Stablecoin Payments Enter the Mainstream

Bolivia has become the latest country to witness a powerful shift toward stablecoins as Toyota, Yamaha, and BYD dealerships began accepting Tether (USDT) for vehicle purchases. This development comes against the backdrop of a deepening dollar shortage and growing distrust in the boliviano, forcing businesses and consumers to turn to digital alternatives.

The news has given new momentum to the Tether adoption in Bolivia narrative, with many observers pointing out that this could be the clearest sign yet of stablecoins moving from speculative trading into everyday commerce.

Paolo Ardoino, CEO of Tether, wrote on X, “Stablecoins are proving essential in regions where the local currency cannot support people’s needs. USDT is filling the gap as a digital dollar.” His comment underscores the role of stablecoins in protecting purchasing power amid macroeconomic instability.

The Dollar Crisis and a Turning Point

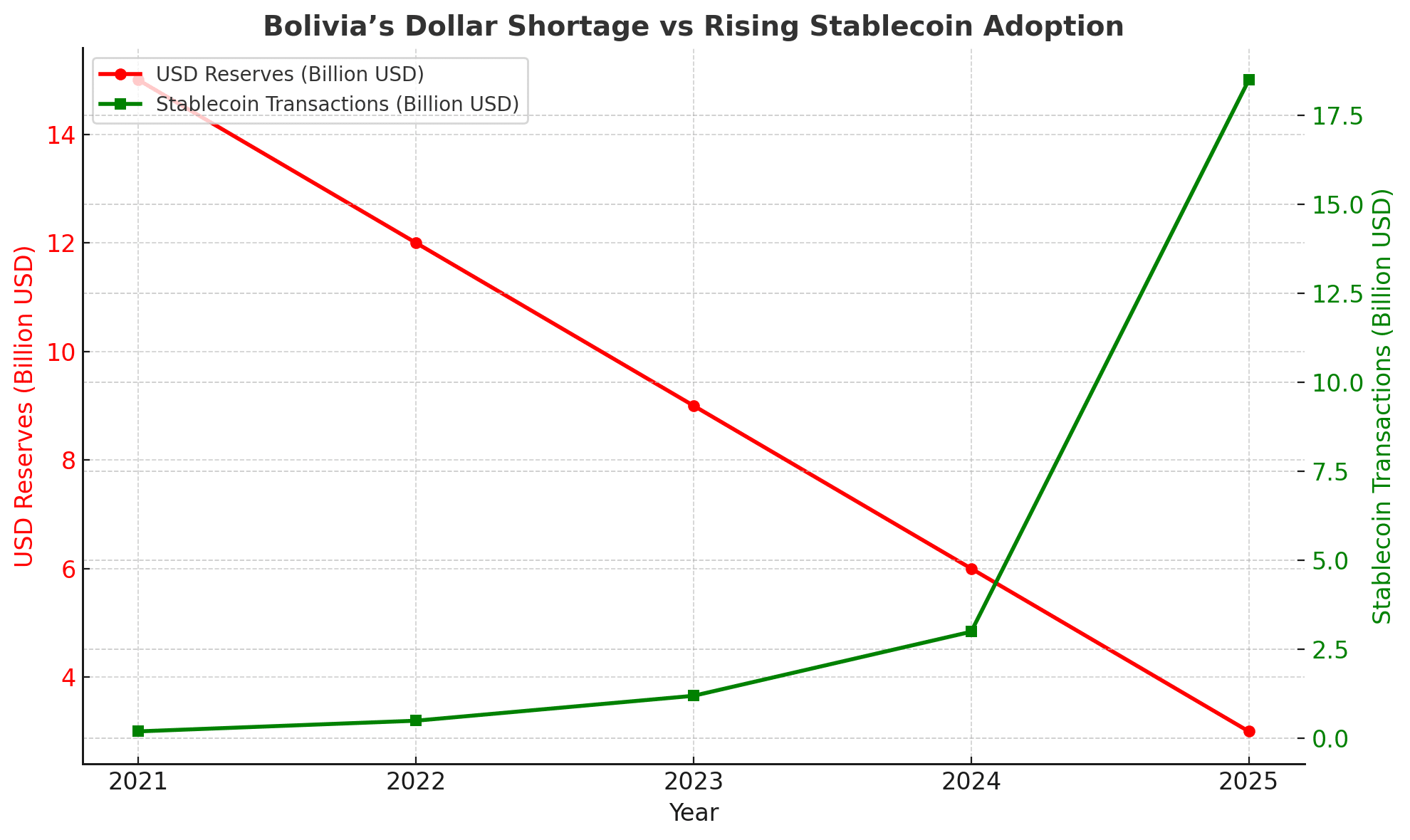

Bolivia’s reliance on U.S. dollars has collided with shrinking foreign reserves and an inflationary wave that has pushed the economy into crisis. With banks unable to provide dollars at scale and the boliviano rapidly losing credibility, dealerships are offering customers the chance to bypass local currency headaches.

By promoting USDT as a payment option, companies are effectively betting that stablecoins can restore liquidity and trust. Early buyers have already used Tether to finalize car purchases, with dealerships publicly advertising “easy and safe” stablecoin transactions.

Analyst Javier Morales commented, “What we are seeing is not just about cars. It’s about businesses adopting what the financial system cannot currently provide. That makes Tether adoption in Bolivia one of the most important experiments in real-world crypto utility.”

Rising Crypto Payments and Retail Expansion

This milestone didn’t happen in isolation. Since Bolivia lifted its blanket ban on cryptocurrencies in 2024, transaction volumes have skyrocketed. Reports suggest a more than 600 percent year-on-year increase in crypto payments, with stablecoins dominating usage. Hotels, importers, and airport retailers have already begun integrating USDT into their payment systems.

The use of Tether for major purchases like vehicles signals a tipping point. For consumers, it reduces exposure to exchange rate swings and ensures faster settlement. For businesses, it guarantees access to a dollar-equivalent currency in an economy where real dollars are scarce.

