This article was first published on Deythere.

- What Stablecoins in DeFi Really Means

- How DeFi Stablecoins Grew Into a Global Payment Layer

- Why Regulators Treat Stablecoins in DeFi as System Money

- Risk and Resilience: What Students and Analysts Must Watch

- Key Crypto Indicators: How Stablecoins Fit the Bigger Picture

- The Future of Stablecoin in DeFi Beyond 2026

- Conclusion

- Glossary of Key Terms

- Frequently Asked Questions

Stablecoins are no longer the quiet background tool of crypto. In 2026, they became the foundation on which the entire digital economy operates. Every swap, every lending market, every liquidity pool, and every on-chain payment now leans on a straightforward idea: digital dollars that behave with near-perfect stability inside a volatile ecosystem. Yet very few understand how this silent layer works or why its influence keeps expanding.

It is even more odd that stablecoins now tie DeFi to the real-world in ways few expected. They lie at work across global remittances, corporate settlements, tokenized bond markets and even cross-border e-commerce systems. Governments regulate them, banks study them, developers build up around them.

The rise of stablecoins in DeFi means not simply a crypto story; it is an overall financial revolution with implications that go far beyond blockchain.

Understanding this shift is no longer optional. It has become essential for students preparing for financial careers, analysts mapping digital trends, and developers shaping the next decade of decentralized systems.

What Stablecoins in DeFi Really Means

Stablecoins in DeFi are tokens that aim to maintain a stable value, usually close to $1, while operating in open, innovative contract systems. These tokens move on public chains instead of closed bank ledgers.

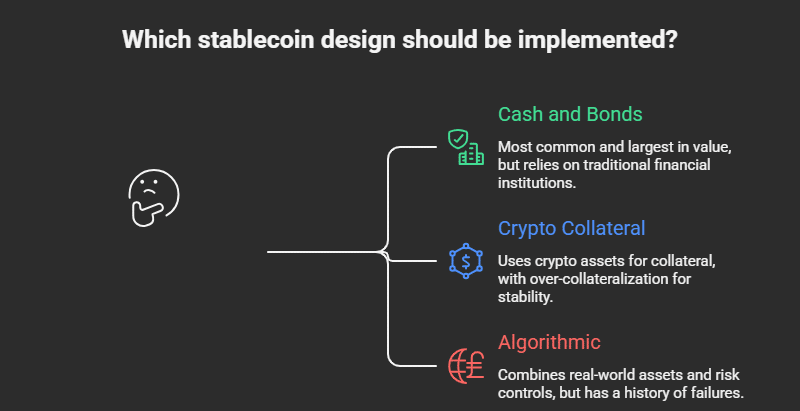

Most designs fall into three groups.

- The first group holds cash and short-term bonds in bank accounts. The token promises one redeemable unit for each dollar in reserve. An IMF study and several central bank reports describe this model as the most common and the largest in terms of value.

- The second group of DeFi stablecoins uses crypto collateral. Users lock assets, such as ether or liquid staking tokens, into smart contracts and mint new tokens that are pegged to those assets’ values. Over-collateralization and automatic liquidations protect the peg when markets move fast.

- The third group uses algorithms and mixed collateral. Some of these designs failed in past years. Others now combine real-world assets and stronger risk controls to avoid earlier disasters.

In every case, the goal stays the same. The system tries to offer digital money that feels stable inside a volatile crypto world.

How DeFi Stablecoins Grew Into a Global Payment Layer

DeFi stablecoins started as a tool for traders who needed a fast “crypto dollar.” Over a few short years, they turned into something larger.

Chainalysis tracks global usage and shows that stablecoins now account for a large share of grassroots crypto activity, especially in regions with weak local currencies or strict capital controls. Many users hold these tokens as digital savings or as a bridge for remittances.

Payment firms also see the shift. A recent briefing by a major consulting firm describes stablecoins as a new payment rail that can settle value faster and with fewer intermediaries. A global card network has even reported billions in annual settlement volume using tokenized dollars, even though these flows still represent a small slice of its total business.

The story does not stop at payments. DeFi lending markets now treat DeFi stablecoins as core collateral. Protocols pool them in large liquidity reserves, price loans with them, and use them as a unit of account. When stablecoins move, the rest of DeFi moves with them.

Why Regulators Treat Stablecoins in DeFi as System Money

As stablecoins in DeFi grow, regulators no longer see them as a niche experiment. They see something that looks close to private money.

