This article was first published on Deythere.

- Trump’s Colombia Statement and Venezuela Military Operation

- Crypto Market Reaction: Bitcoin Around $93K

- Global Diplomatic Response and Regional Tensions

- Conclusion

- Glossary

- Frequently Asked Questions About Trump Military Operation Threats

- Why did the value of Bitcoin rise after Trump’s remarks about Colombia and Venezuela?

- Did U.S. troops really capture Maduro?

- How did other cryptocurrencies react?

- Did the crypto markets panic?

- Do Geopolitical events play a huge role in driving crypto prices?

- References

U.S. President Donald Trump’s statements about possible military operations in Latin America and especially Colombia have coincided with notable movements in global financial markets, including cryptocurrencies.

Based on reports, President Trump has entertained the notion of sending troops to Colombia, accusing the Colombian government of facilitating cocaine flows into the US.

Bitcoin price, meanwhile, is heading toward the $93k mark and that has analysts watching how geopolitical uncertainty impacts investor psychology.

Trump’s Colombia Statement and Venezuela Military Operation

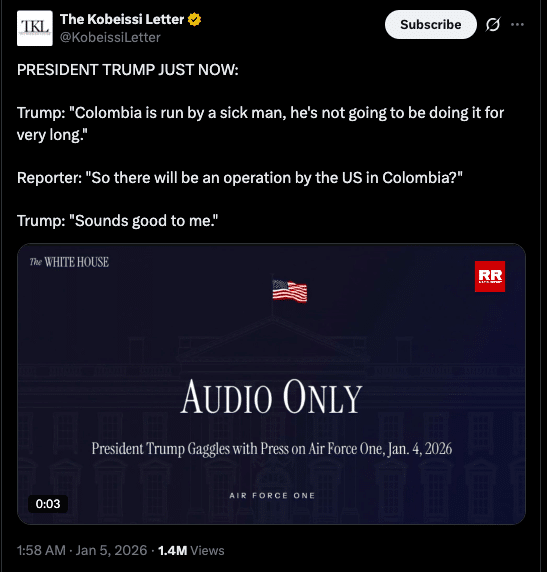

President Trump has confirmed that the idea of a military action against Colombia “sounds good” when asked whether the U.S. would intervene after its recent operation in Venezuela. Trump called Colombia’s government “very sick” and accused its president, Gustavo Petro, of supporting the production and distribution of cocaine to the United States.

“Colombia is very sick, too, run by a sick man, who likes making cocaine and selling it to the United States, and he’s not going to be doing it very long,” Trump warned.

The remarks were part of a general hardening of U.S. policy following the arrest and rendition of Venezuelan President Nicolás Maduro to the United States custody in New York City on drug-trafficking charges by U.S. military forces.

Trump’s team defended the action as needed to combat criminal networks and protect strategic interests, including Venezuela’s immense oil reserves.

The Venezuelan interim government, led by Vice President Delcy Rodríguez, initially denounced the U.S. operation as illegal, pledged to put up resistance, but later offered cooperation.

International response to the Venezuelan intervention has been mixed, with some countries denouncing the action as a breach of Venezuela’s sovereignty and international law.

The increased tensions are also evident in Trump’s remarks about Mexico and Cuba, with him suggesting “something has to be done” in Mexico to root out the cartel activity, and describing Cuba as unstable economically and possibly on the verge of “falling” without Venezuelan oil support.

Crypto Market Reaction: Bitcoin Around $93K

It seems Bitcoin’s price reaction to these geopolitical scenarios presents a nuanced Latin America crypto response that isn’t exactly cut and dried with traditional risk-off dynamics.

