This article was first published on Deythere.

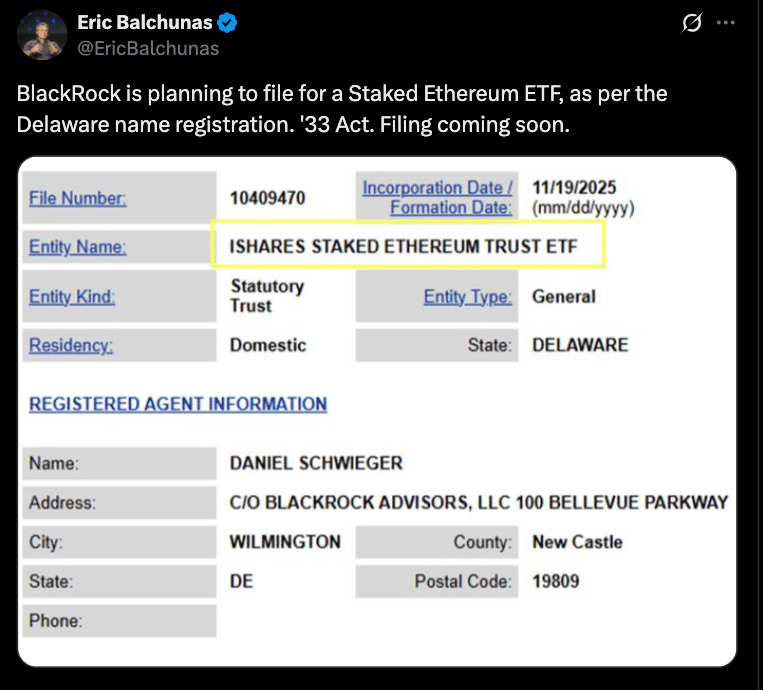

BlackRock has registered a new Delaware-based entity set to bear the name iShares Staked Ethereum Trust.

This action suggests that BlackRock plans to launch a “staking-enabled” Ethereum ETF, one with the potential to allow investors not only exposure to gains in $ETH’s price but staking rewards as well.

While BlackRock has yet to register the full offering of the Staked Ethereum ETF with the SEC, market observers take the Delaware filing as a clear early signal that the asset manager is indeed entering staking-backed crypto products in earnest.

What Does the BlackRock Registration Mean?

The filing in Delaware is a registration of a statutory trust, which is an often-used first step for ETFs.

The filing was submitted by BlackRock managing director Daniel Schweiger, who previously filed for the first iShares Ethereum Trust (ETHA), sources reported.

The filing doesn’t mean BlackRock will definitely register a public SEC product but it serves as the legal vehicle to get a staking-focused product going.

Such a trust structure is standard for crypto ETPs, industry watchers observe. Though the name “Staked Ethereum Trust” heavily hints at staking, the actual ETF prospectus, including how rewards would get passed on to shareholders, has not been circulated publicly.

BlackRock’s Change of Heart on Staking

BlackRock’s decision is a major break. When it debuted its iShares Ethereum Trust (ETHA) in July 2024, BlackRock specifically said the fund wouldn’t stake ETH. The logic was regulatory and operational complexity..

However, in July 2025, BlackRock filed with Nasdaq to change the rules of ETHA so that some of its ETH assets could be staked through authorized providers.

The request for that rule change was made under Rule 5711(d) of Nasdaq, governing commodity-based trust shares. The new Delaware trust appears to take it one step further, rather than converting ETHA, BlackRock could create another product entirely that is solely focused on staking.

Regulatory Context and SEC’s Role

Adding staking to an ETF is not trivial. Regulatory oversight, and the SEC in particular, must weigh issues like how validators are chosen; how rewards get distributed; liquidity; and slashing risk.

In March 2025, the SEC green-lighted a rule change to allow staking for ETFs, via qualified staking providers. But SEC then deferred a decision on BlackRock associate staking changes, lengthening its review period to October 30, 2025.

The SEC’s cautious stance is saying that issuing a regulated product involving staking should require heightened scrutiny due to the novelty and risk evidence associated with staking.

Why It’s Important for Ethereum Investors

If BlackRock is able to bring a Staked Ethereum ETF to the market, it’ll change how institutional and retail investors get staking rewards.

Instead of staking ETH themselves, investors could buy a regulated product that gets them exposure to staking in something they know and understand.

Ethereum staking rewards currently amount to approximately 3.95% annually, according to the latest figures. A staked ETF can also make ETH a “yield plus” asset, more than just a bet on price appreciation.

In addition, this product may allow BlackRock to strengthen its lead in the increasingly popular Ethereum ETF market. ETHA is already one of the three largest Ethereum ETFs, and a staking version could appeal to yield-seeking investors who don’t want the trouble of running validators.

What is Next Now That BlackRock Has a Staked Ethereum ETF

Before BlackRock can publicly launch, it still needs to file a Form S-1 (registration statement) with the SEC pursuant to the Securities Act of 1933. It is unclear when that next filing could come, but many expect it to arrive fairly soon, particularly now that the Delaware trust has been formed.

Meanwhile, other issuers are moving ahead as well. Companies like Grayscale, Fidelity, 21Shares and REX-Osprey are investigating staking initiated through or in conjunction with spot Ethereum ETFs.

The competition could speed up SEC decisions or affect the way BlackRock designs its product.

If approved, BlackRock’s staked Ethereum ETF would likely be a major onramp for institutional capital to access staking without needing to deal with operational overheads of self-staking.

Conclusion

BlackRock’s registration of the iShares Staked Ethereum Trust in Delaware is a noteworthy feat for Ethereum ETFs.

It’s a signal of the firm’s intention to push staking rewards into a regulated, investable vehicle, something that could see Staked Ethereum ETF adoption rise sharply.

BlackRock’s entry could speed the merging of yield generation and institutional crypto exposure, even if regulatory barriers persist.

Glossary

Staked Ethereum ETF: An exchange-traded fund that contains ETH and stakes it in order to collect network rewards.

Delaware Statutory Trust: The legal structure that fund issuers frequently utilize for ETF launches.

Form S-1: A form that companies file with the S.E.C. registering a new security.

Rule 19b-4: A Nasdaq rule that permits trust adjustments, like enabling staking.

Validator: A node in the proof-of-stake system of Ethereum that validates blocks and earns rewards.

Slashing: A punitive measure in PoS networks that penalizes bad conduct (like double signing) by slashing a stakeholder’s staked tokens.

Frequently Asked Questions About BlackRock’s Staked Ethereum ETFs

Has BlackRock officially launched its Staked Ethereum ETF?

Not yet. BlackRock has filed a statutory trust in Delaware but plans to have not yet filed the registration statement with the SEC.

Will BlackRock’s existing ETHA ETF stake ETH?

BlackRock submitted a rule change for the Nasdaq in July 2025 to make it possible for ETHA to stake their ETH by way of approved providers. But the new Delaware trust indicates that a different staking product may be introduced instead.

Why does the S.E.C. care about staking in E.T.F.s?

With Staking, operational and custody risks are introduced and there are reward distribution as well as validator selection concerns that the regulators at SEC will look at very carefully.

What would the return be for investors investing in a staked Ethereum ETF?

Ethereum staking returns are currently around 3.95 percent annually, but real yield varies based on protocol factors and the performance of the staking provider.

When might this ETF come to market?

Timing is uncertain. BlackRock must file an S-1 registration with the S.E.C. Analysts believe this is likely to occur imminently but are not positive it will be approved.

References

Securities and Exchange Commission