trend measured?

- References

On-chain data has shown an unparalleled surge in Bitcoin for Ethereum swaps in as one of the largest cryptocurrency wallets consistently has been selling off Bitcoin to purchase Ethereum.

This surge has signaled renewed appetite among major holders for Ethereum even as the broader crypto market remains under pressure.

Recent news reports center around a whale swapping 1,969 Bitcoin (BTC) for 58,149 Ethereum (ETH), at roughly $181.4 million in value using cross-chain decentralized passageways such as THORChain.

Whale Conversions Trigger Bitcoin to Ethereum Swaps

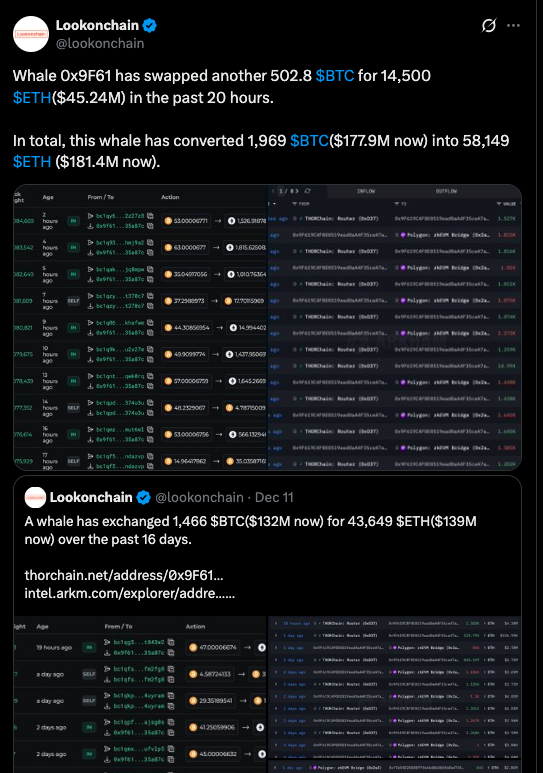

The whale address was most recently observed moving Bitcoin for Ethereum in mid-December 2025. Over a few days, the wallet processed multiple cross-chain swaps, a total of 1,969 BTC in exchange for 58,149 ETH valued at about $181.4M at current prices.

In and of itself, this position transfers some m conservative Bitcoin holdings to Ethereum, seen by industry insiders partially as a response to what they see as perceived value opportunities in Ether.

Data also shows past exchanges from this whale, with 502.8 BTC exchanged for 14,500 ETH in only 20 hours.

Cross-Chain Protocols Power Large-Scale Swaps

Most of these swaps have been performed through cross-chain mechanisms, like THORChain. These protocols enable large holders to exchange assets such as BTC and ETH without intermediaries, with lower friction and faster settlement relative to traditional centralized exchanges.

Cross-chain routing is essential for enabling Bitcoin to Ethereum swaps in a scalable manner. It eliminates the old custodian-based barriers and makes it easier than ever to trade. Observers point out that features such as these are exactly what whales want: low slippage, great privacy, and convenience for large transactions.

Global Whale Behavior and Aggregation Patterns

Earlier in the year, on-chain service Lookonchain reported on another big-time address that traded 1,466 BTC for 43,649 ETH over a period of just 16 days suggesting accumulation buys rather than sporadic trading.

This previous trend suggests a multi-month trend, where money that was traditionally parked in Bitcoin continues to flow into $ETH. Many whale wallets seem to have been active in this bigger Bitcoin to Ethereum swaps, amassing notable Ether positions.

