According to latest industry reports, Vitalik Buterin is back among the crypto billionaires, with his on-chain holdings now worth around $1.04 billion after Ethereum surpassed $4,000, a level not seen since late 2024. Arkham Intelligence confirms Buterin’s on-chain holdings are approximately 240,042 ETH, with small positions in Aave Ethereum (AETHWETH), WhiteRock (WHITE), Moo Deng (MOODENG), and Wrapped Ethereum (WETH).

- A Look Back at Buterin’s Billionaire Origins

- Ethereum’s Price Rally and Market Momentum

- Institutional Inflows Mean Deeper Confidence in ETH

- BitMine and Corporate ETH Treasury Strategies

- Conclusion

- FAQs

- What is Vitalik Buterin’s current $ETH holding value?

- When did he first become a billionaire?

- Why are ETH ETFs outperforming Bitcoin ETFs?

- What is BitMine Immersion’s ETH holding strategy?

- Glossary

A Look Back at Buterin’s Billionaire Origins

Vitalik Buterin first entered the billionaire club in May 2021 when ETH briefly hit $3,000 and his holdings (then 333,500 ETH) were worth around $1.029 billion. At the time, he said he had never controlled more than 0.9% of Ethereum’s total supply and his net worth had “never been close” to $1 billion before that.

Ethereum’s Price Rally and Market Momentum

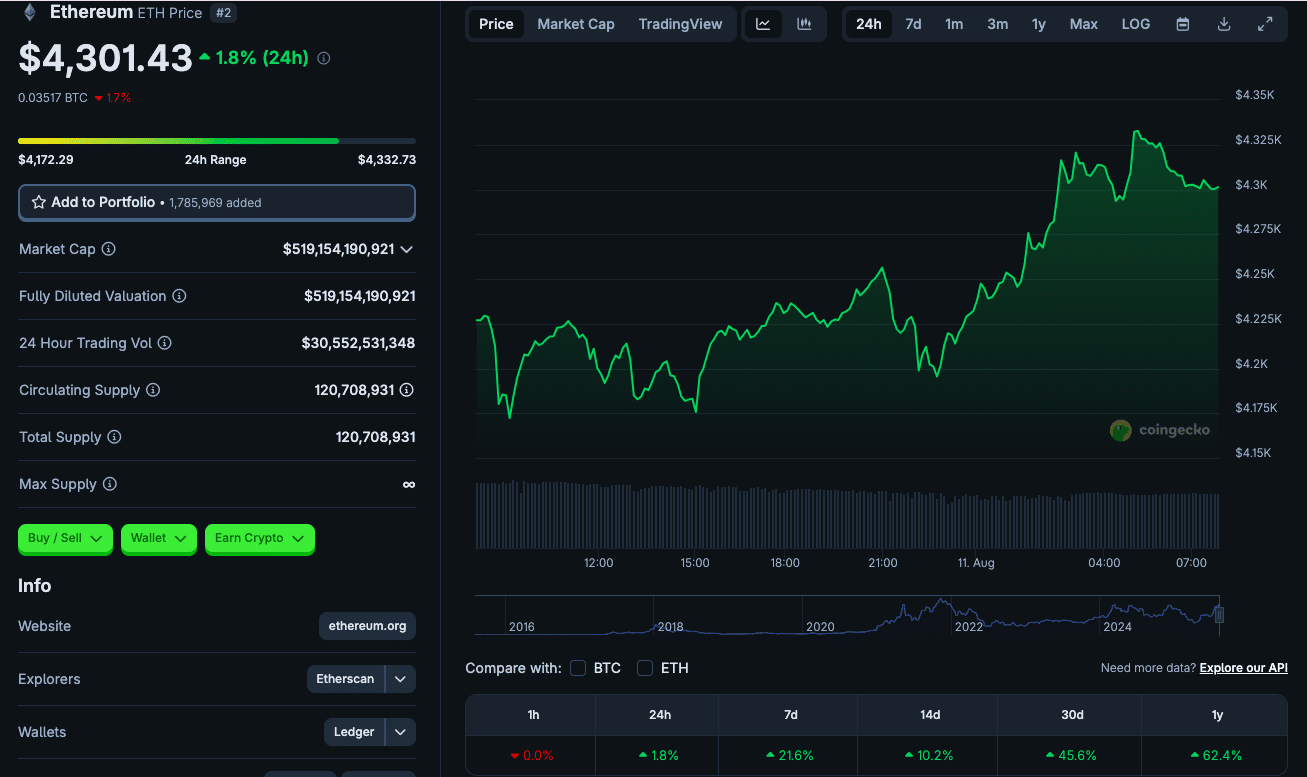

In consonance with this, Ethereum went up 6% on Saturday to $4,332 and then settled at $4,244. As at the time of writing, $ETH trades at $4,301, up 1.8% in 24hrs. Traders are now openly expecting a retest of the November 2021 all-time high of $4,878.

