The corporate world has witnessed a tectonic shift. Strategy’s massive Bitcoin Holding, now worth an estimated $80 billion, has become a benchmark for financial innovation as Bitcoin surged past $126,000 this week.

What began years ago as an ambitious bet on digital currency has evolved into one of the most profitable corporate treasury moves in modern history.

From Bold Bet to Boardroom Blueprint

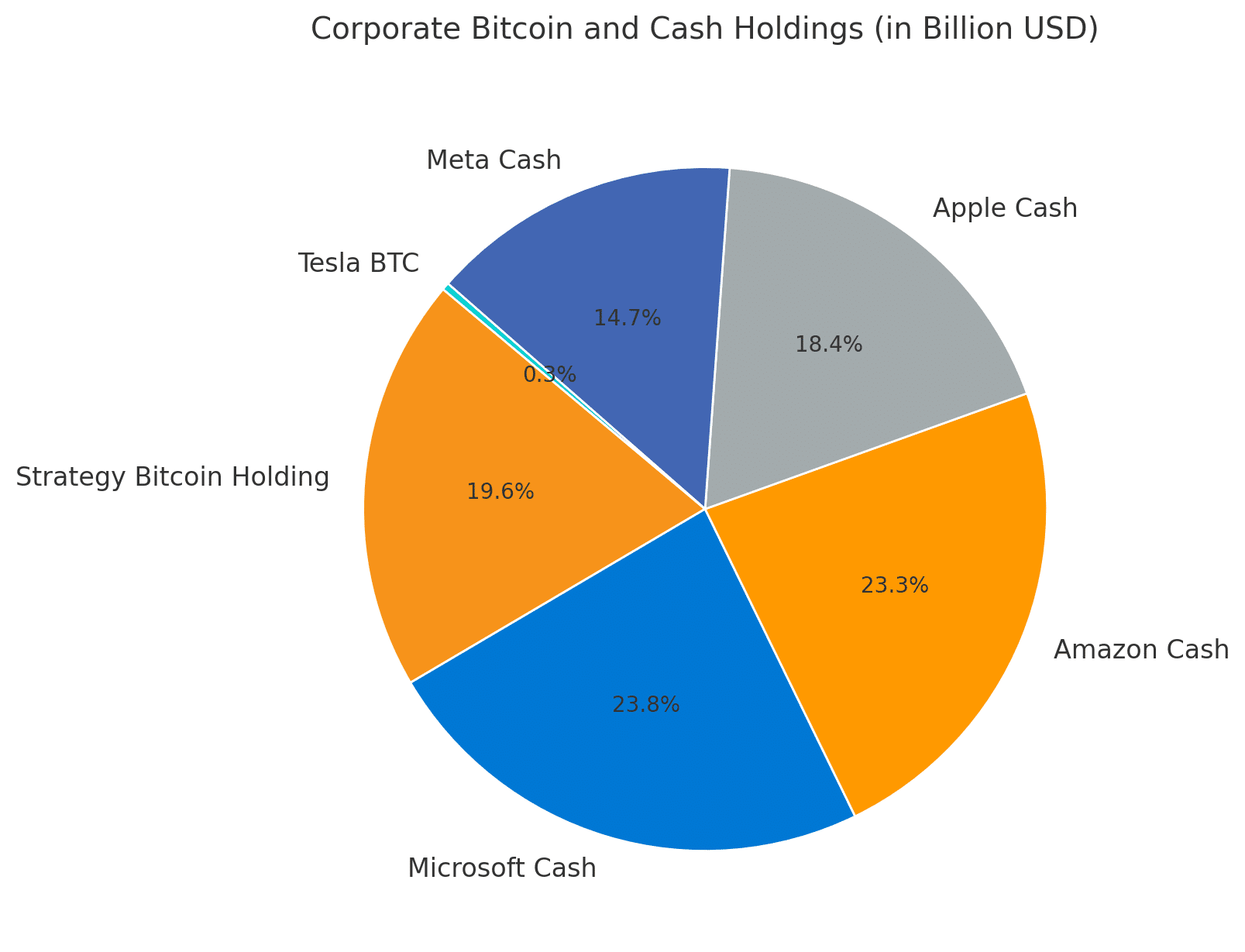

With 640,031 BTC locked in its reserves, Strategy’s Bitcoin Holding now ranks among the largest asset piles owned by any publicly traded company. This figure even edges closer to the liquidity reserves of Amazon and Microsoft, long considered the benchmarks for balance-sheet strength.

