This article was first published on Deythere.

A stablecoin yield meeting could arrive within days, placing U.S. crypto regulation back under a national spotlight. Policymakers are again weighing how interest-bearing digital dollars should function inside the traditional financial system, a question that continues to divide banks and blockchain firms.

The White House is reportedly considering another round of discussions with industry stakeholders. According to journalist Eleanor Terrett, banks and crypto representatives could attend conversations that may take place as early as Thursday, although no official confirmation has been issued. Reports also note that the agenda and final participant list remain unclear, underscoring the early and tentative nature of the planning.

This renewed attention reflects how quickly stablecoins have moved from trading tools to systemic financial concerns. Officials appear focused on gathering perspectives from multiple sectors before shaping formal policy, signaling a collaborative but cautious regulatory approach.

Why Stablecoins Have Returned to the Policy Forefront

Stablecoins are digital assets designed to maintain steady value, usually tied to the U.S. dollar, while enabling fast and inexpensive blockchain transfers. Their reliability has made them essential to crypto trading, decentralized finance activity, and cross-border payments.

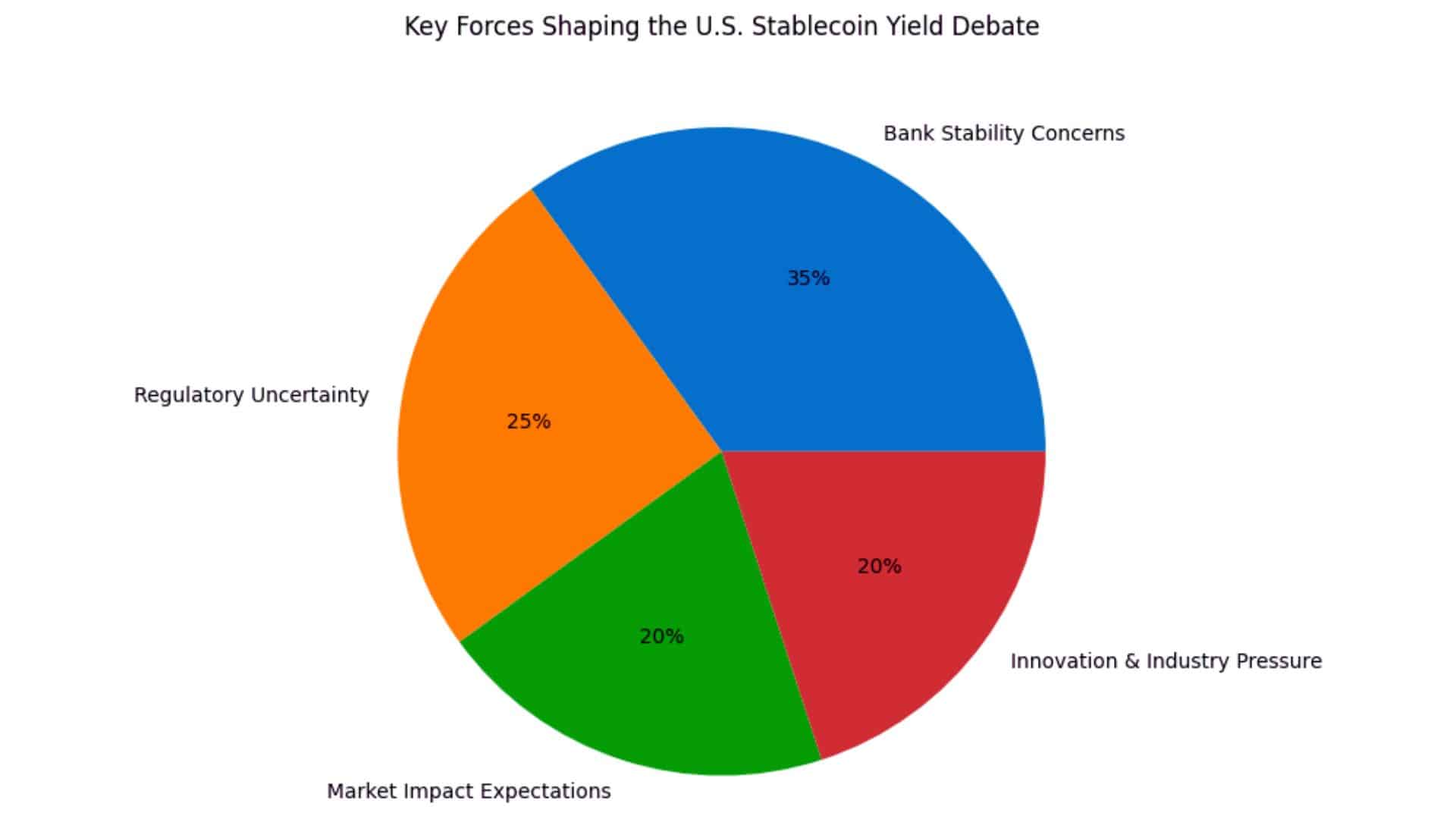

Yield features, however, have complicated their role. Once stablecoins began offering returns similar to interest, regulators started comparing them to bank deposits or money market funds. Independent reporting highlighted through recent coverage shows authorities increasingly concerned that large capital shifts into yield-bearing tokens could create stress for traditional banks during volatile periods.

A stablecoin yield meeting would therefore focus on classification and oversight. Policymakers must decide whether these products fall under banking law, securities regulation, or a new framework built specifically for digital finance. The White House appears to be exploring each path without committing to a final direction.

Stablecoin Yield Meeting Signals Broad Consultation Across Finance

Current reporting makes clear that banks and crypto representatives could attend any upcoming stablecoin yield meeting, confirming that discussions are not limited to regulators alone. This structure highlights an effort to hear competing perspectives before rules are written.

At the same time, uncertainty remains central to the story. Officials have not confirmed the meeting, and both the agenda and confirmed participants are still unknown. Analysts referenced in financial analysis suggest that this ambiguity is typical in early-stage policy coordination, where negotiation often begins before formal announcements.

The White House must balance two competing risks. Strict limits on yield could slow domestic innovation and push development overseas. Weak safeguards could expose consumers and financial institutions to instability. Inclusive consultation may offer the only workable middle ground.

