This week, crypto whales were in the news per usual. Large wallets moved billions of dollars worth of assets in BTC, ETH, PEPE, BNB, stablecoins, and more within the span of this week. These verified transactions tracked by on-chain tools like Whale Alert, Arkham and Lookonchain had immediate market impact and sentiment.

- Major Whale Transactions (June 8–13, 2025)

- Bitcoin Whale Transactions

- Ethereum Whale Transactions

- Altcoin Whale Activity (PEPE, BNB, etc.)

- Market Impact

- Sentiment, and Trading Behavior

- Conclusion

- FAQs

- What is a crypto whale and why do their moves matter?

- Do all whale deposits to exchanges mean a price crash is coming?

- How do whale activities affect small traders?

- Glossary

A notable one was a dormant whale buying 250 BTC on June 8, which gave a bullish sign, while multi-hundred-million-dollar flows to exchanges mid-week was sell pressure.

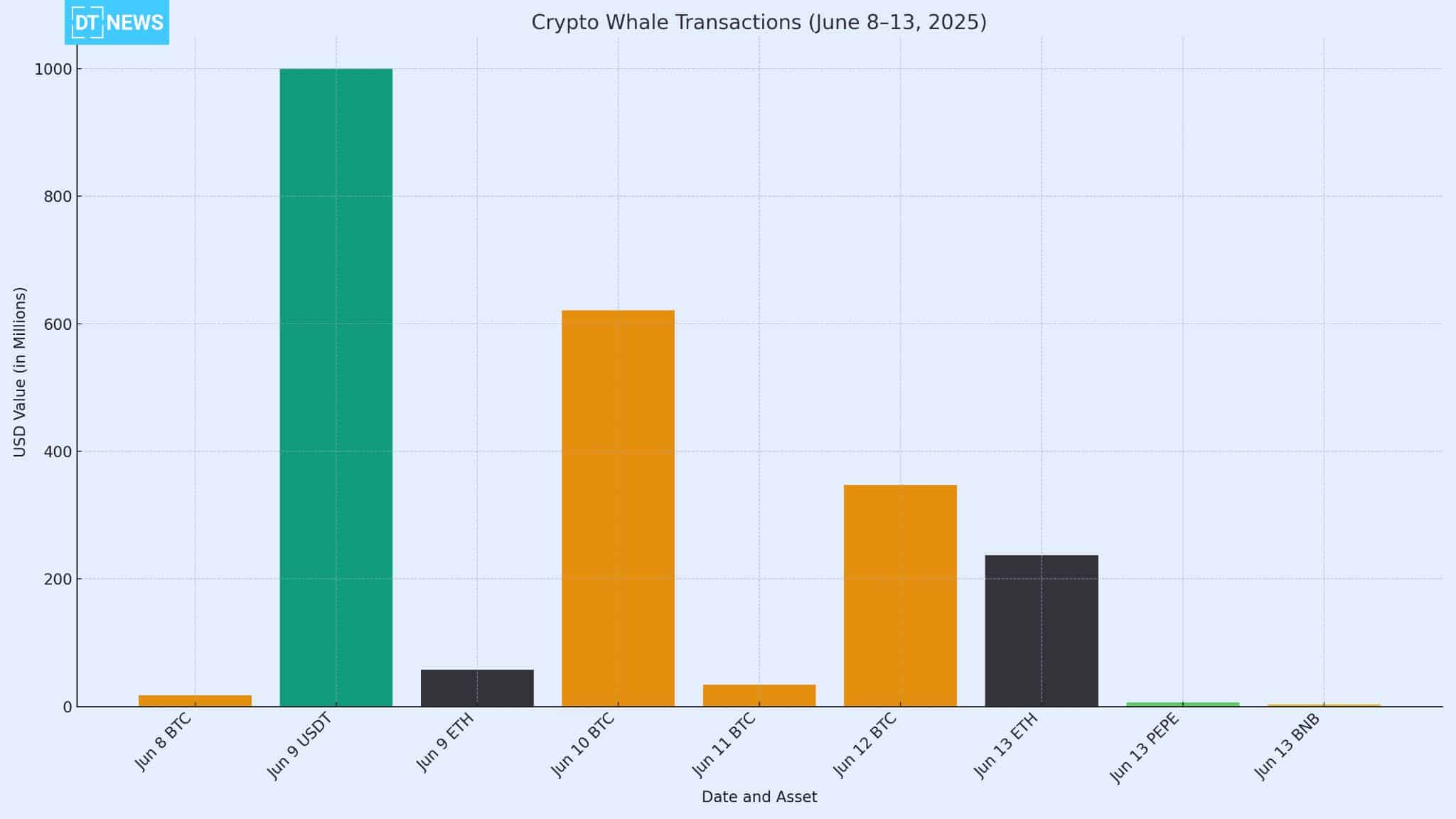

Major Whale Transactions (June 8–13, 2025)