In the European Union, the Markets in Crypto-Assets framework sets strict rules for stablecoin issuers. It defines e-money tokens and asset-referenced tokens and demands strong reserves, clear disclosure, and firm redemption rights at par value. It also bans direct interest payments on many regulated stablecoins to reduce unfair competition with bank deposits.

Singapore’s central bank has finalized a stablecoin framework for single-currency tokens pegged to the local dollar or G10 currencies. It will require 100 percent backing by high-quality liquid assets and tight governance standards when it takes full effect.

The BIS warns that many stablecoins still perform poorly as money because they lack strong backstops and clear legal status. Yet it also notes that cross-border flows of these tokens now influence remittances and short-term dollar funding.

This mix of concern and adoption explains why stablecoins in DeFi sits in the same policy bucket as bank money and payment systems.

Risk and Resilience: What Students and Analysts Must Watch

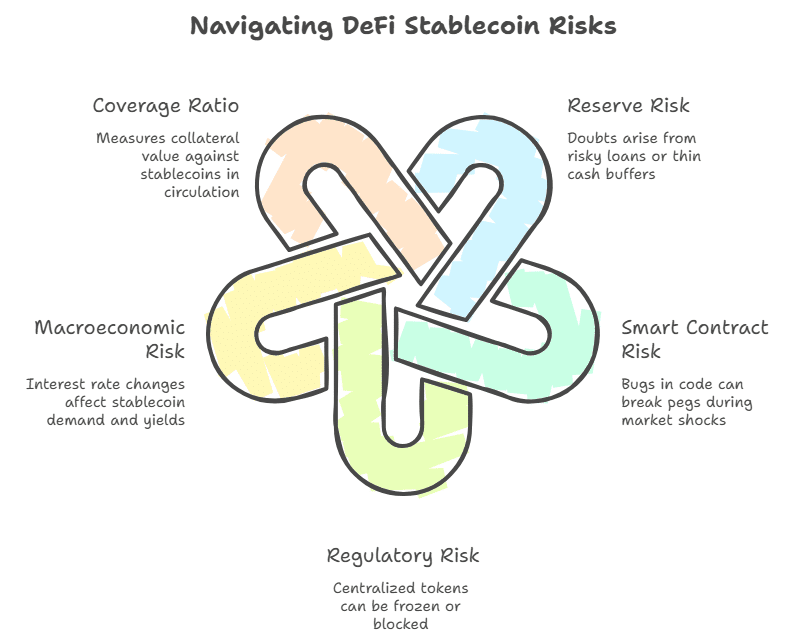

Stablecoins in DeFi do not eliminate risk. It shifts and reshapes it. Serious readers track at least four kinds of risk.

- The first risk comes from reserves. If a fiat-backed token holds risky loans or thin cash buffers, a stress event can trigger doubts. A recent downgrade of one large issuer’s reserves shows how quickly confidence can change when holdings tilt toward volatile assets.

- The second risk lies in smart contracts. DeFi stablecoins run on code that may contain bugs. A single flaw in collateral auctions or price feeds can break a peg during a market shock. Security audits and formal verification lower this risk, but never remove it.

- The third risk lies in regulatory and censorship issues. Many centralized tokens can freeze addresses or block transfers if ordered to do so. This feature helps law enforcement, but it also raises concerns about open finance.

- The fourth risk links back to macro conditions. A BIS paper shows how stablecoin flows into short-term government debt can affect yields. When interest rates rise or fall, demand for yield within DeFi’s stablecoin ecosystem can change, and that shift can ripple through lending and farming strategies.

Because of these links, analysts often track a simple coverage ratio.

Coverage ratio = collateral value ÷ stablecoins in circulation.

A number well above one signals a buffer. A number near one or below one signals danger.

Key Crypto Indicators: How Stablecoins Fit the Bigger Picture

To understand stablecoins in DeFi, readers also need the leading indicators that drive broader crypto markets.

Market capitalization shows the total value of a token. For DeFi stablecoins, this number reflects user trust in the peg and the issuer. Volume shows how many times the token changes hands each day and reveals how useful it is for trading and payments.

Total value locked (TVL) refers to the amount of capital held by DeFi protocols. A large share of this value comes from stablecoins used as collateral and liquidity. When TVL rises, it often signals greater demand for yield and leverage.

