The Hidden Price of Profits: Why Crypto Taxation is More Important Than Ever.

- How the U.S. defines and taxes cryptocurrency earnings

- Europe’s Patchwork: From MiCA to National Rules

- Asia’s Aggressive Tax Landscape

- Middle East and Africa: Tax Havens and Grey Zones

- Reporting Obligations and Cross-border Complexities

- The Use of Technology to Simplify Tax Compliance

- Risks of Non-compliance and Future Outlook

- Conclusion: Crypto Taxation is the Next Competitive Frontier.

- Frequently Asked Questions for Crypto taxation

- Glossary of Key Terms

The development of cryptocurrencies has transformed finance, but taxes remain one of the most perplexing and significant issues for investors. Unlike traditional assets, cryptocurrency transactions take place on decentralized networks that cross borders.

Because of its worldwide scope, crypto taxation is an important topic for traders, developers, and organizations. Misunderstanding tax duties can result in penalties, a loss of earnings, and, in certain situations, legal action.

Governments all across the world are rushing to adapt, with each implementing its own strategy. Investors must understand how crypto taxation works in their jurisdiction, and overseas. It is critical knowledge that can impact financial stability.

How the U.S. defines and taxes cryptocurrency earnings

In the United States, the Internal Revenue Service (IRS) regards cryptocurrencies as property. This implies that any sale, exchange, or usage of cryptocurrency to purchase things is a taxable transaction.

Capital gains tax is levied based on how long the asset was kept. If sold within one year, the gain is deemed short-term and taxed as regular income. If kept for a longer period of time, it may be eligible for long-term capital gains, which are frequently taxed at a reduced rate.

Losses are also important. Investors can deduct capital losses from gains, lowering their overall tax bill. According to IRS Notice 2014-21, taxpayers must record cryptocurrency transactions in US dollars, based on fair market value at the time of the event.

In 2021, the IRS introduced a direct question to Form 1040, asking taxpayers if they acquired, sold, or transferred digital assets, emphasizing the agency’s attention.

