By the end of 2025, one corner of the real-world asset story started to stand out: Tokenized stocks. The category remains tiny next to traditional equity markets, but the growth rate changed the tone across crypto because it suggested familiar assets can attract on-chain activity when rails feel usable.

The data point that made people look twice

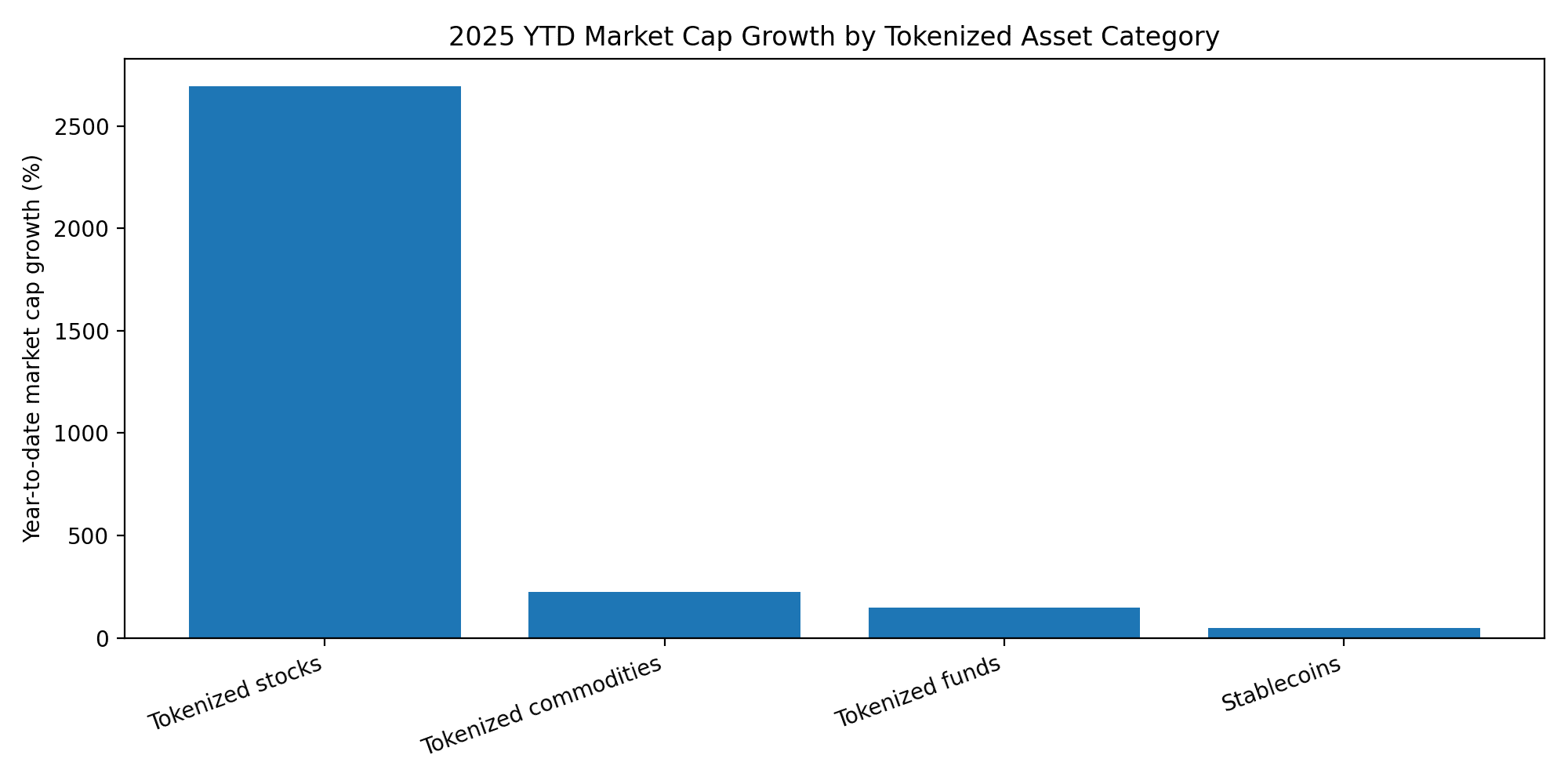

On-chain tracking in 2025 showed Tokenized stocks pulling ahead of other tokenized categories. Year to date, their market cap was reported up 2,695%, outpacing tokenized commodities at 225% and tokenized funds at 148%, while stablecoins rose 49% off a much larger base.