On-chain data adds more detail. Transaction count and speed show how well a chain handles real use. For example, public dashboards report that one well-known high-speed chain can process thousands of transactions per second with low fees. This capacity attracts traders who want fast swaps between DeFi stablecoins and other tokens.

Social sentiment also matters. In community channels, many users debate the future price potential of innovative contract platforms and related tokens. Some compare long-term growth on high-speed networks to the steady role of stablecoins in DeFi, which settles trades there. This discussion helps show how payment-like tokens and volatile assets share the same infrastructure but play very different roles.

Together, these indicators help students and analysts see how DeFi stablecoins sit in the center of a much wider system.

The Future of Stablecoin in DeFi Beyond 2026

Looking ahead, most experts do not expect stablecoins in DeFi to disappear. Instead, it will likely split into transparent layers.

Regulated fiat-backed tokens may dominate card payments, payroll, and bank-level settlement. Central banks continue to explore digital forms of their own money, yet many reports still expect private stablecoins to handle a share of cross-border flows, at least in the medium term.

On the other hand, DeFi stablecoins will continue to serve as native assets for permissionless lending and liquidity. Some projects now test pegs linked to inflation indexes or mixed baskets, to reduce long-term dependence on any single national currency. Researchers and developers debate these models in open forums and technical papers.

The outcome will shape not only traders but also how everyday users move value across borders. For now, one lesson stands clear. Anyone who wants to understand modern digital finance must first learn how stablecoins in DeFi work, where their risks sit, and how their growth might change the next decade of money.

Conclusion

Stablecoins began as a workaround for traders who needed a fast digital version of the dollar. In 2026, they have become something far more powerful: a common language that links on-chain code to real-world financial systems. This rise does not mean the work is complete. It marks the beginning of a more profound transformation where programmable money and traditional finance must learn to operate together.

Risk, regulation, liquidity, and technology will shape this evolution, but the direction is clear. Stablecoins in DeFi are becoming a global settlement layer that touches everyday users as much as market professionals. Anyone preparing for the future of finance should study how these tokens grow, adapt, and recover under stress. The next decade will not be defined by price charts alone. It will be shaped by how well societies learn to trust or question digital forms of money.

In the end, stablecoins challenge a simple idea: what should money look like in a borderless digital world? Those who follow this question with curiosity and discipline will gain an edge in understanding tomorrow’s financial systems.

This article is for informational purposes only and does not constitute financial advice. Readers should conduct their own research before making any investment decisions.

Glossary of Key Terms

Stablecoins in DeFi: Digital tokens with fixed value but built on an open contract platform characterized by independence and self-evolution. It is regularly equal to 100 USD for one USDT.

DeFi stablecoins: Stablecoins that integrate deeply with decentralized lending, trading, and liquidity protocols and often serve as base collateral.

Collateralization ratio: The value of assets backing a stablecoin divided by the value of tokens issued. A higher ratio indicates a larger buffer.

Total value locked (TVL): The total amount of assets locked in DeFi protocols, often measuring dollars. It reveals the magnitude of this field and is a common metric for an industry-wide review of all tokens within it collectively.

On-chain metrics: Data directly derived from blockchains, like the number of transactions, addresses, and costs, can be used to understand true network activity.

Regulated stablecoin: A token that meets the formal rules such as MiCA or MAS framework as well as providing easily understood rights of redemption.

Frequently Asked Questions

How do DeFi stablecoins keep their value?

DeFi stablecoins usually hold reserves or collateral that exceed their total supply. Smart contracts manage minting, burning, and liquidations. Oracles feed prices into the system so that the code can react when markets move.

What drives regulators in their current focus on stablecoins so much?

Stablecoins move vast amounts of money each day up and down the supply chains in trading, lending and remittances. Because they act as company money, policy makers are concerned about consumer protection, money laundering and innate stability of the financial system.

Are stablecoins safer than volatile cryptocurrencies?

Stablecoins remove most price swings when they work well, but they add other risks. These include reserve quality, smart contract bugs, and sudden rule changes. A stable price does not mean a token cannot fail. Users still need careful due diligence.

How can students and analysts begin studying Stablecoins in DeFi?

They can read official regulations, central bank studies, and technical documentation. Good starting points include MiCA summaries, MAS guidance, IMF reviews, BIS working papers, and on-chain dashboards from explorers and analytics firms.

References

Bank for International Settlements