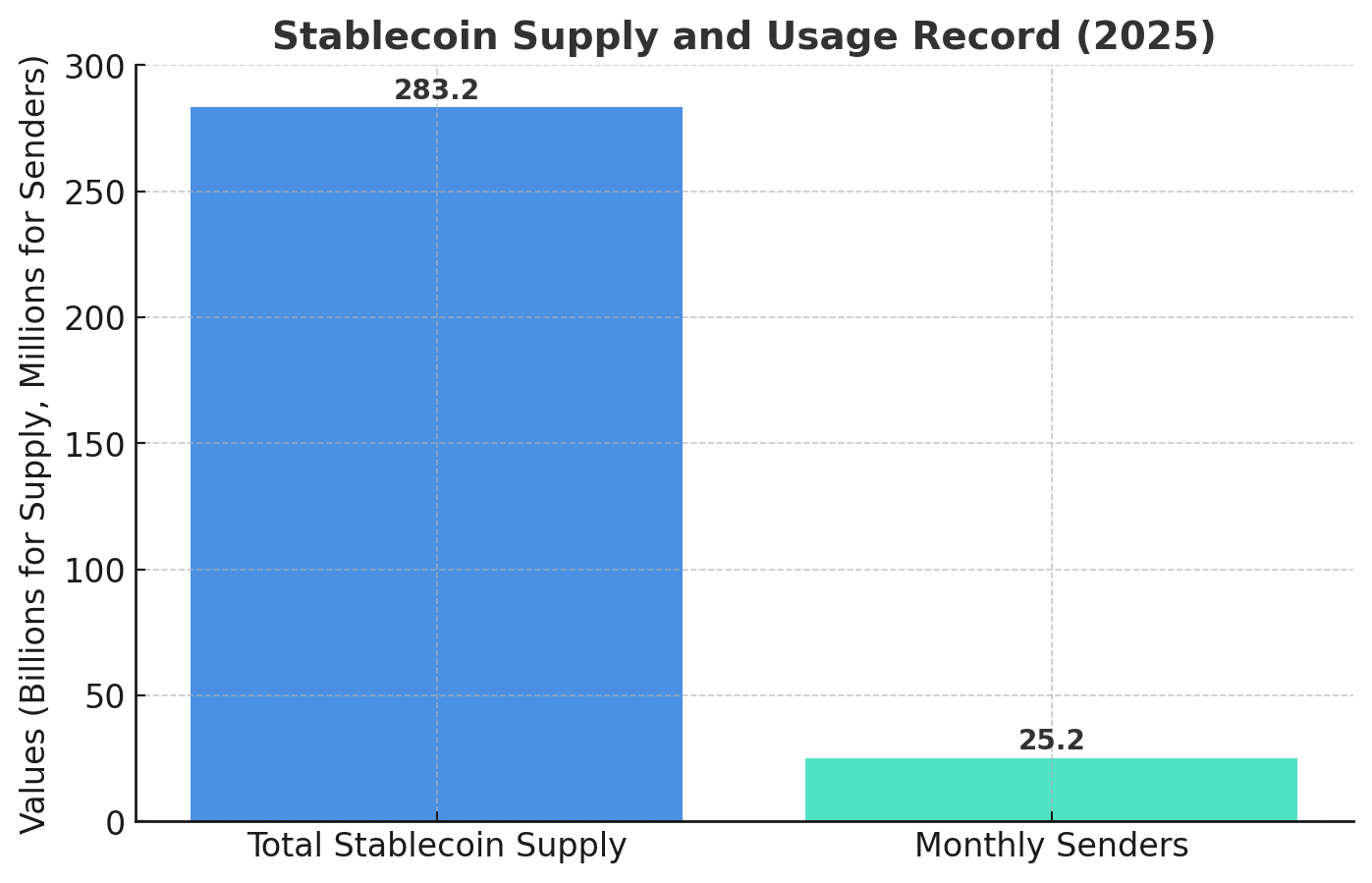

The crypto market has crossed another milestone as stablecoin supply touched an all-time high of $283.2 billion, according to fresh industry data. More than 25.2 million monthly senders are now active, underscoring the accelerating use of stable digital assets for payments, trading, and decentralized finance.

This surge is not just about numbers; it signals a deep shift in how stablecoins are shaping global financial behavior. The top google searchable keyword, stablecoin supply, is becoming central to the narrative of digital currency adoption.

