The U.S. Treasury has tightened its grip on North Korea’s financial network, targeting individuals and entities accused of laundering stolen crypto. The new sanctions reveal a deeper strategy to dismantle state-backed operations using digital currencies to fund weapons and nuclear programs.

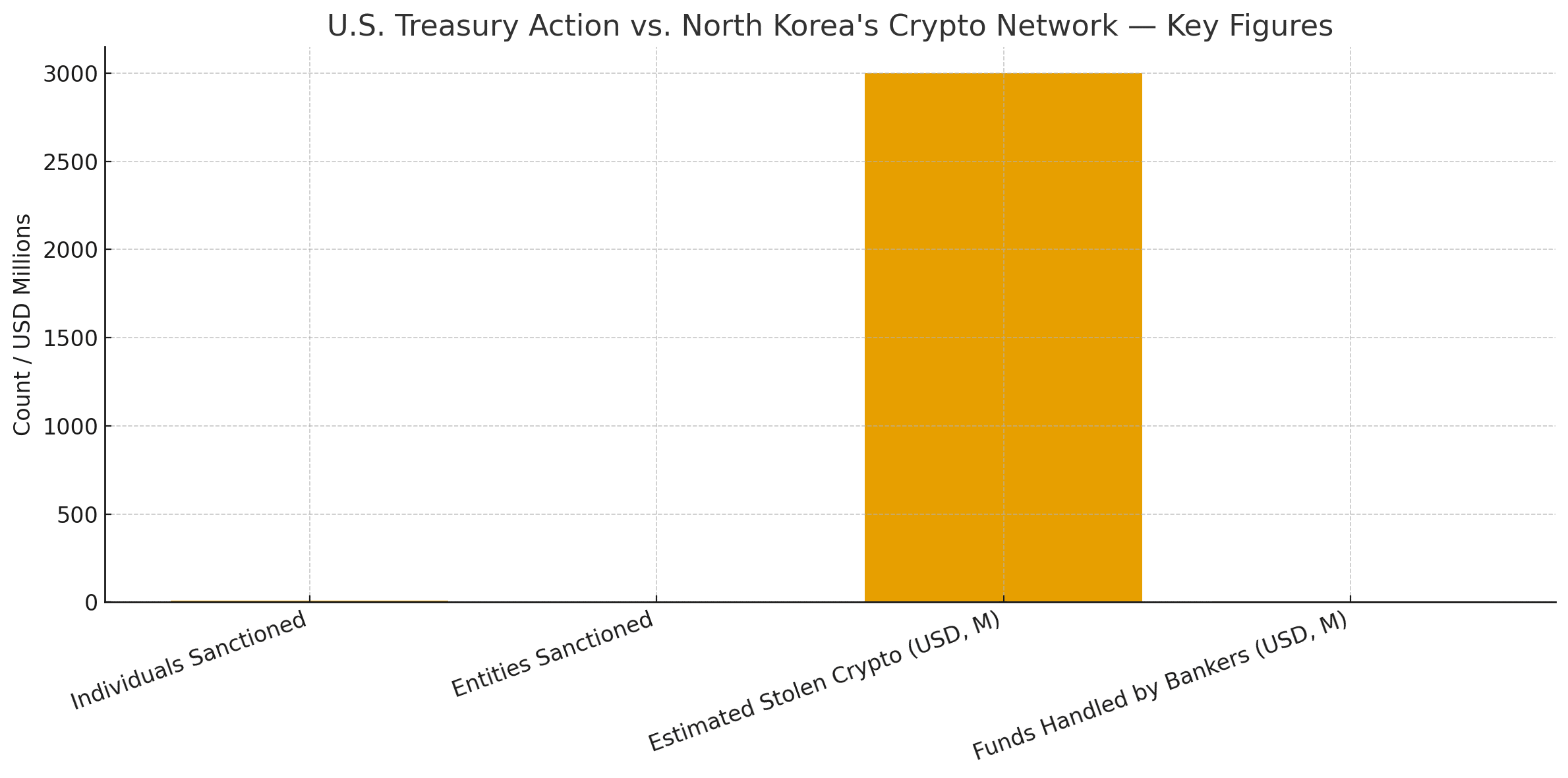

According to officials, the U.S. Treasury imposed restrictions on eight individuals and two organizations involved in crypto-related money laundering. Among them are high-ranking North Korean bankers and executives who allegedly moved over $5 million through blockchain-based transactions. These actions highlight how Pyongyang continues to exploit digital assets to evade sanctions and raise funds despite global monitoring.

