The competition to dominate the US spot Bitcoin ETF market is heating up, and the Trump Media Bitcoin ETF has made a significant stride ahead. In a freshly updated S-1 registration statement filed with the SEC, the business behind Truth Social modified its plan by adding additional disclosures and addressing legal intricacies that might affect its entry into the competitive crypto investing industry.

While the application leaves several key facts unresolved, it indicates a real intention to offer a product that has the potential to shake up both the political and financial worlds.

Amended Filing Includes New Disclosures.

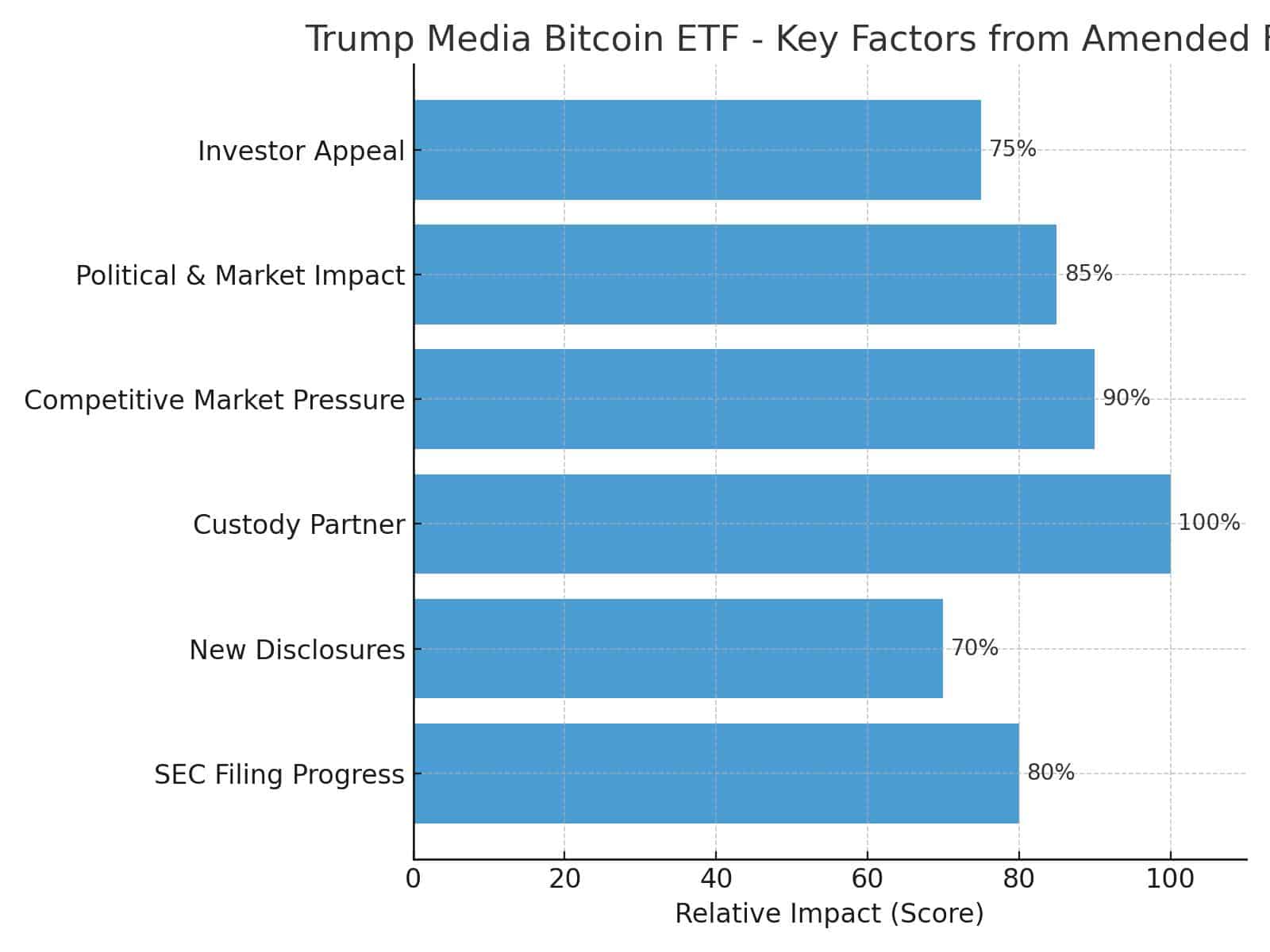

The amended application contains governance rules for airdrops, index benchmark revisions, and more information regarding potential regulatory problems, such as stablecoin concerns and executive directives targeting digital assets.

A financial expert with experience in ETF approvals stated, “The level of detail shows they are preparing for every possible scenario, which could accelerate the approval process if the SEC responds favorably.”

The change does not include the fee structure or the official ticker symbol, both of which are important pieces of information for investors. Despite these omissions, the document shows that Crypto.com will be the only custodian, liquidity provider, and execution agent, with Yorkville America Digital serving as the sponsor.

Competitive Landscape and Challenges Ahead

The Trump Media Bitcoin ETF will face stiff competition from well-established Bitcoin ETFs that currently have a significant market share and liquidity. These established products, supported by significant asset managers, have set high standards for cost efficiency and daily trading volume.

Analysts believe that in order for the Trump-backed fund to stand out, it will need to capitalize on its distinct brand appeal and political influence. There is also conjecture that the product may be positioned as part of a larger “Crypto Blue Chip ETF” strategy that includes Bitcoin, Ethereum, Solana, and Ripple—a notion mentioned in prior filings.

Political and Market Implications

Given the political nature of the brand behind the Trump Media Bitcoin ETF, the file has received more attention than usual ETF applications. Some analysts view it as part of a larger governmental push to reduce regulatory pressure on digital assets, while others warn of possible conflicts of interest.

