Why This Strategy Has Traders Talking

- Dollar Cost Averaging in Crypto: A Beginner’s Strategy Explained

- Why Volatility makes DCA so effective

- Real-World Indicators Supporting the Strategy

- Why Analysts Call It a Safer Approach

- Comparing DCA with Other Crypto Strategies

- Case Studies: Where DCA Works in Practice

- Risks that still exist

- Why This Strategy is Here to Stay

- Conclusion: Stable Steps in a Volatile Environment

- Glossary of Terms

- FAQs for Dollar-Cost Averaging in crypto

The bitcoin market is notoriously volatile. Prices fluctuate rapidly, making it difficult to determine when to purchase. This uncertainty has forced traders and investors to a simple but effective strategy: Dollar-Cost Averaging in Crypto. It may not seem spectacular, but it has been praised as one of the most secure methods to handle digital assets in uncertain times.

Chainalysis and Messari’s research reveals that continuous purchasing has helped decrease vulnerability to catastrophic market losses. This method is appealing to everyone, from rookie retail traders to seasoned analysts.

Dollar Cost Averaging in Crypto: A Beginner’s Strategy Explained

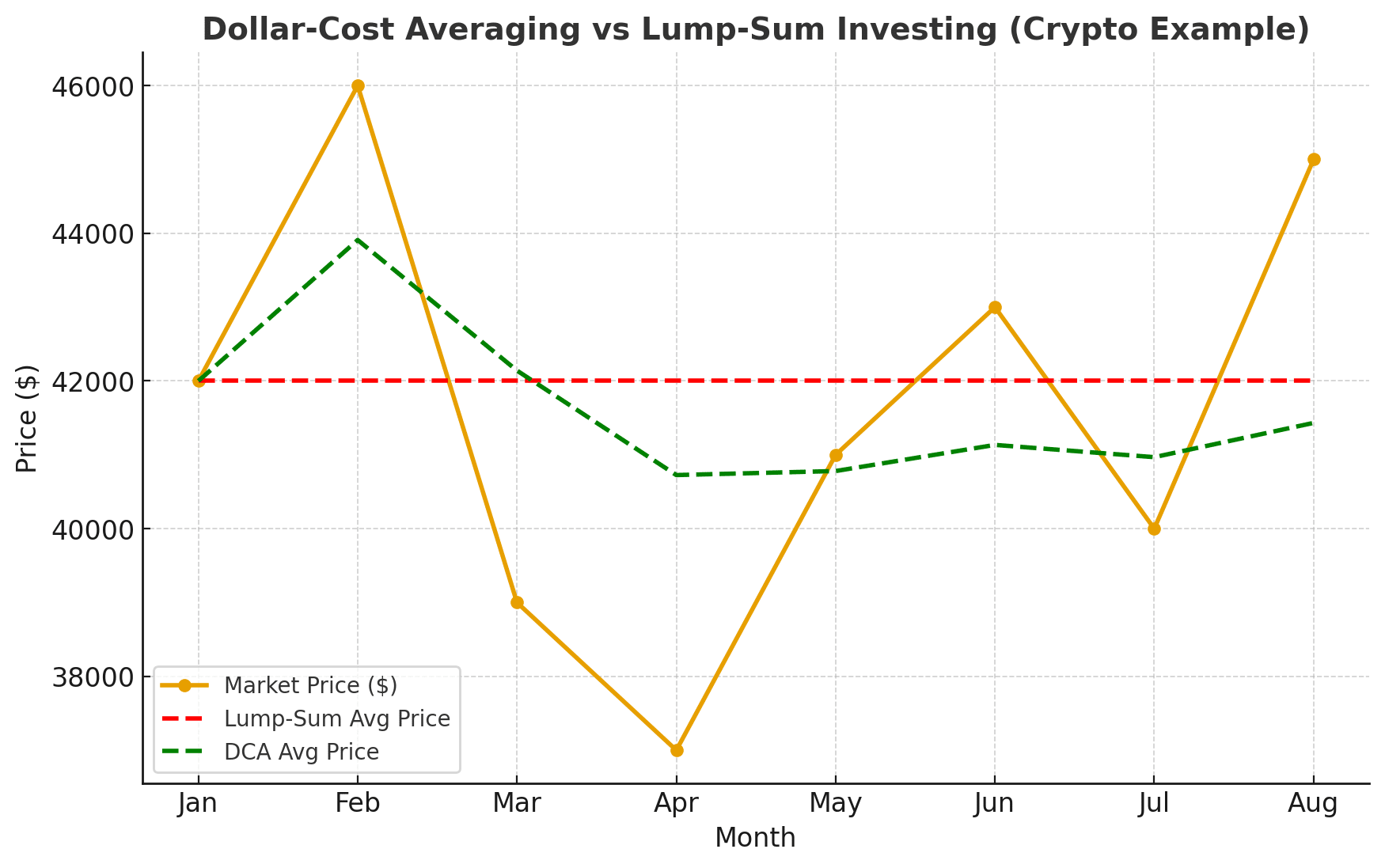

At its foundation, Dollar-Cost Averaging in Crypto is investing a certain amount of money at regular periods, regardless of price. Rather of guessing the ideal entry moment, investors spread out their purchases across time. This decreases the danger of purchasing at a high and helps to mitigate the effects of volatility.

