The UK central bank has taken a careful step toward bringing stablecoins into the core of the financial system. In a new consultation, the UK central bank sketches a regime that welcomes pound based tokens into payments, but only if issuers accept strict rules on reserves, supervision and risk controls.

How The UK Central Bank Wants Stablecoins Backed

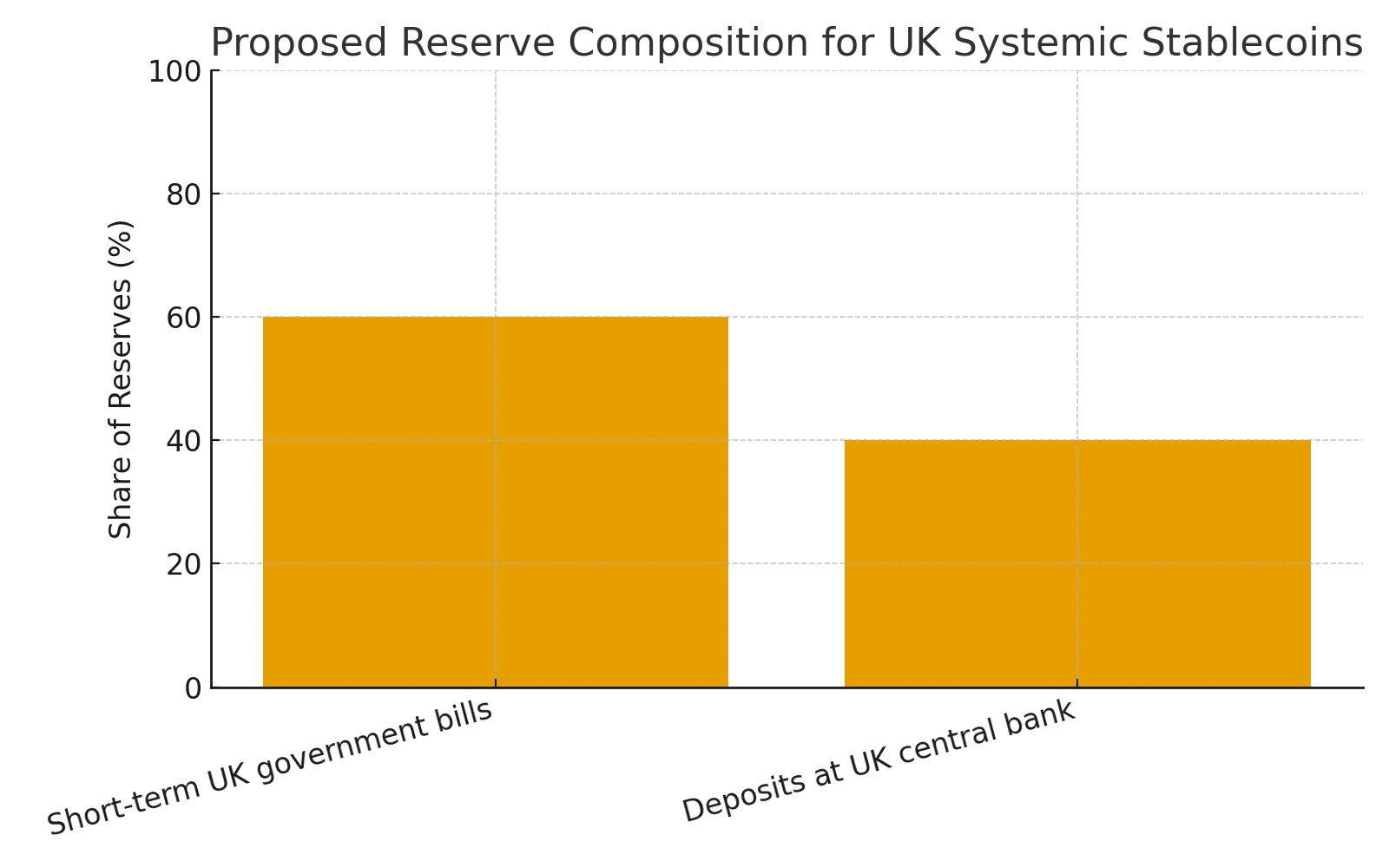

At the heart of the proposal, the UK central bank would oversee sterling stablecoins that become large enough to count as systemic. Issuers could hold around sixty percent of backing assets in short term government bills, while at least forty percent would sit in non interest bearing deposits at the central bank itself. The mix aims to keep reserves liquid in a crisis and to anchor token values closely to the pound.

A coin that must hold high quality government debt should behave more like a narrow money market fund than a loosely supervised token, which can reduce price slippage in volatile periods and make such coins more attractive as collateral for derivatives and margin.

Why Holding Caps Matter For Banks And Crypto

The UK central bank also wants temporary caps on how much a single user can hold in a systemic retail stablecoin. Individuals would face a ceiling near twenty thousand pounds, while companies would be limited to balances in the low millions. The aim is to prevent a rapid flight out of bank deposits into private digital cash at the moment when confidence in the traditional system is weak.

Here the logic of the UK central bank is rooted in financial stability thinking. If deposits drain into large private coins overnight, that funding base could shrink and tighten lending conditions across the real economy.

Signals For Traders And Key Crypto Indicators

For crypto markets, the consultation from the UK central bank feeds into key indicators such as volume, volatility, liquidity depth and real yield. If pound-based stablecoins gain approval under this regime, demand from institutional players that already hold government bills could rise. Deeper order books and tighter spreads on major pairs would support a more reliable basis between spot and futures markets.

Yield is another lever. When reserves sit in short-term bills, the income on that portfolio can either support the issuer or be shared with users through rewards and better pricing, shaping where traders park idle balances and how DeFi pools price risk.

Britain In The Global Stablecoin Race

