This article was first published on Deythere.

Kevin Warsh rate cuts chatter has returned to the center of market attention, stirring curiosity across Wall Street and the crypto economy. A single political remark reopened a debate about money, growth, and risk in a fragile global cycle. Financial students, blockchain builders, and digital asset traders now watch policy signals with renewed urgency.

According to the source, former U.S. President Donald Trump confirmed discussions with economist Kevin Warsh about interest rate direction, though no promise of easing emerged. Even that careful wording shaped expectations. Markets often react to tone before action, and crypto traders understand that pattern well.

A Quiet Comment With Loud Market Echoes

The idea of Kevin Warsh rate cuts carries weight because monetary policy drives liquidity, and liquidity fuels digital assets. When borrowing costs fall, risk appetite usually rises. That pattern appeared in past easing cycles, including the post-crisis era documented in this historical policy archive.

Trump’s history of urging lower rates adds context. During earlier leadership years, Trump pushed the Federal Reserve toward easier conditions to support growth and equity markets. The latest remark keeps that narrative alive. Investors now measure whether Kevin Warsh rate cuts could align with a broader pro-growth agenda.

Why Kevin Warsh Still Matters to the Fed Story

Kevin Warsh served as a Federal Reserve governor during the 2008 crisis, a period that reshaped global finance. His views often stress faster responses to economic stress and clearer communication with markets. Analysts note that such thinking could lean supportive of Kevin Warsh rate cuts if growth weakens.

Trump has not announced any nomination, yet Trump’s public attention alone shifts expectations. Policy speculation can move capital flows before formal decisions arrive. Research highlighted in recent global liquidity analysis shows that anticipated easing often boosts emerging and digital assets first.