One analyst known as “Ted” says it’s “just days away”. CoinGlass data shows that if $ETH hit $4,500, it could trigger a short squeeze and potentially liquidate $1.35 billion in short positions. Vitalik Buterin Reclaims Billionaire Status as Ethereum Surges Past $4,000

Vitalik Buterin Reclaims Billionaire Status as Ethereum Surges Past $4,000

Institutional Inflows Mean Deeper Confidence in ETH

Behind this price action is a shift in investor behavior, with Ether ETFs outpacing Bitcoin ETFs in recent inflows. Based on earlier reports, on a single Friday, ETH ETFs saw $461 million in inflows vs $404 million for BTC ETFs.

Over the last 5 trading days, reports divulge that US spot ETH ETFs saw $326.6 million in net inflows vs $253.2 million for Bitcoin ETFs. This means ETH is gaining traction as an institutional asset and ETF visibility is mounting.

BitMine and Corporate ETH Treasury Strategies

Meanwhile BitMine Immersion Technologies has emerged as a major lead in the market. Since launching its ETH strategy between June 30 and July 8 2025, BitMine has accumulated 833,137 ETH, worth almost $2.9 billion, making it the largest public corporate ETH holder and the 3rd largest crypto treasury in the world behind MicroStrategy and Marathon Digital, according to reports

The pace of accumulation has been insane. In the last week alone, BitMine reportedly added 208,137 ETH, taking its holdings past $3 billion. The strategy fueled a rally so well that BitMine’s stock shot up 3,000% in a week.

Backing from big names has amplified the narrative. Cathie Wood’s ARK Invest, Founders Fund and Peter Thiel have all bet big on BitMine. Thiel’s firm disclosed a 9.1% stake in the company and the stock surged 17%. BitMine’s stock went above $100 briefly amplifying the case of crypto equities going mainstream.

Conclusion

Based on the latest research, Vitalik Buterin’s billionaire rank re-entry together with Ethereum’s move back to $4,000+ brings fresh energy and new questions. Will retail speculation keep this up or can institutional activity sustain the rally?

Analysts are watching the $4,500 resistance zone and ETF inflows as catalysts for more upside to the November 2021 high. As ETH treasuries like BitMine grow, the corporate and regulatory terrain of digital assets are expected to change.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

Vitalik Buterin is a billionaire again as Ethereum goes above $4,000 with his on-chain holdings now over $1.04 billion. ETH’s new rally, short-squeeze triggers and ETF flows show institutions are getting more confident. BitMine Immersion is the largest public company ETH holder with over 833,000 ETH ($2.9-3 billion) backed by big names.

FAQs

What is Vitalik Buterin’s current $ETH holding value?

His on-chain portfolio is about $1.04 billion, 240,042 ETH and some minor positions in AETHWETH, WHITE, MOODENG, WETH.

When did he first become a billionaire?

He became a billionaire in May 2021 when ETH was at $3,000 and his holdings were around $1.029 billion.

Why are ETH ETFs outperforming Bitcoin ETFs?

Recent US spot Ether ETFs have seen more inflows, indicating institutional preference for ETH due to DeFi, staking and smart contracts.

What is BitMine Immersion’s ETH holding strategy?

BitMine launched its ETH acquisition strategy in mid-2025 and now holds over 833,000 ETH ($3 billion), the largest public Ethereum treasury.

Glossary

On-chain holdings – Digital assets traceable on a blockchain network linked to public wallet addresses.

ETF (Exchange-Traded Fund) – Tradable fund tracking assets like ETH, for institutional and retail exposure.

Short squeeze – A sudden price increase when short sellers cover their positions.

Corporate treasury – A company’s strategy for holding long-term digital assets.

Overleverage – Borrowing or margining too much and risking big losses.