Market Impact Hinges on Regulatory Clarity

Even without confirmation, the possibility of a stablecoin yield meeting is already influencing market expectations. Regulatory clarity often shapes institutional behavior more than short-term price movement. Investors, payment firms, and developers closely monitor policy tone when planning long-term strategy.

If discussions lead to clearer guidance, confidence among traditional financial institutions could strengthen. If uncertainty persists, capital and innovation may continue drifting toward jurisdictions with defined crypto rules. The White House, therefore, faces pressure not only to regulate but to do so with precision and speed.

Each prospective stablecoin yield meeting now represents more than routine dialogue. It signals how seriously U.S. leadership is treating programmable money and privately issued digital dollars.

A Defining Moment for Digital Dollar Policy

The anticipated stablecoin yield meeting illustrates a broader turning point in financial governance. Stablecoins are no longer peripheral experiments. They are becoming part of mainstream conversations about payments, liquidity, and monetary structure.

Whether the White House ultimately permits controlled yield or imposes tighter restrictions, the decision will shape global regulatory trends. The direction formed through this stablecoin yield meeting could influence how digital currency integrates with banking systems for years ahead.

Conclusion

The possible stablecoin yield meeting highlights a critical moment where innovation, regulation, and financial stability converge. With Thursday discussions still unconfirmed and key details unresolved, the White House is signaling urgency while maintaining caution.

Clear outcomes could accelerate responsible crypto adoption, while prolonged ambiguity may delay progress. The path chosen in the weeks ahead will help determine how digital dollars evolve within the world’s largest financial system.

Glossary of Key Terms

Stablecoin: A digital token designed to keep stable value, usually tied to fiat currency.

Yield: Earnings generated from holding or lending an asset over time.

Systemic risk: The danger that financial instability spreads across institutions or markets.

Regulatory framework: The legal structure governing financial products and services.

FAQs About Stablecoin Yield Meeting

What is the purpose of the stablecoin yield meeting?

It aims to examine how interest-bearing stablecoins should be regulated in the United States.

Is the Thursday meeting officially confirmed?

No. Reports mention timing, but officials have not issued formal confirmation.

Who could attend the discussions?

Banks and crypto representatives may participate alongside policymakers.

Why does regulation matter for crypto markets?

Clear rules often determine institutional adoption, liquidity growth, and long-term innovation.