Ethereum Staking Queue Under Spotlight

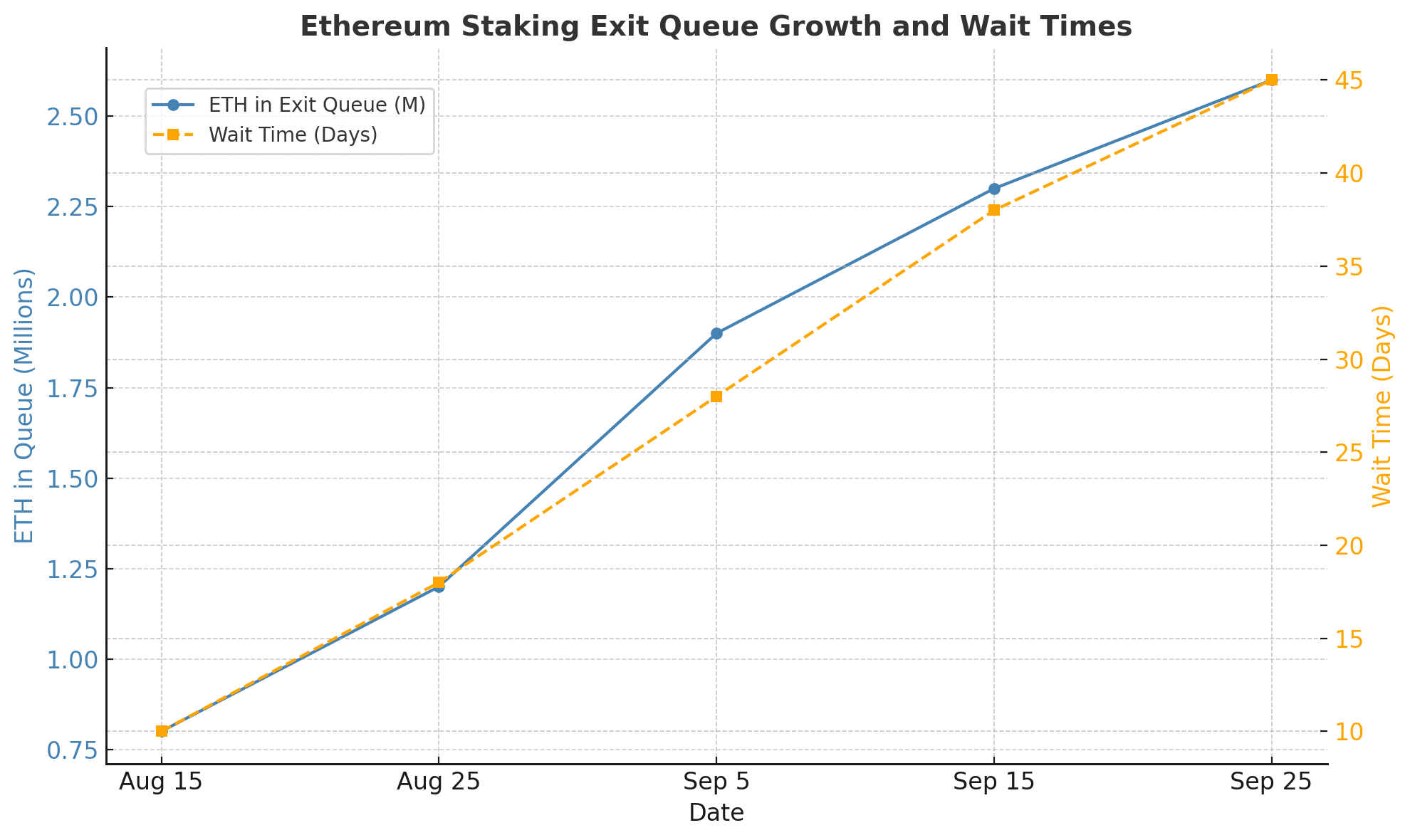

The recent surge in Ethereum’s staking exit queue has become one of the most discussed issues in the market. With wait times stretching beyond 40 days, some industry leaders have raised doubts about whether this system is practical for modern investors.

