From Volatility to Reliability: How Stablecoins Shape the Future of Finance

- Why Do Stablecoins Matter in a Fragmented Financial World?

- The Regulatory Path: Can Safety Be Scaled?

- A Digital Dollar Without Borders: Global Remittances and Emergency Assistance

- Trust by Design: Technology’s Impact on Stability

- Conclusion: Stablecoins are not just digital dollars, but digital guarantees.

- Frequently Asked Questions

As global economies grapple with inflation, debt crises, and financial fragmentation, a new candidate for economic stability is gaining traction: stablecoins. Unlike volatile cryptocurrencies like Bitcoin, stablecoins are tied to fiat currencies or physical assets, most often the US dollar, resulting in a digital financial instrument that combines the speed of blockchain with the stability of traditional money.

What distinguishes them, however, is not only their design. It is their rising role in maintaining financial stability across borders.

Stablecoins are no longer only a blockchain experiment. They are growing as a strong pillar in both emerging and mature economies, providing easier cross-border transactions, quicker settlements, and transparency backed by cryptographic assurance.

The International Monetary Fund (IMF) stated in its 2024 digital asset briefing that “when properly regulated, stablecoins can help enhance payment stablecoin safety and financial inclusion.”

Why Do Stablecoins Matter in a Fragmented Financial World?

Traditional financial systems are sluggish, expensive, and frequently exclusionary. Wire transfers might take days. Remittance fees significantly reduce migrants’ incomes. In areas with little financial infrastructure or volatile currencies, acquiring a secure store of value is practically difficult. Here’s where stablecoins come in.

Stablecoins run continuously because they are based on decentralized blockchains. They enable direct peer-to-peer transactions with no middlemen, lowering settlement risk. More critically, they provide financial stability in turbulent settings. For example, in countries with significant inflation, such as Argentina or Nigeria, stablecoins tied to the dollar provide a dependable option for saving and trading.