Funds and Exchange Outflows Strengthen Ethereum Demand

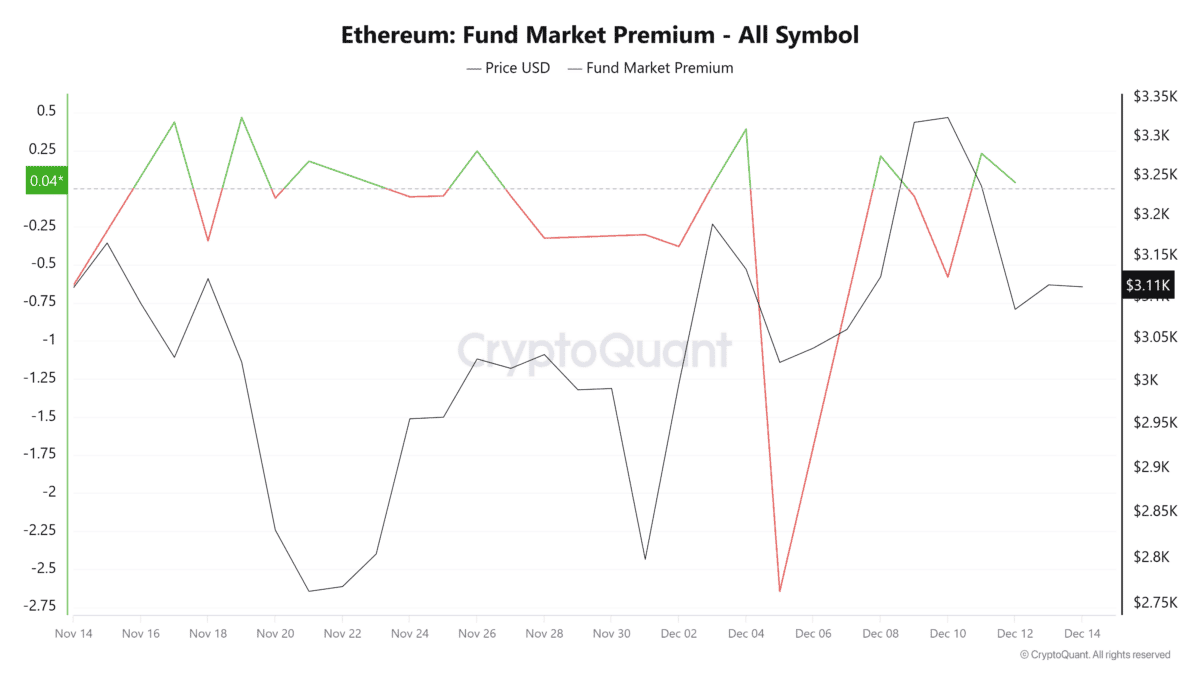

In addition to whale swaps, the appetite for ETH seems to be increasing in both retail and institutional fronts. On-chain sustainability indicators have been very strong over the past several days with the Fund Market Premium for Ethereum staying in positive territory, showing aggressive accumulation by funds.

On the other hand, Ethereum’s exchange netflow, which is the amount of ETH moving out of exchanges versus deposits, has been negative.

Netflow was approximately reported to be -32,000 ETH. Such outflows tend to accompany scarcity and can decrease exchange liquidity, something that traders often interpret as increased spot accumulation.

Some ETF statistics also help illuminate the rising institutional appetite. Spot ETH ETF assets had small net inflows by on-chain ETF flows, with particular issuers seeing 10’s of millions of dollars added in mid-December 2025.

Market Context and Pricing Movements

While the greater crypto-market is reeling, $ETH’s price action has held up better compared to recent highs. ETH was sitting around $3,118 on the day of the whale swap news, up slightly from testing local support levels.

On the other hand, large whale clusters have developed around critical price ranges, too, with on-chain data suggesting that there are ETH holdings concentrated at major technical levels.

These clusters imply conscious accumulation at certain price levels.

Conclusion

The recent surge in Bitcoin to Ethereum swaps that are driven by whale-scale conversions indicates a large change taking place with large holders.

From multi-day cross-chain transactions and positive fund market premiums to exchange outflows, the data all points towards strong demand behind Ethereum despite a broader market pullback.

Given that capital is starting to move around in a decentralized fashion, and through institutional vehicles, such flows could have an impact going forward on pricing dynamics or liquidity distribution.

Glossary

Bitcoin to Ethereum swaps: Significant holders exchanging Bitcoin positions into Ethereum cross-chain, typically through decentralized avenues.

Whale: A nickname for a large holder of cryptocurrencies.

Exchange Netflow: The net (total) amount of the asset moving into or out of exchange wallets, is a measure for accumulation and selling pressure.

Fund Market Premium: A gauge of how much investors are willing to pay over the spot price for fund shares, showing buying interest.

Cross-chain Protocol: A kind of decentralized blockchain system, it can be used for token exchange between different blockchains without centralized agencies.

Frequently Asked Questions About Bitcoin to Ethereum Swap

What is Bitcoin to Ethereum swap?

These transactions are generally large holders swapping Bitcoin into Ethereum, typically through cross-chain protocols that enable trading between different blockchains with no middlemen.

Why are whales exchanging BTC for ETH at this time?

There have been signs of larger capital moving into Ethereum based on recent whale activity, accumulation cues and demand indicators.

Do these trades impact the price of ETH?

Large swaps can influence liquidity and sentiment, with long periods of accumulation often associated with lower exchange supplies and possible upward price pressure.

Are institutions accumulating $ETH?

ETF Flows And Fund Premium Data Suggest Institutional Buying Is Helping Support Ethereum Demand Alongside Whale Activity.

How is this trend measured?

On-chain analytics sites such as Lookonchain and CryptoQuant monitor wallet flows, netflows, and swap volumes to gauge the accumulation and distribution trends.

References