The move coincides with news of a $1.5 billion cryptocurrency treasury project by a related blockchain business, indicating a more aggressive foray into the digital asset market. This combination of political influence and market involvement is unusual, and it has the potential to transform how crypto ETFs are promoted to both retail and institutional investors.

Potential Impact on Investors

For investors looking for regulatory certainty and institutional-grade custody, the Trump Media Bitcoin ETF may provide an alternative way to gain exposure to Bitcoin without having to hold the currency directly. However, the ultimate value proposition will be determined by competitive pricing, tracking accuracy, and the fund’s ability to draw liquidity in a crowded market.

Conclusion

The updated filing is a significant step toward bringing the Trump Media Bitcoin ETF to market. With increased disclosures, high-profile collaborations, and a politically charged brand identity, the fund is expected to receive a lot of attention if authorized.

While there are still questions regarding the pricing structure and ticker designation, the strategic timing and marketing possibilities make it one of the most anticipated ETF debuts of the year.

FAQs

Q: What is the Trump Media Bitcoin ETF?

A: A proposed spot Bitcoin ETF sponsored by Trump Media, currently under SEC review.

Q: Who will custody the ETF’s Bitcoin?

A: Crypto.com has been named as the exclusive custodian, liquidity provider, and execution agent.

Q: What makes this ETF unique?

A: Its association with Trump Media gives it a distinctive political and brand dimension in the crypto ETF market.

Q: Has the SEC approved it yet?

A: No, the ETF is awaiting SEC clearance of the amended S-1 and listing application.

Glossary

S-1 Registration Statement: A required SEC filing before launching securities like ETFs.

Spot Bitcoin ETF: An exchange-traded fund that holds Bitcoin directly rather than derivatives.

Custodian: An institution that safeguards a fund’s assets.

Liquidity Provider: An entity ensuring smooth trading by supplying buy and sell orders.

Index Benchmark: The standard against which an ETF’s performance is measured.

Airdrop: The distribution of cryptocurrency to wallet addresses, often as a promotional or governance activity.