This article was first published on Deythere.

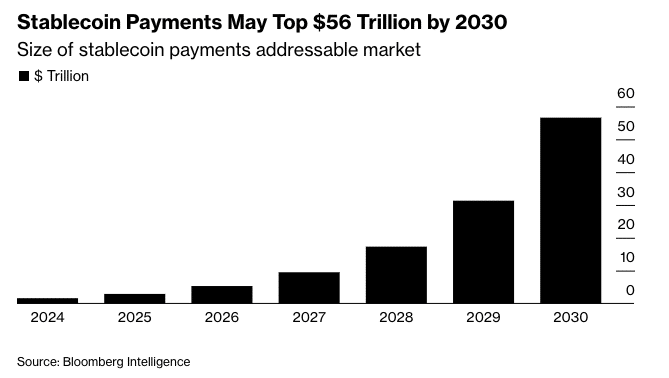

Stablecoin usage is on the rise as new data shows transaction issuance flows and adoption at an all-time high in 2026. Bloomberg Intelligence estimates that Stablecoin payment streams may exceed $56.6 trillion by 2030.

Backed by official analytics from official crypto analytics platforms, increasing institutional interest and clearer regulation in large economies, stablecoins are moving beyond crypto trading into mainstream payment and settlement systems.

Record Volumes and Market Dynamics 2025

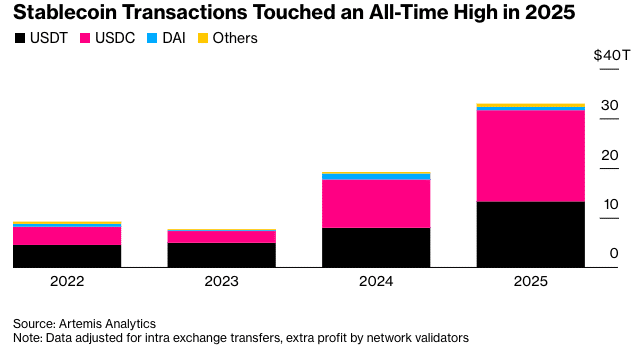

Stablecoin payment activity surged and took off in 2025 with transaction volume involving reaching $33 trillion, an 81 percent increase compared with the year before, Bloomberg Intelligence data gathered by Artemis Analytics showed.

USDC’s transaction flows were the front-runner at $18.3 trillion, USDT accounted for $13.3 trillion, with both coins making up more than 95% of global stablecoin transaction volume over the course of last year.

These numbers are indicative of rising use outside the speculative trading of stablecoins in payments systems, cross-border transfers and business settlements as they function as digital tokens representing the U.S. dollar. USDT still dominates the total market cap, but USDC is taking over as the favorite token on DeFi platforms.

Bloomberg’s $56.6 Trillion Projection Explained

Bloomberg’s prediction draws on stablecoins growing from $2.9 trillion in payment flows by 2025 to $56.6 trillion five years later by 2030.

Assuming this scale is achieved, that would imply a steady-state 81% compound annual growth rate over the next five years. This path puts stablecoins in direct competition with some of the largest global payment rails ever created.

The forecast is driven by a number of factors: rising corporate adoption for treasury services and settlement, wider spread in emerging economies with reliance on volatile local fiat currencies, continued integration with legacy financial systems.

Bloomberg’s analysis highlights how stablecoins may end up being a universally relied upon payment instrument.

Institutional Adoption and Regulatory Factors

One of the drivers behind stablecoin growth 2030 forecast is institutional use. Stablecoin-based settlement methods are being considered by major financial institutions worldwide for faster, efficient payments.

Western Union planned to release a U.S. dollar-pegged stablecoin dubbed the USDPT on the Solana blockchain as of early 2026, to be expected in the first half year.

The service is designed to improve cross-border remittance settlements, drawing on blockchain speed and a global payment network footprint in over 150 countries.

Western Union CEO Devin McGranahan explained that Solana was “the right choice” for an institutional-grade, stablecoin settlement system with his remarks emphasizing accessibility and throughput.

