This article was first published on Deythere.

The tokenized commodities market is entering a decisive phase as investors search for stability beyond volatile digital assets. Rapid inflows into blockchain-based bullion products signal a broader shift in how traditional value is stored, traded, and trusted across financial systems.

According to the source, the tokenized commodities market has jumped more than 53 percent in under six weeks, pushing total valuation above 6.1 billion dollars after starting the year slightly above 4 billion. Verified analytics discussed in a recent industry data report show nearly 2 billion dollars entered the sector within weeks, confirming strong capital rotation toward tokenized gold.

Gold Dominance Concentrates Power Inside the Sector

Growth inside the tokenized commodities market is overwhelmingly tied to tokenized gold, which now represents more than 95 percent of total sector value. This concentration highlights investor preference for physical safe-haven exposure rather than diversified commodity baskets.

Monthly performance data reinforces that trend. Tether Gold expanded 51.6 percent to about 3.6 billion dollars, while Paxos-issued PAX Gold climbed 33.2 percent to nearly 2.3 billion. Together, these assets define the structure of the tokenized commodities market and explain why tokenized gold continues attracting conservative capital during uncertain macro cycles.

Expansion Far Outpaces Tokenized Stocks and Funds

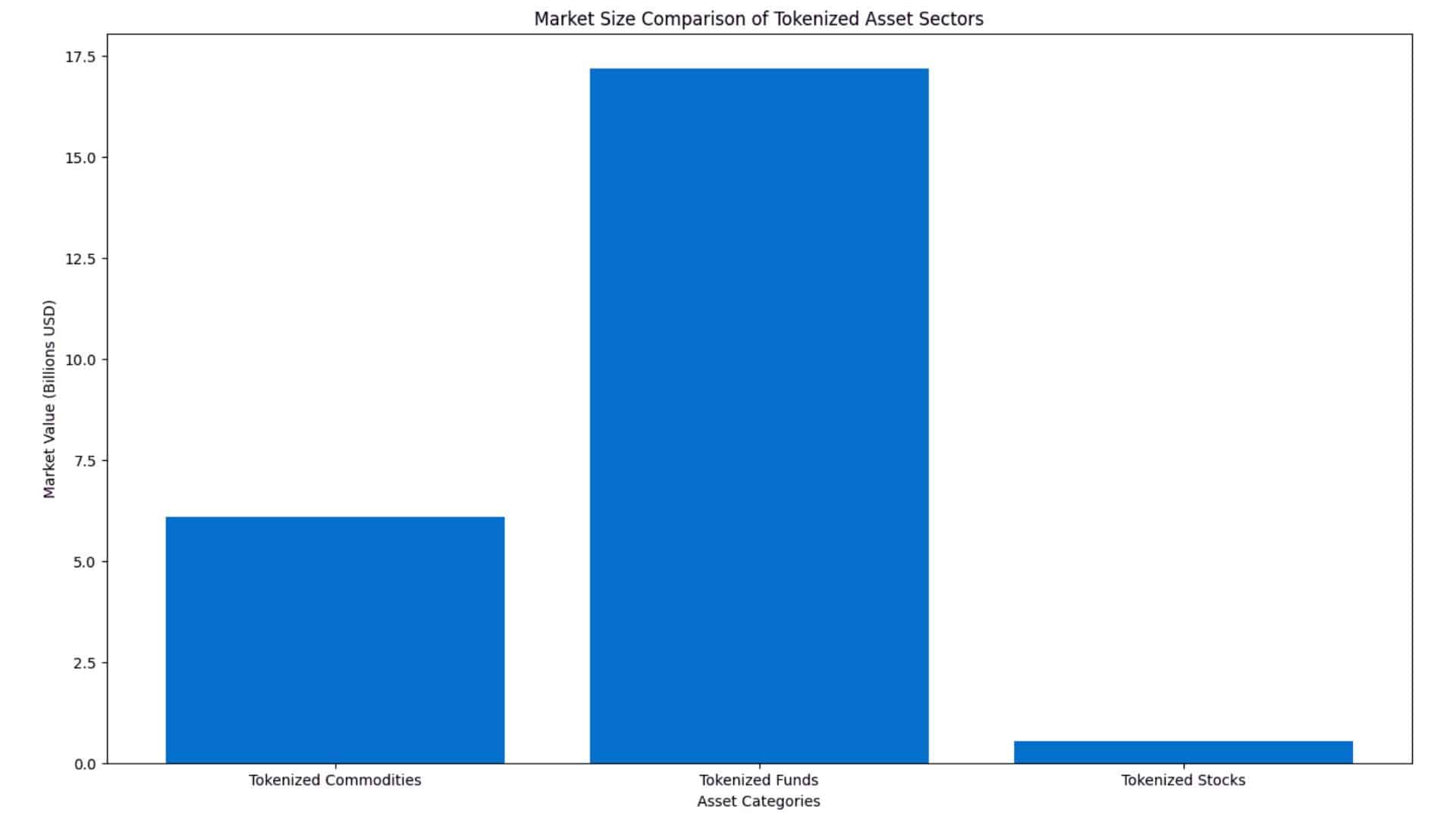

Yearly comparisons reveal the speed of change. The tokenized commodities market has surged roughly 360 percent year over year, far exceeding growth in tokenized equities and tokenized funds. Stocks linked to blockchain issuance rose about 42 percent, while tokenized funds increased only 3.6 percent during the same period.

Despite faster growth, size differences remain clear. Tokenized funds still hold close to 17.2 billion dollars in value, placing the tokenized commodities market at just over one-third of that scale. Tokenized stocks remain much smaller near 538 million dollars, reinforcing how strongly investors favor tokenized gold over blockchain-based equity exposure.

Strategic Moves Connect Digital Tokens to Physical Bullion

Institutional strategy is evolving alongside market growth. Tether recently deployed a 150 million dollar investment into Gold.com to expand infrastructure supporting the tokenized commodities market. Integration plans indicate that XAUt could function directly within retail bullion services, potentially allowing customers to obtain physical metal using stablecoin liquidity.

