This article was first published on Deythere.

US stablecoin yield has quickly moved from a niche crypto topic to one of the most closely watched financial policy debates in years. What once seemed like a technical regulatory detail is now shaping into a broader challenge to the traditional banking system. With a federal deadline set for late February, policymakers must decide whether digital dollars will be allowed to grow more freely or remain tightly restricted.

According to people familiar with the discussions, the White House recently brought together senior leaders from both the banking sector and the crypto industry. Their message was clear: find common ground on whether stablecoin holders can receive rewards, or risk derailing broader digital-asset legislation expected in 2026.

Coverage of the summit confirms that disagreements over interest-like incentives have already slowed progress toward a unified national framework for stablecoin regulation.

The Legal Fault Line Behind the US Stablecoin Yield Conflict

When Congress designed payment stablecoins, lawmakers were careful to avoid making them resemble traditional bank deposits. Issuers are permitted to invest reserves in short-term US Treasuries, but they are not allowed to pass direct interest payments to users holding the tokens.

The current dispute focuses on a critical gray area. Even if issuers cannot provide yield, could exchanges or digital wallets still offer incentives tied to balances, transactions, or network participation? If so, stablecoin users might still receive economic benefits that look very similar to interest.

Banks argue that any reward connected to account balances effectively turns stablecoins into savings substitutes, creating a real threat to traditional deposits. Crypto advocates counter that Congress intentionally left room for usage-based incentives within the law.

How regulators interpret this gray zone will help determine who ultimately captures the financial return generated by digital dollars, and how stablecoin regulation evolves in the United States.

