Stablecoins: A Safe Haven or a Risk in Disguise?

- What Are Stablecoins, and Why Do They Matter?

- USDT vs USDC: The Transparency Divide

- The Fragile Promise of Stability

- Regulation: Building Trust, Not Perfection.

- Security, custody, and investor risks

- Global Impact: Stablecoins as Shadow Dollars.

- Conclusion: Verdict on Stablecoin Safety

- Glossary of Terms

- FAQs on USDT vs USDC

The cryptocurrency market is characterized by volatility. Prices skyrocket one day and plummet the next, leaving investors seeking refuge. Here’s where stablecoins come in.

They guarantee stability by tying its value to the US dollar or other assets. But the larger issue remains: are stablecoins genuinely safe, or is their stability an illusion? The argument frequently focuses on USDT vs USDC, the two dominant stablecoins.

What Are Stablecoins, and Why Do They Matter?

Stablecoins are digital currencies that have a constant value and are typically connected 1:1 to fiat money. They serve as a bridge between traditional finance and cryptocurrency by enabling for fast transfers without the volatile price swings of assets such as Bitcoin or Ethereum.

According to Chainalysis, stablecoins now account for a sizable share of blockchain transactions, making them critical to the industry. However, their safety is totally dependent on the quality of the reserves that support them. Again, the USDT vs USDC issue is essential.

USDT vs USDC: The Transparency Divide

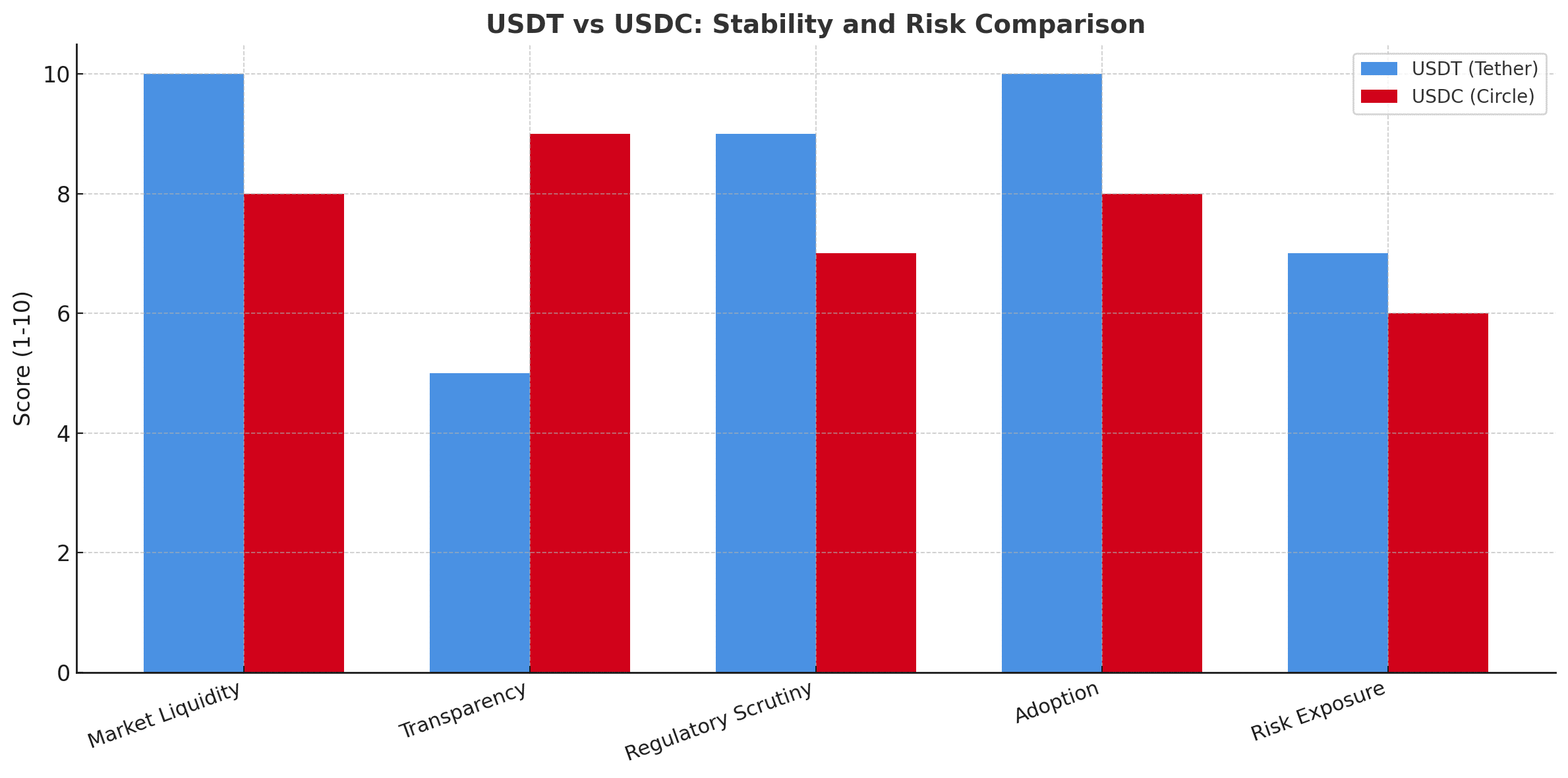

When comparing USDT vs USDC, one key distinction emerges: transparency. USDT, produced by Tether, has dominated markets for years but has been repeatedly questioned about whether it genuinely has enough cash and marketable assets to support its tokens. US authorities have penalized the issuer for previous misstatements, raising concerns about its reserves.

