According to latest reports, the US government has formally activated its Strategic Bitcoin Reserve and is managing roughly 198,000 BTC (over $23 billion) seized from law enforcement. Bo Hines, presidential adviser on digital assets, confirmed the reserve is up and running by saying “We have it, it’s been established.” He called Bitcoin “digital gold” and said the infrastructure to manage the reserve is rolling out promptly.

- Whale Accumulation vs. Mass Sell-Off: On-Chain Forces at Play

- Strategic Reserve Growth Without Taxpayer Money

- Technical Outlook: Will Bitcoin Hit $110K?

- Conclusion

- FAQs

- What is the Strategic Bitcoin Reserve policy?

- How is the reserve funded without taxpayer money?

- Why is $110K now a considered level for BTC?

- Glossary

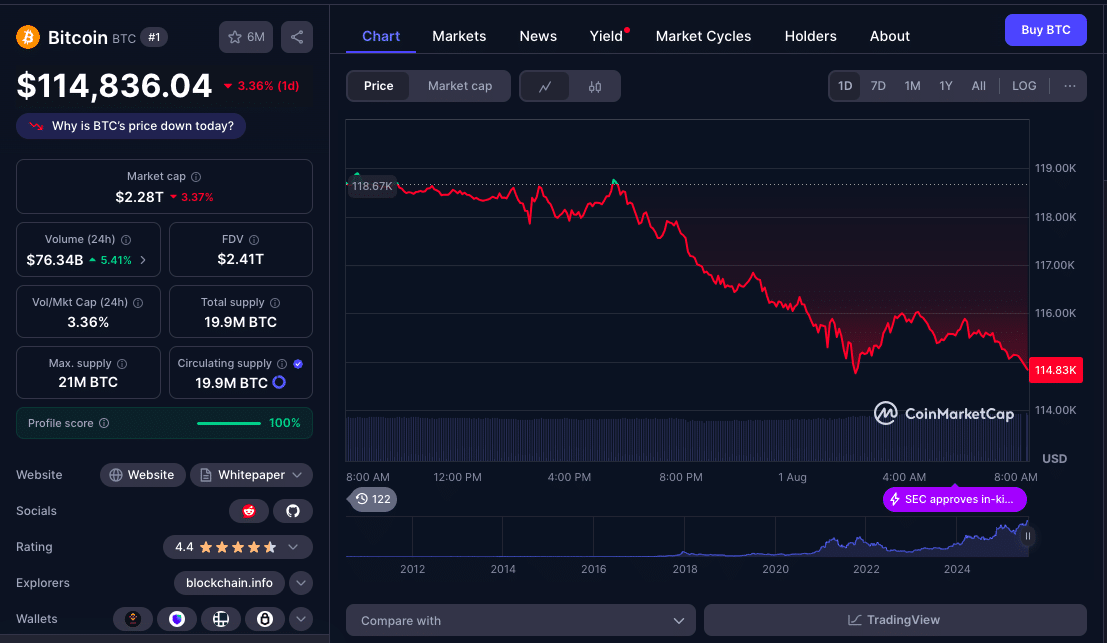

Meanwhile, the market has taken another turn as Bitcoin drops to around $114,800. Traders are waiting to see if it will test $110,000. Technicals show $BTC stuck below the 50-day moving average at $117,919 and RSI at 33, both signs of bearish momentum.

Whale Accumulation vs. Mass Sell-Off: On-Chain Forces at Play

Big holders are buying while others are selling. According to Santiment, wallets holding between 10 and 10,000 BTC, that is accounts that hold around 68.4% of all BTC; have added nearly 0.9% of the circulating supply (30,000 BTC) in 48 hours.

Yet, it should still be noted as previously reported that a single Satoshi-era whale sold 80,000 BTC ($9B via Galaxy Digital), injecting short-term volatility. Glassnode data shows 97% of BTC is still in profit, as a result, most holders have unrealized gains.

Whales are buying while retail is selling. Santiment reports whales bought over 83,000 BTC recently while retail addresses sold around 290 BTC, so there’s a divergence in sentiment.

Strategic Reserve Growth Without Taxpayer Money

Hines has reiterated that the US will not sell its BTC. Instead, new Bitcoin will be acquired through budget-neutral methods, using tariff revenues or revaluing gold reserves. These they say, are creative ways to grow the Bitcoin reserve without new federal spending.

The broader Bitcoin Reserve policy rollout is accompanied by regulatory moves. At the America First Policy Institute forum, SEC Chairman Paul Atkins said sweeping reforms to simplify cryptocurrency definitions and expand tokenized securities access are “once in a generation” changes to reduce institutional uncertainty.

Combined with the digital asset framework from the Trump-era working group which includes the SEC and CFTC, these changes will lower barriers to entry and increase institutional adoption.

Technical Outlook: Will Bitcoin Hit $110K?

Bitcoin is currently under pressure. The $5.6B Bitcoin options expiry on August 1 created concentrated selling pressure at the $117,000 “max pain” price . This forced market makers to hedge positions through spot sales, amplified by $81M liquidations as BTC broke below the 23.6% Fibonacci support at $118,859.

After breaking below $116,872, the bearish engulfing candle and RSI divergence show buyers are losing control. Critical support zones are $114,532, $112,726 and finally $110,587; unless a strong bounce happens soon. As at the time of writing, $BTC trades at $114,836.

Until BTC gets back above $117,900 bearish momentum is strong. If USD flows into ETFs and public treasuries continue, that may offset technical weakness, but a drop to $110,000 seems possible without quick institutional support.

Conclusion

Based on the latest research, the Strategic Bitcoin Reserve policy is a welcome development in US crypto policy, with nearly 198K BTC as sovereign reserves and long-term institutional commitment.

However, Bitcoin is getting fragile, with technical breakdowns putting $110,000 in reach. Whale accumulation is going in the opposite direction of retail, so the market is at a juncture. Price action now depends on institutional flows, policy rollout and whether key levels hold.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

The US has renewed its Strategic Bitcoin Reserve policy with nearly 200,000 BTC in sovereign reserves. Despite this milestone, Bitcoin has fallen around $114,800 and broken its 50-day moving average, heading towards $110,000. On-chain data shows whales are buying 0.9% of supply in 2 days while retail is selling.

FAQs

What is the Strategic Bitcoin Reserve policy?

A government program to hold and manage confiscated and future-acquired BTC ( about 120K coins) as a reserve asset.

How is the reserve funded without taxpayer money?

The administration will grow reserves via tariff revenues, revalued gold certificates and reinvestment of seized assets.

Why is $110K now a considered level for BTC?

Bitcoin’s structure broken below support and moving averages is at risk of further down moves unless buyers step in.

Glossary

Strategic Bitcoin Reserve policy – A government stash of BTC held as a reserve asset, funded through forfeitures and creative public funding.

Whale accumulation – Big BTC holders buying more coins, means they are bullish.

Bearish engulfing candle – Technical chart pattern where a big down candle follows an up candle, means bearish reversal.

50-day Simple Moving Average (SMA) – Trend indicator; below it means bearish.

RSI divergence – Momentum indicator showing waning upward strength despite price rise, often precedes a pullback.