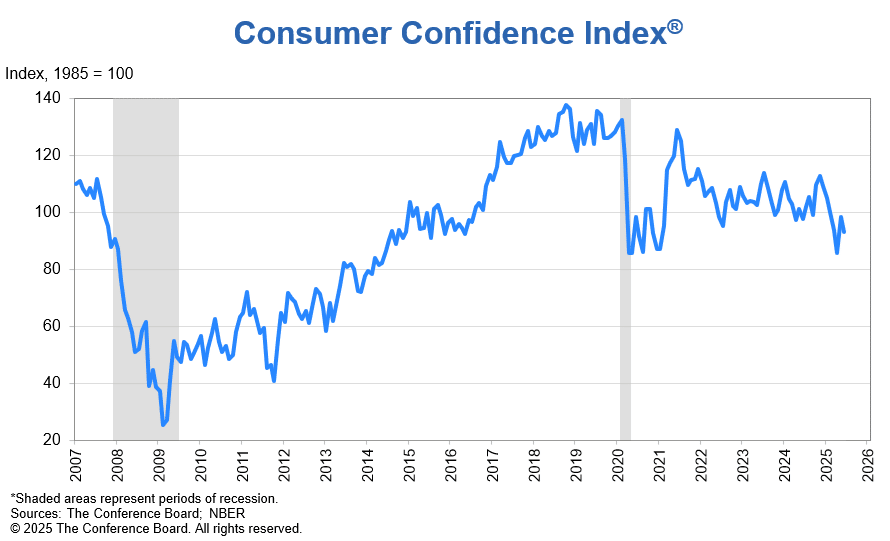

The U.S. Conference Board has just released its June Consumer Confidence Report, delivering data that could shape short-term trends in both traditional finance and digital asset markets. The headline figure shows a 5.4-point drop in the index, signaling growing uncertainty among American consumers. While equity markets have responded with cautious optimism, crypto investors may find opportunity in the policy implications of this decline.

Confidence Slips, But Not All Is Lost

The Consumer Confidence Index fell to 98 from May’s 103.4—erasing nearly half of last month’s sharp rebound. Stephanie Guichard, Senior Economist at The Conference Board, noted that the decline was broad-based. Both the Present Situation Index and the Expectations Index registered weakening sentiment around job conditions, income growth, and the general business outlook.

According to Guichard:

“Consumers were less positive about current business and labor market conditions compared to May. Their outlook for the next six months, including job availability and income prospects, also deteriorated—though not drastically.”

This cooling sentiment—especially regarding the labor market—could ease inflationary pressures and encourage the Federal Reserve to initiate rate cuts sooner. For crypto, a dovish Fed would likely trigger renewed investor inflows into high-risk, high-reward assets.

Stock Market Optimism Lends Indirect Support to Crypto

Interestingly, the same report highlighted a rebound in stock market expectations. In June, 45.6% of consumers said they believe stock prices will rise over the next 12 months—up from 37.6% in April. Historically, stronger confidence in equities often correlates with increased risk-on behavior, which can extend to digital assets like Bitcoin and Ethereum.

As noted by Dey There, crypto tends to follow macro sentiment closely. If investors regain optimism in traditional markets, it often spills over into digital assets—particularly when interest rate cuts are on the horizon.

What’s Next: Policy Path and Iran War Resolution

Market analysts are closely watching the next steps in U.S. tariff negotiations and the resolution of the Iran conflict—both of which have contributed to the recent economic uncertainty. If geopolitical tensions ease and domestic data stabilizes, consumer confidence could rebound in Q3. This would align with a potentially more accommodative Fed posture, further lifting crypto sentiment.

Conclusion: Subdued Confidence May Be Crypto’s Catalyst

While a weaker consumer outlook might seem bearish on the surface, the macro implications point to potential monetary easing. For crypto markets, that’s good news. As Dey There observes, sometimes what’s bad for Main Street in the short term creates the perfect conditions for blockchain-based assets to thrive.

References:

The Conference Board. “Consumer Confidence Survey – June 2025.” www.conference-board.org

Bloomberg Markets. “U.S. Confidence Falls as Labor Views Weaken.” www.bloomberg.com/markets

CNBC. “Fed Rate Expectations and Market Outlook.” www.cnbc.com