This article was first published on Deythere.

- How much hydropower could realistically support mining operations?

- How does electricity capacity convert into Bitcoin hashrate?

- Can larger projects move Greenland Bitcoin mining beyond pilots?

- How does Trump-linked mining capital factor into the equation?

- What do Greenland’s wind resources imply for long-term limits?

- Conclusion

- Glossary

- Frequently Asked Questions About Greenland Bitcoin Mining

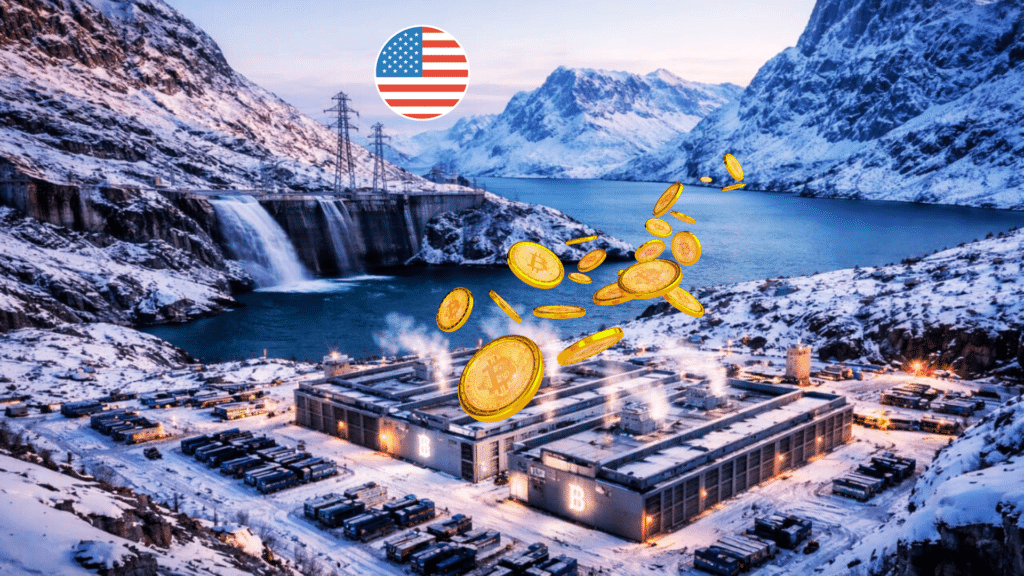

Greenland Bitcoin mining is being looked at as a way to use the island’s unused renewable energy, especially hydropower. The U.S. is showing renewed interest in Greenland’s strategic and economic role, but questions about its future remain. Meanwhile, miners and planners are focusing on Greenland’s energy development schedule.

How much hydropower could realistically support mining operations?

Greenland’s government plans to open a public tender round in the second half of 2026 for its two largest mapped hydropower sites intended for industrial use, Tasersiaq (site 07.e) and Tarsartuup Tasersua (site 06.g). Combined, the two sites are expected to produce more than 9,500 gigawatt-hours of electricity annually.

On an energy basis, that output equates to roughly 1.08 gigawatts of average continuous power if fully utilized. This level marks the first point at which Greenland Bitcoin mining enters a gigawatt-scale discussion rather than remaining limited to pilot deployments.

By comparison, Greenland’s existing hydropower capacity totals about 91.3 megawatts across its systems. Average electricity sales were reported at approximately DKK 1.81 per kilowatt-hour in 2024, a pricing level that does not align with Bitcoin mining economics unless power is supplied through industrial agreements or directly from the new generation.

How does electricity capacity convert into Bitcoin hashrate?

Using Bitmain’s Antminer S21 specification of 200 terahashes per second at 3,500 watts, mining efficiency sits near 17.5 J/TH. Applying a planning power usage effectiveness of 1.1 to account for cooling and overhead, 1 megawatt of facility power supports approximately 0.052 EH/s at that efficiency.

Across a broader efficiency band of 15–22 J/TH, the implied hashrate ranges from roughly 0.041 to 0.061 EH/s per megawatt. At small scales, this means that 5 megawatts of power supports about 0.26 EH/s, while 25 megawatts supports roughly 1.30 EH/s.

50 megawatts corresponds to about 2.60 EH/s, and 100 megawatts to approximately 5.19 EH/s. If between 5 and 25 megawatts of surplus power were aggregated behind the meter near existing plants, the resulting hashrate ceiling would fall between roughly 0.21 and 1.52 EH/s across the efficiency band. This is sufficient for pilot operations but not enough to materially shift global network share.

Can larger projects move Greenland Bitcoin mining beyond pilots?

The next level of scale is linked to Nuuk’s main hydropower plant at Buksefjord. The facility is planned to expand from 45 megawatts to 121 megawatts, with construction expected to begin in this year and commissioning targeted for 2032.

