This article was first published on Deythere.

- SUI Crushing Market Leaders on Hypothetical Privacy Invasion

- Mysten Labs Privacy Research Explained

- Roadmap Toward Privacy Features

- Market Rotation and Broader Trends

- Conclusion

- Glossary

- Frequently Asked Questions About Sui Privacy Research Surge

- Why did the value of SUI overtake Bitcoin and Ethereum?

- Has the research introduced the launch of a new privacy product?

- Are privacy transactions coming to Sui?

- What cryptographic techniques are involved?

- Does this affect institutional interest?

- References

The Sui privacy research wave has taken the SUI token into the limelight early this year as the native asset of the Sui blockchain outperformed major blockchains including Bitcoin and Ethereum.

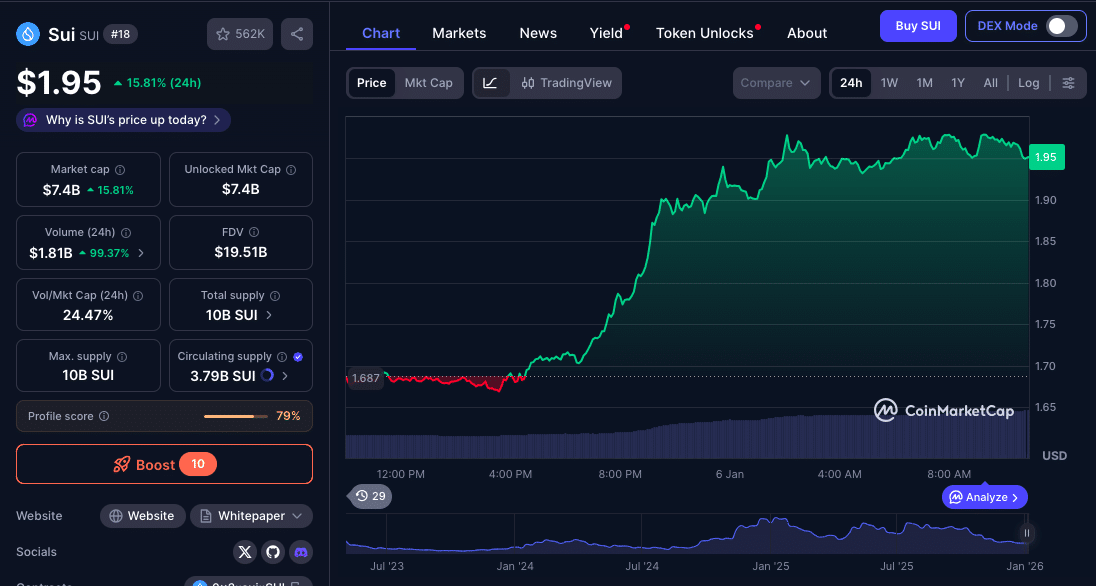

SUI recently recorded a 15% increase, far exceeding what Bitcoin or Ether had done at that point. This rise was driven not by a product release, but by a research paper from Mysten Labs which proposed a possible design for incorporating privacy preserving technologies in present blockchain systems.

The market read this as a sign of increasing desire for financial privacy functionality, and interest in the future development plans of Sui and what it could mean for bringing more privacy into blockchain ecosystems.

SUI Crushing Market Leaders on Hypothetical Privacy Invasion

Sui’s native token SUI recently rose over 15%, and became highest-performing large-caps outpacing leading cryptocurrencies. Over the same stretch, Bitcoin returned a modest 1% while Ethereum saw a 1.2% gain, suggesting that SUI wasn’t following a general market spike upwards but was rather specific to its native token development news.

Analysts and traders alike attributed this outperformance to speculation around privacy enhancements that could make Sui a more attractive platform for financial use cases where confidentiality matters.

The rally came after research from Mysten Labs, the core development team for Sui was released, demonstrating how privacy solutions could be used on account-based blockchains such as Sui, Ethereum and Solana.

The paper did not propose any new protocol, nor did it time when one will be implemented, but instead described possible frameworks to reach different degrees of privacy including basic confidentiality level, advanced sender-receiver unlinkability and stronger anonymity patterns using cryptographic techniques like zero-knowledge proof or homomorphic encryption.

Investors took this research as an indicator of future protocol evolution and that influenced capital flows into SUI.

Mysten Labs Privacy Research Explained

Mysten Labs’ research forms the foundation of the Sui privacy research campaign, focusing on strategies to build a confidentiality feature into modern blockchain design and without reliance upon legacy privacy coin designs.

