A New Era of Open Finance

- The Rise of a Permissionless Economy

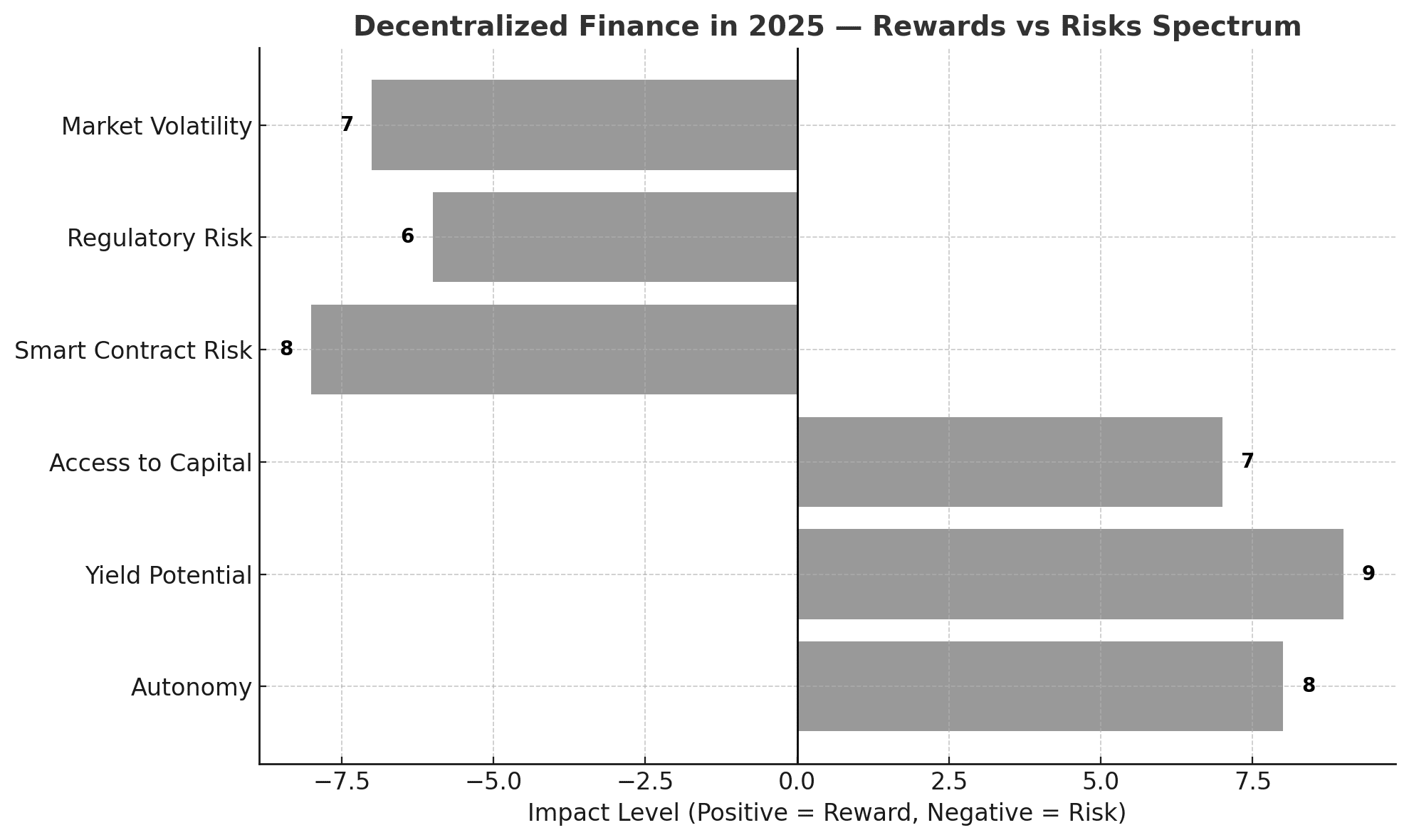

- Rewards: Yield, Access, and Financial Creativity

- Risks: The Other Side of Freedom

- The Regulatory Balancing Act

- The Institutional Shift: From Hype to Utility

- The Human Factor: Trust Without Intermediaries

- Emerging Trends: Real-World Assets and On-Chain Credit

- Conclusion: Responsibility in the Age of Autonomy

- Frequently Asked Questions

In 2025, Decentralized Finance is no longer just a crypto experiment. It has grown into a parallel financial system, one that challenges traditional banking models and redefines how money moves across the world.