The U.S. Treasury Expands Its Blockchain Oversight

The U.S. Treasury’s Office of Foreign Assets Control (OFAC) has made crypto wallets and on-chain addresses part of its enforcement arsenal. By linking blockchain identifiers directly to sanctioned individuals, regulators are sending a message that the digital realm is no longer an escape route for illicit actors. This step represents a milestone in merging traditional financial enforcement with on-chain transparency.

The U.S. Treasury’s investigation uncovered multiple shell companies and proxy accounts stretching from China to Russia. These intermediaries reportedly helped convert stolen crypto into fiat, masking the origin of funds. The strategy marks an expansion of the Treasury’s efforts beyond cybercriminals, now targeting the underlying financial architecture that sustains them.

North Korea’s Growing Dependence on Stolen Crypto

Analysts say the sanctions underscore growing concern about North Korea’s heavy reliance on crypto theft. The regime has reportedly stolen more than $3 billion in digital assets in recent years through ransomware and cyberattacks on exchanges. The U.S. Treasury views these funds as a critical lifeline supporting the country’s banned weapons programs.

The sanctioned organizations include technology companies accused of deploying North Korean IT workers abroad. These workers allegedly disguise their identities to take remote jobs at Western firms, earning crypto salaries that are funneled back to the regime. The U.S. Treasury called this a sophisticated, multi-layered approach that uses modern financial systems against themselves.

Global Implications for Crypto Exchanges and Regulators

For crypto exchanges worldwide, the latest move by the U.S. Treasury serves as a reminder that compliance is no longer optional. Financial institutions are expected to strengthen Know Your Customer (KYC) and Anti-Money Laundering (AML) controls, particularly for cross-border transactions. The U.S. Treasury’s actions emphasize that even indirect exposure to sanctioned wallets can carry significant legal risks.

This enforcement wave also puts pressure on regulators in other jurisdictions. Many countries, including those in Asia and the Middle East, are now reassessing how to align their frameworks with U.S. Treasury standards. As crypto adoption grows, the challenge is to balance innovation with accountability.

The Future of Crypto Regulation

The U.S. Treasury has stated that it will continue to expand collaboration with international partners to identify digital assets linked to state-sponsored crime. By tightening oversight on blockchain flows, the agency aims to prevent the misuse of crypto in global conflicts and geopolitical financing. The move also signals the increasing role of blockchain analytics in policy enforcement, merging technology with national security priorities.

For the broader crypto market, this could mark a turning point. Increased regulatory scrutiny may initially slow transaction volumes, but it can also bring legitimacy and investor confidence in the long term. Market observers expect further U.S. Treasury actions targeting cyber-linked laundering networks across Asia and Eastern Europe in the coming months.

Summing Up

The U.S. Treasury’s latest sanctions are more than a financial blockade. They represent a shift in how nations confront cybercrime in the digital era. As blockchain technology evolves, so too will the methods of enforcement. The global crypto community now faces a new chapter where transparency, compliance, and accountability define survival in the digital finance ecosystem.

FAQ

What is the main goal of the U.S. Treasury’s sanctions?

The U.S. Treasury aims to disrupt North Korea’s access to funds generated through stolen crypto and prevent these resources from financing weapons programs.

How does the U.S. Treasury trace crypto transactions?

Through blockchain analytics and partnerships with global agencies, the U.S. Treasury can identify digital wallet addresses linked to illicit activities.

What impact do these sanctions have on exchanges?

Crypto exchanges must tighten compliance to avoid dealing with wallets or intermediaries connected to sanctioned entities.

Will these measures affect regular users?

Ordinary crypto holders are unaffected unless they interact with blacklisted wallets. However, stricter KYC rules may apply globally.

Glossary of Key Terms

OFAC: The Office of Foreign Assets Control, which oversees sanctions against individuals and organizations.

KYC: Know Your Customer, a regulatory standard requiring identity verification of users.

AML: Anti-Money Laundering, policies to detect and prevent illicit fund movement.

Sanctions: Legal measures used to restrict trade or finance with targeted parties.

Blockchain Analytics: The process of tracking and analyzing transactions on a blockchain to detect suspicious activities.

Crypto Laundering: The act of disguising the origins of illegally obtained cryptocurrency funds.