Tether, the company behind the world’s largest stablecoin USDT, has revealed plans to launch a separate U.S.-compliant dollar-pegged stablecoin, even as the GENIUS Act inches closer to becoming law in the United States.

- Tether’s Strategic Response to the GENIUS Act

- Regulatory Clarity vs Global Dominance

- Focus Remains on Emerging Economies

- Tether’s Regulatory Tightrope

- Industry Reactions and Outlook

- Conclusion

- Frequently Asked Questions (FAQs)

- What is Tether planning in response to the GENIUS Act?

- What is the GENIUS Act?

- Will Tether stop supporting USDT?

- Why does Tether criticize MiCA regulations?

- Where is Tether currently based?

- Glossary of Key Terms

In an interview published by CryptoSlate on May 26, Tether CEO Paolo Ardoino confirmed that while the firm supports the proposed legislation, its core business strategy remains focused on international markets, especially the underserved unbanked population across Asia, Africa, and Latin America.

“The GENIUS Act is a great idea — 100% cash-equivalent reserves are the right approach,” Ardoino said. “But we must wait for full regulatory clarity before issuing a U.S.-specific coin.”

Tether’s Strategic Response to the GENIUS Act

The GENIUS Act (Guaranteed Emergency National Infrastructure for U.S. Stablecoins) seeks to regulate stablecoin issuers within the U.S. by enforcing strict 1:1 reserve requirements in cash or U.S. Treasury equivalents and mandatory AML (anti-money laundering) compliance.

Tether’s approach is measured but proactive: it will continue operating USDT globally while exploring the issuance of a distinct dollar-pegged coin specifically for the U.S. market if and when the legislation passes.

Key Highlights of the GENIUS Act:

