Stablecoins have quietly taken center stage again. In the third quarter of 2025, on-chain transfer activity reached a staggering $15.6 trillion, setting a fresh record for the sector. That figure alone could make anyone believe stablecoins are taking over global payments. Yet beneath the surface, the story is more layered, because most of that movement wasn’t driven by humans.

Roughly 71 percent of all stablecoin transfers came from bots and automated trading systems, according to data from on-chain analytics. The remaining 29 percent belonged to regular users, internal smart contracts, and smaller exchange operations.

Even so, the quarter wasn’t just about machines. It also marked a meaningful rise in retail-sized transfers under $250, showing how individuals are starting to use stablecoins beyond speculation.

Automation Dominates, But at What Cost?

Much of today’s stablecoin activity is powered by automation. Bots handle market-making, arbitrage, and high-frequency transactions across different exchanges and chains. They’re relentless, moving billions around the clock.

Illya Otychenko, an analyst familiar with the data, noted that “algorithmic trading accounts for most of the throughput, some of it is healthy liquidity flow, some of it is just noise.” He added that bots can run thousands of transactions a day, inflating total volume while masking how much actual economic value is being exchanged.

Around 20 percent of total activity came from what analysts call “non-bot transfers”, a category that includes ordinary users and mid-sized entities. Another 9 percent were smart contract calls and exchange back-end movements, where stablecoins simply rotate between wallets.

This heavy automation highlights a curious paradox: stablecoins are thriving, yet much of the traffic may not represent genuine adoption.

The Rise of the Retail User

Beyond the algorithms, something more organic is happening. Smaller, human-driven transfers have surged to record levels. Transactions below $250 spiked during Q3, pointing to new patterns in how people use stablecoins.

Many of these smaller transfers still tie back to trading, moving assets between wallets and exchanges, but the narrative is shifting. Analysts say a growing portion involves remittances, cross-border payments, and everyday transfers, hinting that stablecoins are beginning to touch real lives, not just crypto portfolios.

“Stablecoins are slowly turning into digital dollars for emerging markets,” said Otychenko. “People are learning to use them the way they use cash apps or online banking.”

