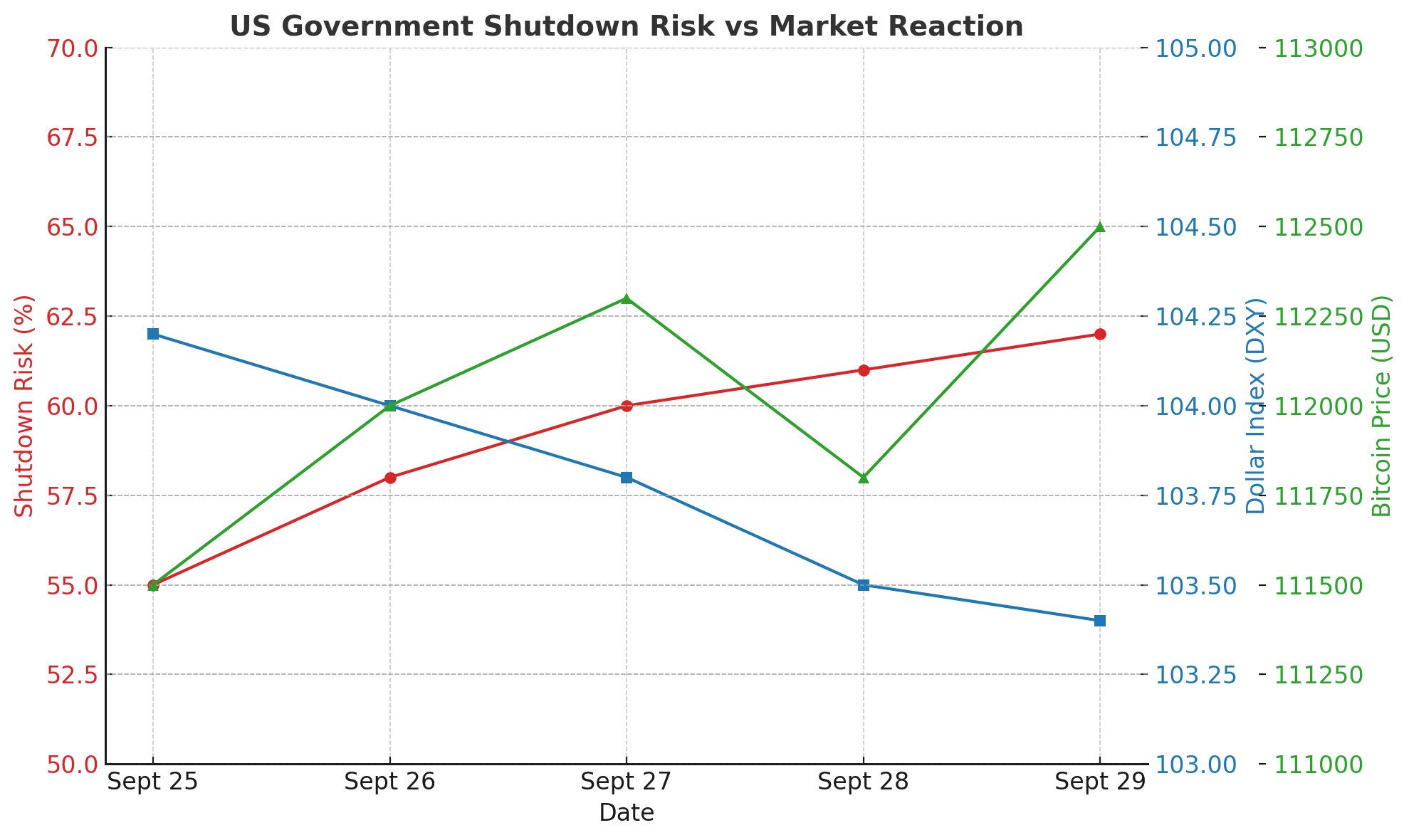

With just days before the new fiscal year, the US Government Shutdown risk has climbed to more than 60%, casting a shadow over both traditional finance and the digital asset sector.

The standoff in Congress over budget negotiations has raised the odds of a funding lapse by October 1, fueling uncertainty in global markets and stalling investor sentiment.