Below are the top whale moves and their market effects this week.

| Date | Asset | Quantity | Approx. USD Value | Note |

| Jun 8, 2025 | BTC | 250 BTC | $17.5 million | Dormant whale reactivated, adding to holdings. |

| Jun 9, 2025 | USDT | 1,000,000,000 USDT (mint) | $1,000 million | Tether minted 1B USDT on Tron (liquidity boost). |

| Jun 9, 2025 | ETH | 23,075 ETH | $57.6 million | Transferred to Binance exchange (sell signal). |

| Jun 10, 2025 | BTC | 5,637 BTC | $620.8 million | Large transfer (unknown – unknown). |

| Jun 11, 2025 | BTC | 307.5 BTC | $33.8 million | Withdrawn from Binance to cold storage (accumulation). |

| Jun 12, 2025 | BTC | 3,165 BTC | $347 million | Moved to Coinbase exchange (potential sell-off). |

| Jun 13, 2025 | ETH | 86,430 ETH | $237 million | Sent to liquid-staking platform (holding for yield). |

| Jun 13, 2025 | PEPE | 609 billion PEPE | $6.43 million | Deposited to Binance (likely sell pressure). |

| Jun 13, 2025 | ETH | 48,825 ETH | $127 million | Whale buy on exchanges (post-crash accumulation). |

| Jun 13, 2025 | ETH | 2,825 ETH | $7.5 million | Whale buy (ConsenSys-related). |

| Jun 13, 2025 | BNB | 5,000 BNB | $3.0 million | Sent to Binance hot wallet (pre-sell signal). |

Bitcoin Whale Transactions

According to reports, on June 8 this week, a long dormant crypto whale woke up and bought 250 BTC (around $17.5 M). The whale had been inactive for two years and was adding to its position. On June 10-11 bigger flows happened. Whale Alert data showed a 5,637 BTC ($620.8 M) transfer between unknown wallets on June 10 and online speculation was rampant. Then on June 11 a big whale withdrew 307.5 BTC ($33.8 M) from Binance to cold storage.

Moving BTC off exchanges reduces available sell liquidity and is often seen as a bullish accumulation sign. The whale’s balance reportedly went up to 2,307 BTC and analysts noted an 8% increase in Binance BTC/USDT trading volume after that move, indicating that traders were likely buying.

In contrast 3,165 BTC ($347 M) flowed into Coinbase over two hours on June 12. Large inbound flows to an exchange often means sell pressure. Binance commentary said whales moving BTC to exchanges “might be selling”. As of mid-week however, Bitcoin was still strong having just broken above $110,000 resistance.

The diverging crypto whale flows; one whale pulling BTC off Binance and others sending BTC into Coinbase, created uncertainty and potential for short term dips and rallies.

Overall, these BTC crypto whale moves caused volatility. After the June 8 accumulation, Bitcoin rose slightly. The June 11 withdrawal reduced supply on exchanges and trading volume spiked. By June 12, heavy inflows to Coinbase coincided with Bitcoin trading at $108-109K and analysts were warning of possible dips which saw BTC drop to the $105K range.

The big whale BTC moves this week opened up for more volatility as traders watched key support levels and resistance (around $110K) closely.

Ethereum Whale Transactions

Ethereum also had crypto whale activity this week. On June 9, 23,075 ETH (about $57.5 M) was reportedly moved from an unknown wallet to Binance. The Binance report of the transfer said traders were already “speculating” if this was an incoming sell-off or a repositioning.

ETH was trading around $2,800 at the time of the transfer; the deposit to Binance caused some pressure but no big drop followed immediately. Still, it put the markets on alert for more volatility.

The next big ETH event was on June 13 during a short-term price dip. Ethereum had a flash crash from around $2,650 to $2,518 (9% drop) on June 13 which triggered liquidations. Whales bought ETH aggressively. On-chain analysis via Lookonchain showed one whale tied to ConsenSys, buying 2,825 ETH ($7.5 M) at $2,593 each. Around the same time, reports say another whale bought 48,825 ETH ($127 M) from Coinbase and Wintermute at $2,605 average.

Overall, this address bought around 160,736 ETH ($421 M) in two weeks, which likely helped stabilize ETH after the crash.

Also on June 13, a whale transferred 86,430 ETH (about $237 M) to a liquid staking platform. Instead of selling, this large holder reportedly moved ETH into staking, earning network rewards while keeping liquidity via staking tokens. Binance views this as “bullish” since large funds held off-exchange reduce supply.

The accumulation after the June 13 crash showed big players buying and that helped to cushion the price.

Altcoin Whale Activity (PEPE, BNB, etc.)

