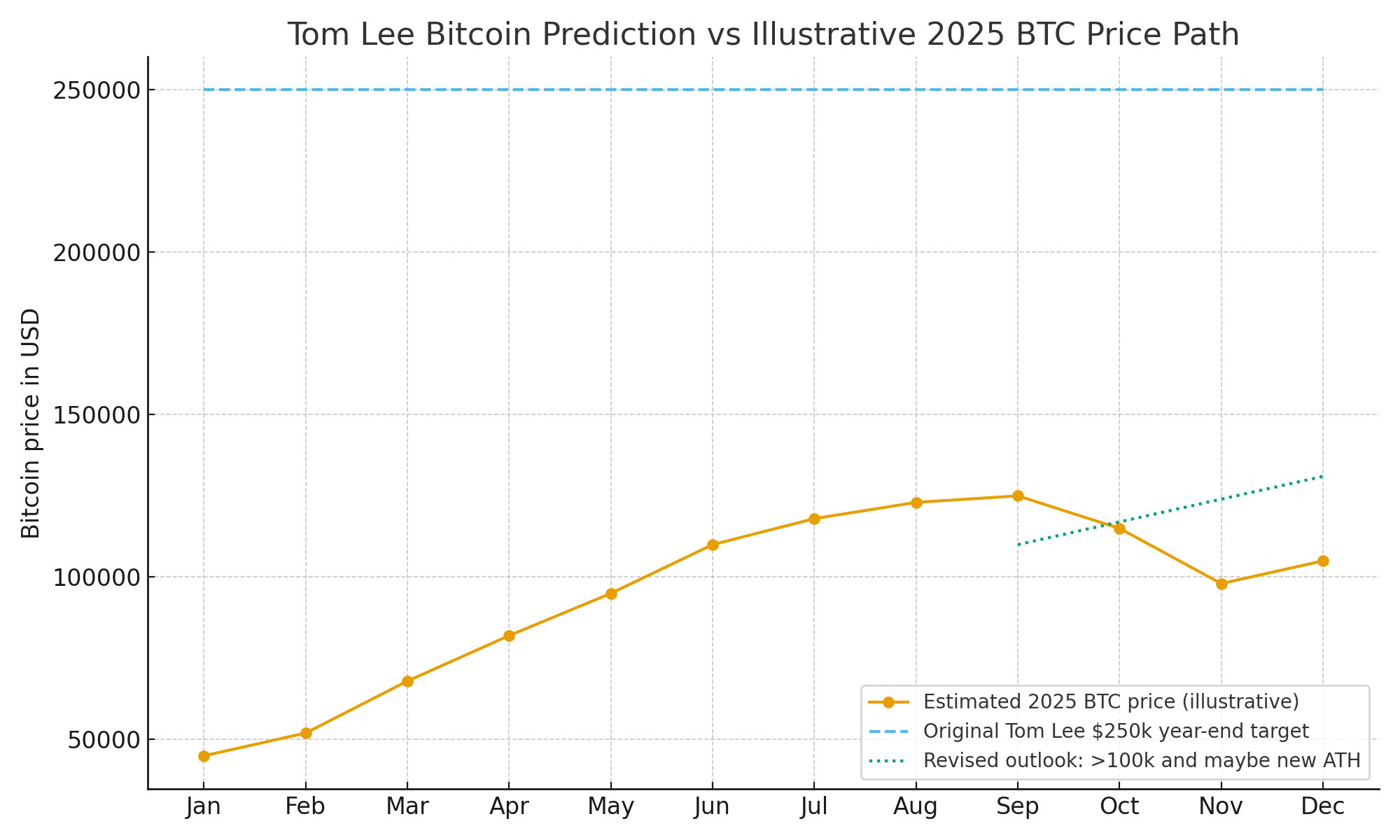

BitMine chair Tom Lee is taking a step back from his forecast for Bitcoin. After months of saying BTC could reach $250,000 by the end of 2025, he now describes a return to the October all time high near $125,100 as only a “maybe.” The latest Tom Lee Bitcoin prediction has shifted from slogan to cautious scenario.

In a recent television interview, Lee remarked, “I think it is still very likely that Bitcoin is going to be above $100,000 before year-end, and maybe even to a new high,” tying the Tom Lee Bitcoin prediction to the final weeks of the year rather than a single blow-off top. That keeps the Tom Lee Bitcoin prediction firmly bullish, but no longer built around one dramatic year-end number.

