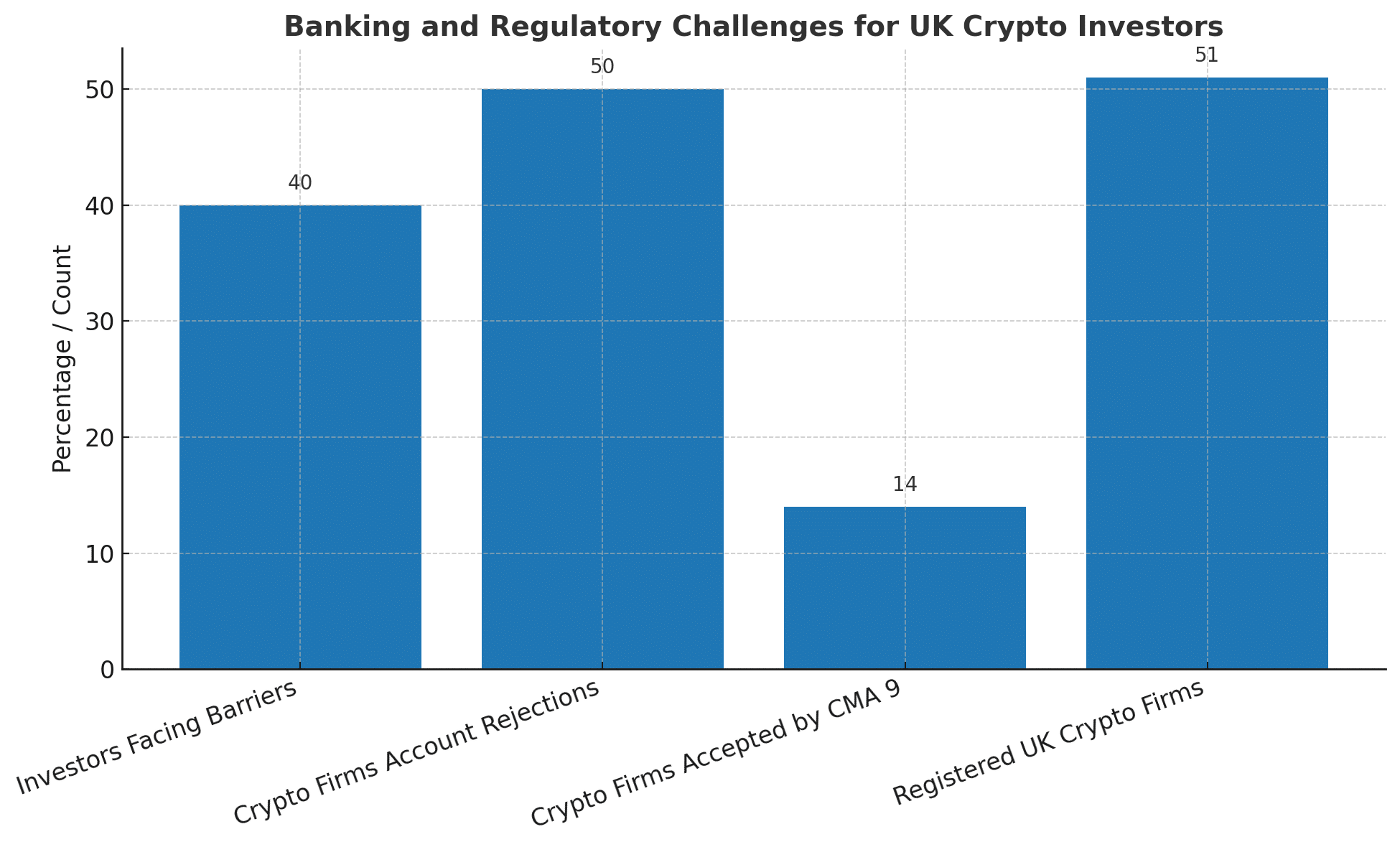

A storm is developing in Britain’s banking industry. According to recent estimates, approximately 40% of UK crypto investors’ banks have blocked or delayed payments to cryptocurrency exchanges. For many, the fight has gone beyond discomfort, with some moving banks completely to continue trading digital assets.