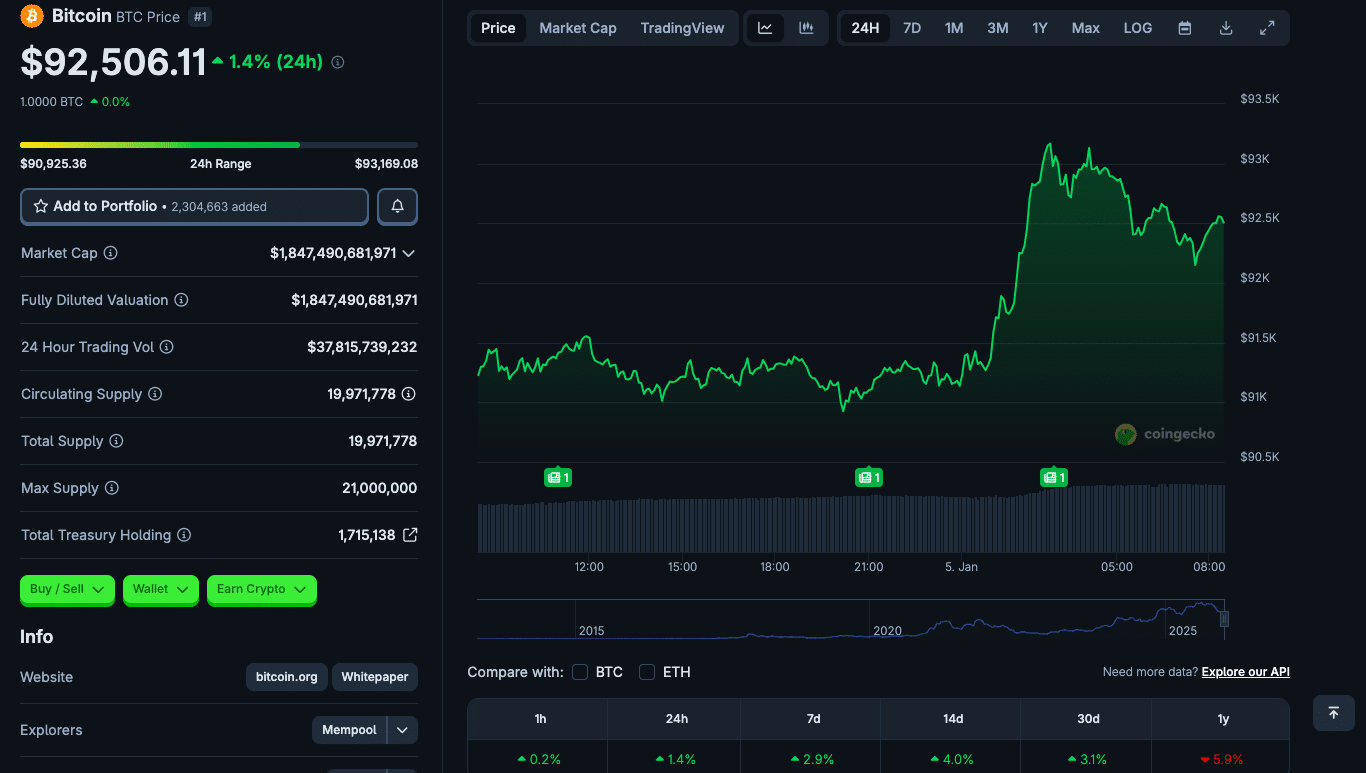

According to data, Bitcoin jumped from about $89,990 to almost $93,000 in price upon news of the Venezuelan operation and Trump’s comments.

Data from CoinGecko supports this rise of approximately 3.35% over a short period, indicating a fairly positive near-term reaction.

Several reports on the crypto markets suggest that the Venezuelan incident didn’t cause panic selling at once, as operations were fast-moving, and there was time for the markets to adjust before prices began moving.

Analysts like Crypto Rover pointed out that Maduro’s capture came before an extended period of uncertainty had a chance to be further priced into the market, so disruption to crypto prices was minimal.

More broadly, Bitcoin, as well as other major cryptocurrencies such as Ethereum, along with XRP, BNB, and Solana, were also recorded gains as part of the same reaction, lifted by more short covering and an upping of risk appetite after geopolitical developments.

This reaction pushed the total crypto market capitalization slightly upwards.

Market watchers also pointed to the fact that Bitcoin moving above $91,000 marks its best level since mid-December.

Global Diplomatic Response and Regional Tensions

The proposed operation in Venezuela by the U.S. military and Trump’s recent comments regarding his views about Colombia also prompted fury on the international stage, as there is growing concern across the hemisphere.

A number of governments, notably Brazil, Mexico, Chile, Colombia and Uruguay, also issued joint statements against the use of force unilaterally and stressed the need to respect sovereignty and international law.

They said the actions set a dangerous precedent that threatened regional stability and the safety of civilians.

Colombian President Gustavo Petro again rejected military confrontation and insisted that peace and the UN Charter should prevail. Petro’s reply showed regional unease with outside interference, even as geopolitical narratives harden.

Cuba’s government, which is closely allied with Venezuela, also condemned the US strikes as “state terrorism” that the world should condemn.

Conclusion

The Latin America response to Trump’s controversial military rhetoric and U.S. operation in Venezuela, coupled with the crypto market moves and actions, shows how geopolitical developments and market psychology might be interconnected.

While diplomatic circles debate questions of sovereignty, legality and regional stability, crypto markets responded with a striking rise in prices for Bitcoin and other assets.

The fact that Bitcoin is surging toward $93,000 in the face of growing tensions suggests digital assets may offer some independence from traditional equities and macro indicators.

With the standing US threats towards Colombia, Mexico and Cuba,the geopolitical space is liable to keep impacting crypto markets in early 2026.

Glossary

Bitcoin (BTC): The biggest cryptocurrency by market value, which is frequently referred to as a digital alternative to gold.

Ethereum (ETH), XRP, BNB, Solana: Other top cryptocurrencies that usually track broader market emotions and Bitcoin.

Geopolitical Risk: Uncertainty in financial markets that arises from political and diplomatic events.

Market Sentiment: The general mood of the investors in a specific market.Such emotion is usually linked to news or macroeconomic information.

Frequently Asked Questions About Trump Military Operation Threats

Why did the value of Bitcoin rise after Trump’s remarks about Colombia and Venezuela?

Bitcoin was up in what some analysts said symbolized more risk appetite and an embrace of alternative investments at a time of geopolitical uncertainty, as investors re-evaluate the old rules governing traditional markets.

Did U.S. troops really capture Maduro?

Multiple reputable outlets reported that Venezuelan President Nicolás Maduro had been detained by United States forces and transported to the United States to face charges of drug-trafficking , but allied governments have disputed specifics.

How did other cryptocurrencies react?

Ether, XRP, BNB and Solana also registered small gains alongside Bitcoin, suggesting wider crypto market sensitivity to geopolitical updates.

Did the crypto markets panic?

No. Analysts said that the reaction had been muted, with a relative absence of panic selling and prices recovering quickly, signaling that markets may have been anticipating the news or digesting it without too much fear.

Do Geopolitical events play a huge role in driving crypto prices?

Yes. With global markets increasingly integrated, such geopolitical shocks can affect how investors think and feel about risk in the world of crypto markets.

References

Reuters

Axios

Cryptonews

Business Standard

AInvest

Coingecko