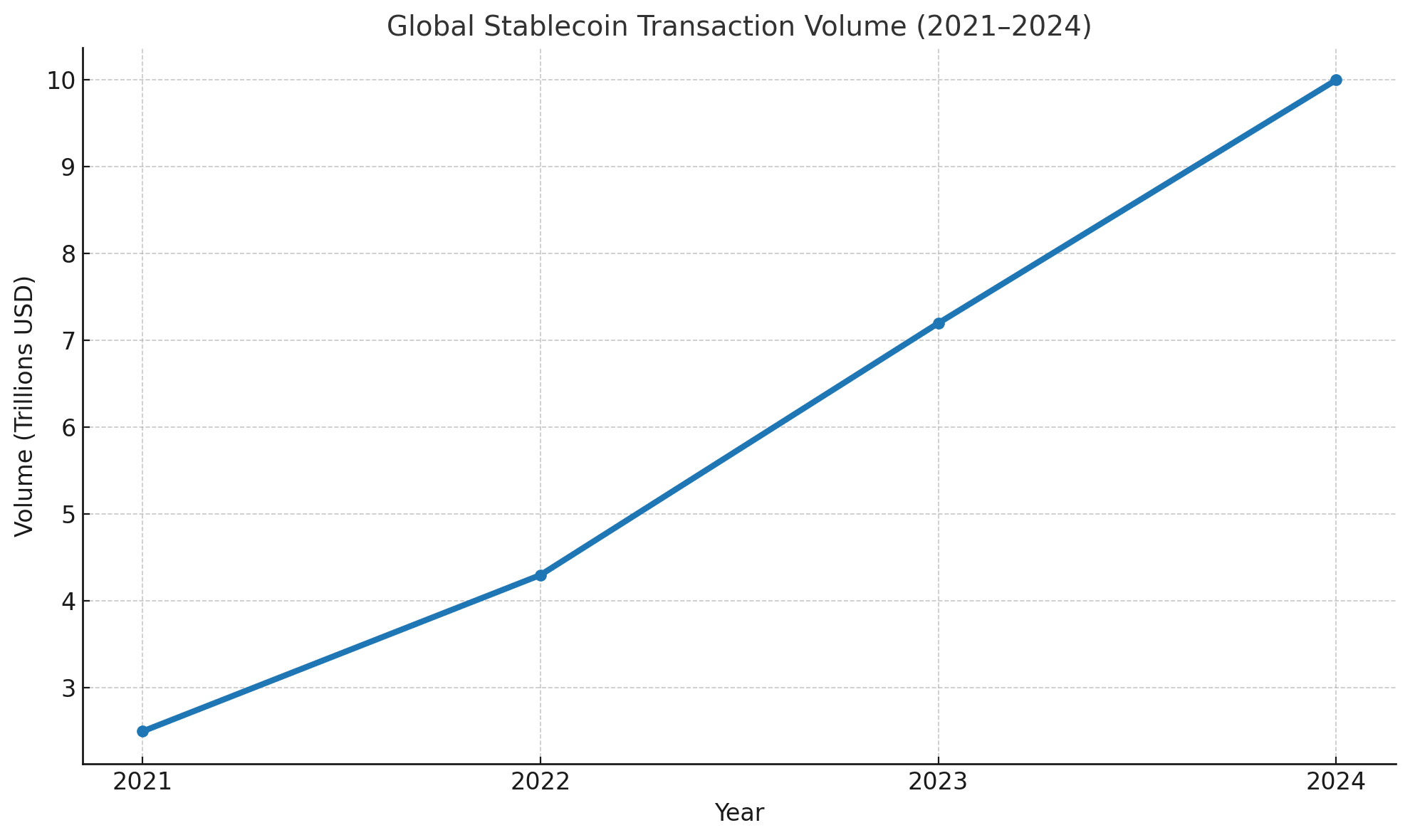

However, even in mature economies, stablecoins help to minimize capital market friction. Stablecoins allow institutional investors to clear and pay transactions very instantly, considerably reducing counterparty and operational risks. Chainalysis data show that stablecoin transactions in 2024 will top $10 trillion worldwide, a 300% increase from 2021.

The Regulatory Path: Can Safety Be Scaled?

Despite their potential, stablecoins continue to raise concerns about reserve transparency, technological weaknesses, and systemic risk. Without sufficient regulation, the mechanisms used to ensure stablecoin safety might be abused, exploited, or even cause financial instability.

To combat this, governments are stepping up regulation. The United States approved the GENIUS Act in early 2025, requiring reserve disclosure, limitations on algorithmic stablecoins, and stress testing of stablecoin issuers. Europe responded by amending MiCA (Markets in Crypto-Assets Regulation), which established explicit capital and governance rules for stablecoin operators.

These frameworks reflect more than just bureaucracy; they are crucial to public confidence. “Stability must be programmable, but also verifiable,” one central banker stated at this year’s BIS Innovation Summit. That verification is accomplished through transparent audits, third-party reserve attestations, and blockchain-based solvency proofs.

A Digital Dollar Without Borders: Global Remittances and Emergency Assistance

One of the most potential uses of stablecoins is for remittances and emergency help. According to the World Bank, about $800 billion in remittances are transferred each year, with an average cost of 6%. Stablecoins can lower this to less than 1%, providing billions of dollars in additional income to low- and middle-income people.

Furthermore, stablecoins have become instruments of financial diplomacy. During the crisis in Ukraine and natural catastrophes in Turkey and Morocco, NGOs and diaspora groups utilized dollar-pegged stablecoins to rapidly and openly transfer donations across borders. In many situations, these transactions came in hours rather than days, with complete on-chain transparency.

This has drawn the attention of governments and institutions. The United Nations Development Programme (UNDP) is currently investigating stablecoin incorporation into its humanitarian procedures. Central banks are keeping a careful eye on digital currencies, which provide new levers for financial inclusion and resilience.

Trust by Design: Technology’s Impact on Stability

Stablecoins’ competitive advantage stems from its architecture. They are translucent by default. Every transaction is recorded immutably on public ledgers, making fraud more difficult and compliance easier. Smart contracts may automate compliance triggers, impose limitations, and conduct real-time audits.

Projects such as RLUSD (by Ripple) and PYUSD (by PayPal) have incorporated reserve reporting using third-party oracles and blockchain proofs. Meanwhile, Circle, the USDC issuer, produces monthly reserve attestation reports in collaboration with licensed financial custodians.

This transparency, however, must be balanced with user safety. Experts caution that not all stablecoins are made equally. Algorithmic versions, like as the notorious TerraUSD, failed in 2022 owing to poor design and a lack of protections. The message is clear: stablecoin safety is dependent on governance as much as technology.

Conclusion: Stablecoins are not just digital dollars, but digital guarantees.

Stablecoins are becoming a staple of modern finance, not because they resemble fiat currencies, but because they enhance them. They add automation, transparency, and speed to an otherwise slow financial system. They provide both convenience and security. In times of turmoil, they may be a lifeline for millions.

However, this potential is contingent on the proper mix of innovation and regulation. Stablecoins, if constructed on solid foundations like as clear legal status, transparent reserves, and sturdy technology, have the potential to become one of the safest digital assets available.

A recent IMF paper states, “The stablecoin of tomorrow may become the payment rail of today, if we design it with the stablecoin safety of the entire financial system in mind.”

Frequently Asked Questions

1. Are stablecoins safer than cryptocurrencies like Bitcoin?

Yes, stablecoins are designed to maintain a stable value, often pegged to fiat currencies like the U.S. dollar, which makes them less volatile than Bitcoin.

2. How are stablecoins regulated?

Major economies have introduced regulations like the U.S. GENIUS Act and EU’s MiCA to ensure stablecoin issuers maintain transparent reserves and meet risk compliance standards.

3. Can stablecoins replace banks?

No. Stablecoins complement traditional banking by offering faster, programmable payment options. They still rely on banking infrastructure for fiat conversion.

4. What risks do stablecoins carry?

Risks include lack of reserve transparency, smart contract bugs, or regulatory non-compliance. Proper oversight and auditing reduce these risks.

Glossary

Stablecoin: A cryptocurrency pegged to a stable asset like the U.S. dollar.

Fiat Currency: Government-issued money not backed by a physical commodity.

MiCA: EU regulation for markets in crypto-assets.

GENIUS Act: U.S. legislation governing stablecoin reserves and transparency.

Smart Contract: A self-executing contract with terms directly written into code.

Blockchain: A decentralized digital ledger that records transactions securely.