The disagreement reveals a larger issue: a confrontation between regulatory prudence and a growing thirst for cryptocurrency usage. The experience of UK crypto investors reflects both a lack of banking access and a legal structure that is still evolving.

Banks Versus Digital Assets: A Tense Relationship

Traditional banks in the United Kingdom have increased limits on cryptocurrency transactions. According to a poll performed by IG Group, over half of digital asset investors have encountered difficulties while attempting to shift cash between exchanges. Some even claimed full account closures.

Concerns about financial exclusion have arisen among UK crypto investors. Fintech and blockchain startups have similar problems. According to research, 50% of crypto businesses’ accounts were denied or closed by high-street banks. Only 14% were able to establish accounts with the so-called “CMA 9,” the nine largest British banks that dominate the market.

Regulatory tension is at the heart of the debate.

Regulators believe that banks are correct to be cautious, citing dangers of fraud, money laundering, and volatility. Without a clear standard, many financial institutions choose to err on the side of risk aversion.

However, industry leaders believe that regulatory uncertainty stifles innovation. Former Chancellor George Osborne has warned that Britain risks slipping behind its global competition.

In a letter co-signed by MPs, two urgent remedies were identified: enhancing banking access for regulated crypto businesses and expediting the Financial Conduct Authority’s (FCA) registration procedure. Currently, only 51 businesses are legally registered in the UK.

For UK crypto investors, these delays mean greater prices, less trust, and an unequal playing field as compared to places like the United States and the European Union.

Policy Changes and Market Openings

Despite the hurdles, glimpses of improvement are appearing. The FCA recently declared that individual investors will recover access to cryptocurrency Exchange-Traded Notes (ETNs) beginning in October 2025. This judgment signals the end of a five-year restriction on ETNs, potentially opening up new prospects for UK crypto investors.

The government is also consulting on stablecoin legislation, hoping to incorporate them into current e-money systems. Analysts believe that this step will provide banks with a firmer legal framework, decreasing uncertainty and allowing for more balanced interaction with crypto firms.

Stakes for Innovation and Adoption

The result of these regulatory discussions has major implications. If banking access improves, the UK may recover momentum as a cryptocurrency powerhouse, promoting start-ups and drawing worldwide investment. If limitations continue, more entrepreneurs may migrate to more favorable countries.

The UK crypto investors themselves are at the core of this division. Their capacity to trade, invest, and create is based not only on blockchain technology, but also on equitable access to the existing financial system.

Conclusion: A Test of Policy and Trust

The scenario developing in Britain is more than just a conflict between banks and digital assets. It will challenge regulators, banks, and investors’ ability to find a balance between security and innovation. For UK crypto investors, the outcome will decide whether the country emerges as a worldwide leader in digital finance or falls behind.

As changes take shape and political pressure mounts, the next two years might determine the destiny of Britain’s crypto economy. It is evident that financial constraints must be addressed if adoption is to increase sustainably.

Glossary

CMA 9: The nine largest banks in the UK that dominate the retail banking sector.

Crypto ETNs: Exchange-Traded Notes that track crypto assets like Bitcoin or Ethereum.

FCA (Financial Conduct Authority): The UK regulator overseeing financial services, including crypto firms.

Stablecoin: A cryptocurrency pegged to a stable asset such as the U.S. dollar or British pound.

E-money framework: Existing UK regulations covering digital payments and electronic money services.

FAQs on UK Crypto Investors

Q1: Why are UK crypto investors facing banking barriers?

Many banks block or delay transactions due to regulatory uncertainty and fraud risks.

Q2: What role does the FCA play?

The FCA registers crypto firms and oversees compliance but faces criticism for slow approvals.

Q3: How will ETNs help UK crypto investors?

ETNs will allow retail traders to access regulated Bitcoin and Ethereum-linked products from October 2025.

Q4: Could UK crypto investors see relief soon?

Yes. With regulatory reforms and political pressure, banking access could improve in the coming years.

Sources/References