UK Opens Retail Access to UK Crypto ETNs: A Watershed Moment for Global Investors

In a watershed moment for financial access and digital asset regulation, the United Kingdom has formally allowed individual investors to purchase cryptocurrency Exchange-Traded Notes (UK crypto ETNs). This regulation move, which takes effect on October 8, 2025, marks a watershed moment in how regular people interact with cryptocurrencies, without the need to actually possess Bitcoin, Ethereum, or any other digital asset.

The Financial Conduct Authority (FCA) has reversed a prior 2020 prohibition that confined ETNs to professional investors. This is not merely policy; it is a signal. The UK is already presenting itself as a worldwide hub for regulated cryptocurrency engagement, with far-reaching repercussions.

New Era of Regulated Retail Participation

The primary attractiveness of ETNs is their simplicity. They are exchange-traded debt products that are tied to the performance of a certain asset. In this scenario, the asset is a cryptocurrency, such as Bitcoin (BTC) or Ethereum. Instead of dealing with digital wallets, private keys, or custodial risk, ordinary investors may now acquire exposure to the cryptocurrency market via standard brokerage accounts.

According to an FCA statement from July 2025, the go light was given following lengthy deliberation with market professionals, compliance organizations, and blockchain developers. The government stated that the rising maturity of the cryptocurrency ecosystem, together with enhanced consumer safeguards and transparency measures, helped explain the decision.

Why ETNs Are More Important Than Ever.

Crypto ETNs provide a link between traditional finance and the decentralized promise of blockchain. Their comeback to retail marketplaces occurs at a pivotal juncture. Global cryptocurrency usage is increasing, but trust gaps persist. ETNs offer a type of exposure that is easier to control, audit, and incorporate into tax systems, which appeals to both governments and conservative investors.

According to blockchain expert Anna Whitman, “The reintroduction of UK crypto ETNs is more than a compliance upgrade, it reflects growing institutional confidence in crypto’s staying power.” This viewpoint is consistent with many findings from European financial supervision bodies, which have underlined the need of both investor education and access.

Ethereum, Bitcoin, and the emergence of transparent trading

Bitcoin and Ethereum will be among the first assets offered through these new retail offers. With UK clearance, the London Stock Exchange (LSE) is likely to offer many UK crypto ETNs linked to Bitcoin and Ethereum. This is a big endorsement for Ethereum in particular, as its daily transactions in 2025 have hit all-time highs, indicating substantial real-world value.

Industry analysts also point out that ETNs may reduce volatility hurdles for regular investors. Because ETNs are cash-settled, slippage and network risk have less of an impact on trade execution. Unlike owning the underlying asset, which can result in hefty costs or technical complexity, ETNs simplify the process while maintaining market exposure.

Regulation and Risk: What Investors Should Know.

While this change creates new opportunities, it does not erase cryptocurrency’s concerns. Market volatility, token devaluation, and shifting regulation are all legitimate worries. The FCA has mandated that all UK crypto ETN products adhere to tight risk disclosures, safe custody requirements, and real-time market tracking methods.

Furthermore, the EU’s MiCA regulatory framework, which oversees cryptocurrency assets in the EU, is expected to have an impact on how these ETNs evolve. Analysts expect cross-border harmonization in ETN offers over the next year, particularly as other countries evaluate the UK’s deployment.

The success of this project will be highly dependent on investor awareness. Retail traders unfamiliar with cryptocurrency may view UK crypto ETNs as safer alternatives to direct crypto holdings, but price volatility persists. As a result, various investor education efforts are scheduled to support the October debut.

Institutional Momentum and What’s Next

Several asset managers are already planning to increase their cryptocurrency portfolios to accommodate the rising public demand. Portfolio strategist Jamie Heath stated in a recent financial paper that “the ETN greenlight is a liquidity multiplier for both retail and institutions.” As volume grows, spreads tighten and transparency improves.

