According to sources, the list of CFTC chair candidates 2025 is drawing a lot of attention from the crypto world and financial regulators. The Trump administration pulled Brian Quintenz’s nomination, leaving the CFTC without a permanent leader.

- Who Are the Leading Contenders for the CFTC Chair?

- What Experience Do Former Commissioners Bring?

- How Does Josh Sterling Stand Out?

- Could the SEC and CFTC Be Combined?

- How Has the Crypto Industry Reacted?

- What Are the Next Steps for the Nomination Process?

- Conclusion

- Glossary

- Frequently Asked Questions About CFTC Chair Candidates 2025

This has made finding a new chair more urgent. Experts say that choosing someone who supports crypto could influence how digital assets are regulated in the US.

Who Are the Leading Contenders for the CFTC Chair?

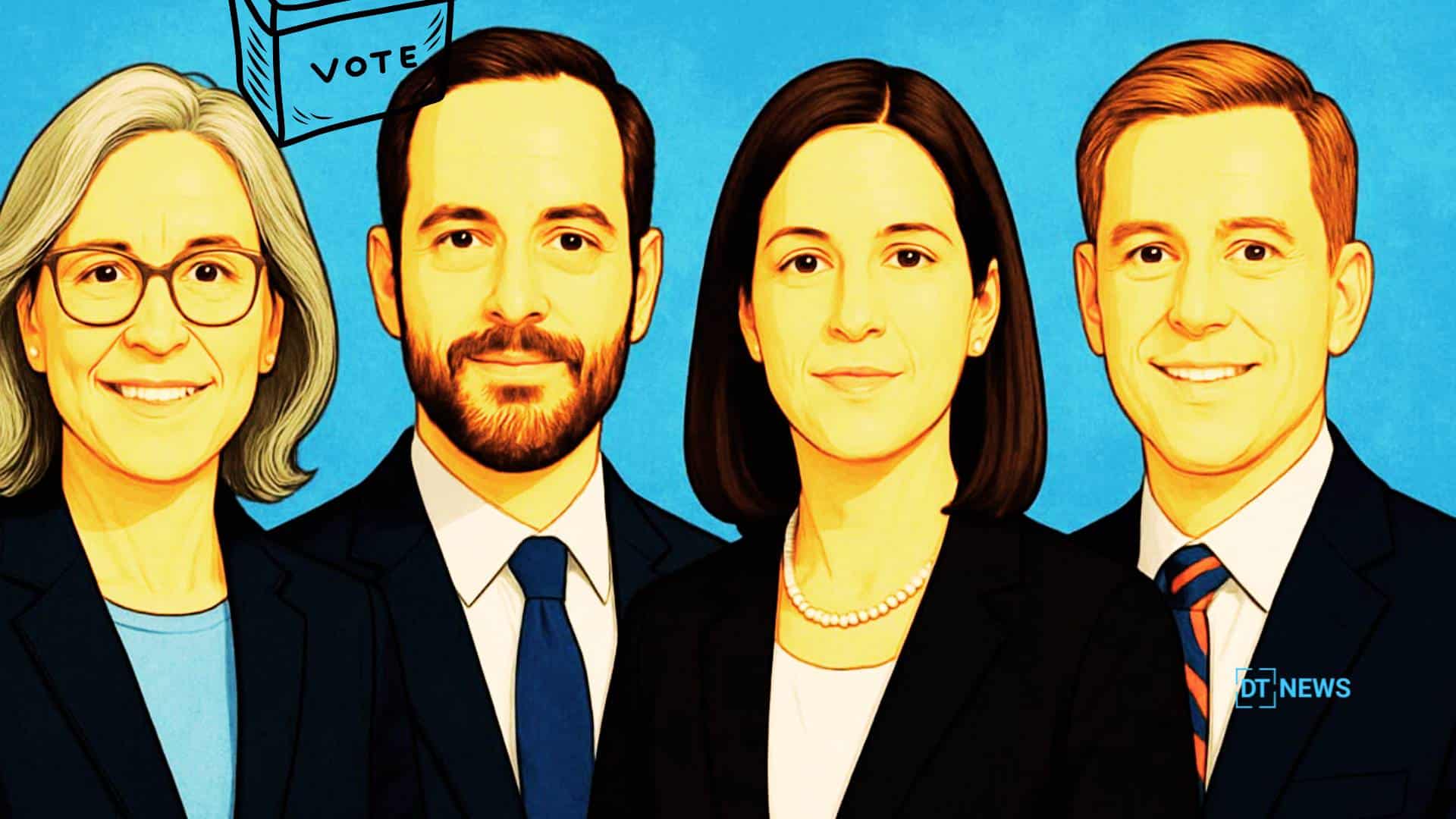

The White House is reviewing several people for the CFTC chair candidates 2025 position. One of the main names is Michael Selig, chief counsel for the SEC’s crypto task force. Selig has said the next leader should follow a do no harm approach to cryptocurrencies. He has also called for stopping regulation that relies mainly on enforcement actions.