That number is not a guarantee of permanence. It is a signal that tokenization is moving from theory to early usage, especially as major financial institutions describe tokenization as a way to improve how assets move and settle.

Why fast growth can still be thin

Early markets can expand in market cap faster than they grow in liquidity. Thin liquidity tends to show up through wider spreads, more slippage, and uneven tracking during volatile sessions.

Mid-2025 activity offered a tangible sign of adoption. A market update described tokenized equity products linked to popular tickers and index exposures reaching $53.6 million in market cap, while associated on-chain addresses rose from about 1,600 to more than 90,000 within a month. Participation often leads to liquidity, so those metrics matter even when volumes are still maturing.

The chain race is no longer theoretical

Ethereum remained the largest venue for issuance, but Tokenized stocks were increasingly described as a multi-chain market. Several networks captured meaningful slices of market cap, including Solana, BNB Chain, Arbitrum, Base, and Polygon.

The logic is practical. If a product is meant to behave like an equity exposure, fees, reliability, and throughput start to matter like they do in mainstream brokerage apps. Lower costs make smaller positions viable, and predictable performance keeps markets usable when attention spikes.

Issuers are chasing distribution

The 2025 surge was linked to multiple issuers pushing harder on Tokenized stocks as more networks became viable venues for issuance and transfers.

Roadmaps for 2026 reinforced that direction. A December report described plans to offer tokenized U.S. stocks and ETFs on Solana in early 2026, reflecting a broader push to expand access beyond a single chain.

Key indicators that separate a narrative from a market

For crypto readers, Tokenized stocks should be judged with a slightly different scoreboard. Market cap and year to date growth are the loudest metrics, but liquidity depth and tracking quality are the deciding ones.

Participation indicators also matter. Active address growth can hint at demand, but it is most meaningful when paired with sustained volume and tighter spreads over time.

Finally, credibility matters. Post-trade infrastructure groups have been working on tokenization while keeping ownership rights and investor protections in view, and recent updates have pointed to regulatory engagement around tokenization initiatives.

Risks and rules that cannot be ignored

Tokenization is not risk-free. A global securities watchdog warned in 2025 that investors may be unclear whether they hold the underlying asset or a digital representation, and it highlighted counterparty and operational risks tied to third-party issuers, especially when tokenized products connect to broader crypto markets.

Because of that, Tokenized stocks demand higher standards of disclosure than most crypto assets. The essential questions are direct: What is the legal claim, how is custody handled, what are redemption terms, how are dividends or splits processed, and what happens if the issuer fails.

Conclusion

2025 did not deliver a finished on-chain equity market, but it did turn Tokenized stocks into a measurable trend with real competitive pressure behind it. The next chapter will be written by liquidity and compliance, not slogans. If tracking tightens, spreads narrow, and regulated infrastructure keeps moving forward, 2026 could make tokenized equity feel less exotic and more like a normal option.

Frequently Asked Questions

What are Tokenized stocks?

Tokenized stocks are blockchain-based tokens designed to provide equity exposure through an issuer framework that defines backing, custody, and redemption. The structure varies, so legal terms matter.

Do tokenized equities trade 24/7?

Transfers can run around the clock, but trading access depends on platform rules, compliance checks, and the issuer model. Continuous transfer does not always mean continuous redemption.

Why did the theme accelerate in 2025?

Growth accelerated as issuance expanded and multiple networks competed on fees, throughput, and usability for tokenized equity products.

What risk should be understood first?

Issuer and legal risk. Investors should confirm whether the token represents ownership of the underlying asset or a contractual claim, and what protections apply if the issuer has problems.

Glossary of Key Terms

Tokenization: Representing a real-world asset or claim as a digital token on a blockchain.

Underlying asset: The real share or exposure that the token tracks or references.

Issuer: The entity that creates the token and defines backing, custody, and redemption rules.

Custody: Safekeeping and recordkeeping for the underlying asset and associated entitlements.

Settlement: The process that finalizes a trade by transferring ownership and completing payment.

Counterparty risk: The risk that an issuer or intermediary fails to meet obligations related to backing or redemption.

References