This article was first published on Deythere.

- Vanguard Crypto ETF Breakthrough

- Crypto ETFs on Vanguard: Which Ones Are Available

- Impact for Vanguard’s 50M+ Clients

- How Vanguard’s Move Reflects a Trend

- Expert Perspectives

- Regulatory and Industry Context

- Conclusion

- Glossary

- Frequently Asked Questions About Vanguard crypto ETFs

- What crypto ETFs will Vanguard clients have access to trade?

- Will Vanguard introduce its own crypto ETFs?

- Why does Vanguard’s move matter?

- How could this impact crypto markets?

- References

Vanguard, a traditional conservative investment giant, has announced that its clients can now buy and sell Vanguard crypto ETFs through its brokerage accounts.

Commencing this December 2025, more than 50 million Vanguard brokerage account holders will be able to directly purchase third-party spot cryptocurrency ETFs (which track Bitcoin, Ether, XRP and Solana) issued by leading firms directly through the platform

Vanguard Crypto ETF Breakthrough

Until now, Vanguard had prohibited most cryptocurrency products on its platform. The firm refused the listing of newly launched Bitcoin ETFs in January 2024, it even removed Bitcoin futures funds.

However, Vanguard has now agreed to allow its clients to trade approved and regulated crypto E.T.F.s and mutual funds. The products on offer will be spot-crypto ETFs linked to Bitcoin (BTC), Ethereum (ETH), Ripple (XRP) and Solana (SOL).

Vanguard is currently avoiding anything related to meme coins or unregistered tokens. This policy change was implemented under Vanguard’s new head, Salim Ramji.

Notably, Vanguard will not be introducing its own crypto funds. Instead, the company will enable conservative customers to access crypto ETFs elsewhere ( such as BlackRock’s iShares, Fidelity and Bitwise), so long as they come from other sponsors.

Vanguard itself has said it has no plans to launch their own cryptocurrency ETFs or mutual funds and will just list third-party crypto ETFs that the firm believes to meet regulatory standards.

The firm says these third-party funds have “been stress-tested through volatile market conditions and continue to operate as designed with appropriate liquidity.

This mirrors the way Vanguard approaches gold ETFs; It gives investors access to gold funds managed by others, but it has never offered its own gold ETF.

Crypto ETFs on Vanguard: Which Ones Are Available

All the approved crypto ETFs on Vanguard’s platform are based on spot pricing and linked to main coins. Investors will have access to Bitcoin and Ethereum ETFs including BlackRock’s iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA), as well as funds tied to XRP and Solana.

These funds trade on regulated exchanges like stock ETFs. Effectively, Vanguard clients can get exposure to the price of crypto without dealing with private keys or wallets.

As Eric Balchunas of Bloomberg has observed, these ETFs “have done exactly what they’re supposed to do … even during a time when the market collapsed.”

Vanguard’s brokerage accounts (and that includes self-directed IRAs) will allow these trades. Institutional and retirement plan accounts can continue to stay restricted , as Vanguard tends to be cautious.

But for accounts that are eligible, the crypto ETFs will seamlessly integrate into Vanguard’s trading platform with stocks, bonds and traditional ETFs.

According to Vanguard Head of Brokerage and Investments Andrew Kadjeski, a move is warranted after these crypto ETFs have already proven their infrastructure: “

“Cryptocurrency ETFs and mutual funds have been tested through periods of market volatility, performing as designed while maintaining liquidity”

Impact for Vanguard’s 50M+ Clients

Vanguard’s decision could place cryptocurrency exposure in many average investors’ portfolios, considering it has over 50 million brokerage clients and manages about $11 trillion.

Vanguard offering crypto ETFs widens access. Previously, investors who wished to buy into crypto had to leave Vanguard for niche platforms. Now, they can execute it from their trusted Vanguard account.

At the same time, access does not equal adoption. Among Vanguard’s thousands of clients are retirement savers who have favored stocks, bonds and index funds.