Tyler Williams, counselor to Treasury Secretary Scott Bessent on digital asset policy, is another key candidate. He helped write the White House’s crypto report and highlights the need for a clear framework for digital assets.

Analysts say his experience in both government and private sectors makes him attractive to regulators. Many in the market also see his background as a positive for the crypto industry.

Also read: New CFTC Framework Aims to Launch Spot Crypto Trading in the U.S.

What Experience Do Former Commissioners Bring?

Jill Sommers, a former CFTC commissioner, is also being considered for the CFTC chair candidate for 2025. She has led the Global Markets Advisory Committee and was on the FTX.US board of directors.

Her background in derivatives and working with regulators makes her well-versed in compliance. She is seen as a candidate who can balance rules with innovation. Kyle Hauptman, who is the chairman of the National Credit Union Administration, is also on the shortlist.

He has not spoken publicly about crypto. However, he has a history of supporting new technology and avoiding strict regulation. This approach could make him a positive choice for the digital assets sector.

How Does Josh Sterling Stand Out?

Josh Sterling, a partner at Milbank and former senior CFTC official, has become a top candidate for CFTC chair candidates 2025. He represents the prediction market Kalshi and has talked about the CFTC’s role in supporting innovation in digital asset products.

Experts say his mix of legal knowledge and regulatory experience is valuable. Sterling could help guide the agency as the crypto market continues to grow.

Could the SEC and CFTC Be Combined?

Some insiders have suggested combining the SEC and CFTC, which could put SEC Chair Paul Atkins in charge of both agencies. Experts question whether this would be legal or practical.

Law professors warn that concentrating power could strain management. They also say it might lead to ethical problems.

How Has the Crypto Industry Reacted?

The crypto community has been watching the CFTC chair candidates 2025 closely. Brian Quintenz’s nomination was withdrawn after opposition from influential people like the Winklevoss twins.

Market participants say it is important to have a chair who encourages new ideas but also protects investors. Experts say that strong leadership at the CFTC can make people more confident in U.S. digital asset markets.

Also read: Trump’s CFTC Appointee Sacks Top Ranks, Eyes Broader Crypto Oversight

What Are the Next Steps for the Nomination Process?

The White House has not yet named a final choice for CFTC chair candidates 2025. The new nominee will need to be approved by the Senate, which may take several weeks.

Experts say the confirmation process will show how well the CFTC can manage trillions of dollars in swaps trading. It will also affect how the agency regulates growing crypto markets.

Conclusion

Based on the latest research, CFTC chair candidates 2025 could have a big impact on how digital assets are regulated. A nominee who supports new ideas and clear rules could help the crypto industry grow safely.

The market is paying close attention as the White House makes its decision. Leadership at the CFTC will affect the wider financial system for years to come.

Summary

CFTC chair candidates 2025 are getting a lot of attention from the crypto world and regulators. Brian Quintenz’s nomination was withdrawn, leaving the CFTC without a permanent leader.

Top candidates include Michael Selig, Tyler Williams, Jill Sommers, Kyle Hauptman, and Josh Sterling, all with experience in crypto and regulation. Experts say choosing someone who supports new ideas and clear rules could help the crypto industry grow safely and give investors more confidence.

Stay updated on latest news on CFTC chair candidates 2025 and see who will shape crypto’s future only on our platform

Glossary

CFTC: U.S. agency that sets rules for futures, derivatives, and digital markets.

Chairperson: The official leading the CFTC and directing policy decisions.

Do No Harm Approach: Guiding markets with minimal restrictions to foster growth.

Enforcement Strategy: How regulators ensure compliance with rules.

Regulatory Vision: Long term strategy leaders use to shape financial and crypto markets.

Frequently Asked Questions About CFTC Chair Candidates 2025

Who are the main CFTC chair candidates for 2025?

The main candidates include Jill Sommers, Kyle Hauptman, Josh Sterling, Michael Selig, and Tyler Williams.

Why is the CFTC looking for a new chair?

The previous nominee, Brian Quintenz, withdrew, leaving the CFTC without a permanent leader.

Why is the choice of CFTC chair important for crypto?

The new chair could influence how digital assets are regulated in the US and support innovation.

Has anyone already led the CFTC before?

Yes, former commissioners like Jill Sommers have led the CFTC and have regulatory experience.

Could the SEC and CFTC work together in the future?

It is possible, as experts sometimes discuss combining their efforts to better regulate digital assets.