Record Growth in Stablecoin Supply

Stablecoins are pegged to traditional assets, usually the US dollar, offering crypto users stability in a volatile market. The latest record shows an unprecedented expansion of stablecoin supply, reflecting confidence in their role as a bridge between traditional money and blockchain ecosystems.

The increase in monthly senders highlights how these tokens are moving beyond passive holdings to active usage. Transfers, remittances, and DeFi transactions are driving this momentum.

“Stablecoins are no longer a side note in crypto markets. They are becoming the bloodstream of decentralized economies,” said Michael Song, a blockchain analyst on X, capturing the sentiment of many observers. His remark echoes a reality where stablecoin supply is being watched as closely as Bitcoin or Ethereum.

Institutional Interest and Regulatory Shifts

The rise in stablecoin supply coincides with growing institutional participation. Large financial players are adopting stablecoins for settlements, liquidity management, and as gateways into crypto markets.

Regulatory clarity in regions like the Middle East and North America is also contributing. Recently, Canada’s central bank urged policymakers to weigh the merits of stablecoin regulation, and Bahrain introduced its own law specifically addressing its role in payments.

According to financial strategist Laura Perez, “The supply growth reflects not just retail adoption but also institutional trust. Regulators stepping in with clear rules adds a layer of legitimacy that encourages long-term participation.” Her view emphasizes that stablecoin supply growth is both a market-driven and policy-enabled phenomenon.

Market Impacts and Price Indicators

The expansion of stablecoin supply affects liquidity across exchanges. More circulating tokens mean more collateral for lending, smoother trading pairs, and greater depth in markets. On Ethereum alone, stablecoin supply has topped $166 billion, highlighting its dominance as the leading chain for such assets.

This has direct implications for the Relative Strength Index and Moving Average Convergence Divergence indicators of major cryptocurrencies, as stablecoin inflows often precede bullish momentum in volatile assets.

For investors, stablecoin supply is an early indicator of market sentiment. Rising issuance can reflect demand for safe havens during downturns or fresh capital entering the ecosystem during bull phases. The 25.2 million monthly senders demonstrate that stablecoins are becoming indispensable in both contexts.

Challenges and Future Outlook

While record highs in stablecoin supply show strength, concerns persist. Transparency over reserves, compliance with international regulations, and the risks of concentration among a few issuers remain key questions. Despite these challenges, projections suggest total stablecoin supply could reach $1 trillion by 2028 if current trends hold.

Market watchers believe the surge may push more governments to introduce clear frameworks. As one policymaker in Asia noted, “Stablecoins are here to stay. The question is how to regulate them without stifling innovation.” With global regulators paying close attention, the path forward will depend on balancing innovation with oversight.

Conclusion

The new record in stablecoin supply reflects more than technical growth; it captures a turning point for digital assets. With $283.2 billion circulating and millions of active senders, stablecoins have become essential infrastructure for crypto adoption.

They are not only expanding liquidity but also shaping the future of payments, cross-border transactions, and institutional integration. The stability they provide is increasingly matched by their significance in global financial debates.

FAQs

Q1: Why has stablecoin supply reached a record high?

It reflects growing demand for stable assets in crypto trading, DeFi, and cross-border payments, alongside institutional and retail adoption.

Q2: How many people are using stablecoins actively?

Over 25.2 million monthly senders are now moving stablecoins, a clear sign of active global usage.

Q3: What role do regulators play in stablecoin supply growth?

Clear regulations in key markets are helping institutions and individuals trust and adopt stablecoins more widely.

Q4: Could stablecoin supply reach $1 trillion?

If current growth rates continue, analysts project stablecoin supply could cross the trillion-dollar mark by 2028.

Glossary of Key Terms

Stablecoin: A digital token pegged to a stable asset like the US dollar to minimize volatility.

Stablecoin Supply: The total circulating amount of stablecoins in the market, used as a liquidity and adoption indicator.

DeFi (Decentralized Finance): Blockchain-based financial services like lending, borrowing, and trading without intermediaries.

Liquidity: The ease with which assets can be traded without affecting price; higher supply usually increases liquidity.

RSI (Relative Strength Index): A technical indicator that measures momentum to determine if an asset is overbought or oversold.

MACD (Moving Average Convergence Divergence): A technical tool that identifies shifts in momentum and possible trend reversals.