President Donald Trump said the United States will reduce the effective levy on Chinese imports to 47 percent from 57 percent. He called his meeting with President Xi Jinping “amazing” and “12 out of 10,” and said fentanyl related duties will fall to 10 percent while China resumes large soybean purchases.

He added that Beijing will pause new rare earth restrictions for a year. The direction is clear. The two sides stepped back from the brink. Chip policy remains unresolved, according to briefings and wire reports.

Why crypto cares right now

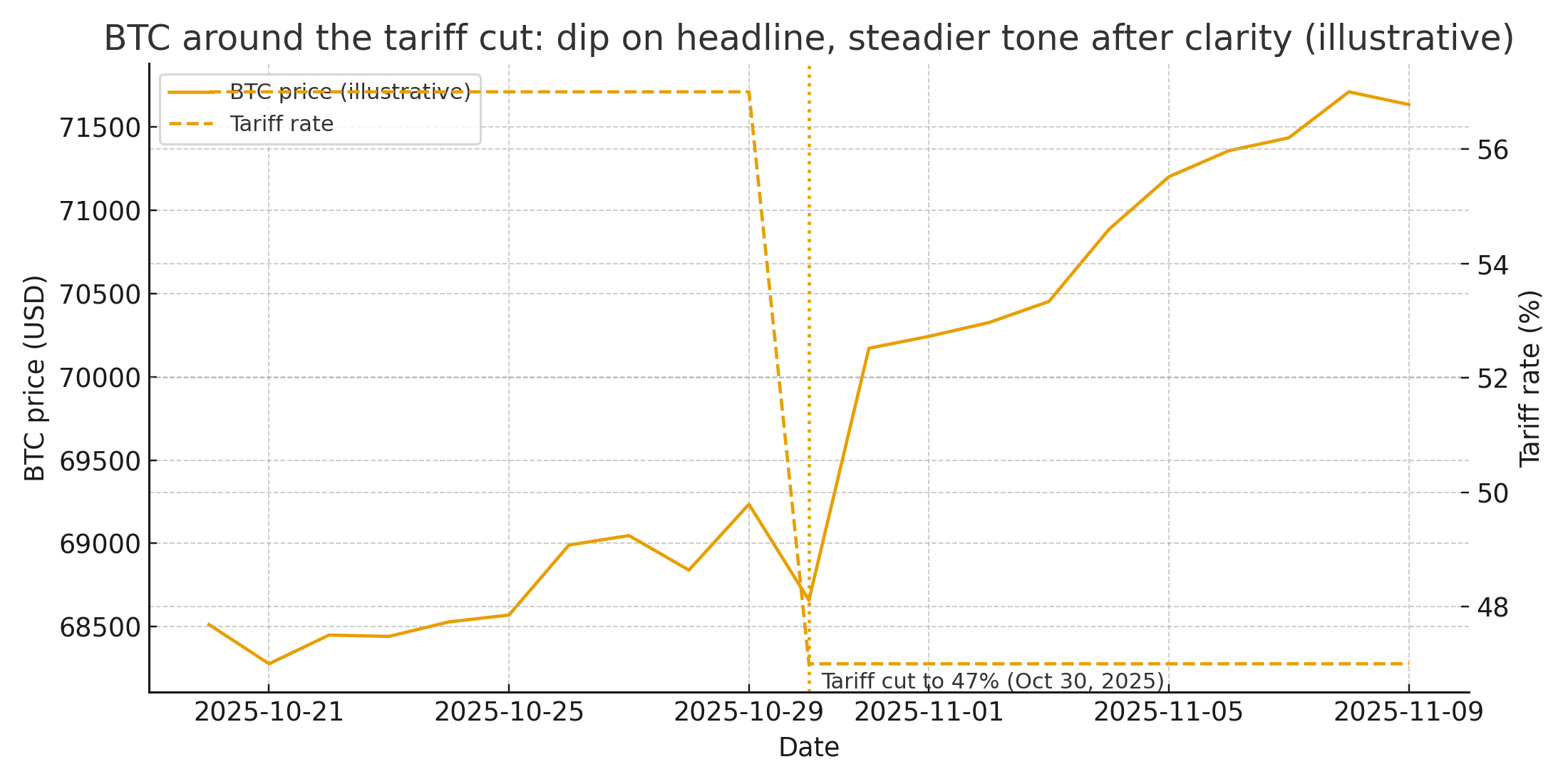

For crypto, macro matters because it moves liquidity and shapes risk appetite. A smaller tariff burden can soften the dollar at the margin, calm equity volatility, and reduce the impulse to de risk. That backdrop often helps Bitcoin stabilize after headline shocks.

Earlier in October, tariff salvos and tough talk pushed Bitcoin lower, before price recovered as details clarified and positioning lightened. Today fits that pattern, with sentiment improving as traders mark down tail risks. Market reaction was cautious but constructive at close.

Officials also pointed to targeted relief. Trump said China would “work very hard” to fight fentanyl flows and that shipments of rare earth inputs would continue while talks proceed. He described the exchange with Xi as producing “tremendous” soybean orders for American farmers. Markets do not need perfect harmony to rally. They do need fewer shocks.

Risks that can cap the bounce

The near-term checklist is simple. Watch perpetual funding rates. If they drift toward neutral without flipping wildly positive, leverage is normalizing rather than overheating. Track open interest and the spot-to-futures basis. Rising open interest alongside a steady or modestly positive basis usually signals healthier directional interest instead of forced short covering. On-chain, short-term holder cost basis offers a clean line in the sand. Holding above it implies that recent buyers are not underwater.

Policy risk has not disappeared. Export controls on advanced chips remain unresolved. If talks stall there, the relief trade can fade. The rare earth reprieve is temporary, which means supply anxiety could resurface next year. Still, the tone has shifted. Trump said he plans to visit China, and both sides outlined working groups that can fill in tariff lines, enforcement triggers, and quotas.

Conclusion

The meeting changed the temperature of the trade story and, by extension, the mood in digital assets. Lower tariffs and clearer diplomatic lanes invite capital back into risk. The signal to trust is not a podium quote. It is the flow, from stablecoin issuance to futures positioning and the cash to futures basis that shows whether buyers are real.

FAQ

Did the United States cut the overall tariff rate to 47 percent today?

Yes. Officials announced an immediate reduction from 57 percent to 47 percent following the Trump and Xi meeting in South Korea.

What other steps were mentioned alongside the cut?

Fentanyl related tariffs were halved to 10 percent, China agreed to resume soybean purchases, and new rare earth limits were paused for a year, pending talks.

Glossary of Key Terms

Perpetual funding rate

A periodic fee that longs pay shorts or shorts pay longs in perpetual futures. It keeps the contract near spot and reflects positioning pressure.

Spot to futures basis

The difference between the cash price and the futures price for a given maturity. A widening or tightening basis maps risk appetite and carry demand.

Short term holder cost basis

An on chain metric that estimates the average price paid by recent buyers. Trading above it often signals supportive market structure.