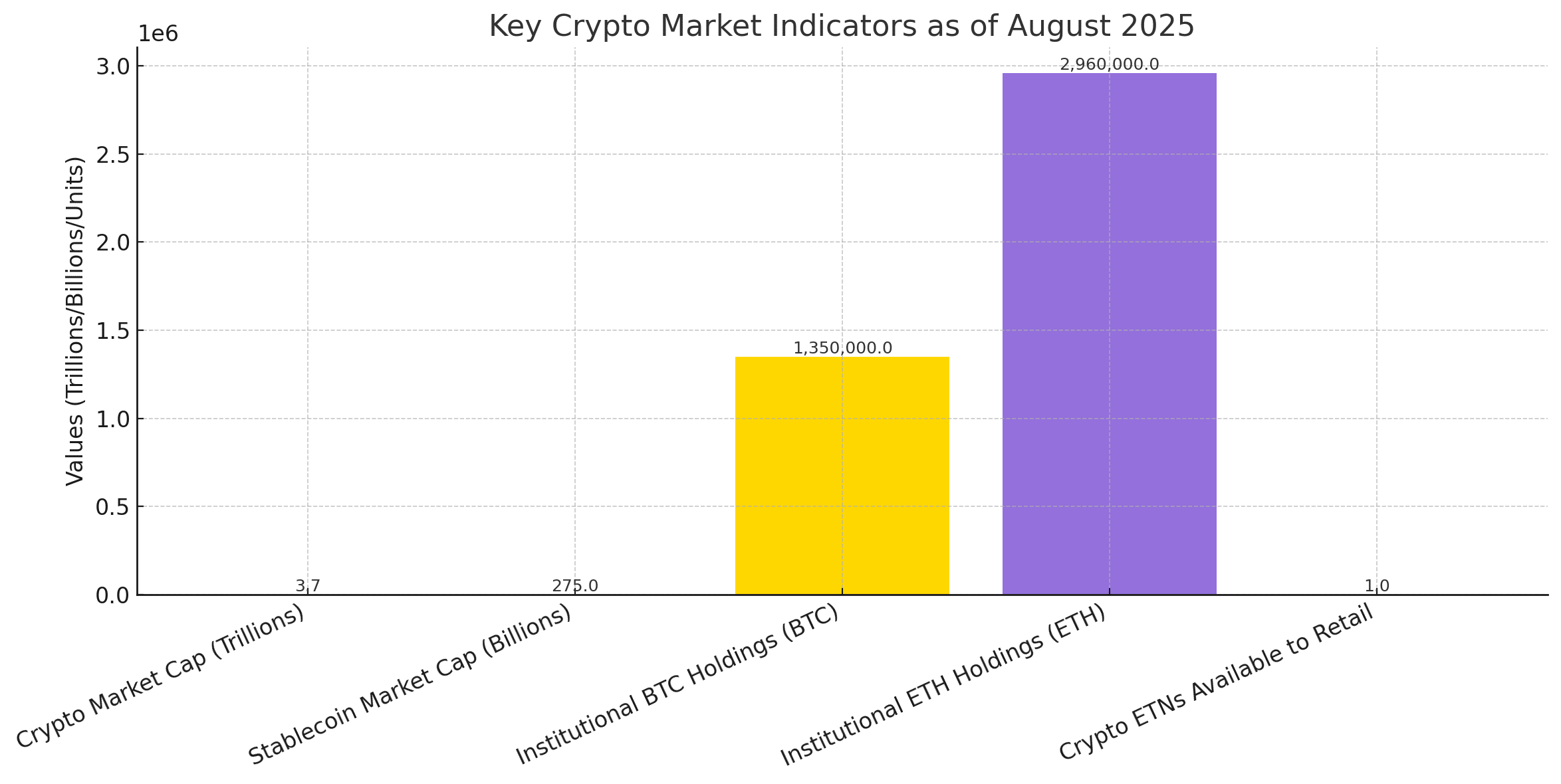

Furthermore, this development occurs at a time when the crypto market capitalization is approaching $3.7 trillion and institutional stockpiling of BTC and ETH continues robust. With global stablecoin liquidity over $275 billion, the ecosystem is poised for greater, controlled expansion.

For coders and blockchain businesses, this is validation. Traditional markets now recognize digital assets as real components of future finance, rather than merely speculative instruments.

Conclusion: Retail has entered the chat.

The UK’s decision to allow retail access to UK crypto ETNs represents a systemic progression rather than a technological shift. It allows ordinary investors a place at the crypto table using a framework familiar to existing financial institutions.

In a world where legislation frequently falls behind innovation, this action bridges the gap. It acknowledges the dangers, values the opportunities, and sends a clear message: cryptocurrency is no longer fringe. It is formalizing.

As retail enters and institutions adjust, the focus will be on how the UK manages this transition. If successful, it might serve as a model for balanced cryptocurrency adoption throughout the world.

Frequently Asked Questions

1. What are crypto ETNs and how do they work?

Crypto ETNs are exchange-traded notes that let investors gain exposure to crypto prices without owning the asset. They’re traded on traditional exchanges.

2. Why is the UK allowing retail access now?

The UK believes the crypto market has matured enough for wider participation, with stricter compliance rules and more secure infrastructure.

3. Are crypto ETNs safe for beginners?

They simplify access, but investors should still understand crypto volatility and read risk disclosures carefully.

4. Will other countries follow the UK’s lead?

Possibly. The UK may become a regulatory model, especially for EU countries aligning with MiCA standards.

Glossary of Key Terms

Crypto ETN – A financial product traded on stock exchanges that tracks the price of a cryptocurrency without requiring the investor to hold the asset directly.

FCA (Financial Conduct Authority) – The UK regulator responsible for overseeing financial markets and protecting investors.

Retail Investor – Individual, non-professional investor who buys and sells financial assets for personal gain.

Volatility – The rate at which the price of a cryptocurrency increases or decreases for a given set of returns.

MiCA (Markets in Crypto-Assets) – A regulatory framework set by the European Union to govern crypto asset issuance and service providers.