The Ethereum staking queue is drawing attention from traders, developers, and institutions alike, as it reflects both the protocol’s strengths and its friction points.

Michael Marcantonio, Head of DeFi at a leading digital asset firm, described the wait time as “troubling” on X. He compared Ethereum unfavorably to rival networks, where unstaking is far quicker. His remarks sparked heated debate, with critics warning that long delays could deter institutions from fully embracing the network.

Vitalik Buterin Pushes Back on FUD

Ethereum co-founder Vitalik Buterin stepped in to counter what he called exaggerated fear surrounding the Ethereum staking queue. In a post on X, he likened unstaking to a soldier’s duty: “Unstaking an asset is more like a soldier deciding to quit the army.”

Buterin argued that having friction in the process is intentional, meant to ensure security and discourage opportunistic withdrawals that could destabilize the system.

Buterin emphasized that the design is not perfect but highlighted its protective role. Reducing parameters to speed up exits, he explained, could undermine trust in the network. By making it easy for unreliable validators to leave quickly, the system might weaken overall reliability. This defense underlines Ethereum’s approach: prioritizing stability and decentralization over instant liquidity.

Record High Exits Trigger Debate

The concerns about the Ethereum staking queue intensified after more than 2.5 million ETH, worth over $11 billion, entered the exit process. Much of this came from Kiln, a major infrastructure provider that pulled out validators following security incidents in the industry. This mass withdrawal pushed the queue to record levels, forcing stakers to wait more than six weeks to fully exit.

Despite the delays, validators still earn rewards while in the queue. This incentive is meant to reduce panic and reassure stakers that their funds remain productive even as they wait. Analysts caution, however, that the optics of a 45-day withdrawal period could clash with institutional expectations of speed and liquidity.

Security Versus Usability

The Ethereum staking queue illustrates a classic trade-off between security and usability. Ethereum limits how many validators can enter or exit during each epoch. Known as churn limits, these rules ensure that sudden shifts do not compromise consensus. While other networks offer quicker exits, they also assume higher risks of mass withdrawals.

Critics argue that Ethereum’s long delays make it harder for staking to compete with traditional financial products. Yet supporters highlight that safety and resilience come first. “If Ethereum loses sight of its conservative design, the foundation of its trust could crack,” said trader Scott Melker in response to the debate.

For developers and financial analysts, this tension is a case study in how decentralized networks manage scale, security, and market expectations all at once.

Conclusion

The rise of the Ethereum staking queue underscores both the strength and the growing pains of the network. Vitalik Buterin’s defense shows that Ethereum remains committed to cautious, security-first design even as institutional demand increases. The record-high exit requests highlight the system’s resilience but also its limits in meeting modern financial expectations.

For investors, the debate boils down to priorities. Faster liquidity exists on rival platforms, but Ethereum offers unmatched stability and decentralization. As the ecosystem matures, balancing usability with trust will define how staking evolves.

FAQs about Ethereum staking

Why is the Ethereum staking queue so long?

High exit requests and built-in churn limits stretch the wait time, sometimes beyond 40 days.

Do validators still earn rewards in the queue?

Yes, validators continue earning rewards until their exit is finalized.

What triggered the surge in exits recently?

Security-related exits by a large staking provider significantly expanded the queue.

How does Ethereum compare to other networks?

Rival chains like Solana allow faster exits, but Ethereum prioritizes security and decentralization.

Glossary

Ethereum Staking Queue: The waiting line for validators to fully exit and withdraw staked ETH.

Churn Limits: Protocol rules that cap how many validators can join or leave per epoch.

Validator: A participant who locks ETH to help secure the network and earns rewards.

Epoch: A fixed time period in Ethereum during which staking operations are processed.

Unstaking: The process of withdrawing staked ETH from validator duties.

Block Rewards: The combined staking rewards and transaction fees earned by validators.