Trillion-Dollar Deposit Risks Raise the Stakes

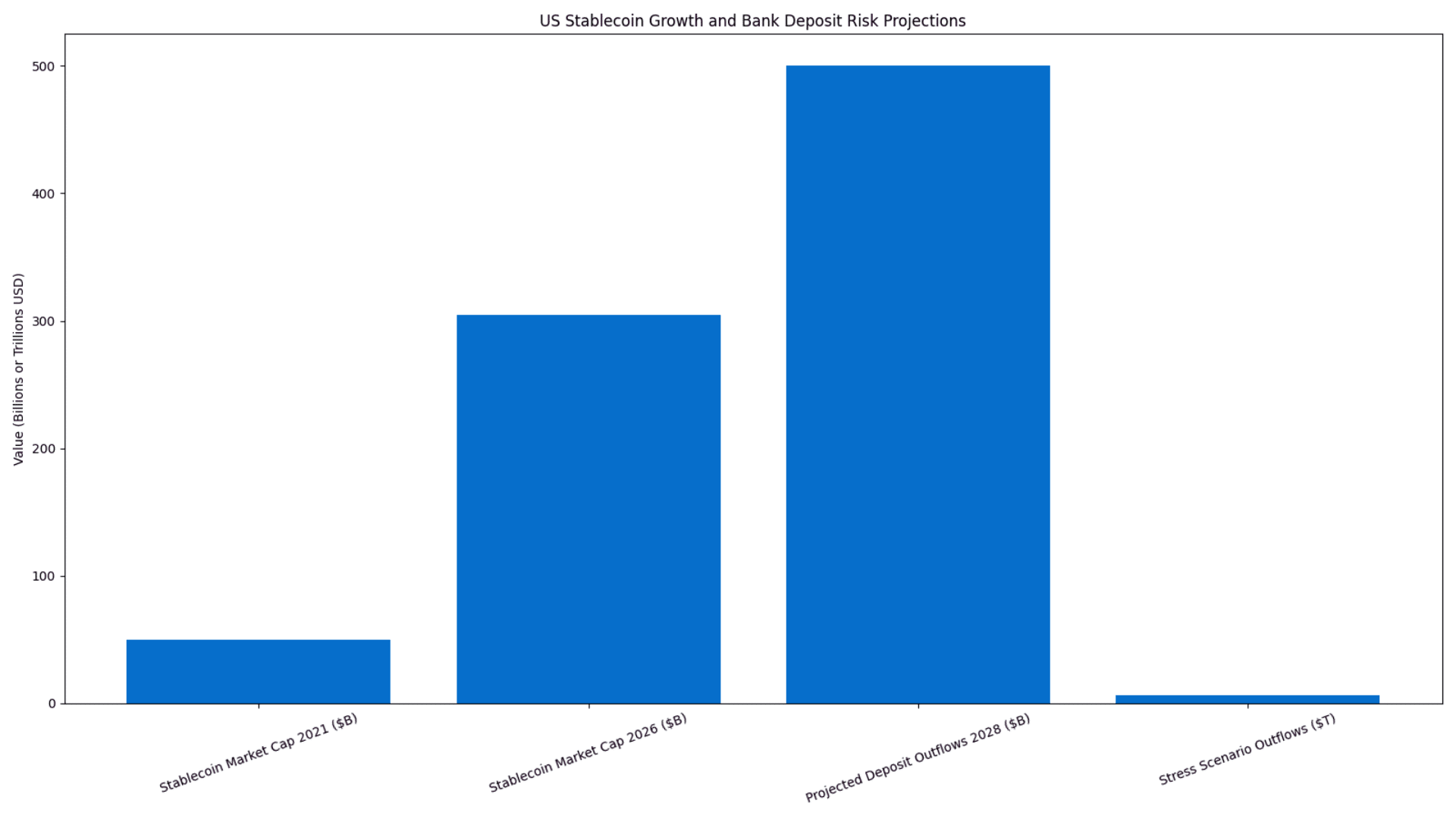

Stablecoins are no longer small. Their total market value has surged from under $50 billion in 2021 to roughly $305 billion by early 2026. With growth accelerating, policymakers are increasingly worried about financial-stability risks.

Some projections warn that meaningful US stablecoin yield could pull massive sums out of the banking system. One estimate suggests $500 billion in deposit outflows by 2028, while a Treasury-linked stress scenario discussed in policy circles reaches as high as $6.6 trillion.

Numbers of this scale explain why regulators now treat stablecoin policy as a core financial-stability issue rather than a narrow crypto concern.

Three Legislative Paths Under Consideration

Negotiators are currently exploring several compromise approaches:

- Activity-based rules would ban rewards for simply holding stablecoins but allow incentives tied to payments, transfers, or real network use.

- Reserve-placement requirements would push stablecoin backing assets into community banks, linking crypto growth directly to the traditional financial system.

- Institution-focused incentives would restrict retail rewards while allowing certain institutional programs under strict disclosure and capital standards.

Other jurisdictions are facing similar decisions. Hong Kong plans to begin licensing stablecoin operations in March 2026, while the United Kingdom is working on rules designed to prevent payment tokens from functioning like savings products.

Because of the size of the US market, America’s final decision will likely influence where global liquidity, innovation, and regulation ultimately settle.

If No Deal Emerges, CLARITY Could Stall

The outcome now appears stark. A negotiated compromise could allow the CLARITY market-structure bill to move forward, though likely in a diluted form. Failure, however, could leave the United States without comprehensive digital-asset legislation in 2026.

In that scenario, oversight would shift toward enforcement actions, agency interpretation, and a patchwork of state-level rules. Even without new laws, scrutiny of US stablecoin yield would almost certainly intensify.

The dispute is also creating divisions within the crypto industry itself. Retail-focused platforms depend heavily on reward programs, while offshore-leaning issuers appear more open to restrictions. Policy reporting suggests Tether’s US-facing operations have shown support for draft limits on yield, distancing themselves from exchange-driven opposition.

These internal splits could shape future battles over custody, DeFi access, and taxation long after the current regulatory fight ends.

Conclusion: A Turning Point for Digital Dollars

The debate over US stablecoin yield has grown far beyond a technical rule. At stake is the balance between financial innovation and banking stability, and possibly the future structure of money in the digital age.

The late-February deadline may determine whether the United States finds a workable compromise or enters a prolonged period of regulatory uncertainty. Either way, the decision will influence competition in finance, the direction of global regulation, and the long-term role of digital currencies worldwide.

Glossary of Key Terms

Stablecoin: A digital token designed to maintain a stable value, typically pegged to the US dollar.

Yield: The financial return earned from holding or using an asset.

CLARITY Act: Proposed US legislation aimed at defining digital-asset market structure and oversight.

Deposit Flight: The movement of funds from traditional banks into alternative financial systems.

FAQs About US Stablecoin Yield

What is US stablecoin stab?

It refers to rewards or financial returns earned from holding or using dollar-linked stablecoins.

Why is stablecoin regulation especially important in 2026?

Because the market has grown large enough to potentially impact bank deposits and overall financial stability.

Could money really leave banks at scale?

Regulatory stress scenarios suggest that significant outflows are possible if stablecoin incentives expand.

When will a final decision be made?

Officials have set February 28, 2026 as the key policy deadline.