This widening base of utility is a critical driver of Tether adoption in Bolivia, pushing stablecoins beyond niche use cases into mainstream economic life.

Risks, Regulation, and Political Shifts

While optimism runs high, risks remain. Stablecoins still depend on their peg to the U.S. dollar, and questions about oversight, taxation, and anti-money laundering compliance are becoming more urgent. Bolivia’s upcoming presidential run-off in October may further shape the regulatory landscape, with candidates divided on how openly to embrace crypto.

Economist Carla Ruiz cautioned, “Adoption is accelerating faster than regulations can keep up. That can create grey areas for businesses and consumers alike. Still, the momentum behind Tether adoption in Bolivia shows no sign of slowing down.”

The challenge ahead will be balancing innovation with oversight. If regulatory clarity is achieved, Bolivia could position itself as a leader in practical crypto adoption across Latin America.

Conclusion

The decision by Toyota, Yamaha, and BYD to accept Tether payments represents more than a marketing experiment, it is a direct response to Bolivia’s economic struggles and a sign of the growing importance of stablecoins in global commerce.

With adoption spreading across industries and everyday life, Tether adoption in Bolivia may mark the start of a wider movement in emerging economies seeking stability outside traditional finance.

FAQs about Tether adoption in Bolivia

Why are Bolivian dealerships accepting Tether?

Severe dollar shortages and inflation have pushed businesses to stablecoins as reliable alternatives for major transactions.

Is this the first time Tether has been used for cars?

Yes, dealerships in Bolivia are among the first globally to openly promote USDT for vehicle purchases.

What risks come with Tether adoption in Bolivia?

Regulatory gaps, taxation issues, and reliance on the U.S. dollar peg remain key challenges.

Could other Latin American countries follow?

Yes, as economic instability spreads, stablecoin adoption could expand across the region, especially in high-inflation markets.

Glossary

Stablecoin: A cryptocurrency pegged to a stable asset like the U.S. dollar.

Liquidity Crisis: A shortage of cash or reserves that limits access to foreign currencies.

Peg: The fixed value a stablecoin maintains relative to a fiat currency, usually USD.

Inflation: The rate at which the value of a currency falls, reducing purchasing power.

Regulatory Oversight: Rules and monitoring put in place by governments to supervise financial activities.

Adoption: The process by which new technology gains acceptance and regular use in society.