Research examining real-world asset adoption notes that blockchain settlement can reduce friction in commodity ownership while improving transparency for global users. Findings summarized in a recent financial stability analysis suggest tokenization may broaden access to traditionally restricted assets such as gold, further strengthening the tokenized commodities market.

Gold Strengthens While Bitcoin Faces Renewed Scrutiny

Macro price behavior helps explain investor rotation. Physical gold has rallied more than 80 percent over the past year, reaching nearly 5,600 dollars in late January before briefly falling toward 4,700. Prices later stabilized near 5,050, reinforcing confidence in tokenized gold as a defensive store of value.

Bitcoin followed a different trajectory. A sharp crash on October 10 triggered about 19 billion dollars in liquidations and drove the asset down more than 52 percent from roughly 126,000 to near 60,000 before a partial rebound toward 69,000. This divergence has intensified debate about whether Bitcoin behaves like digital gold or a high-risk technology asset, especially as capital flows into the tokenized commodities market.

Conclusion

Momentum inside the tokenized commodities market reflects more than short-term speculation. Strong dominance by tokenized gold, rapid capital inflows, and widening gaps with tokenized equities signal a structural evolution in blockchain finance.

As infrastructure improves and physical redemption pathways expand, the tokenized commodities market may emerge as one of the most stable bridges between traditional wealth preservation and decentralized technology. That shift could redefine how global investors approach safety, ownership, and trust in the digital age.

Glossary of Key Terms

Tokenized commodities market: Blockchain ecosystem representing physical commodities as tradable digital tokens.

Tokenized gold: Digital asset backed by vaulted physical gold reserves.

Real-world assets: Traditional financial or physical holdings issued on blockchain networks.

Liquidations: Forced closure of leveraged positions during sharp market declines.

FAQs About Tokenized Commodities Market

Why is the tokenized commodities market growing so quickly?

Rising gold demand, easier blockchain access, and faster settlement are drawing new institutional and retail investors.

What role does tokenized gold play in this growth?

It dominates sector value, providing stability linked to physical bullion rather than speculative crypto pricing.

How does this trend affect Bitcoin’s narrative?

Bitcoin faces scrutiny as capital shifts toward safer assets during volatile market periods.

Can tokenized commodities reshape global finance?

Yes. Improved access, transparency, and settlement efficiency could expand commodity ownership worldwide.