VanEck and the Jito Foundation have filed an S-1 with the US Securities and Exchange Commission for JitoSOL, the first exchange-traded fund backed exclusively by a liquid staking token. This action might change the way traditional investors access blockchain staking income.

VanEck JitoSOL ETF bridges DeFi yields with traditional finance

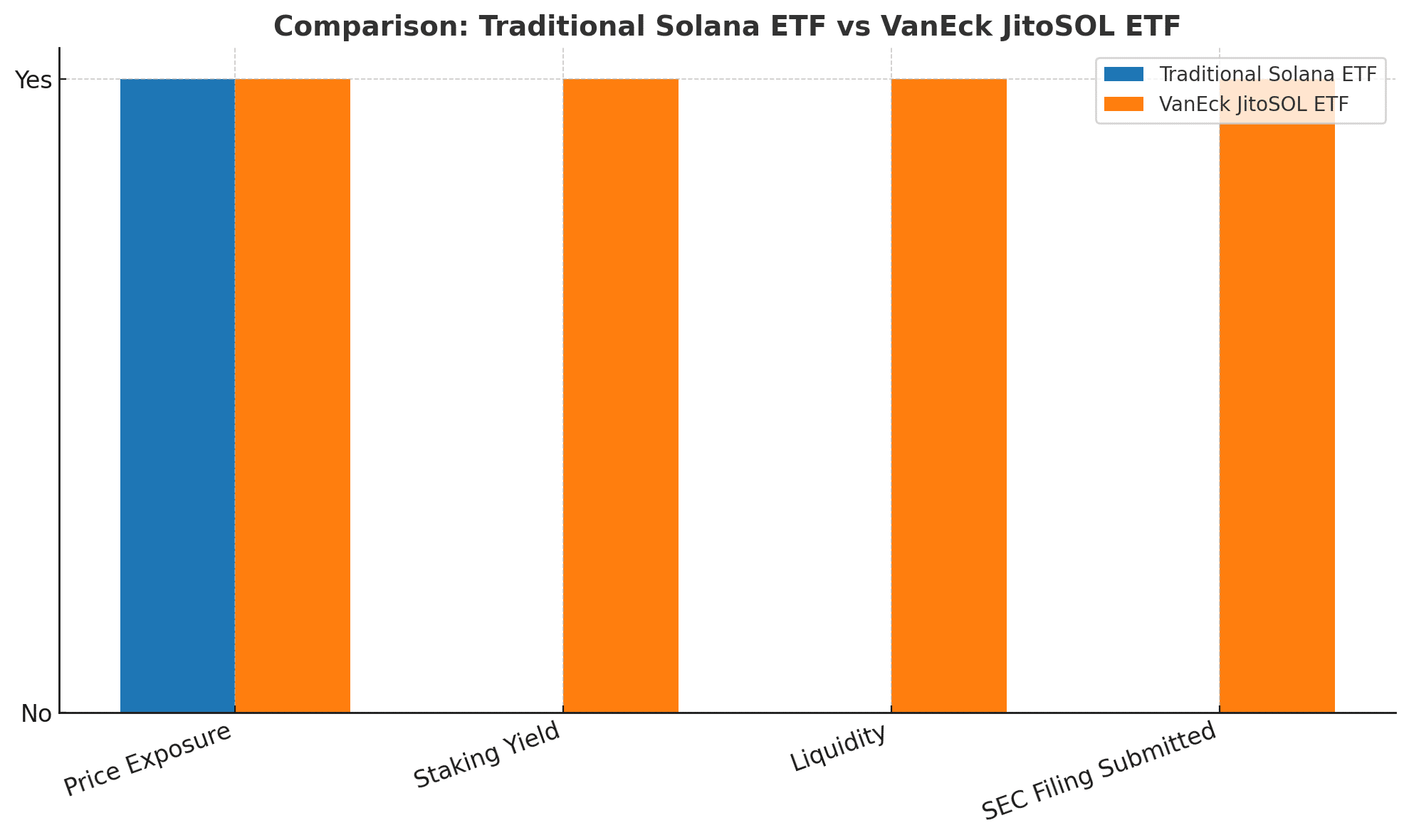

The proposed VanEck JitoSOL ETF will solely contain JitoSOL, a cryptocurrency that represents staked Solana and earned staking profits. Unlike other crypto ETFs, our structure incorporates both price exposure and income production within a regulated investment instrument.