Net Inflows Show Renewed Demand

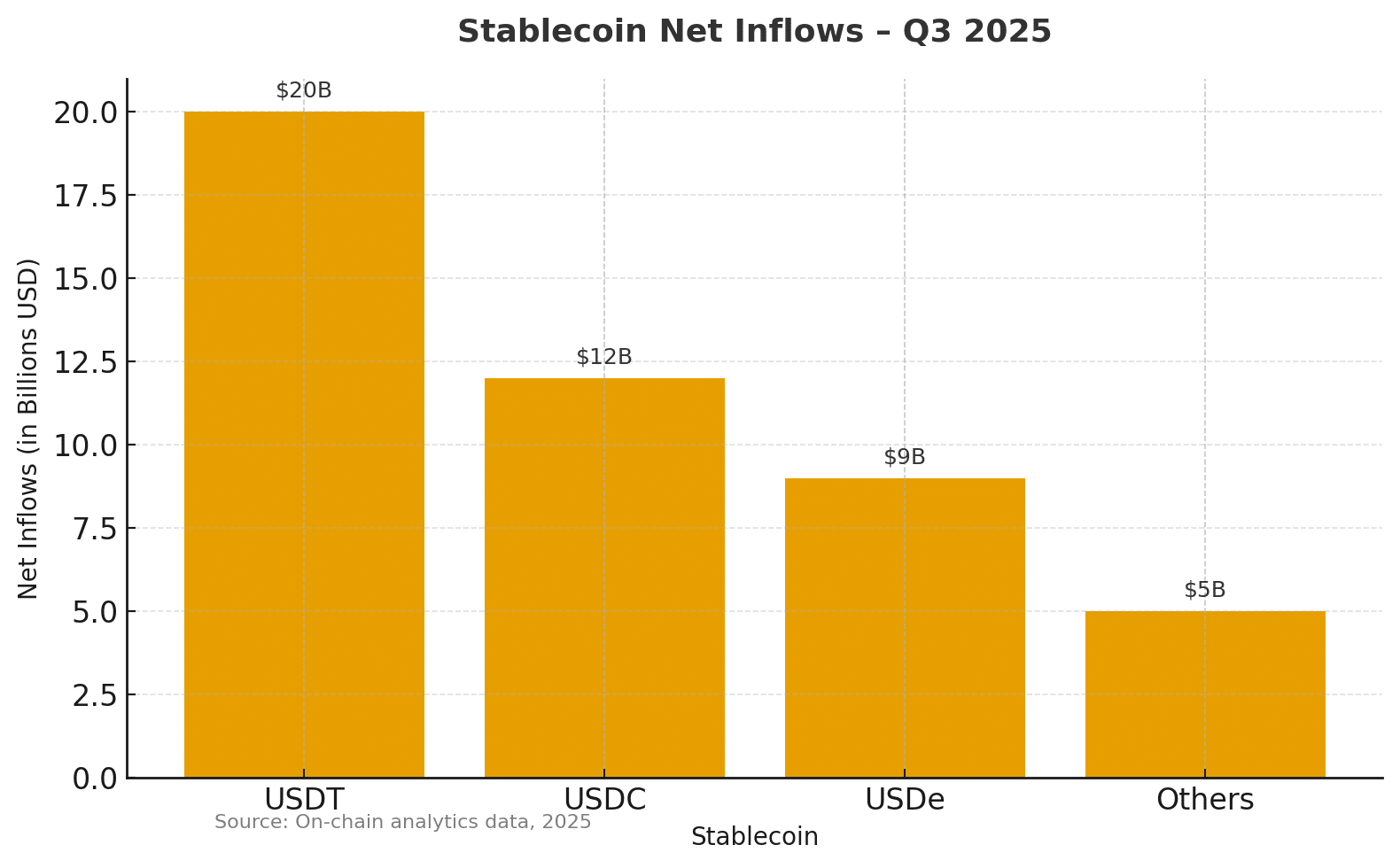

Stablecoin circulation also grew fast. Net inflows, the difference between tokens issued and redeemed, rose by $46 billion during the quarter. USDT dominated with roughly $20 billion of new issuance, followed by USDC at $12 billion and USDe at $9 billion.

This surge signals confidence in the underlying peg mechanisms and the broader demand for dollar-linked assets. For many, stablecoins are a refuge from volatility in native crypto markets, a parking spot between trades or a stable payment rail for global users.

A Turning Point for the Stablecoin Market

This quarter may go down as a turning point. Record volumes show the scale of stablecoins as infrastructure, but they also raise a deeper question: how much of this ecosystem reflects real financial utility versus algorithmic noise?

If bots continue to dominate, regulators may tighten scrutiny. They want to know whether stablecoins serve as legitimate payment tools or speculative instruments fueling synthetic volume. Either way, the line between trading liquidity and real economic use is blurring fast.

The surge also reveals a balancing act between efficiency and authenticity. Automated systems make stablecoin markets liquid, but true growth depends on human participation and trust.

Conclusion

The stablecoin market is no longer a side story in crypto. It’s the backbone of the system, moving $15.6 trillion in just three months. Yet that number hides two worlds running in parallel: the automated engine room run by bots, and the quiet rise of retail users discovering the utility of digital dollars.

The next phase will decide which side defines the future. Are stablecoins destined to be tools of trading machines, or the global currency rails of everyday users? Q3 2025 was the loudest signal yet that both realities are now colliding.

Frequently Asked Questions

Q: Why are bots responsible for most stablecoin transfers?

Bots automate arbitrage, liquidity balancing, and high-frequency trades. They can execute thousands of transfers per hour, driving up total volume.

Q: What are retail transfers and why do they matter?

Retail transfers are small-value transactions, often under $250. They reveal how individuals, not just traders, are beginning to use stablecoins for daily transactions.

Q: Which stablecoins lead the market?

USDT remains the largest, followed by USDC and the fast-growing synthetic asset USDe. Together, they make up most of the transfer volume.

Q: Is the $15.6 trillion figure a sign of mass adoption?

Not entirely. While adoption is increasing, a big share of that figure comes from automated trading and internal exchange movement rather than human-driven usage.

Glossary of Key Terms

Bot Activity: Automated trading actions that execute high-frequency or arbitrage strategies without human input.

Retail Transfer: A smaller, human-driven stablecoin transaction typically used for payments, remittances, or transfers.

Net Inflows: The net amount of newly issued stablecoins after accounting for redemptions, reflecting user demand.

Arbitrage: The strategy of profiting from small price differences across multiple markets or exchanges.

Synthetic Stablecoin (USDe): A non-collateralized stable asset that maintains its peg using algorithmic mechanisms rather than reserves.