According to SUI Group Holdings, the launch of the suiUSDe stablecoin is an important step for the Sui blockchain and its ecosystem. The token has been developed through a partnership between SUIG, Ethena Labs, and the Sui Foundation.

With this move, Sui is the first non EVM network to bring a native dollar asset that can also generate yield. This creates new chances for liquidity and growth in decentralized finance.

How does the suiUSDe stablecoin operate?

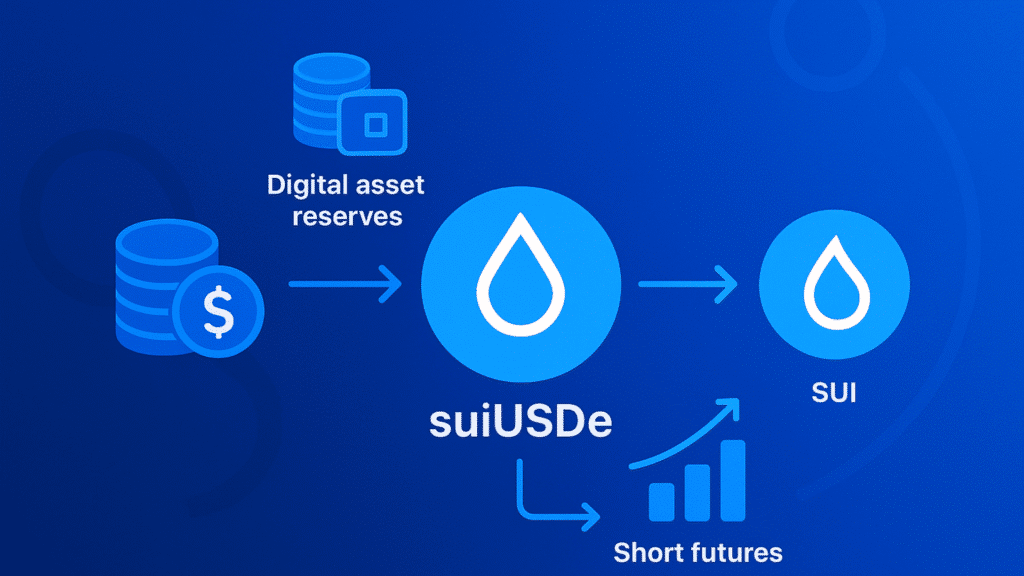

The suiUSDe stablecoin uses Ethena’s model that joins digital asset reserves with short futures positions. This setup helps the token to keep its value stable while also creating revenue. A special feature of this system is that the earnings from it will be sent back into the Sui network.

These funds will be used to buy SUI tokens directly from the market. By connecting revenue with SUI buybacks, the system builds a cycle where the growth of the suiUSDe stablecoin raises demand for the native token.

This approach helps both the stablecoin and the blockchain grow together. Experts say the setup makes the value of the stablecoin closely linked to the strength of the Sui network. Many in the market see this as a way to support long term stability.

Also read: SUI Price Prediction 2025-2026: Is a 1,500% Rally to $32 Possible?

What role does SUIG play in the launch?

SUIG, also called SUI Group Holdings, is the first publicly traded digital asset treasury company to create and launch this kind of stablecoin setup. It has joined hands with Ethena and the Sui Foundation to bring the suiUSDe stablecoin to the market. This move is part of the company’s wider plan to build stronger financial tools for the Sui network.

It also shows SUIG’s aim to connect traditional finance with blockchain growth. According to Chairman Marius Barnett, SUIG wants to create a base for a “SUI Bank” that would act as a central hub of liquidity and link both investors and developers to the stablecoin market.

SUIG has also shared that some of the revenue from the suiUSDe stablecoin and another token called USDi will go into building its treasury. This plan is meant to make the company stronger over time. It is also aimed at giving lasting value to its shareholders.

How does Ethena strengthen the project?

Ethena brings its experience from creating the successful USDe stablecoin, which is now one of the largest digital dollar assets in the market. By using the same approach on Sui, Ethena gives the suiUSDe stablecoin a strong foundation for earning yield and keeping liquidity.

This makes the new token more reliable. It also helps support the growth of the Sui network. Analysts say Ethena’s system makes the launch more trustworthy because it has already shown success on exchanges and in DeFi applications.

Through this partnership, Sui gets access to proven technology. At the same time, SUIG can expand its chances to earn revenue. The collaboration benefits both the network and the company.

What other products are planned alongside suiUSDe?

Along with the suiUSDe stablecoin, SUIG and its partners plan to launch USDi, a stablecoin that does not generate yield and is backed by BlackRock’s USD Institutional Digital Liquidity Fund. USDi is designed for users who prefer stability without taking on yield risks.

This gives the Sui network options for different types of investors. Both tokens together aim to expand the blockchain’s financial tools. Together, the suiUSDe stablecoin and USDi increase the choices available on the Sui blockchain.

Experts say having both tokens could bring in users who prefer safety as well as those looking for yield. This dual approach makes the network more versatile. It also strengthens Sui’s position in the stablecoin market.