Assume someone invests $100 in Bitcoin per week. They purchase when the price is high and sometimes when it is cheap. Their average buying price gradually levels off. This technique makes cryptocurrency markets less daunting, particularly for novices.

Why Volatility makes DCA so effective

Volatility is both a cryptocurrency’s strength and weakness. Massive price fluctuations may generate opportunities, but they can also destroy portfolios overnight. This is where Dollar-Cost Averaging in Crypto shines. It takes advantage of volatility by guaranteeing that dips really benefit investors.

For example, purchasing more units during a slump reduces the average cost of ownership. In the long run, this strengthens resistance against abrupt market collapses. Traders who use methodical tactics such as DCA often beat those seeking rapid returns.

Real-World Indicators Supporting the Strategy

Dollar-Cost Averaging in crypto is backed by strong market signs. Trading volume data indicate that continuous purchasing helps to stabilize demand. According to Glassnode research, wallets that practice steady accumulation often retain for longer periods of time, making them less likely to panic sell.

Another important sign is Bitcoin’s dominance. When dominance fades, altcoins gain popularity, and volatility grows. During these stages, Dollar-Cost Averaging in Crypto becomes even more important, allowing investors to avoid emotional judgments.

Why Analysts Call It a Safer Approach

Analysts suggest that risk-management principles are aligned with DCA tactics. Rather of investing everything on one entrance, traders spread the risk over numerous transactions. This does not completely remove risk, but it does make losses less severe.

“This post is intended for informative purposes only and does not provide financial advice. Readers should do their own research before making any investing choices.