Political Stalemate Raises Shutdown Risk

The gridlock stems from disagreements between lawmakers on funding priorities. Continuing resolutions have been proposed, yet both chambers remain divided.

The US Government Shutdown narrative is not new, but this time the tension feels sharper as agencies, courts, and federal programs prepare contingency plans. According to Reuters, the judiciary has warned that it may not be able to fully operate past October 3 if funds run dry.

Former President Donald Trump added fuel to the fire, declaring on social media that “any shutdown pain would be caused by the Democrats,” attempting to frame the blame game ahead of the deadline. Such rhetoric has only intensified partisan divisions and heightened the perception of political dysfunction.

Market Signals Point to Jitters

The ripple effect of a US Government Shutdown is already visible in markets. Equities across Asia rose only modestly, and the U.S. dollar dipped as traders priced in the likelihood of delayed economic data releases.

Without key indicators such as jobs reports and CPI numbers, the Federal Reserve could be forced to navigate policy blindfolded. For crypto, that means volatility may accelerate as investors look for alternative signals to guide trades.

Analysts point out that uncertainty in Washington has historically boosted safe-haven assets like gold, and in some cases, Bitcoin. But the linkage is not always direct. The reality is that a US Government Shutdown creates a data vacuum, leaving traders to lean heavily on technical charts, on-chain flows, and sentiment indexes.

Crypto Market on Edge Amid Fiscal Risks

The digital asset community has not ignored the threat. Market strategists note that while Bitcoin has hovered near key resistance, altcoins remain especially vulnerable to external shocks. The Fear & Greed Index, which tracks investor sentiment, shifted toward neutral after weeks of fear, signaling that traders are bracing but not yet panicking.

Commenting on X, Galaxy Digital’s Mike Novogratz remarked, “This kind of gridlock doesn’t just hurt confidence in Washington, it spills into crypto as global investors question stability”. His comment captures how a US Government Shutdown reverberates well beyond the political arena.

Global and Institutional Repercussions

Beyond markets, institutions are already mapping contingency measures. Reports suggest the White House is weighing “backdoor cuts” and even potential layoffs in nonessential programs if the standoff persists.

Such measures could further erode confidence and slow federal responses to emerging crises. For crypto markets that thrive on narratives, a US Government Shutdown adds to the uncertainty that shapes daily volatility.

At its core, this is a test of both governance and market resilience. The risk is no longer hypothetical; prediction markets are actively pricing it, giving investors a tangible signal that the danger is real.

Conclusion

The US Government Shutdown debate underscores how deeply political dysfunction can bleed into markets, from stocks to crypto. As October approaches, traders, analysts, and institutions alike must prepare for potential disruptions.

Whether the shutdown becomes reality or gets narrowly averted, the lead-up has already reshaped sentiment. For crypto investors, the episode is yet another reminder that Washington’s battles can be just as impactful as on-chain data.

FAQs

1. What does a US Government Shutdown mean?

It happens when Congress fails to pass funding bills, causing federal agencies to halt or reduce operations.

2. How could a US Government Shutdown impact crypto markets?

It can increase volatility by delaying economic data, weakening confidence, and pushing investors to rely on technical signals.

3. Why does the judiciary warn of disruption during a shutdown?

Courts rely on federal funding, and without it, operations may be limited after October 3.

4. What role do prediction markets play in shutdown risk?

They reflect real-time odds by pricing bets on whether a shutdown will occur, offering traders a market-based probability gauge.

Glossary of Key Terms

Continuing Resolution: A temporary measure to keep the government funded when Congress has not passed a full budget.

Fear & Greed Index: A sentiment indicator tracking market emotions ranging from extreme fear to extreme greed.

Safe-Haven Asset: Investments like gold or Treasury bonds that retain value during times of uncertainty.

On-chain Flows: Movements of cryptocurrency between wallets and exchanges, often used to gauge market sentiment.

Volatility: The degree of variation in trading prices over time, often heightened by uncertainty.

Prediction Market: Platforms where traders bet on future events, offering a crowd-based probability measure.