Also read: SUI Price Analysis 2025: Can Sui Reach New Heights Amid ETF Filings and DeFi Growth?

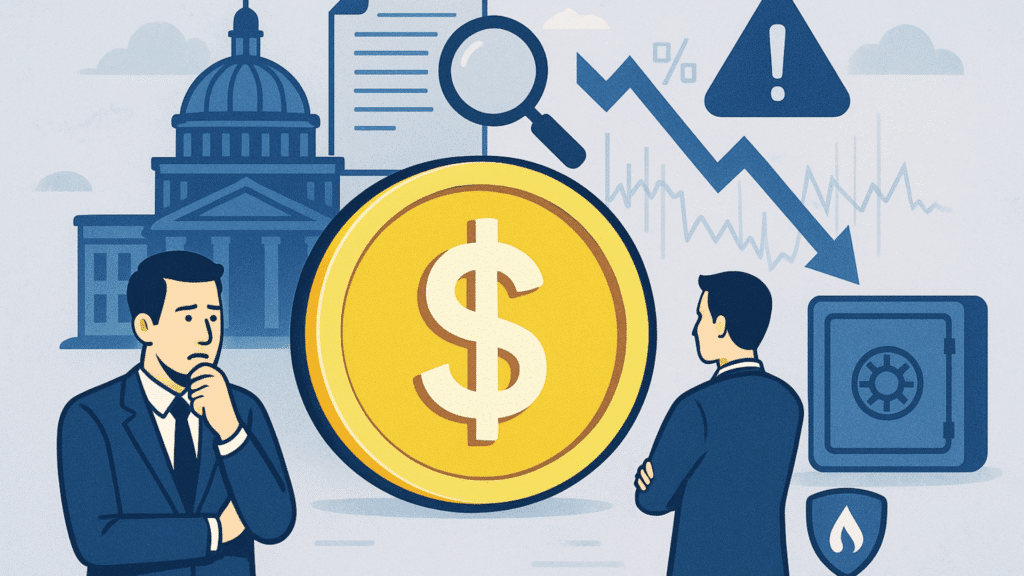

What are the risks to adoption?

Despite its potential, the suiUSDe stablecoin faces challenges from both regulators and the market. U.S. authorities are reviewing synthetic stablecoins under the GENIUS Act. The rules may require issuers to keep reserves in Treasuries.

This could make running and designing the stablecoin more complicated. There are also worries about investigations into digital asset treasury companies like SUIG. Fluctuations in the market create more uncertainty.

The suiUSDe stablecoin relies on steady demand for both the dollar token and SUI to work properly. Any drop in demand could affect its performance and revenue.

Conclusion

Based on the latest insights, the suiUSDe stablecoin is more than just a new digital dollar. It has been created together by Ethena, SUIG, and the Sui Foundation to build a strong financial system for the Sui ecosystem. If it works well, it will increase liquidity on the network.

It will also connect the growth of stablecoins directly to the demand for SUI tokens. Even with regulatory checks and market risks, this partnership has made Sui the first non EVM network to offer a native stablecoin that generates yield.

The success of this project could decide if Sui becomes a strong player in the stablecoin market. Sui is taking steps to grow its network and offer new features. People are watching to see how well the suiUSDe stablecoin works in the coming months.

Summary

The suiUSDe stablecoin is an important new token for the Sui blockchain, created by SUIG, Ethena Labs, and the Sui Foundation. It is a dollar-backed token that can earn yield and help increase liquidity on the network.

Part of its revenue will be used to buy SUI tokens, supporting the native token. Along with USDi, a stablecoin without yield, these tokens give users more choices. While rules and market changes could cause challenges, the project could make Sui stronger in the stablecoin market.

Stay updated on the development of the suiUSDe stablecoin and see how it shapes growth on the Sui blockchain, only on our platform

Glossary

SUIG: SUI Group Holdings, a publicly traded digital asset treasury supporting blockchain projects.

Ethena: A stablecoin issuer providing technology and models for suiUSDe.

Short futures positions: Financial contracts used to stabilize value

Token buybacks: The process of purchasing tokens from the market to increase demand.

Blockchain ecosystem: The network of users, applications, and tokens that operate on a blockchain like Sui.

Frequently Asked Questions About suiUSDe Stablecoin Launch

What is the suiUSDe stablecoin launch about?

The launch presents a native stablecoin on Sui to boost DeFi liquidity and support SUI token buybacks.

Who partnered to launch suiUSDe?

SUIG, Ethena Labs, and the Sui Foundation collaborated on this launch.

How does suiUSDe benefit SUI token demand?

The growth of suiUSDe increases demand for SUI tokens through buybacks.

How does Ethena support the project?

Ethena brings its proven stablecoin model and technology to ensure liquidity and reliability.

Is there another stablecoin planned on Sui?

Yes, USDi will also launch as a stable, non yield generating option.

When is suiUSDe expected to launch?

Both suiUSDe and USDi are expected to launch before the end of 2025.