According to latest reports, President Donald Trump has appointed Stephen Miran, a Bitcoin advocate and current chair of the Council of Economic Advisers (CEA), as a temporary member of the Federal Reserve Board. The announcement came on Thursday that he is to fill the seat vacated by Adriana Kugler who is set to step down on Friday.

- Trump’s Appointment and Confirmation Process

- Miran’s Economic Views: Tariffs, Growth, and Inflation

- Bitcoin and the Crypto Factor

- Federal Reserve Policy Direction

- Conclusion

- FAQs

- Who is Stephen Miran?

- Why did Trump appoint Miran to the Fed?

- What are Miran’s views on cryptocurrency?

- When will the Senate confirm Miran?

- What could Miran’s impact be on Fed policy?

- Glossary

Trump’s Appointment and Confirmation Process

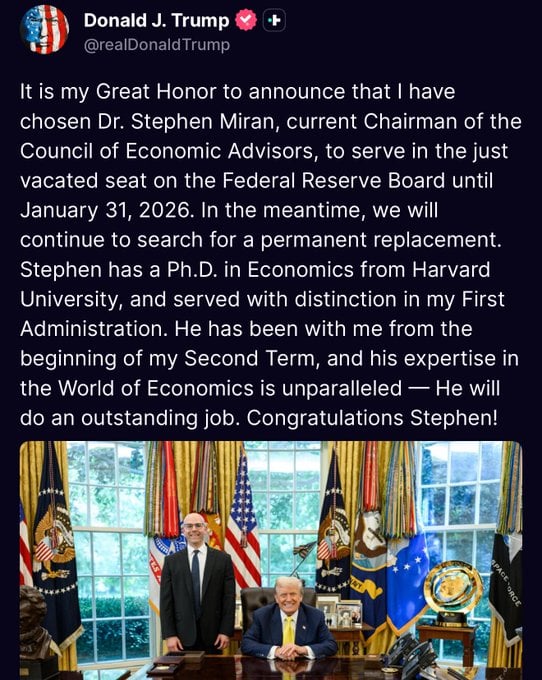

Trump’s announcement emphasized his confidence in Miran’s ability to steer policy in line with the administration’s economic goals. He said;

“It is my Great Honor to announce that I have chosen Dr. Stephen Miran, current Chairman of the Council of Economic Advisors, to serve in the just vacated seat on the Federal Reserve Board.

Miran’s term, if confirmed, will run until January 31, 2026, and will complete the remainder of Kugler’s term. But the Senate won’t act on the nomination until September. If confirmed in time, Miran could participate as a voting member in the Federal Open Market Committee (FOMC) meeting next month where markets expect the Fed’s first rate cut since December 2024.

Miran’s Economic Views: Tariffs, Growth, and Inflation

Miran is a big supporter of Trump’s economic policy, especially the use of tariffs to rebalance trade and stimulate domestic manufacturing. Unlike some Fed officials who warn against the inflationary risks of tariffs, Miran has consistently downplayed those concerns.

“President Trump was right in 2018-2019 when he said there was no inflation and no need for higher interest rates. And eventually Chairman Powell caught up to him. President Trump was right in 2021 when he said…inflation is going to be out of control. We need higher interest rates now. The Fed dismissed it as transitory,” Miran said in an interview with MSNBC, adding that history has proven Trump right.

Bitcoin and the Crypto Factor

Outside of traditional economic policy, Miran’s views on cryptocurrency set him apart from many central bankers. He believes digital assets like Bitcoin could be a catalyst for growth if incorporated into national policy under another Trump administration.

“I think crypto has a big role to play in innovation and another Trump Administration economic boom,” Miran has said.

Federal Reserve Policy Direction

Miran’s temporary appointment to the Federal Reserve Board could impact near-term interest rate decisions and longer-term debates about the central bank’s role in innovation. His views are in line with Trump’s economic policy which covers growth through deregulation, targeted trade policies and openness to new financial technologies.

If Miran participates in the September FOMC meeting, investors will be looking for signs the Fed might redirect to looser monetary conditions if economic data shows slowing growth but contained inflation.

Conclusion

Based on the latest research, Stephen Miran’s appointment as a temporary Federal Reserve governor could bode well for US economic policy; most especially for his pro-Bitcoin stance, tariff-friendly trade views, and alignment with Trump’s economic philosophy.

While his tenure is short-term, the policies and perspectives he brings could have a lasting impact on both the Fed’s monetary policy and its relationship with the crypto space.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

Stephen Miran, a Bitcoin advocate and chair of the Council of Economic Advisers, has been appointed by President Donald Trump as a temporary Federal Reserve governor pending Senate confirmation. He is open to crypto innovation and as a result, market watchers weigh a possible friendlier regulatory environment during his time.

FAQs

Who is Stephen Miran?

Stephen Miran is the current chair of the Council of Economic Advisers and a Bitcoin enthusiast and pro-growth economist.

Why did Trump appoint Miran to the Fed?

Trump appointed Miran to replace Adriana Kugler and to align Fed decision making.

What are Miran’s views on cryptocurrency?

Miran sees crypto as a driver of innovation and economic growth especially under a Trump administration.

When will the Senate confirm Miran?

The Senate will review the nomination after it gets back in September.

What could Miran’s impact be on Fed policy?

His approach might mean more openness to crypto regulation and maybe potentially influence rate cuts.

Glossary

Fed Board: The U.S. central bank’s governing body.

FOMC: The Fed’s interest rate and monetary policy setting committee.

CBDC: Central Bank Digital Currency. Government-backed digital money.

Tariffs: Taxes on imported goods to protect domestic industries or adjust trade balances.