Europe’s Patchwork: From MiCA to National Rules

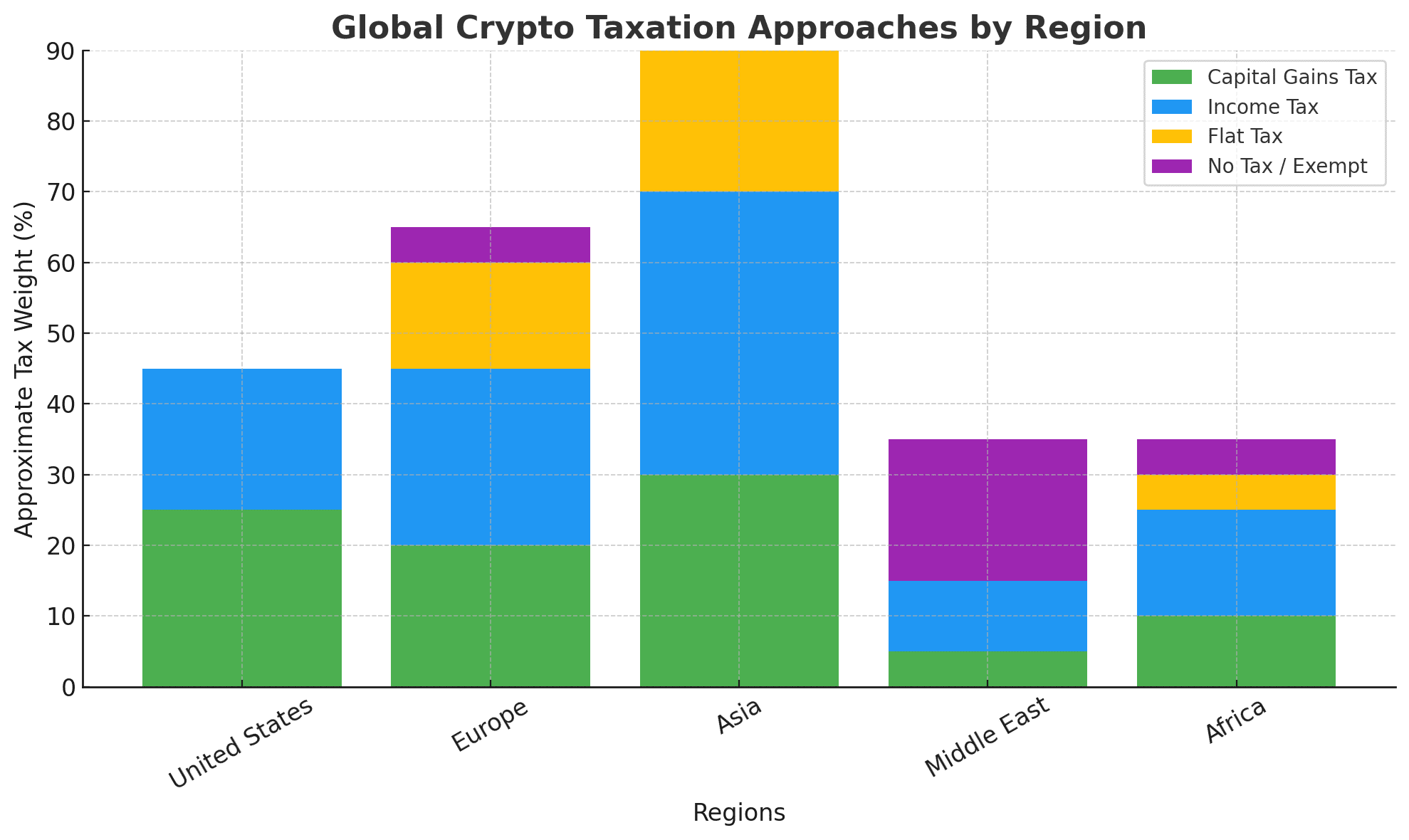

Europe has come closer to standardization with the Markets in Crypto Assets (MiCA) law, which aims to unify rules across member states. However, taxes is still a national problem. In Germany, investors who keep cryptocurrency for more than a year are excluded from paying capital gains tax. In contrast, France imposes a flat 30% tax on digital asset gains, regardless of holding term.

Cross-border complication emerges when an investor transfers between EU nations. Gains may be taxed differently based on your residency and the location of the transaction utilized. Academic studies from the European Central Bank highlight the fact that harmonization is still imperfect, leaving investors uneasy.

Asia’s Aggressive Tax Landscape

Asian regulators have implemented some of the harshest taxing policies. In India, all cryptocurrency profits are taxed at a fixed 30% rate, with no deductions for losses. This approach has sparked criticism from business executives, who claim it hinders innovation and forces trade underground.

Japan adopts a stricter approach, crypto taxation earnings as miscellaneous income. This can drive high-income people into tax levels that surpass 45%.

South Korea’s 20% crypto taxation proposal was first delayed, but officials continue to suggest that it would be implemented eventually. These examples demonstrate that Asian governments perceive cryptocurrency as both an asset class and a substantial income source.

Middle East and Africa: Tax Havens and Grey Zones

In the Middle East, methods vary greatly. The United Arab Emirates does not impose personal income tax, making Dubai an appealing location for cryptocurrency businesses. Companies must, however, comply with new federal tax rules and anti-money laundering (AML) regulations. Saudi Arabia has yet to issue clear taxes legislation, yet rigorous regulatory control exists.

Africa shows a mixed image. South Africa crypto taxation as capital gains, while Nigeria’s policies are still being refined. Many African countries lack clear guidelines, resulting in gray areas where enforcement is uneven. Chainalysis reports that this lack of certainty has encouraged both growth and danger.

Reporting Obligations and Cross-border Complexities

One of the most difficult components of crypto taxation is reporting. Investors who trade on numerous exchanges and wallets must aggregate data to ensure correct tax filings. This becomes more challenging when transactions cross borders. For example, a German investor who invests in the US market may have dual reporting duties.

Global groups such as the Financial Action Task Force (FATF) have pushed countries to implement universal reporting standards, comparable to the Common Reporting Standard (CRS) used in banking. However, complete adoption is years away. Until then, cross-border traders must negotiate overlapping authorities.

The Use of Technology to Simplify Tax Compliance

Tax software that works with blockchain explorers is becoming a crucial tool. Platforms can automatically compute capital gains, manage cost basis, and provide tax returns that comply with local regulations. Messari’s analysis found that use of such tools has surged by more than 200% since 2020, with institutional investors and individual traders driving the growth.

Developers are also creating decentralized compliance systems, which use smart contracts to compute and reserve tax amounts in real time. While still in the experimental stage, these technologies have the potential to transform how individuals manage crypto taxation.

Risks of Non-compliance and Future Outlook

Noncompliance bears significant risks. In the United States, failure to disclose can result in audits, penalties, and, in severe circumstances, criminal prosecution. In Asia, severe tax regimes can lead to rapid penalties or account suspensions.

The future is expected to bring increased international collaboration. Blockchain data is transparent; therefore, regulators are investing in analytics tools to trace transactions across networks. Chainalysis experts warn that when governments employ better surveillance systems, it will become increasingly difficult to hide profits.

The message to investors is clear: compliance is not a choice. Proper planning, precise reporting, and expert counsel are required.

Conclusion: Crypto Taxation is the Next Competitive Frontier.

Crypto taxation is more than just a technological issue. It influences investor behavior, drives innovation, and determines how nations fight for digital asset leadership. Investors who understand these standards may safeguard their wealth, limit risk, and capture opportunities in a complying manner.

The worldwide hodgepodge of laws may be perplexing, but it also demonstrates how seriously governments increasingly regard the business. Tax certainty is as vital to the maturation of cryptocurrency as technological achievements. Knowledge is the best protection, and planning is the wisest investment.