The company’s founder described Bitcoin as “the ultimate asset for a world losing trust in fiat,” a statement that once sounded extreme but now echoes across trading desks and boardrooms alike.

At an average acquisition cost of roughly $73,981 per coin, Strategy is sitting on an unrealized profit north of $30 billion. That gain alone could finance the annual operating budget of several Fortune 500 firms combined.

The Broader Ripple in Corporate Finance

Bitcoin Holding discussions are now mainstream among finance executives who once dismissed crypto as speculative noise. Market analysts note that more than 200 listed companies hold Bitcoin today, collectively owning several percent of total circulating supply. The narrative is no longer about hype; it’s about strategy, risk mitigation, and diversification.

Tesla, though quieter lately, still maintains over 11,000 BTC, worth about $1.4 billion, and continues to benefit from Bitcoin’s long-term climb. Even mid-tier fintech firms have begun quietly allocating a slice of reserves to Bitcoin Holding strategies, treating the asset as digital gold rather than a volatile gamble.

Bitcoin’s New Highs Reinforce Market Conviction

While Bitcoin briefly retraced to around $122,000 after setting a new record, the conviction behind this rally feels different from past cycles. Institutional ETFs, pension funds, and corporate treasuries are driving much of the volume, not retail traders chasing quick gains.

Bitcoin’s total market capitalization now stands at approximately $2.4 trillion, with daily trading volume surpassing $78 billion. JPMorgan analysts recently labeled Bitcoin and gold as “defensive stores of value in an age of fiscal uncertainty.” Meanwhile, investor commentary on X suggests that Bitcoin Holding by corporations could eventually rival sovereign reserves if the macro backdrop persists.

Why Bitcoin Holding Is Reshaping the Treasury Model

Traditional corporate finance relies on short-term bonds and dollar cash equivalents as liquidity buffers. But rising inflation and prolonged rate volatility have made that playbook less reliable. Bitcoin Holding, capped at 21 million coins, offers scarcity, global accessibility, and immunity to central bank manipulation, traits few traditional assets can match.

One investment strategist summed it up simply: “Holding Bitcoin today is like holding gold in 1971, the moment it detached from paper promises.” On-chain metrics back the enthusiasm: Bitcoin reserves on exchanges have dropped to their lowest levels in six years, suggesting accumulation rather than distribution.

The Final Word

Strategy’s $80 billion Bitcoin Holding is not just a financial statement, it’s a manifesto. It reflects a world where corporations are reclaiming control of their value storage, free from monetary debasement and inflationary erosion.

As Bitcoin continues to mature, Strategy’s playbook may soon become less of an anomaly and more of a model for financial resilience in the digital age.

Frequently Asked Questions

1. How much Bitcoin does Strategy currently own?

Strategy holds about 640,031 BTC, valued at nearly $80 billion based on current market prices.

2. How profitable is Strategy’s Bitcoin position?

The company bought its Bitcoin at an average of $73,981 per coin and now holds unrealized gains exceeding $30 billion.

3. Why are more firms adopting Bitcoin Holding?

Many corporations view Bitcoin as a hedge against inflation, currency risk, and the diminishing yield of fiat assets.

4. What makes Strategy’s approach significant?

It legitimizes Bitcoin Holding as a serious treasury model, proving that long-term conviction can outperform short-term caution.

Glossary of Key Terms

Bitcoin Holding: The amount of Bitcoin owned by individuals or institutions for investment or treasury purposes.

Fiat Currency: Government-issued money not backed by a physical commodity, such as the U.S. dollar or euro.

Treasury Reserve: Liquid assets held by companies to manage operations, investments, and risk exposure.

On-Chain Metrics: Analytical data derived directly from blockchain activity, used to gauge investor and market behavior.