Crypto’s Sensitivity to Interest Rate Signals

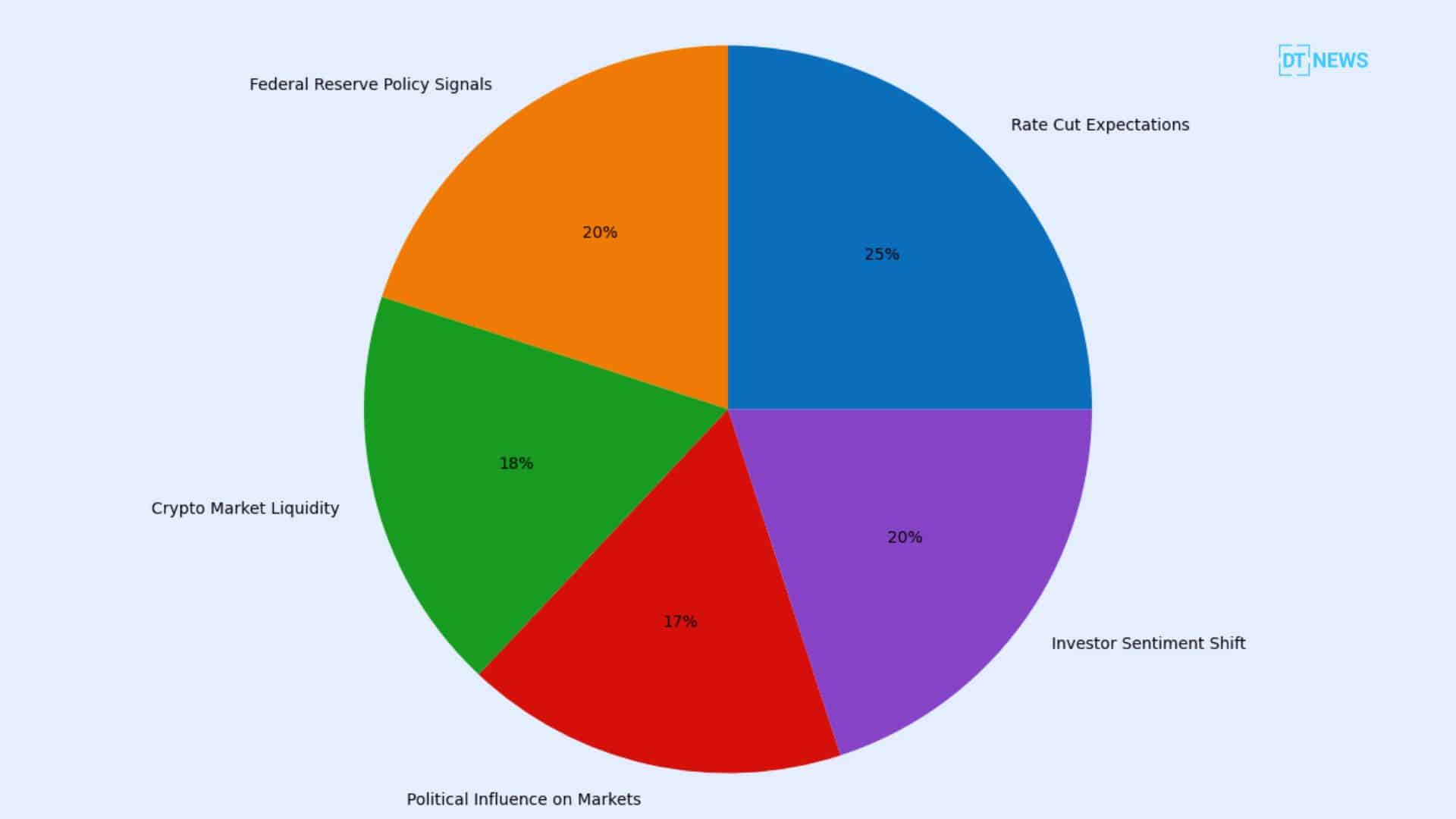

Digital asset markets respond quickly to macro signals. Lower yields reduce the appeal of holding cash and bonds, pushing investors toward higher-risk opportunities like Bitcoin and tokenized finance. That relationship explains why Kevin Warsh rate cuts discussions spread fast across crypto trading desks.

Trump’s remarks arrived during a period of cautious sentiment. Traders search for confirmation that tightening cycles may fade. If Kevin Warsh rate cuts ever materialize, analysts expect renewed inflows into decentralized finance, venture funding, and blockchain infrastructure. Still, uncertainty remains the dominant force.

Political Tone Versus Policy Reality

Speculation does not equal action. Kevin Warsh rate cuts remain hypothetical until formal authority changes hands. Central bank independence also limits political influence, even when Trump voices clear preferences. History shows that institutional checks often shape final outcomes more than campaign rhetoric.

Yet perception matters. Trump understands how messaging guides expectations, and markets listen closely. Each mention of Kevin Warsh rate cuts adds another layer to forward guidance, even without official policy movement. That subtle influence reflects modern financial psychology.

Conclusion

Kevin Warsh rate cuts may never arrive, yet the conversation alone reveals how fragile confidence remains across global finance. Trump’s remarks highlight the thin line between speculation and strategy. For crypto participants, the lesson is simple. Monetary signals travel fast, and narratives move capital before data confirms direction.

Future clarity will depend on nominations, inflation trends, and growth stability. Until then, Kevin Warsh rate cuts remain a possibility that keeps traders alert and policymakers under scrutiny.

Glossary of Key Terms

Interest Rate Cuts: They refer to central bank decisions that lower borrowing costs to stimulate spending and investment.

Monetary Policy: It describes actions taken by central banks to control inflation, liquidity, and economic stability.

Liquidity: It means the ease with which money flows through markets and financial systems.

Decentralized Finance: It represents blockchain-based financial services that operate without traditional intermediaries.

FAQs About Kevin Warsh Rate Cuts

What are Kevin Warsh rate cuts?

They describe potential support from Kevin Warsh for lowering interest rates under certain economic conditions.

Why did Trump’s comment matter?

Trump’s history with Federal Reserve pressure makes any policy discussion influential for markets and sentiment.

How could rate cuts affect crypto?

Lower rates often increase liquidity, which can drive investment into digital assets and blockchain projects.

Is any policy change confirmed?

No official nomination or commitment exists, so expectations remain speculative.