How The Tom Lee Bitcoin Prediction Evolved In 2025

For much of the year, the Tom Lee Bitcoin prediction of $250,000 by year end sat at the top of bullish forecasts. Earlier in 2025 he repeated that target in multiple media appearances, arguing that post-halving supply cuts and strong demand could justify that level by the close of the cycle. His thesis behind the Tom Lee Bitcoin prediction combines the halving-driven supply squeeze with growing institutional demand through spot-listed products and corporate treasuries that treat Bitcoin as a long-term reserve asset.

Other veteran voices framed the odds more carefully. Galaxy Digital chief Mike Novogratz warned in an interview that “there would have to be a heck of a lot of crazy stuff to really get that kind of momentum,” when asked about the idea of Bitcoin racing to $250,000 in this timeframe. A 133% rally from roughly $107,000 in a short window would be statistically rare, so against that backdrop the hard version of the Tom Lee Bitcoin prediction already looked stretched even before the latest pullback.

Market Liquidations And Macro Shocks Test Bullish Calls

The market tape explains part of the mood change. Since 10 October, Bitcoin has trended lower after roughly $19 billion in leveraged positions were liquidated following the announcement of a new 100% tariff on Chinese goods. The cascade drove price under $90,000 before buyers clawed it back and left November trading far weaker than its usual profile.

Separate analysis shows November 2025 on track to be one of Bitcoin’s softest Novembers since the 2018 bear market, with losses near 20% at one point. That backdrop naturally puts pressure on the strongest version of the Tom Lee Bitcoin prediction.

Why The Tom Lee Bitcoin Prediction Still Matters

Lee has not abandoned his core argument about how Bitcoin tends to deliver gains. He highlighted that the asset often “makes its move” in roughly 10 trading days each year, with most of the annual performance packed into a tiny slice of the calendar. Bitwise chief executive Hunter Horsley made a similar point in a widely shared post on X, writing that “missing Bitcoin’s best 10 days historically means missing nearly all of its returns,” and sharing data that illustrated how a handful of sessions can define an entire year.

For long term holders who believe in the Tom Lee Bitcoin prediction over several years, this pattern supports staying invested rather than trying to jump in and out around headlines.

History keeps expectations grounded. In early 2018, Lee suggested that Bitcoin could reach $125,000 by 2022. That level did not materialize until October 2025, when BTC finally pushed into that zone. Yet a 2017 base case that mapped a move to between $20,000 and $55,000 by 2022 lined up with the peaks of the 2020 and 2021 cycle, when Bitcoin topped around $20,000 and later near $55,000. His calls have been early at times and surprisingly accurate at others, which is exactly what one would expect around an asset with extreme volatility.

What Investors Should Watch Beyond Any Single Target

For investors, the practical takeaway is to study supply, leverage, seasonality, volatility, and institutional flows, rather than fixating on a single Tom Lee Bitcoin prediction. Post-halving supply dynamics, the size of liquidation cascades, realized volatility, the strength of demand through regulated products, and macro factors such as tariffs or liquidity policy all help determine whether targets like $200,000 or $250,000 sit in the realm of probability or mostly in the realm of hope.

In the end, the evolving Tom Lee Bitcoin prediction underscores a simple truth. Even one of the market’s most persistent optimists now treats $250,000 as a possibility rather than a promise. The long term narrative for Bitcoin, from digital gold story to deeper institutional adoption, remains intact, but the road toward any future all time highs will continue to twist.

Frequently Asked Questions

Why did Tom Lee soften his $250,000 call?

He now describes a year-end all-time high as only a “maybe” after a sharp liquidation-driven sell-off, weaker November performance, and increased awareness of how difficult a near-term $250,000 print would be under current conditions.

What key indicators matter for this forecast?

He focuses on post halving supply, the way Bitcoin’s strongest days cluster into short bursts, realized volatility, and institutional demand through regulated investment products such as spot-based exchange-traded vehicles.

Is $250,000 still possible for Bitcoin?

Analysts say it remains possible over a longer horizon, especially if liquidity expands and institutional flows remain strong, but it appears less likely as a straight move from current levels within a single year.

Glossary of key terms

All time high (ATH)

The highest price an asset has ever reached in its trading history.

Liquidation

A forced closing of leveraged positions when price moves against traders and collateral is no longer sufficient to support the borrowed exposure.

Seasonality

The tendency for markets to show recurring strength or weakness in particular months or periods of the year, based on historical performance patterns.