VanEck’s head of digital assets research, Matthew Sigel, tweeted:

“We’ve been very selective with our single-token ETF filings this year, but today’s S-1 for the VanEck JitoSOL ETF matters.”

If listed, it would be a new piece of market infrastructure that connects DeFi innovation to TradFi accessibility.”

Regulatory breakthrough opens the way

Regulatory clarification came after the SEC provided advice in August confirming that, when properly constructed, liquid staking tokens such as JitoSOL are not securities.

This conclusion eliminates a significant barrier for ETFs based on such tokens. Jito’s S-1 filing and previous securities classification report explain JitoSOL as a decentralized infrastructure rather than an investment contract.

Why This Matters to Investors and the Solana Network

Liquid staking tokens, such as JitoSOL, provide operational advantages over traditional staking systems. Investors may prevent unbonding delays while getting consistent staking profits.

The ETF form allows for daily creation and redemption, combining liquidity with yield. Regulators, custodians, and exchanges, including Jito Foundation CCO Thomas Uhm, worked closely together to develop the essential infrastructure.

Institutionally, this product offers a regulated path to blockchain-based yield, possibly increasing accessibility. It also promotes decentralization by dividing stake across Solana validators, hence improving network security.

Looking ahead: A Milestone for Crypto ETFs

If authorized, the VanEck JitoSOL ETF would introduce a new type of exchange-traded product: staking yield instruments. Other large firms, like Fidelity, Grayscale, and Franklin Templeton, are allegedly considering introducing Solana funds. The outcome of this filing may establish a precedent for future liquid staking ETFs.

Meeting market demand for yield-generating cryptocurrency products

Retail and institutional investors are increasingly looking for crypto products that provide return, especially in a low-interest environment. Traditional ETFs have opened the way to cryptocurrency investing, but the ability to capture staking benefits within the same wrapper improves the value proposition.

Conclusion

VanEck and Jito’s JitoSOL ETF registration is a watershed moment in cryptocurrency finance, combining Solana staking incentives with traditional investing avenues. As the first liquid staking-backed ETF in the United States, this product represents innovation, regulatory adaptation, and investor attractiveness.

Its acceptance might usher in a new age of yield-focused crypto products, changing asset access for both DeFi enthusiasts and institutional investors, and suggesting a larger change in the integration of blockchain technology with conventional finance.

Glossary

Liquid staking token (LST): A token that represents staked assets and accumulated staking yields, providing liquidity and tradability.

JitoSOL: Solana-based liquid staking token that underlies the proposed ETF.

ETF (Exchange-Traded Fund): A regulated investment fund that trades like a stock and typically tracks an underlying asset or index.

S-1 Filing: The initial registration document required by the SEC for companies or funds seeking to offer securities to the public.

Unbonding Delay: The waiting period required when unstaking tokens to become liquid again.

DeFi (Decentralized Finance): Blockchain-based financial services operating without centralized intermediaries.

FAQs on JitoSOL

Q1: What is JitoSOL, and how does it function?

JitoSOL is a liquid staking token on the Solana blockchain that accrues staking rewards while remaining tradeable, bypassing unbonding delays.

Q2: Why is VanEck’s ETF filing significant?

This marks the first U.S. ETF proposal fully backed by a liquid staking token, merging yields with regulated investment.

Q3: How did regulatory clarity enable this filing?

The SEC issued guidance in 2025 confirming that properly structured liquid staking tokens are not considered securities, clearing entry for ETF inclusion.

Q4: What benefits does a liquid staking–backed ETF offer?

It provides seamless yield, liquidity, and ease of access through traditional brokerage accounts, without requiring direct blockchain interaction.

Sources/References