This article was first published on Deythere.

- Network Effects Push the USDC Stablecoin Into Mainstream Finance

- AI Wallets May Soon Automate Trillions of Stablecoin Transactions

- Regulation, Market Growth, and Circle’s IPO Strengthen the Outlook

- Partnership Momentum Shows Stablecoins Support—Not Replace—Traditional Networks

- Conclusion

- Glossary

- FAQs About USDC Stablecoin

The USDC stablecoin re-entered global headlines at Davos this year as Circle CEO Jeremy Allaire reshaped long-standing assumptions about how digital money will move across the financial world. His remarks revived debates about whether stablecoins could one day rival traditional payment giants, while firmly dismissing the idea that USDC aims to replace Visa or Mastercard.

According to the source, Allaire rejected the “Visa Killer” narrative during an appearance on CNBC’s Squawk Box, stating that USDC serves as neutral financial infrastructure, not a competing payment product. He described Visa and Mastercard as “significant partners,” reinforcing that stablecoins act as shared settlement utilities rather than closed financial systems.

Industry analysts note that this shift signals a broader change across global markets: banks, card networks, and payment platforms now treat blockchain as a companion layer, not a threat. With stablecoins surpassing $33 trillion in settlement volume in 2025, exceeding Visa and Mastercard’s combined totals, digital settlement has become a core element of modern value transfer.

Today, Circle’s USDC is the world’s second-largest stablecoin, with $73.6 billion in circulation, trailing only Tether’s USDT at $186.6 billion. The total stablecoin market now stands at $308 billion, according to analysts.

Network Effects Push the USDC Stablecoin Into Mainstream Finance

Allaire said stablecoins are “network-effect businesses,” gaining value as more developers, merchants, banks, and institutions integrate them. He emphasized:

“We’re a neutral company. We don’t compete with banks, we don’t compete with payment companies, we don’t compete with exchanges.”

Statements published on an external research platform show that open systems scale faster than closed ones, mirroring how USDC adoption grows across ecosystems.

Recent partnerships highlight this acceleration:

Visa expanded USDC settlement trials across multiple regions.

Mastercard launched direct settlement support for USDC and EURC across Eastern Europe, the Middle East, and Africa, allowing merchants to settle transactions directly in stablecoins.

BVNK partnered with Visa to enable stablecoin payouts through Visa Direct’s $1.7 trillion real-time payments network.

These collaborations reduce liquidity friction and embed stablecoin payments deeper into regulated frameworks, reinforcing USDC’s role in global payment infrastructure.

AI Wallets May Soon Automate Trillions of Stablecoin Transactions

Artificial intelligence dominated Davos discussions, with Allaire predicting a future where AI agents control wallets and perform trillions of automated transactions across global markets.

He said automation will drive transaction costs toward zero and shift value away from fee-based models toward infrastructure reliability:

“In that future world, where AI agents are doing the money movement, it’s going to be hard to know exactly what the payment business model is.”

Analysts believe that AI-driven micro-transactions could reshape money movement worldwide, positioning USDC as a core settlement layer for machine-to-machine payments.

Studies published on an AI research portal indicate that autonomous financial tools may soon process massive flows across commerce, logistics, computing, and digital platforms.

Regulation, Market Growth, and Circle’s IPO Strengthen the Outlook

Regulators continue to examine the Digital Asset Markets Clarity bill, with Allaire noting “clear bipartisan desire” to advance the framework. The legislation could define how digital assets interact with capital markets, a key focus for both Wall Street and crypto-native institutions.

USDC has posted 80% year-over-year growth for two consecutive years, and Allaire maintains a conservative long-term outlook with a 40% compound annual growth baseline. Analysts say this pace reflects the deepening integration of stablecoins into global settlement systems.

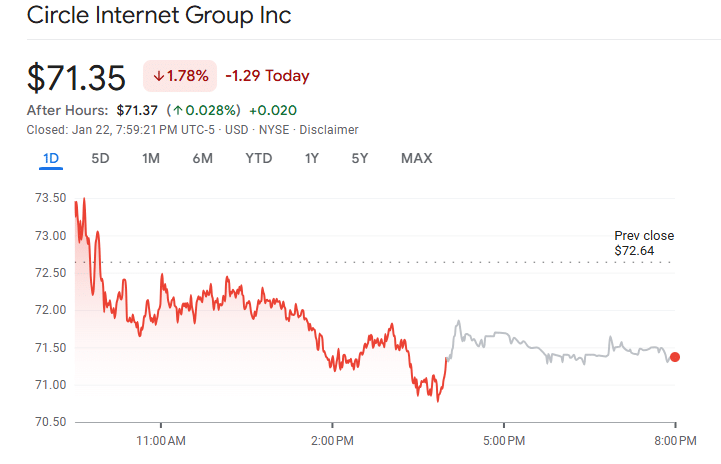

Circle also went public in June 2025, pricing its IPO at $31 before opening at $69. The stock peaked at $263.45 during the same month and currently trades around $72, according to market data.

This public-market debut expanded Circle’s visibility and reinforced investor confidence in the stablecoin ecosystem.

Partnership Momentum Shows Stablecoins Support—Not Replace—Traditional Networks

Visa, Mastercard, and financial institutions worldwide are increasingly introducing blockchain settlement options alongside traditional rails, not instead of them.

These alliances confirm Allaire’s central argument: stablecoins are not replacing financial systems; they’re becoming an invisible engine behind them.

As more banks and payment firms connect to stablecoin infrastructure, value movement across borders becomes faster, cheaper, and more predictable.

Conclusion

The picture emerging from Davos shows a global financial system in transformation. What was once a niche digital asset is rapidly evolving into a universal settlement layer.

With AI-driven automation, expanding regulation, institutional partnerships, and accelerating network effects, the USDC stablecoin is positioning itself as a foundational component of how value will move across the world in the coming decade.

Glossary

Stablecoin: A digital token backed by cash or similar assets.

Network Effects: Growth driven by increased user participation.

Liquidity Friction: Delays that complicate money movement.

Settlement: Final confirmation of a financial transaction.

FAQs About USDC Stablecoin

Is USDC well-regulated?

It follows strict reserve and reporting standards.

Why do firms adopt USDC?

It provides fast, predictable digital transfers.

Are stablecoin payments increasing?

Yes, adoption is expanding across global markets.

Can AI improve digital transfers?

AI may soon automate payments and reduce errors.