According to latest reports; Tether has denied allegations that it sold Bitcoin to fund a gold push. CEO Paolo Ardoino came out to say that the company is committed to “safe assets like Bitcoin, gold and land”. This unfounded Tether rumor was met with sharp refutation that the company balances its reserves between volatility and stability during global uncertainty.

Busting the Tether Rumor: No Bitcoin Was Sold

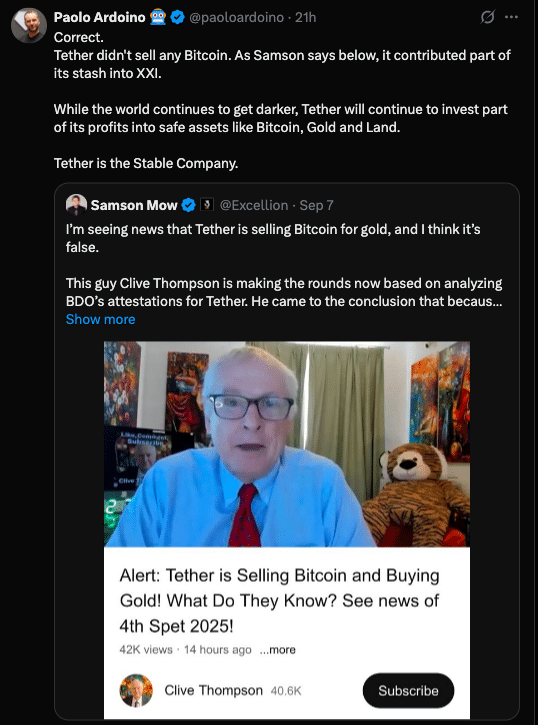

Earlier this month, a YouTuber had claimed that Tether sold over $1 billion in $BTC and increased its gold holdings by $1.6 billion.

On getting a whiff of this; Paolo Ardoino responded on X saying “Tether didn’t sell any Bitcoin” and reiterated the company’s long term investment in “safe assets like Bitcoin, Gold and Land”. His declaration provided the needed clarity and put the rumor to rest.

Samson Mow, CEO of Jan3, further debunked the YouTuber’s claims by saying the apparent $BTC dip was due to certain transfers which included 19,800 BTC moved to Twenty One Capital (XXI), not sold. Once this transfer is accounted for, Tether’s BTC holdings actually grew by over 10,000 BTC in Q2 2025.

Also read: How Tether Is Building an Entire Crypto Economy in East Africa

Deepening Gold Strategy, Not Divesting Bitcoin

Rather than abandoning Bitcoin, Tether seems to be deepening its gold exposure. In June, the firm reportedly took a 37.8% stake in gold royalty firm Elemental Altus for $90 million. Last week, it injected $100 million into the company as it merged with EMX, expanding its presence in mining royalties and refining earnings.

This just shows their stance on how gold isn’t a replacement for Bitcoin but rather an additional layer of safe-asset diversification. Tether already backs its gold-backed stablecoin XAUt with 7.66 tons of physical gold and gold constitutes over 5% of its USDT reserves.

Behind the Strategy

Tether’s safe-asset approach is a response to market complexity. With USDT reserves over $168 billion and USDT transfer volumes $1.32 trillion in August, Tether is still the backbone of crypto liquidity.

Gold is rallying (approaching $3,550 per ounce) so demand for traditional safe havens is increasing. By investing in mining royalties and issuing XAUt; Tether seems to be aligning itself with core inflation hedges while being transparent and credible.

Also read: BREAKING: Tether Building U.S. Stablecoin for Banks After GENIUS Act Signed

Conclusion

Based on the latest research, Tether’s approach of combining Bitcoin with gold and land shows a forward thinking framework of resilience, transparency and diversification.

CEO Ardoino’s response to the speculation reframed the narrative that it isn’t a move away from crypto but a reinforcement of the balanced approach.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

Tether CEO Paolo Ardoino has put to rest rumors of selling Bitcoin, saying the company will invest in “safe assets like Bitcoin, Gold and Land”. Despite the apparent $BTC reduction, Tether actually added over 10,000 BTC, transferred to its Twenty One Capital subsidiary, not for liquidation. Tether also doubled its stake in gold royalty company Elemental Altus.

Glossary

Tether safe assets – Tether’s asset diversification strategy using Bitcoin, gold and land for reserve stability.

Twenty One Capital (XXI) – Tether’s Bitcoin investment initiative receiving $BTC transfers, not for market sale.

XAUt – A gold-backed stablecoin by Tether, collateralized by physical bullion.

Gold royalty firm – A company earning a percentage of mining revenues without handling operational mining risks.

Asset diversification – A way of spreading investments across asset types to reduce risk and increase stability.

FAQs for Tether Rumor Busted

Did Tether sell Bitcoin to buy gold?

No. The decrease in $BTC was due to transfers to Twenty One Capital, not a sale.

Why Did Tether invest in Elemental Altus?

It gives Tether exposure to mining related revenue without operational risks and supports its reserve diversification.

What percentage of USDT reserves is backed by gold?

Over 5%. XAUt is backed by 7.66 tons of gold stored in Switzerland.

How big is USDT today?

It’s the largest stablecoin with over $168 billion in reserves and over $1.3 trillion in monthly transfer volumes.

Why invest in gold now?

Gold is going up due to inflation and economic uncertainty, Tether’s move is strengthening stability and investor confidence.