Still, some surveys indicate there may be a disproportionate number of younger, tech-savvy clients who are seeking to tap into crypto. In fact, at least one study reported that more than one-third (35%) of affluent young Americans switched advisers over the absence of crypto options.

Vanguard’s move acknowledges that demand. However, Portfolio allocations of Vanguard investors are likely to be small, at least initially (estimates range from fractions of a percent of total assets).

The kind of flows that Vanguard brings are not what early adopter, crypto ETF investors bring. Vanguard flows are disciplined and “sticky,” they follow target allocations rather than chasing short-term price moves.

For instance, if a balanced portfolio has a small dedicated “crypto sleeve,” Vanguard’s automatic rebalancing (e.g. a 60% stocks / 40% bonds / 1% crypto model) could create steady “buy the dip” behavior. Analysts believe this could ironically dampen volatility: in a falling market, Vanguard-driven purchases might provide a floor of demand.

How Vanguard’s Move Reflects a Trend

Several big financial firms have loosened their crypto restrictions in late 2025. For example, Bank of America just begun permitting wealth advisors to recommend investing between 1-4% into crypto (mostly via regulated Bitcoin ETFs) for clients suitable for such recommendations.

JPMorgan Chase and Morgan Stanley offer its clients access to a few crypto ETFs or trading already, as does Charles Schwab and Fidelity. Even fintechs and brokerage firms such as SoFi recently made the rollout of crypto trading available to all 12.6 million members.

Vanguard’s move into this category is a notable signal, said Mason Borda, an investor and developer who has built a suite of financial services for the digital currency markets

In other words, at this point, it’s hard to overlook regulated crypto products.

Expert Perspectives

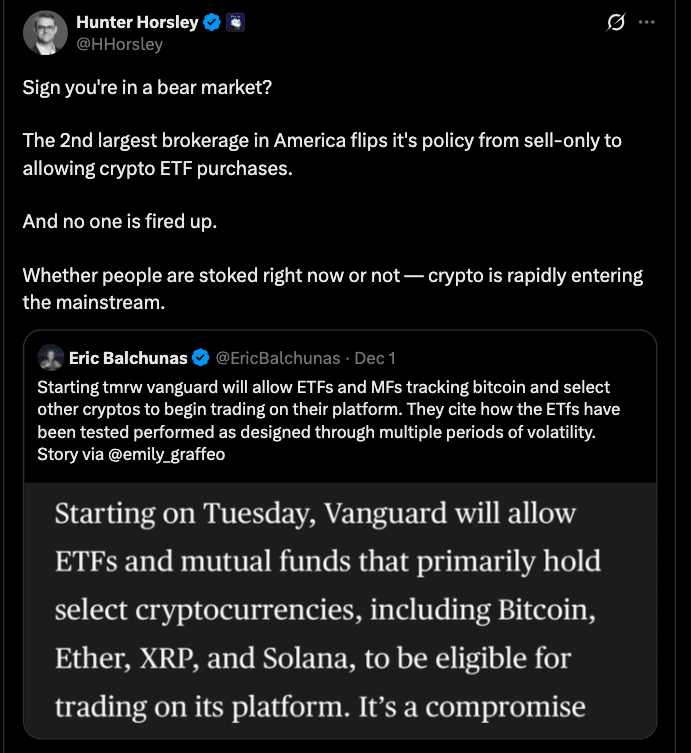

Industry experts like Bitwise CEO Hunter Horsley observed the muted response to this news as proof of crypto’s maturation. He said:

“The 2nd largest brokerage in America flips its policy from sell-only to allowing crypto ETF purchases. And no one is fired up… crypto is rapidly entering the mainstream.”

Bloomberg ETF analyst Eric Balchunas also correctly informs that all is well for crypto ETFs: “the chosen ETFs have endured market volatility and preserved liquidity

All told, there are two things experts want to stress. First, Vanguard’s arrival legitimizes crypto assets more. A company with $11 trillion under management offering access to crypto ETFs represents a step-up in confidence and regulatory acceptance.