The research classifies privacy into different levels, ranging from transaction amount privacy (where values are hidden) to more general sender receiver anonymity that hides linkage.

The framework stresses that achieving stronger privacy comes with a cost such as increased computational complexity; potential higher resource demands; and legal/operational considerations; an admission that being able to take advantage of these powerful features in the real world involves striking a balance between confidentiality, usability, and compliance.

During the course of 2025, coins with a focus on privacy (Zcash and Monero in particular) had demonstrated relative strength even while broader markets began to struggle, hinting at renewed interest from investors for privacy and financial freedom.

Roadmap Toward Privacy Features

Experts say the Sui privacy research boom is more than a short term market cycle, it’s supported by real development that was verified by the main code contributors.

In late December 2025; Adeniyi Abiodun, Chief Product Officer of Sui announced publicly that by 2026 Sui would release “private transactions” on the network. And privacy isn’t an option, it’s a protocol level feature, with transaction confidentiality actually woven into the core fabric of the blockchain itself, Abiodun explained.

This capabilities-based integration should enable users to transact with privacy as a default, sharing private data only where necessary and within regulatory parameters.

This protocol design approach is a departure from classical privacy coins, traditional privacy coins where privacy is bolted on through optional mixers or shielded pools.

Instead Sui intends to take privacy into its infrastructure from the outset, making it appealing for applications that value both secrecy and compliance like consumer payments or enterprise solutions and regulated finance use cases.

This ambition sets Sui at the next-generation blockchain platforms that are balancing privacy, performance, and aligning with regulation.

In addition to privacy, there are other indicators that support Sui’s network momentum. Recent data shows that Sui is controlling network activity, boasts of healthy throughput performance, processing hundreds of transactions per second and hitting application ecosystem achievements including decentralized exchange volume growth and token unlock absorptions, all in the absence of a noticeable price impact.

There is increasing interest from institutional sources which has also been indicated by applications for SUI spot exchange traded products by industry players such as Bitwise and Canary Capital, who have demonstrated a legalized appetite to gain exposure to Sui’s developing ecosystem.

Market Rotation and Broader Trends

In the second half of 2025, segments such as privacy coins and real use-case protocols have outperformed in times of macro pressure, showing a move toward assets that are defined as “digital cash” or utility tokens as opposed to pure risk on plays.

This really implies that privacy, regulation and real world use-case potential will be substantial drivers of capital allocation behaviour in 2026.

Sui’s spike is a transparent case of the power that research and capability holds in influencing market behavior, even if no product actually materializes immediately.

Conclusion

SUI’s impressive performance against Bitcoin and Ethereum in January 2026 can be attributed to Mysten Labs’ investigation into how privacy could be incorporated into blockchain structures of today.

Though No timeline for immediate deployment was provided, this research however was widely viewed in the market as strong signal around Sui’s future position of a privacy-first blockchain world.

With confirmed protocol level private transaction plans in 2026, and growing institutional interest as seen by proposed Spot SUI ETFs, Sui is proof that innovation really matters when it comes to market positioning even ahead of actual product releases.

Glossary

Privacy-preserving transactions: Blockchain transactions that hide key details (like sender, receiver, or amount) via cryptographic operations like zero-knowledge proofs.

Zero-knowledge proofs: A cryptographic technique that makes it possible to prove something without having to disclose or describe the thing.

Homomorphic encryption: Cryptographic method permitting computations to be performed directly on encrypted data, without first having to decrypt it.

Protocol-level privacy: Privacy features integrated in the blockchain protocols, not as opt-in tool tip.

Frequently Asked Questions About Sui Privacy Research Surge

Why did the value of SUI overtake Bitcoin and Ethereum?

The outperformance of SUI was attributed based on speculation that its blockchain will be able to support privacy-preserving transactions in the future, based on Mysten Labs roadmap privacy framework paper outlining anonymity tools.

Has the research introduced the launch of a new privacy product?

No. The paper outlines a privacy roadmap but did not announce any specific product or timeline. Investor hope, on the other hand, read between the lines of the research as a potential harbinger for development down the road.

Are privacy transactions coming to Sui?

Yes. Sui plans to introduce privacy at protocol level, Mysten Labs cofounder Adeniyi Abiodunverfired.

What cryptographic techniques are involved?

The paper looks at methods such as zero-knowledge proofs and homomorphic encryption as potential building blocks for privacy features.

Does this affect institutional interest?

Recent filings for SUI spot ETFs reflect increasingly institutional focus on the evolution of Sui, driven in part by privacy and scalability stories.

References

Coindesk

Whalesbook

Phemex

Mifengcha

Kucoin