If between 50 and 121 megawatts of Buksefjord’s output were contracted to mining, the electrical ceiling would reach approximately 2.07 to 7.33 EH/s across the 15 to 22 J/TH range, or about 2.6 to 6.3 EH/s at 17.5 J/TH. This assumes that output is not absorbed by Nuuk’s population growth or electrification plans.

Taken together, the two hydropower sites would produce more than 9,500 gigawatt-hours a year. That level of output could support roughly 44.8 to 65.7 EH/s of Bitcoin mining, depending on efficiency. At 17.5 J/TH, the figure comes out to about 56 EH/s.

Current tracking places global Bitcoin hashrate around 1.03 to 1.17 ZH/s, with minerstat reporting network difficulty near 148 trillion. On that baseline, Greenland Bitcoin mining tied to a fully utilized hydropower tender would represent roughly four to 6% of today’s network. That share would decline if global hashrate continues to expand.

How does Trump-linked mining capital factor into the equation?

Trump-linked mining capital is already active in the sector. Hut 8 partnered with Eric Trump to form American Bitcoin, an investor group that also includes Donald Trump Jr., while Hut 8 retained an 80% stake. The company reported an installed hashrate of about 24 EH/s, with fleet efficiency near 16.4 J/TH as of Sept. 1, 2025, illustrating the scale of U.S.-Trump-backed operations.

At that efficiency and using a planning PUE of 1.1, sustaining 24 EH/s requires roughly 430 megawatts of facility power, or about 460 megawatts when modeled at 17.5 J/TH. A fully utilized 1.08-gigawatt hydropower buildout in Greenland could therefore support a fleet of comparable size more than once over, assuming energy offtake were dedicated to mining and construction timelines aligned, highlighting the potential for Greenland Bitcoin mining at industrial scale.

Transmission remains a constraint for Greenland Bitcoin mining. Greenland Connect, the subsea cable linking Canada, Nuuk, Qaqortoq, and Iceland, does not provide access to remote hydropower basins, reinforcing the need for colocated mining near generation sites.

What do Greenland’s wind resources imply for long-term limits?

Beyond hydropower, Greenland Bitcoin mining also intersects with the island’s onshore wind potential, which sets a theoretical upper bound. A systems study indexed on ScienceDirect estimates about 333 gigawatts of nameplate wind capacity, producing roughly 1,487 terawatt-hours a year if 20% of Greenland’s ice-free land were available.

On an energy basis, that translates to about 170 gigawatts of average generation. Absorbing that output as a flexible load would imply around 7.0 to 10.4 ZH/s at 15 to 22 J/TH, far above today’s network hashrate of around 1 ZH/s. However, this represents an energy-average ceiling rather than a firm 24/7 baseload, as such deployment would require extensive overbuild, curtailment, storage, and transmission.

A linear extrapolation of the same land-use assumption from 20% to 100% implies approximately 7,435 terawatt-hours per year, or about 848 gigawatts of average generation, translating to roughly 34.8 to 51.7 ZH/s. This remains a physics-and-maps ceiling rather than a practical build plan. Cost remains a limiting factor for Greenland Bitcoin mining.

IRENA estimates the global average installed cost for onshore wind in 2023 at about $1,154 per kilowatt, placing 333 gigawatts of turbines at roughly $384 billion. OneMiners lists the Antminer S21 XP Hyd at $6,799 for 473 terahashes per second, implying roughly $143 billion in ASIC costs to utilize that capacity.

Conclusion

Greenland Bitcoin mining presents a clear contrast between near-term feasibility and long-term theoretical limits, a gap now being assessed in parallel with renewed U.S. interest and policy discussions linked to President Trump.

In practical terms, Greenland’s energy resources are sufficient to support meaningful industrial mining at scale, but translating that potential into sustained network share will depend on infrastructure execution.

Glossary

Gigawatt-Scale Power: Gigawatt-scale power means electricity produced in huge volumes.

Exahash per Second (EH/s): EH/s measures large-scale Bitcoin mining power.

Hashrate: Hashrate shows how quickly mining machines work.

Hydropower: Hydropower is electricity generated from flowing water.

Stranded Energy: Stranded energy is unused available electricity.

Frequently Asked Questions About Greenland Bitcoin Mining

Why is Greenland being considered for Bitcoin mining?

Greenland is being considered because it has large amounts of unused clean energy.

How is electricity delivered across the island?

Electricity is delivered through small local power systems that serve nearby towns.

How much new hydropower could support mining?

Planned hydropower projects could supply more than 1 gigawatt of continuous power.

Why does the power structure affect Bitcoin mining?

The local power structure limits how large and fast mining operations can expand.

How much mining power can 1 megawatt support?

One megawatt of electricity can support about 0.05 exahash per second of Bitcoin mining.

Sources