Secondly, even a modest level of allocation from Vanguard clients could drive meaningful demand.

Analysts say that if even 1-2% of Vanguard’s eligible assets were to be allocated to crypto ETFs, the number could be tens of billions of dollars in new investment..

Regulatory and Industry Context

Vanguard’s move follows years of regulatory changes. Spot Bitcoin ETFs were approved by the U.S. SEC in early 2024 followed by spot Ethereum ETFs later that year. Strong frameworks for surveillance, custody and disclosure helped to drive off the regulatory uncertainty that Vanguard blamed as a hurdle.

In a sense, by late 2025, crypto ETFs had passed the test of compliance and liquidity. The head of brokerage at Vanguard has admitted that the administrative procedures to service these funds have evolved.

Competitors have flooded in. BlackRock’s iShares Bitcoin Trust (IBIT) was the fastest-growing ETF of all time, reaching $70B in assets. Leading crypto funds from Fidelity and new entrants, including Bitwise, Franklin Templeton, and others, have attracted significant inflows.

In short, Vanguard’s move echoes a consensus: regulated crypto ETFs have their place in modern portfolios. The risk is now seen as tolerable in terms of the conventional investment routes.

Conclusion

Vanguard Crypto ETFs are set to be opened up to more than 50M investors. Vanguard’s welcoming of regulated Bitcoin, Ethereum, Solana, and XRP ETFs on its $11 trillion platform brings institutional-scale validation to digital assets.

The move follows industry peers and reflects ongoing client demand for crypto exposure in a safe manner. For both retail and institutional portfolios, it increases the options for diversification.

Glossary

E.T.F.: An abbreviation for an exchange-traded fund, which is a security that tracks an asset (such as Bitcoin) or an index and trades like a stock on an exchange. Offers exposure, without holding the asset directly.

Spot Bitcoin/Ethereum ETF: A fund that owns and holds Bitcoin/Ether directly, allowing investors to obtain exposure to the price. Example: BlackRock’s iShares Bitcoin Trust (IBIT) or Ethereum Trust (ETHA).

Brokerage Platform: The online investment platform on which clients go to trade stocks, bonds, ETFs and so on via an online investment account (e.g., Vanguard’s website).

Regulated Vehicle: Investment products (like a crypto ETF) that have to obey strict existing financial industry regulations and SEC oversight, as opposed to unregulated crypto exchanges.

Asset Allocation: What an investor does in terms of how they split up their portfolio among stocks, bonds, crypto, etc.

Frequently Asked Questions About Vanguard crypto ETFs

What crypto ETFs will Vanguard clients have access to trade?

As of early December 2025, Vanguard brokerage customers may trade spot ETFs related to Bitcoin (e.g. BlackRock’s IBIT), Ethereum (e.g. BlackRock’s ETHA or Fidelity’s), Solana, and XRP. These are third-party, securitized ETFs that are SEC approved and regulated.

Will Vanguard introduce its own crypto ETFs?

No Vanguard has indicated it does not have plans to offer its own crypto funds. It will list only eligible third-party crypto ETFs on its platform.

Why does Vanguard’s move matter?

Vanguard has more than 50 million investors and manages over $11 trillion. For the trading platform to list crypto ETFs is validating for digital assets. It means a lot of conservative, retirement-focused investors now have tidy, regulated access to the prices of cryptos and that could send demand soaring.

How could this impact crypto markets?

If just a small slice of Vanguard’s assets heads into crypto ETFs, that could translate to tens or hundreds of billions in new inflows. Vanguard’s clients tend to be buy-and-hold at their target allocations, and that could produce some stable “buy-the-dip” demand and help ETF liquidity. Eventually it could flatten volatility parameters and bid-ask spreads.