MoneyGram and Zelle, meanwhile, are just beginning to introduce services enabled by stablecoin in order to speed up the process of international transfers, embedding digital dollars more deeply into regular payments and business transactions.

Regulators in notable economies have provided further grounds for the move. The GENIUS Act was passed in 2025 in the US. This created a formal framework for payment stablecoins and increased institutional confidence.

At the same time, Canada and the UK have continued to drive the implementation of stablecoin frameworks as part of a broader policy trend towards integrating stablecoins into regulated finance systems on a global scale.

Emerging Market Adoption and DeFi Usage Trends

Stablecoins are becoming the currency of choice in countries with inflation or a depreciating local currency, as they provide an alternative that is pegged to the dollar and can be used to transact.

The increasing use of U.S. dollar stablecoins is in reaction to an increasingly unstable geopolitical environment, which in turn drives individuals and businesses to digital dollars for domestic and international payments, according to Artemis co-founder Anthony Yim.

CeFi adoption is strong even in the face of decentralization trends. On-chain activity revealed that USDT is used as daily, transactional money (payments in retail stores or commercial transactions), and USDC is dominant in DeFi platforms that use stablecoins for liquidity provision and position cycling.

Connecting Crypto to the Global Financial System

2026 sure seems like it’s setting up to be a significant year for stablecoins bridging the crypto market and traditional finance space.

The stablecoin market currently sits at $312 billion, with the US Treasury estimating in April that it would reach $2 trillion by 2028.

Major payment networks are building stablecoin rails into their current settlement structures, enabling cross-border payments that have been slowed by long delays and high costs associated with traditional correspondent banking networks.

Global remittance powerhouses have seen the deployment of stablecoin settlement systems as a move beyond experiments, through to practical business implementation.

The integration brings policy compliance in a number of jurisdictions to support stablecoins as digital dollar instruments as opposed to unregulated crypto tokens.

Institution-wide demand for interactive settlement and faster capital movement is increasing, providing a convenient option for firms where security and efficiency are paramount.

Conclusion

Stablecoin usage and payment flows are accelerating sharply in 2026, with Bloomberg Intelligence predicting that the total flow in stablecoins might reach $56.6 trillion by 2030.

This is supported by all-time transaction volumes, institutional adoption that’s on the rise, accommodative regulation, and increasing utilization in the developing world.

Stablecoins like USDC and USDT have already processed tens of trillions of dollars in payments, pointing to the transition from speculative crypto tools to essential global payment infrastructure.

With the world’s leading remittance companies integrating stablecoin settlement solutions and regulations evolving, stablecoins are set to play a bigger role in the future of global financial connectivity and digital payments.

Glossary

Stablecoin Payment Flows: The aggregate amount of payments made using stablecoins, usually pegged to fiat currency.

CeFi: Centralized finance in which regulated entities or platforms hold crypto assets.

DeFi: Decentralized finance, in which blockchain protocols offer financial services without the need for conventional intermediaries.

USDPT: U.S. Dollar Payment Token, a Solana network project to launch in 2026 developed by Western Union, Inc.

GENIUS Act: U.S. law to provide a legal basis for payment of stablecoins.

Frequently Asked Questions About Stablecoin Growth

What does the $56.6 trillion estimate for stablecoins mean?

It is a prediction by Bloomberg Intelligence for total global stablecoin payment flows of $56.6 trillion by 2030, with the shift being led by institutional adoption and more widespread use in payments.

What stablecoin recorded the highest transaction volume in 2025?

In 2025, transaction flows for USDC led with $18.3 trillion, with USDT’s $13.3 trillion as the next highest.

Why are stablecoins growing fast?

Stablecoin growth and demand come from institutions, cross-border payments, remittances, and additional in those economies whose local currencies are volatile.

Are stablecoins regulated?

The US has the GENIUS Act, providing a payment stablecoin legal structure, and other countries are developing regulatory structures.

References