| Requirement | Details |

|---|---|

| Reserves | 100% in cash or cash equivalents |

| AML Compliance | Mandatory KYC/AML policies |

| U.S. vs Foreign Issuers Distinction | Differentiated regulatory treatment |

| Regulatory Oversight | U.S. Treasury and other financial agencies |

Regulatory Clarity vs Global Dominance

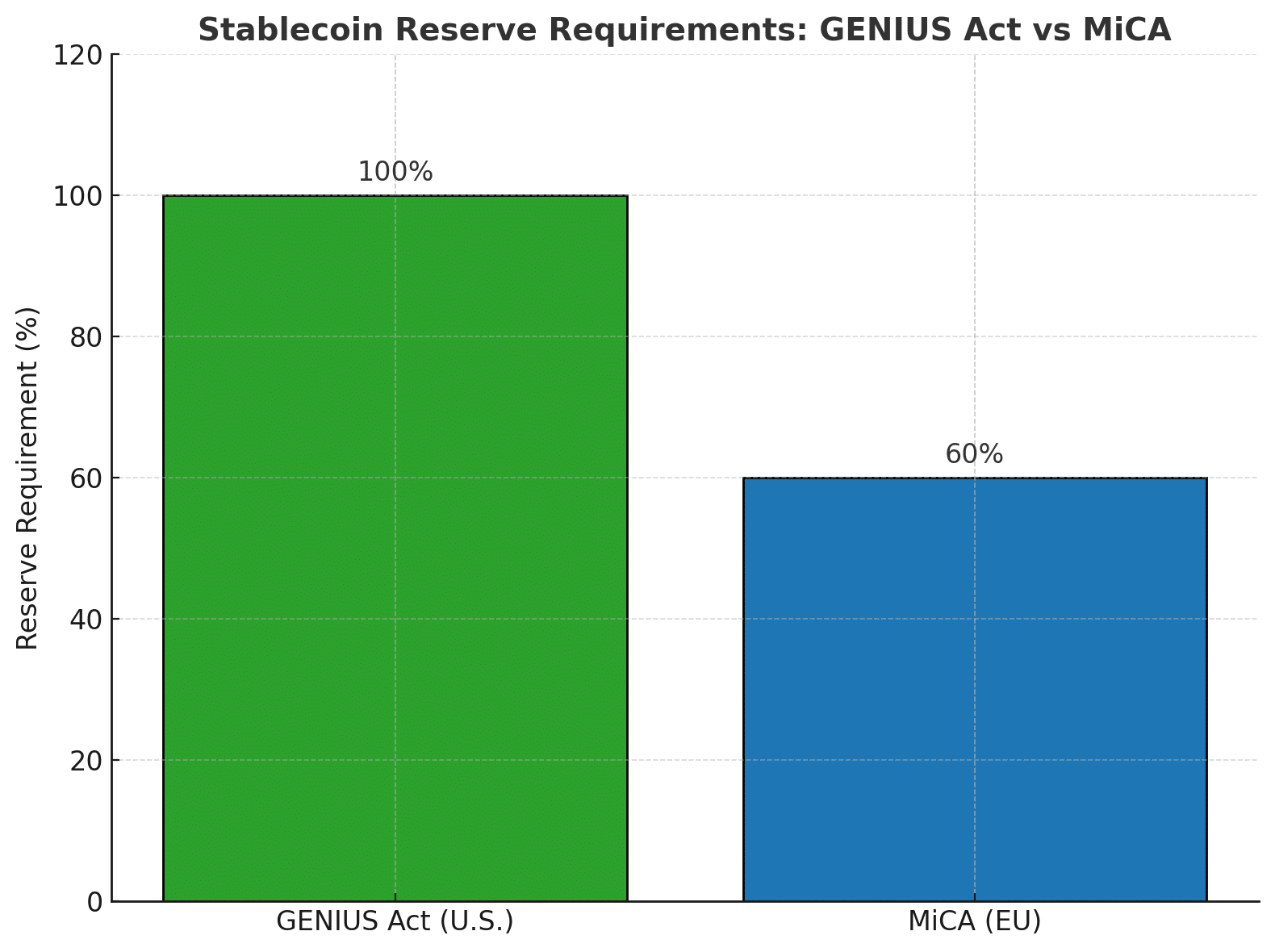

While the U.S. regulatory environment is moving toward clarity, Tether remains cautious about expanding aggressively in the American market until the framework is finalized. Ardoino noted that Europe’s MiCA regulation contrasts sharply with the GENIUS Act.

“MiCA wants 60% of reserves in EU banks — that’s a bad idea,” Ardoino argued. “The U.S. approach is more sound.”

This signals that Tether may lean more favorably toward U.S. regulatory alignment, despite its base of operations being in El Salvador and its primary business centered in non-Western jurisdictions.

Focus Remains on Emerging Economies

Despite exploring a compliant stablecoin for the U.S., Tether has no plans to shift its core business focus. The company says its real mission remains serving the unbanked, especially in regions with limited financial infrastructure.

According to Ardoino:

“Most of our users are from countries where banking access is limited or non-existent. That’s who we build for.”

This approach aligns with Tether’s rapid adoption in countries like Turkey, Venezuela, and Nigeria, where USDT acts as a hedge against hyperinflation and unstable fiat currencies.

Tether’s Regulatory Tightrope

Tether’s recent moves suggest a more collaborative posture toward regulators — a contrast from earlier years when the company often operated in regulatory gray zones. The decision to create a second stablecoin tailored to U.S. compliance may help:

Preempt legal scrutiny under the GENIUS Act

Maintain USDT’s offshore utility

Ensure Tether isn’t excluded from the largest capital market in the world

This dual-track model, one coin for U.S. regulation, one for global liquidity, could become the industry norm as stablecoin frameworks mature worldwide.

Industry Reactions and Outlook

Tether’s initiative has sparked varied reactions. Some industry figures applaud the move as “pragmatic,” while others view it as a defensive measure to maintain dominance amid rising competition from Circle’s USDC, PayPal’s PYUSD, and future CBDCs.

“Tether is playing both sides of the regulatory fence,” said regulatory strategist Erica Simmons. “It’s smart, and necessary.”

With $110 billion in circulating supply, Tether remains the top stablecoin by far. But with growing U.S. scrutiny, competition, and evolving regulations, its future depends on agility, transparency, and compliance.

Conclusion

Tether’s plan to issue a U.S.-compliant stablecoin signals its willingness to evolve with regulation. without compromising its global mission. By aligning with the GENIUS Act, it positions itself for legitimacy in U.S. markets and sets a new precedent for how stablecoin giants may operate under multiple legal regimes.

As stablecoins become the backbone of global digital finance, Tether’s hybrid strategy may define the next chapter of decentralized dollar dominance.

Frequently Asked Questions (FAQs)

What is Tether planning in response to the GENIUS Act?

Tether plans to launch a separate U.S.-compliant stablecoin while continuing global operations with its primary token, USDT.

What is the GENIUS Act?

The GENIUS Act is proposed U.S. legislation that requires stablecoins to be fully backed 1:1 by cash or cash equivalents and follow AML rules.

Will Tether stop supporting USDT?

No. Tether will continue supporting USDT globally, especially in emerging markets, while preparing a new coin for U.S.-specific compliance.

Why does Tether criticize MiCA regulations?

Tether CEO Paolo Ardoino called MiCA’s requirement to hold 60% reserves in EU banks a “bad idea” compared to the U.S. approach of 100% liquidity.

Where is Tether currently based?

Tether is headquartered in El Salvador, with most of its user base in countries with limited access to traditional banking.

Glossary of Key Terms

Stablecoin: A cryptocurrency pegged to a stable asset, such as the U.S. dollar.

USDT: Tether’s main dollar-pegged stablecoin, the largest by market cap.

GENIUS Act: A proposed U.S. bill to regulate stablecoins, enforcing strict reserve and AML requirements.

MiCA (Markets in Crypto-Assets): The European Union’s framework for crypto asset regulation.

AML (Anti-Money Laundering): Legal requirements to prevent financial crimes.

Cash Equivalents: Highly liquid, low-risk assets such as U.S. Treasuries.