Top NFT marketplaces 2026 are changing the way people think about digital ownership. They’re moving far beyond the early days of profile pictures and simple collectibles. These platforms now act as complete digital ecosystems. They combine AI tools, tokenized real-world items, and the ability to move assets across multiple blockchains. They are no longer just places to buy and sell NFTs. They have become key parts of the digital economy. This connects creators, collectors, and companies while creating real-world value.

- How Top NFT Marketplaces 2026 Are Reshaping Digital Ownership?

- What Innovations Define NFT Marketplaces 2026?

- Which Platforms Are Leading the Top NFT Marketplaces 2026?

- How NFT Marketplaces 2026 Handle Fees, Royalties, and Security?

- What Challenges Still Face NFT Marketplaces in 2026?

- What the Future Holds Beyond 2026?

- Conclusion

- Glossary

- Frequently Asked Questions About Top NFT Marketplaces 2026

Today’s NFT marketplaces support practical uses in gaming, real estate, fashion, entertainment, and finance. With features like AI verification, dynamic and interactive NFTs, and subscription-based services, these platforms have become important tools for creators and businesses. Those folks aim to grow and operate in the Web3 environment.

How Top NFT Marketplaces 2026 Are Reshaping Digital Ownership?

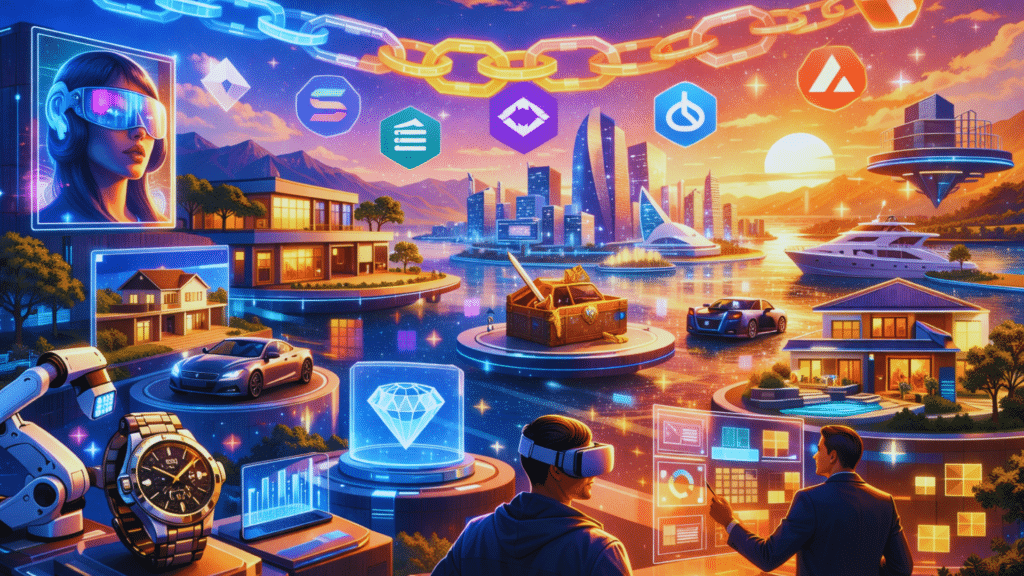

NFT marketplaces 2026 are no longer just simple online shops for digital art. They have grown into complete digital ecosystems. On these platforms, users can buy, sell, trade, or create NFTs of all kinds, including AI-generated art, gaming items, and tokenized real-world assets like houses, cars, and luxury watches. This change shows that people want NFTs that do more than just sit in a wallet and they want items that have real use and value.

AI has become a central part of these marketplaces. It helps verify that NFTs are authentic, detect fraud, personalize user experiences, and even create new digital items automatically. When combined with tokenized physical assets, this makes marketplaces safer, faster, and more useful for both buyers and creators. Multi-chain and cross-chain support lets users move NFTs between Ethereum, Solana, Polygon, Avalanche, Sui, and Aptos. This level of flexibility was not possible in the early days of NFT trading.

Gaming remains a key driver of NFT marketplace activity. Popular collections such as Illuvium, Parallel, Shrapnel, Sorare, and Pixels see thousands of trades every week, showing how NFTs have become an important part of gaming economies.

Experts note that NFT marketplaces are now focused on practical use rather than just speculation. These platforms are serving as tools for finance, social interaction, and gaming, allowing users to get real benefits from their NFTs instead of just collecting them.

What Innovations Define NFT Marketplaces 2026?

NFT marketplaces 2026 are defined by innovation and practical utility. One major development is the tokenization of real-world assets. Homes, cars, luxury items, and collectible goods can now be bought, sold, and traded digitally. This creates a bridge between physical and virtual ownership. Marketplaces have also adopted AI-powered systems to detect fraud, validate authenticity, and even create dynamic NFTs that change over time.

Multi-chain functionality is another defining feature. Users no longer have to remain locked into a single blockchain. Cross-chain swaps and multi-chain minting allow assets to move freely across Ethereum, Solana, Polygon, and other networks. This has become an expected standard for any leading platform.

Integration with gaming and metaverse economies keeps growing. NFT marketplaces support in-game items, virtual avatars, skins, and digital land that can operate across multiple games or virtual worlds. These ecosystems now support Web3-based financial models, subscription services, and NFT memberships, allowing users to derive tangible benefits from ownership.

Regulatory compliance has also become a core focus. KYC and AML modules, on-chain identity verification, and legally compliant smart contracts are increasingly common, reflecting the maturation of NFT marketplaces into professional, secure trading environments.