USDC, on the other hand, is issued by Circle and operates more transparently. It reports monthly reserve attestations and mostly keeps cash and US Treasuries. This transparency has made USDC a popular among institutions.

However, both coins have had crises—when one of USDC’s financial partners failed in 2023, its price momentarily fell to $0.87 before rebounding. This demonstrated how even openness cannot eliminate all danger.

The Fragile Promise of Stability

Stablecoins are supposed to remain stable at one dollar; however, this promise is not guaranteed. When trust is low, de-pegging events occur. For example, liquidity shocks or reserve concerns might disrupt stability, and stablecoins, unlike bank accounts, are not insured by the government.

This is why analysts advise investors to carefully compare USDT vs USDC before accepting them as secure investments. Both are less volatile than other cryptocurrencies, but they are not without danger.

Regulation: Building Trust, Not Perfection.

The emergence of stablecoins has piqued the interest of authorities worldwide. In the United States, the Genius Act requires stablecoins to be backed by liquid assets like as cash or Treasury notes. Europe has implemented MiCA, which requires tight reporting and control.

These procedures make USDT look safer than USDC, but they do not guarantee protection from abrupt market runs or liquidity freezes.

The Bank for International Settlements warns that broad use of stablecoins might disrupt global banking if they are not rigorously regulated. Their expanding size even has an impact on US Treasury rates, demonstrating how closely they are now linked to traditional financial markets.

Security, custody, and investor risks

Stablecoins potentially pose concerns that go beyond legislation. Technical flaws in smart contracts, exchange hacking, and inadequate custody might jeopardize user cash. Researchers emphasize that, while USDT vs USDC are centralized and simpler to manage, consumers must entirely trust issuers. If assets are frozen or confiscated, owners may lose access overnight.

The collapse of TerraUSD, an algorithmic stablecoin, demonstrated that not all pegs can withstand stress. Unlike USDT and USDC, it lacked adequate collateral and finally collapsed. The message is clear: stability must be supported by tangible assets and a trustworthy government.

Global Impact: Stablecoins as Shadow Dollars.

In underdeveloped nations, stablecoins are increasingly being utilized as dollar alternatives to avoid inflation. Here, the USDT vs USDC rivalry is once again visible. USDT leads owing to its increased availability, whilst USDC appeals to customers who value transparency.

However, central banks are concerned that this trend may erode monetary management, driving initiatives to develop Central Bank Digital Currencies (CBDCs) as an alternative.

Conclusion: Verdict on Stablecoin Safety

Stablecoins are crucial to the cryptocurrency ecosystem. They connect trade, payments, and DeFi while providing the reliability that other tokens lack. However, the discussion over USDT vs USDC demonstrates that not all stablecoins are equal. USDT provides liquidity and domination, although its reserves are called into question. USDC offers openness and institutional appeal while remaining sensitive to systemic shocks.

The fact is that stablecoins are safer than volatile crypto assets, but not as secure as insured savings. Their future safety is dependent on regulation, transparency, and responsible implementation. Investors must see them as instruments with benefits—but also hazards that cannot be overlooked.

This article is for informational purposes only and does not constitute financial advice. Readers should conduct their own research before making any investment decisions.

Glossary of Terms

Stablecoin: A cryptocurrency pegged to fiat or assets for price stability.

USDT: Tether’s stablecoin, largest by volume but criticized for opaque reserves.

USDC: Circle’s stablecoin, praised for transparency but exposed to banking risks.

Peg: A fixed value, usually $1, maintained by reserves.

Reserves: Assets backing stablecoins to preserve stability.

De-pegging: A break in the stablecoin’s fixed value.

MiCA: European law regulating stablecoins and crypto assets.

CBDC: Government-issued digital currency designed as a safer alternative.

FAQs on USDT vs USDC

1. Is USDT vs USDC a fair comparison of safety?

Yes. Both are leading stablecoins but differ in transparency, liquidity, and risk exposure.

2. Which is more trusted, USDT or USDC?

USDC is considered more transparent, but USDT maintains dominance through higher liquidity.

3. Can stablecoins lose value?

Yes. Events like banking crises or reserve doubts can cause temporary or permanent de-pegging.

4. How do regulators view stablecoins?

They see them as critical but risky. Laws like the Genius Act and MiCA aim to enforce stability.

5. Do stablecoins impact global finance?

Yes. Their reserves, often in Treasuries, now influence interest rates and market liquidity.

Sources/References