In the global policy race, the UK central bank is trying to sit between very light oversight and outright prohibition. Some jurisdictions focus on fast growth of digital assets and tolerate higher opacity in reserve composition, while others keep private tokens at the edge of the system. Britain is pitching a middle course that aims to draw capital into a more transparent, pound based ecosystem.

Conclusion: Regulation As The Next Catalyst

The latest consultation from the UK central bank shows how the next phase of stablecoin growth will be shaped as much by regulation as by code. For investors and founders, the message is that credible pound-linked tokens will have to live inside a strict, bank-style perimeter if they want to reach scale in everyday payments. The reward is greater trust from institutions, clearer rules on collateral and, over time, a deeper pool of liquidity for crypto markets that rely on stable rails.

If policymakers keep that balance, stablecoins tied to the pound could gain new credibility without losing the programmability and openness that first drew people into digital assets. In that scenario, careful regulation would not smother innovation but act as a catalyst that connects crypto infrastructure to the broader financial system.

Frequently Asked Questions

How could these rules affect stablecoin prices in the short term?

Clear backing and caps can reduce panic selling and narrow price gaps during stress, but strict limits may also slow very rapid inflows of new money.

Why is the UK central bank so focused on banks in this debate?

Banks remain the main source of credit for households and firms. Regulators want to avoid sudden deposit outflows into private coins that might weaken lending to the real economy.

What should crypto investors watch as the framework develops?

Important signals include which issuers seek authorisation, how reserve portfolios are built, and how quickly pound-based stablecoins gain listings, volume, and DeFi use.

Glossary Of Key Terms

Stablecoin

A digital token that aims to keep a stable value, usually by holding reserves in cash, bank deposits or short term government debt.

Systemic stablecoin

A stablecoin that is large or widely used enough that its failure could harm the wider financial system.

Reserves

The assets that back a stablecoin and are meant to support its value, such as cash, deposits and government bills.

Liquidity

The ability to buy or sell an asset quickly and with limited impact on its price.