Frequently Asked Questions for Crypto taxation

1. Do all countries tax cryptocurrency the same way?

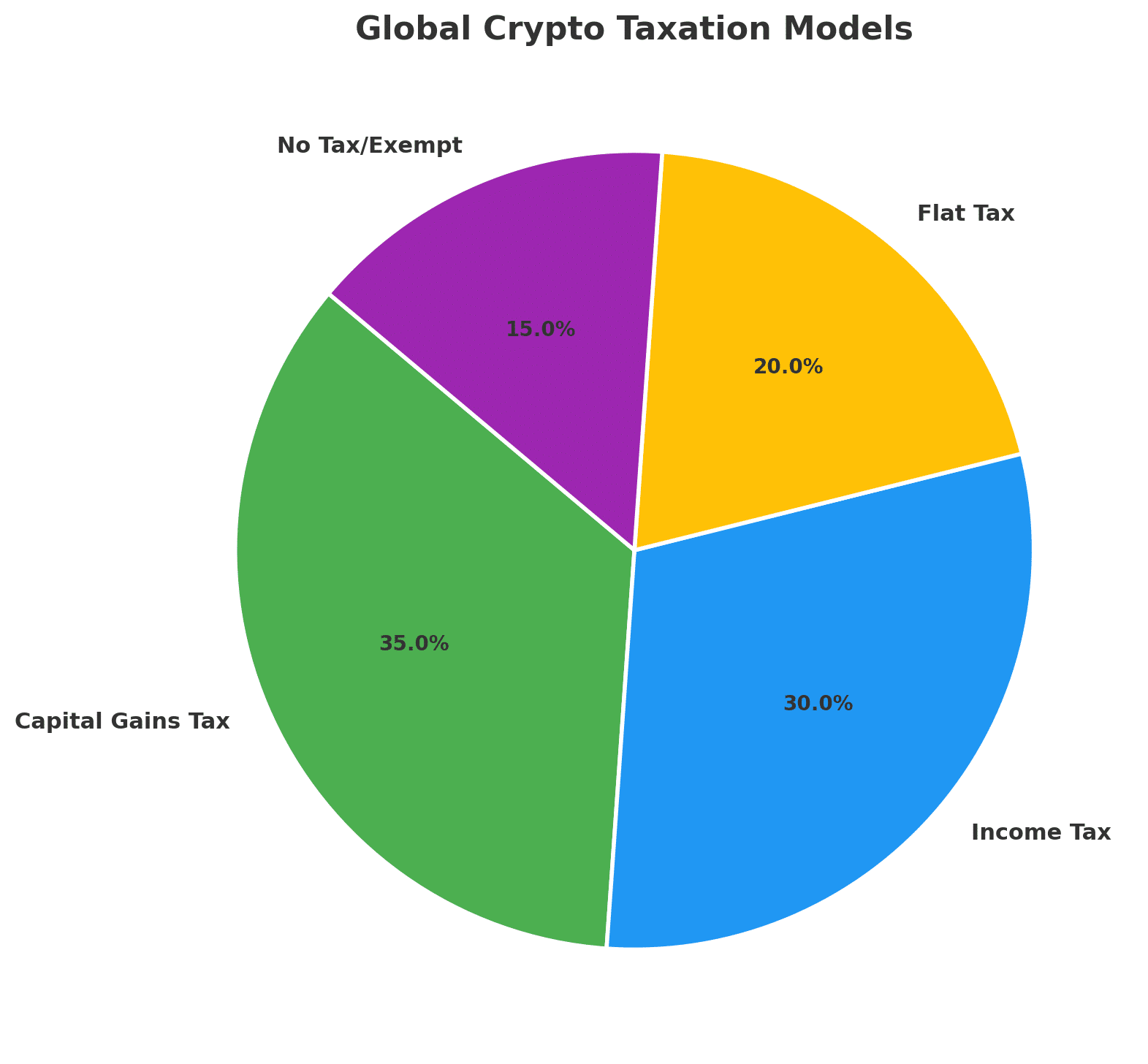

No. Tax rules differ widely, with some nations treating crypto as property, others as income, and some imposing no tax at all.

2. Can crypto losses reduce my tax liability?

Yes, in countries like the U.S. and Germany. Losses can offset gains, but some jurisdictions, such as India, do not allow this.

3. Is using crypto for payments taxable?

Yes. Many jurisdictions consider spending crypto a taxable disposal, requiring calculation of capital gains or losses.

4. Are NFTs taxed differently than cryptocurrencies?

Often yes. Some regulators classify NFTs as collectibles, leading to different tax rates compared to standard tokens.

5. Can blockchain explorers help with taxes?

Yes. They provide transaction histories that tax software can use to calculate accurate gains and losses.

6. Will global crypto taxation ever be harmonized?

Experts predict partial harmonization under FATF or similar frameworks, but full global alignment is unlikely in the near future.

Glossary of Key Terms

Capital Gains: Profit earned from selling an asset above its purchase price.

Cost Basis: The original value of an asset, used to calculate gains or losses.

Decentralized Exchange (DEX): A trading platform without central authority.

FATF (Financial Action Task Force): Global body that sets AML and tax standards.

MiCA Regulation: EU’s framework for digital asset markets and investor protection.

Tax Reporting Standard: Rules that define how financial accounts must be disclosed to authorities.

Tokenomics: Study of economic models behind cryptocurrencies, including supply and utility.