According to latest reports, Native Markets has been chosen by the Hyperliquid ecosystem to issue USDH stablecoin after a validator-led governance vote. This means Native Markets will control the USDH, which is the ticker for Hyperliquid’s new stablecoin, to reduce reliance on USDC and USDT.

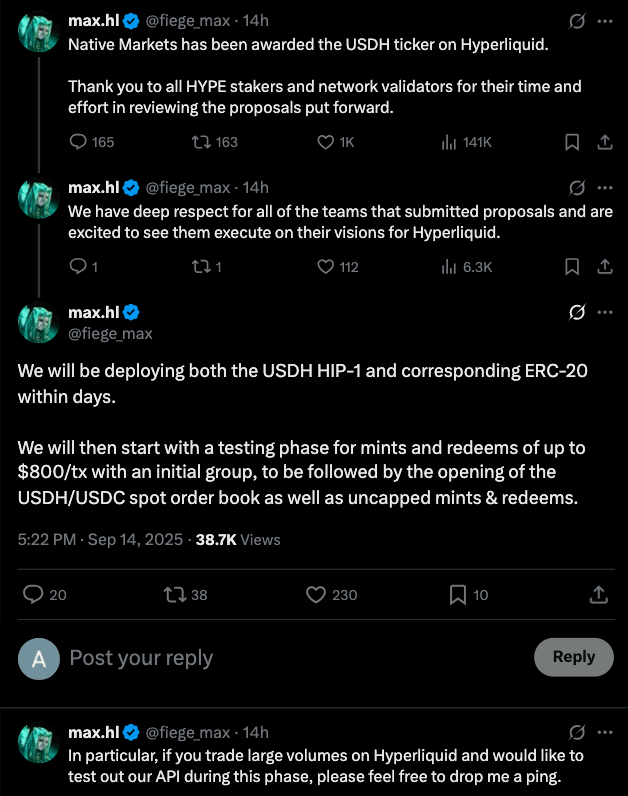

The decision was confirmed by co-founder Max Fiege. Native Markets beat out high-profile competitors like Paxos, Frax and Ethena, with over 70% of delegated validator stake. A phased rollout is planned, with limited minting and redemption testing first, then full free flows.

The Governance Process and Competing Proposals

Hyperliquid launched the USDH contest on September 5, and invited proposals from well known stablecoin issuers and DeFi infrastructure firms. Native Markets won despite the strong institutional credentials of its competitors. Reports showed that validators and HYPE token stakers delegated over 70% in support of Native Markets by the end of the vote.

Ethena dropped out during the process which helped Native Markets a lot. Critics raised concerns around validator concentration and perceived favoritism. For example, one validator wallet held 15% of all delegates, which raised questions around decentralization of decision making.

Also read: Why Validators Forced Ethena Labs to Step Aside in the Hyperliquid USDH

USDH Structure, Reserves and Rollout Plan

The USDH stablecoin Native Markets proposal outlines a reserve structure split between off-chain and on-chain components. Off-chain reserves will be in cash and U.S. Treasury equivalents managed by BlackRock; on-chain reserves will be handled via Superstate using Stripe’s Bridge infrastructure.

Yield from the reserves will be split 50/50: half to HYPE token buybacks and half to ecosystem growth. Deployment will be on Hyperliquid’s HyperEVM network. Initially minting and redeeming will be capped (about $800 per transaction) in early test stages.

Native Markets will also release a Hyperliquid Improvement Proposal (HIP-1) and an ERC-20 version in the coming days. A USDH/USDC spot market will follow, along with uncapped minting/redemption and high volume trader APIs.

Implications

USDH stablecoin Native Markets brings big changes to how stablecoins will be used and governed inside Hyperliquid. USDC has reportedly been the dominant stablecoin on the platform with about $6 billion. USDH is expected to bring more diversity in stablecoins and internalized yield mechanisms.

Experts say Ecosystem participants will benefit from yield sharing, more liquidity and less dependency on external stablecoin issuers. However, experts also say success will depend on transparent reserve audits, stable pegging mechanisms and community and validator trust.

Risks Ahead

Despite the support, USDH stablecoin still has risks. Validator concentration worries persist as a few validators hold large stakes. Transition from test to full flow may surface technical, regulatory or security issues.

The capped initial mint/redeem transactions are a band aid, but scaling could put pressure on the system. Ensuring peg to USD and reserve transparency will be important, especially against established stablecoins like USDC and USDT. Regulatory scrutiny around stablecoins as DeFi grows may add more compliance burden.

Also read: Understanding Stablecoins: The Hidden Risks Behind USDT vs USDC

Conclusion

Based on the latest research, USDH stablecoins are quite big of a deal for Hyperliquid.

Owing to their strong validator support, good reserve structures (off-chain/off-chain split, BlackRock, Superstate) and a staged rollout including HIP-1 and ERC-20, market watchers are projecting that USDH is going to be a major stablecoin in the Hyperliquid ecosystem.

This will happen if it delivers technical stability, maintains trust and handles regulatory pressure.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

Native Markets won the USDH stablecoin bid on Hyperliquid via validator vote, beating Paxos, Frax and Ethena. The USDH stablecoin will be deployed on HyperEVM, with reserves managed off-chain by BlackRock and on-chain by Superstate through Bridge.

Glossary

USDH Stablecoin – The stablecoin chosen by Hyperliquid to be issued and managed by Native Markets under the USDH ticker.

Hyperliquid – A decentralized derivatives exchange focused on perpetual futures backed by the HYPE token.

Validator vote – A governance mechanism where stakeholders (validators, stakers) decide between proposals.

HIP-1 – Hyperliquid Improvement Proposal-1, native token contract standard for USDH issuance within Hyperliquid.

ERC-20 – Ethereum token standard; version of USDH compatible with Ethereum network.

Pegged stablecoin – A stablecoin whose value is maintained at or near a target value (usually USD) through reserves and mechanisms.

FAQs about USDH Stablecoin Native Markets

What does it mean Native Markets won USDH?

They were chosen by the community to issue the USDH stablecoin for Hyperliquid. They control the ticker and will manage the issuance and reserve structure.

How will USDH reserves be managed?

Reserves will be off-chain (cash and U.S. Treasury equivalents via BlackRock) and on-chain (via Superstate through the Bridge infrastructure).

What’s the rollout timeline?

Launches (HIP-1 and ERC-20) will be within days, starting with capped test transactions ($800 each), then spot markets and uncapped.

How is yield from USDH handled?

Yield from reserves will be split 50/50: 50% to HYPE buybacks; 50% to ecosystem growth.

What are the risks of USDH?

Risks are validator concentration, peg failure, governance transparency and technical/security issues as it scales.