Outside of BTC and ETH, there were some big crypto whale moves in altcoins. On June 9, 1 billion USDT was reportedly minted on Tron by Tether. Large stablecoin minting injects liquidity into the market. Binance said “large-scale minting of USDT can provide liquidity to the market and is a signal for big capital inflow soon”.

Meme and platform tokens also had their day. A whale with address 0x6ea reportedly deposited 609 billion PEPE (about $6.43M) to Binance. Iimmediately after the deposit, PEPE/USD on Binance dropped 1.2% and 24h volume spiked 18%. The analysis said this deposit likely increased short term liquidity and suggested possible selling pressure as traders feared more selling.

Another altcoin whale alert on June 13 was Binance Coin (BNB). Whale Alert showed 5,000 BNB ($3M) sent to a Binance hot wallet at 11:30 AM UTC. Such a deposit often precedes exchange activity. The commentary said it could mean the whale was going to sell or reposition. $3M is small compared to BNB’s market cap but the signal triggered caution for traders watching volume and order-books.

This week, the altcoin crypto whale moves (PEPE and BNB) caused immediate reactions. PEPE dropped on the large deposit, reflecting sell side anxiety. BNB’s large transfer caused speculation about a pullback if the whale sold.

Market Impact

For Bitcoin, the week saw it test and go below previous highs. BTC slightly went above $110K by Wednesday, June 11. Whale accumulation (like the June 8 reactivation) supported this move while large transfers to exchanges caused caution.

When Coinbase saw $347M inflows on Thursday, analysts warned of possible dips and said selling pressure could push BTC down to $105K-$107K. The back and forth between bullish whale moves and bearish signals caused volatility.

Ethereum’s price was more volatile on Friday as a “flash crash” wiped out about 9% intraday mostly due to liquidation cascades. But crypto whale buying in that low range stopped the bleeding. ETH trading volumes surged as big orders hit the market.

Sentiment flipped from panic selling by retail to cautious optimism as big whales stepped in. Technical analysis showed Ethereum was still in a higher-timeframe consolidation pattern despite the drop, partly because crypto whales accumulated aggressively during the dip.

Stablecoin minting also influenced liquidity and sentiment. The Tether mint on June 9 was seen as a sign of rising bullishness: injecting $1B of USDT gave traders more dry powder to deploy.

Sentiment, and Trading Behavior

In general, sentiment was a mix of FOMO from recent highs and caution from crypto whales. Market participants used whale alerts as signals: big outflows from exchanges (like BTC and ETH withdrawals) were seen as bullish backings, while big inflows (to Binance or Coinbase) were seen as downside risk.

On-chain metrics reflected these behaviors. Glassnode reported a 15% increase in big BTC transactions (100+ BTC) after the June 8 whale move. Crypto funds also saw flows: Bitcoin ETFs absorbed hundreds of millions that week, partly correlated to whale activity. In summary, the top whales between this week were the market movers and their verified actions were the catalysts for price moves, volume shifts and sentiment changes across the crypto space.

Conclusion

This week saw several big crypto whale transactions in Bitcoin, Ethereum and alts. Dormant whales bought fresh BTC, whales bought discounted ETH after the crash and meme-coin crypto whales deposited large amounts signaling sell. Stablecoin supply surged with a $1B USDT mint.

Each move rippled through the markets: volatility, sentiment and prices. In many cases, the crypto whales were bullish (e.g. moving coins off exchanges or into staking) and in others they were bearish (large exchange deposits).

For crypto-savvy investors, these on-chain flows are important and noteworthy signals.

FAQs

What is a crypto whale and why do their moves matter?

A whale is an individual or entity holding a lot of cryptocurrency. Because they move big sums, whales can move the price and market sentiment.

Do all whale deposits to exchanges mean a price crash is coming?

Not always. Big inflows can mean sell, but some whale deposits are internal transfers or preparation for other activities. Traders use additional context: a whale that buys and rarely sells is bullish, a sudden spike in exchange inflow means sell. It’s safest to combine whale data with technical and market analysis.

How do whale activities affect small traders?

Whale moves can create volatility that small traders feel first hand. For example big sells by whales can cause short term price drops and liquidations. Conversely whale accumulation can rally prices.

Glossary

Crypto Whale: An individual/entity holding large amounts of a cryptocurrency. Whale moves can move the market.

Stablecoin: A cryptocurrency pegged to a stable asset (often USD). Examples are USDT (Tether) and USDC.

On-Chain: Refers to transactions on a blockchain. On-chain analysis means looking at these public records.

Liquid Staking: A staking method where staked crypto remains liquid. Users get a tokenized representation of their stake (e.g. stETH for ETH) that can be traded. It lets whales earn staking rewards without locking funds long term.

Cold Wallet (Cold Storage): Offline crypto storage (e.g. hardware wallet) not connected to the internet.

Support/Resistance: Price levels where an asset stops falling (support) or rising (resistance). Traders watch these levels to see how whales affect price.