The idea that individuals could earn, lend, or invest without a bank once sounded radical. Today, it is routine. Billions of dollars flow daily through decentralized protocols, handled not by clerks or brokers but by lines of verified code.

Still, DeFi’s story is one of tension: innovation racing ahead while risk follows close behind. Its growth has brought efficiency and access, but also new forms of fragility that regulators and investors are still learning to understand.

The Rise of a Permissionless Economy

The most striking evolution in Decentralized Finance is its reach. What began with simple token swaps on Ethereum has expanded into lending markets, synthetic assets, derivatives, and tokenized real-world instruments.

By 2025, total value locked (TVL) across all DeFi networks has exceeded $170 billion, recovering from previous downturns and stabilizing with new institutional inflows. The return of large players, from hedge funds to fintech treasuries, has given the sector credibility it once lacked.

But what makes DeFi truly transformative is its inclusivity. A small trader in Nairobi or a startup in Mumbai can access the same liquidity pools as billion-dollar funds in New York or London. That flattening of opportunity is reshaping access to finance.

A digital assets strategist recently said in a conference, “DeFi is the first financial system where geography doesn’t matter. Only code does.”

Rewards: Yield, Access, and Financial Creativity

The promise of Decentralized Finance lies in its structure, open, programmable, and permissionless. Anyone can participate and, in return, potentially earn.

DeFi users today can stake assets, provide liquidity, or participate in governance-based earnings. Yields range widely, but the average stablecoin yield sits around 5 percent, which is notably higher than many traditional fixed-income instruments.

For investors seeking alternatives to conventional banking products, DeFi represents autonomy and control. They no longer depend on intermediaries; instead, they engage directly with protocols that execute transactions transparently.

Large institutions are taking note. Some corporate treasuries now diversify holdings into tokenized bonds and regulated yield pools. Decentralized Finance has turned into a financial laboratory, blending blockchain efficiency with real-world utility.

It has also become a magnet for innovation. Developers build faster, smarter, and more interoperable protocols that can move billions in seconds. The possibilities seem endless, until the code breaks.

Risks: The Other Side of Freedom

For all its potential, DeFi remains risky. The same openness that empowers users also exposes vulnerabilities.

Smart contracts, while transparent, can be exploited. In 2025 alone, cybersecurity firms recorded more than $1.2 billion in stolen assets from faulty contracts, flash loan attacks, and governance exploits.

Liquidity is another double-edged sword. When market conditions shift, cascading liquidations can spread through DeFi ecosystems at lightning speed, erasing billions in minutes.

But not all risk comes from code. Human behavior, greed, speculation, and herd mentality, still drive much of DeFi’s volatility. In bull cycles, investors chase unsustainable yields; in downturns, they retreat en masse, leaving protocols illiquid and unstable.

The Regulatory Balancing Act

Regulation is the great unknown in DeFi’s next chapter. Governments around the world are grappling with how to monitor systems that operate globally and autonomously.

Europe’s MiCA framework has started bringing some structure to the space, especially around stablecoins and DeFi service providers. Singapore, Japan, and the UAE have introduced sandbox programs that allow Decentralized Finance projects to operate within controlled compliance zones.

In the United States, however, policy remains fragmented. Lawmakers continue to debate whether decentralized platforms are financial institutions or just pieces of open-source software. The outcome could reshape how DeFi operates, or whether it can remain truly decentralized.