Comparing DCA with Other Crypto Strategies

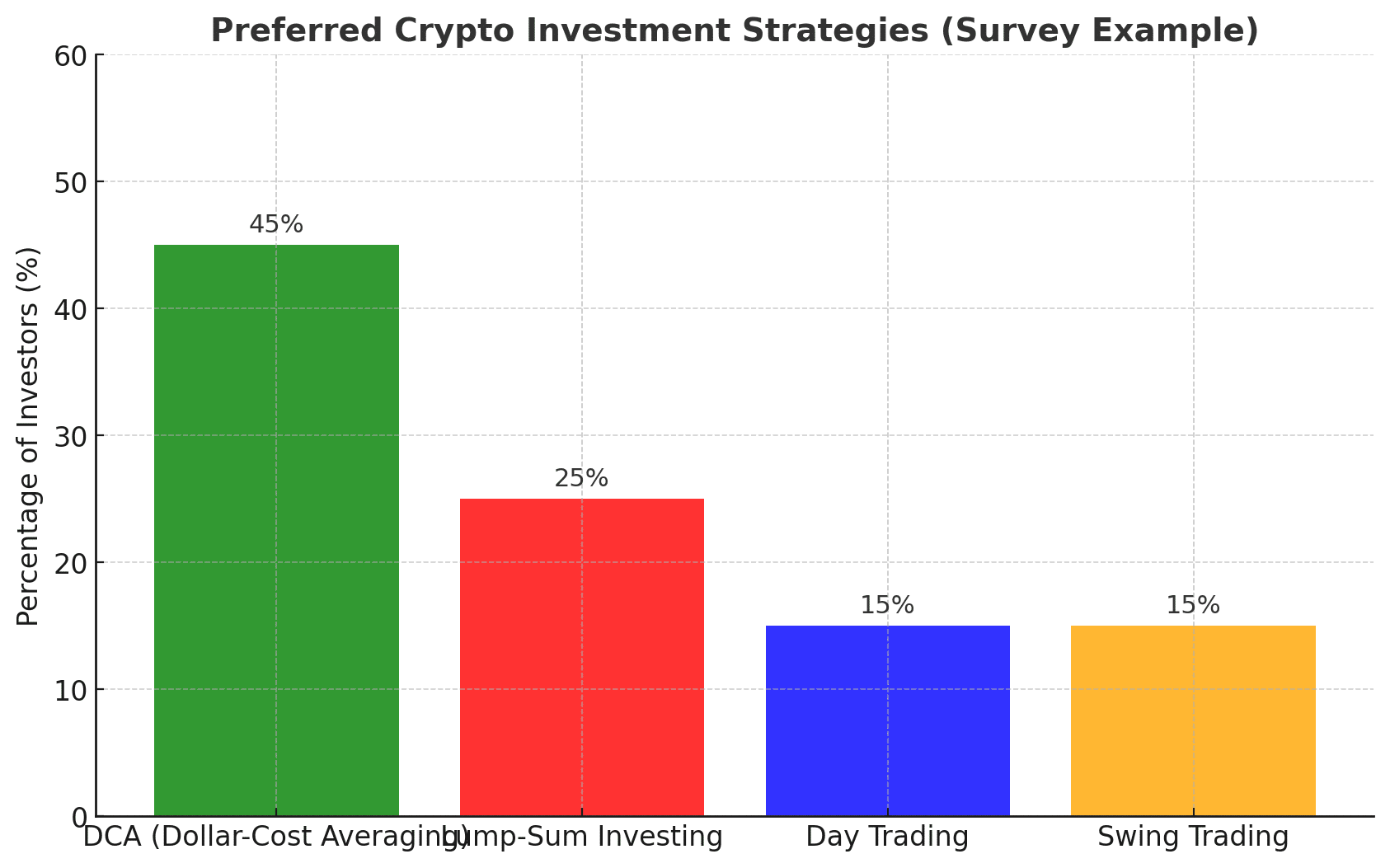

Dollar-Cost Averaging in Crypto is passive, as opposed to day trading, which involves continual monitoring, and swing trading, which relies on short-term movements. It does not need hours of chart analysis. It also avoids the traps of attempting to time the market, which even pros seldom win.

In contrast, if done correctly, lump-sum investment may provide significant returns. However, according to Vanguard and Fidelity research, the majority of individual investors do not time the market, often purchasing high and selling low. Dollar-Cost Averaging in Crypto lowers this risk by emphasizing discipline over timeliness.

Case Studies: Where DCA Works in Practice

During the 2018 Bitcoin bear market, many lump-sum investors lost a lot of money. However, individuals who used Dollar-Cost Averaging in Crypto consistently reduced their average purchase price. By the time markets recovered in 2020 and 2021, their portfolios had seen better returns.

Similarly, Ethereum investors who made consistent purchases during market downturns accumulated at prices far lower than the 2021 high. This strategy converted short-term misery into long-term positioning.

Risks that still exist

No plan is flawless. Dollar-Cost Averaging in Crypto works best in markets that rise over time. If a token completely crashes, DCA will not protect investors’ losses. Regulatory issues, smart contract exploits, and unstable projects continue to pose challenges.

That is why experts emphasize the significance of using DCA only on assets with a proven track record, robust development communities, and open tokenomics. Choosing solid assets is just as vital as the plan itself.

Why This Strategy is Here to Stay

As cryptocurrency acceptance develops, tactics such as Dollar-Cost Averaging in Crypto are anticipated to gain popularity. DCA’s popularity indicates a maturing industry, with large funds adopting algorithmic versions and ordinary traders automating purchases via exchanges.

Most importantly, it teaches discipline. Rather of chasing excitement, investors learn to prioritize steadiness. And in markets as volatile as cryptocurrency, consistency often outperforms short-term luck.

Conclusion: Stable Steps in a Volatile Environment

Dollar-Cost Averaging in crypto does not imply becoming wealthy immediately. It is about surviving the turbulence of digital marketplaces while gradually creating riches. For financial students, blockchain engineers, and traders, the message is clear: patience, discipline, and consistent purchasing can withstand even the most extreme swings.

Cryptocurrency may remain volatile, but tactics like DCA demonstrate that stability is possible, even in the world’s most uncertain market.

Glossary of Terms

Dollar-Cost Averaging (DCA): Investing fixed amounts at regular intervals.

Volatility: The degree of price fluctuation in a market.

Bitcoin Dominance: The share of Bitcoin in the overall crypto market cap.

Accumulation Wallets: Wallets that steadily increase holdings over time.

Lump-Sum Investing: Putting all funds into the market at once.

Tokenomics: The economic design and distribution of a cryptocurrency.

FAQs for Dollar-Cost Averaging in crypto

1. What is Dollar-Cost Averaging in Crypto?

It’s a strategy where investors buy fixed amounts of crypto regularly, regardless of price.

2. Why is DCA effective in crypto?

Because it smooths out volatility and avoids the risk of buying at market peaks.

3. Does DCA guarantee profits?

No, it reduces risk but cannot protect against project failures or long-term declines.

4. Is DCA better than lump-sum investing?

For most retail traders, yes. It avoids mistiming the market and builds discipline.

5. Can institutions use DCA?

Yes, many funds automate versions of DCA through algorithmic trading.