In a last minute switch on Tuesday, US President Donald Trump convinced a group of House Republicans to change their minds and revive stalled crypto legislation- the GENIUS Act, the CLARITY Act, and the Anti-CBDC Surveillance State Act; (dubbed Trump Crypto Bills) after a procedural vote had temporarily killed them. This has opened up the national debate over federal crypto regulation with lawmakers and DeFi leaders are divided on whether these bills promote innovation or stifle digital asset freedoms.

- GOP Reverses Revolt Amid CBDC Fears

- Regulatory Push vs. Digital Sovereignty

- Democratic Opposition and DeFi Backlash

- Trump’s Crypto Plan

- Conclusion: What’s Next?

- FAQs

- What is the GENIUS Act?

- Why did Republicans oppose the bill?

- What is the CLARITY Act?

- Is Trump in favor of the crypto bills?

- What do experts say about these bills?

- Glossary

GOP Reverses Revolt Amid CBDC Fears

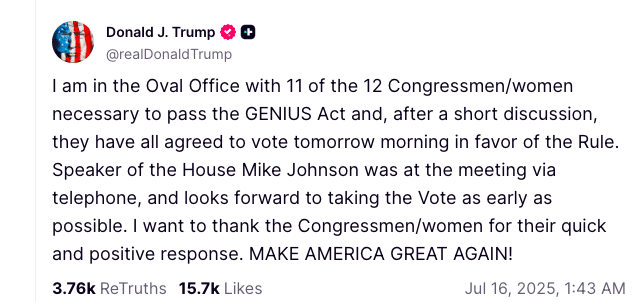

Earlier in the day, the House voted 196–223 against the rule that would have brought the bills to the floor. The procedural vote happened during the administration’s so called Crypto Week and caught everyone off guard. But by nightfall, President Trump had reportedly met with 11 of the 12 GOP holdouts in the Oval Office and announced on Truth Social they had agreed to support the rule.

“I am in the Oval Office with 11 of the 12 Congressmen/women necessary to pass the GENIUS Act and, after a short discussion, they have all agreed to vote tomorrow morning in favor of the Rule,” Trump wrote at 8:51 pm ET.

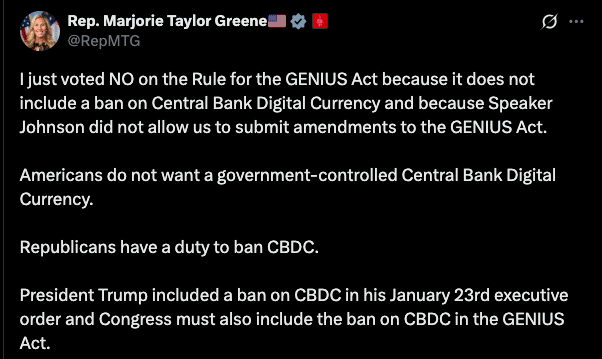

The procedural vote puts the bills back on track but the ideological divide within the GOP remains. Many Republican opponents, including Rep. Marjorie Taylor Greene (R-Ga.), are still skeptical of the GENIUS Act and fear it could lead to a central bank digital currency (CBDC) despite assurances to the contrary.

“I just voted NO on the Rule for the GENIUS Act because it does not include a ban on Central Bank Digital Currency,” Greene said on X. “And because Speaker Johnson did not allow us to submit amendments.”

Regulatory Push vs. Digital Sovereignty

The GENIUS Act regulates stablecoins, the CLARITY Act defines digital asset classifications, and the Anti-CBDC Surveillance State Act prevents the Federal Reserve from launching a surveillance-based CBDC. However, critics say the GENIUS bill is vague enough to leave regulatory loopholes for future government-backed digital currencies.

Kadan Stadelmann, CTO of the Komodo blockchain platform, told sources that the bill “does not include provisions that prevent the Federal Reserve from creating a CBDC.” He also said the bill would allow the U.S. Treasury to test such systems indirectly.

“Instead of regulating stablecoins, Trump should be building a national Bitcoin reserve,” said Stadelmann. “Bitcoin is about reliance on independent systems rather than government mandated ways of transacting.”

Democratic Opposition and DeFi Backlash

The bills have also been criticized by Democrats. Rep. Maxine Waters (D-Calif.), the ranking Democrat on the House Financial Services Committee, said the bills could lead to massive fraud.

“This will open the floodgates to massive fraud and financial ruin for millions of American families,” Waters said on the floor Tuesday.

DeFi leaders are joining the chorus of concern, saying the CLARITY Act would restrict open-source development and send American devs offshore.

According to industry legal experts, the act would “decimate the novel DeFi sector in America” and cause a brain drain and regulatory arbitrage.

Trump’s Crypto Plan

Despite the concerns, Trump is committed to making the US a leader in digital assets. After Tuesday’s failed vote, he urged Republicans to pass the GENIUS Act, calling it crucial to keeping the country ahead in financial innovation.

“This will make America the undisputed number one leader in digital assets,” Trump said at a press event.

Notably, while many of Trump’s supporters are focused on anti-CBDC language, experts say the real impact is in how stablecoins are defined and monitored.

Conclusion: What’s Next?

Based on the latest research, for Trump crypto bills, a new procedural vote is expected this week, possibly opening the floor for debate on all three bills. Crypto stakeholders, regulators and institutional investors will be watching for clarity in this crazy regulatory landscape.

Analysts also expect more lobbying from pro-crypto PACs and civil liberties groups on surveillance and overreach.

As Crypto Week 2025 unfolds in DC, sentiment is mixed. Some see the bills as a path to legitimize digital finance, others think it’s the start of a government-controlled era in crypto; something antithetical to the asset class itself.

Summary

Trump crypto push got House Republicans to flip on key bills and the GENIUS Act, CLARITY Act and Anti-CBDC Surveillance Act moved forward. Earlier the CBDC pathways killed a 196–223 procedural vote. Trump’s evening meeting in the Oval Office convinced 11 GOP holdouts.

FAQs

What is the GENIUS Act?

The GENIUS Act is a proposed US bill to regulate stablecoins and outline government oversight in crypto.

Why did Republicans oppose the bill?

Some Republicans, including Rep. Greene, said the GENIUS Act would allow for a central bank digital currency (CBDC), despite the bill stating otherwise.

What is the CLARITY Act?

This bill would classify digital assets and clarify which are securities or commodities, affecting DeFi projects.

Is Trump in favor of the crypto bills?

Yes. Trump has said the bills would make America great again in digital assets.

What do experts say about these bills?

Experts like Kadan Stadelmann and the DeFi community say the bills would centralize control and stifle innovation in DeFi.

Glossary

CBDC – Central Bank Digital Currency, government backed digital fiat.

Stablecoin – Cryptocurrency pegged to a stable asset, often the US dollar.

DeFi – Decentralized Finance, financial systems on public blockchains without intermediaries.

Procedural Vote – Vote in Congress to see if a bill can move to full debate or vote.

Truth Social – Social media platform created by Trump Media & Technology Group, used by Donald Trump.