Which Platforms Are Leading the Top NFT Marketplaces 2026?

The leading platforms in 2026 vary in functionality and audience focus. OpenSea remains a generalist hub, providing extensive chain coverage and a broad catalog of assets. Its focus on accessibility ensures that both seasoned traders and casual users can participate effectively. It holds a dominant share of total NFT trading volume in early 2026, making it the largest single marketplace by activity.

Blur caters to professional traders with fast execution, aggressive bidding tools, and portfolio management features. It leads Ethereum trading with tools optimized for high-frequency flips and is particularly popular among traders focused on active engagement rather than casual browsing.

Magic Eden, Solana-dominant with the lion’s share of Solana NFT volume, has expanded to Ethereum, Polygon, Base, and Bitcoin Ordinals/Runes. Its multi-chain reach appeals to collectors seeking a single home base for cross-ecosystem NFTs. Tensor specializes in Solana NFTs with strong monthly volume, acting as the go-to professional terminal for active Solana traders.

Rarible serves both consumer markets and brands seeking infrastructure for NFT commerce. Community-driven LooksRare incentivizes participation and engagement, while curated platforms like Foundation and SuperRare prioritize provenance, artist narratives, and auction-driven sales.

Niche platforms like Zora, objkt, fxhash, and Element Market focus on specific chains, artistic styles, or Layer-2 solutions. These platforms maintain lower fees and strong community engagement, providing specialized support for creators and collectors. Experts recommend choosing a marketplace based on liquidity, chain compatibility, creator tooling, and user goals rather than brand reputation alone.

How NFT Marketplaces 2026 Handle Fees, Royalties, and Security?

Marketplaces in 2026 employ clear, structured fee systems. Platforms charge 0.5–2.5% fees, for example, OpenSea at 2.5%, Magic Eden is variable around 2%, and Tensor averages 2%. Some marketplaces subsidize fees through incentives to increase liquidity and user engagement.

Royalties vary by ecosystem. Some are enforced at the contract level, while others rely on marketplace enforcement tools. Proper planning ensures creators receive their due revenue, even on secondary sales.

Security remains critical. Operational mistakes, such as granting unlimited wallet approvals or interacting with counterfeit collections, are the leading cause of NFT losses. Regular review of permissions and verification of collection contracts through official channels are considered essential practices for both creators and collectors.

What Challenges Still Face NFT Marketplaces in 2026?

Despite rapid innovation, challenges remain. User education is crucial as NFTs become increasingly complex. Regulatory frameworks continue to evolve, requiring marketplaces to adapt compliance modules constantly. Security risks and interoperability issues across blockchains present ongoing obstacles. Market volatility also affects asset valuation, emphasizing the need for robust risk management strategies.

These challenges are driving further innovation. AI verification, cross-chain liquidity, and user-focused design improvements aim to address operational, technical, and educational barriers, supporting the sustainable growth of NFT ecosystems.

What the Future Holds Beyond 2026?

NFT marketplaces are expected to grow more intelligent, secure, and integrated with real-world economies. Upcoming innovations include NFT-based digital identities for licenses, certifications, and educational credentials. Fractional ownership will allow co-investing in property, artwork, and collectibles. Subscription-based platforms will enable creators and brands to monetize memberships and exclusive content. Physical-digital marketplaces will link NFTs with redeemable tangible items.

Fully interoperable, cross-chain ecosystems will allow seamless movement of assets, increasing utility and value. Analysts predict NFT marketplaces will form the foundation of future digital economies, supporting financial services, gaming, virtual workspaces, and even digital citizenship by 2030.

Conclusion

The top NFT marketplaces 2026 have evolved into sophisticated ecosystems supporting gaming, AI, real-world assets, and practical utility. Cross-chain technology, AI integration, and regulatory compliance distinguish the leading platforms. OpenSea and Magic Eden excel in broad discovery and multi-chain access, Blur and Tensor focus on trading efficiency, and curated marketplaces like Foundation and SuperRare serve art-focused communities. Niche platforms such as Zora, objkt, and fxhash prioritize creator engagement and chain-specific cultures.

NFTs have moved beyond collectibles into functional digital assets, and marketplaces are leading this transition. By combining utility, security, and interoperability, NFT marketplaces 2026 are establishing themselves as critical infrastructure for the next-generation digital economy. In 2026, they are no longer trends. They are essential tools shaping ownership, engagement, and commerce in the Web3 era.

Glossary

NFT Marketplace: A site to create, buy, or sell NFTs across blockchains.

Tokenized Assets: Physical items turned into digital NFTs.

Cross-Chain Trading: NFTs moved or traded across different blockchains.

Dynamic NFTs: NFTs that update or change automatically.

Metaverse Integration: NFTs used in games, virtual worlds, and digital spaces.

Frequently Asked Questions About Top NFT Marketplaces 2026

How are NFT marketplaces 2026 adapting to change?

NFT marketplaces now use AI, support gaming items, tokenized real-world assets, and allow cross-chain trading.

What types of NFTs can I buy in 2026?

You can buy digital art, gaming items, AI-generated collectibles, and tokenized real-world assets like houses or cars.

How does AI help NFT marketplaces 2026?

AI checks authenticity, detects fraud, personalizes content, and can even create dynamic NFTs automatically.

How do NFT marketplaces 2026 handle fees and royalties?

Fees range from 0.5% to 2.5%, and royalties ensure creators earn money on primary and secondary sales.

Why are NFTs considered useful now?

NFTs now give real value through gaming, financial tools, tokenized assets, memberships, and digital identity features.