Interestingly, traditional banks are not staying on the sidelines. Major institutions are testing DeFi-inspired infrastructure for interbank settlements and tokenized collateral.

The Institutional Shift: From Hype to Utility

Unlike the speculative frenzy of 2021, institutions in 2025 are approaching Decentralized Finance with strategy, not slogans.

Instead of chasing token rewards, firms are using DeFi infrastructure to streamline operations. Tokenized treasury bills, permissioned liquidity pools, and insured lending markets have become legitimate tools for balance sheet management.

These developments are also reshaping perceptions. DeFi is no longer viewed purely as a Wild West of finance but as a prototype for what future banking might look like, open, programmable, and interoperable.

A recent market report noted that nearly 30 percent of new blockchain-based funds now include exposure to DeFi yield strategies, a sign of institutional confidence growing within a regulated framework.

The Human Factor: Trust Without Intermediaries

Perhaps the most profound shift brought by Decentralized Finance is psychological. It replaces institutional trust with algorithmic assurance.

Users don’t have to rely on centralized entities; they can verify everything, from reserves to liquidity, directly on-chain. Transparency is built in, not promised.

But this autonomy comes at a cost: full responsibility. There are no customer support lines or bailout funds. Mistakes, once made, are often irreversible.

DeFi’s culture reflects this mindset, independence coupled with accountability. Investors who thrived in this environment learned not just to profit, but to understand risk deeply.

Emerging Trends: Real-World Assets and On-Chain Credit

The integration of Decentralized Finance with traditional markets is the next great leap. Real-world assets (RWAs), such as government bonds, real estate, and private credit, are being tokenized and traded on-chain.

This convergence is already driving capital inflows from traditional institutions that previously ignored crypto. Tokenized yield products pegged to short-term treasuries now represent a multi-billion-dollar segment of DeFi.

Interoperability protocols are another key trend, allowing assets to move seamlessly between blockchains without custodial risk. That level of composability is pushing DeFi closer to becoming the backbone of global finance.

With this integration, DeFi is no longer an alternative system, it is fast becoming the infrastructure of finance itself.

Conclusion: Responsibility in the Age of Autonomy

Decentralized Finance in 2025 sits at a crossroads. It has been proven that a financial world without middlemen is possible, efficient, inclusive, and transparent. But it has also shown that with freedom comes risk, and with risk comes the need for greater discipline.

For investors, DeFi represents both promise and pressure. The potential for returns is extraordinary, but the margin for error remains thin.

The next evolution will depend not only on technology but on education, teaching users, institutions, and regulators how to coexist in a system where trust is written in code.

The question is no longer whether Decentralized Finance will last. It’s how responsibly it will grow.

Frequently Asked Questions

1. Why is Decentralized Finance important in 2025?

It bridges traditional finance with blockchain technology, giving users direct access to global markets and yield opportunities without intermediaries.

2. Is Decentralized Finance safe to use?

While transparency has improved, smart contract risks and market volatility still exist. Users should conduct thorough research and use audited platforms.

3. How are institutions using DeFi now?

Corporates and funds use DeFi for yield management, tokenized bonds, and liquidity solutions, often within regulated frameworks.

4. What future trends define Decentralized Finance?

Tokenized real-world assets, interoperable blockchains, and hybrid regulatory models are leading DeFi into its next growth phase.

Glossary of Key Terms

Smart Contract Exploit:

A vulnerability in blockchain code that attackers use to manipulate or drain funds from a protocol.

Tokenized Yield Products:

On-chain investment vehicles that offer returns derived from traditional assets like bonds or treasury bills.

Liquidity Pools:

Shared pools of funds in DeFi protocols that facilitate decentralized trading and lending without intermediaries.

Interoperability Layer:

A system that connects different blockchains, allowing users to transfer assets and data seamlessly across networks.

Composability:

The ability of DeFi protocols to integrate and interact with each other, enabling new financial products and strategies.