According to the latest news reports, analyst Nate Geraci has said that once the U.S. government shutdown ends, the resolution could trigger a massive surge in approvals for crypto ETF launches, most especially the spot XRP ETF. Sharing his thoughts in a recent tweet, Geraci said; “Once the government shutdown ends, the floodgates for spot crypto ETFs will open.”

The Regulatory Shift That Cleared The Path To Progress

The U.S. Securities and Exchange Commission finally adopted some generic listing standards in September that made it a lot easier for exchanges to list commodity-based ETFs, including crypto products.

Under the old system, this would have required a separate 19b-4 filing and loads of time spent on a case-by-case review. All of this added up to a lot of extra work.

The new framework lets exchanges like NYSE, Cboe and Nasdaq just adopt standard listing rules instead. This reduces the processing time from as long as 240 days down to just 60 to 75 days which is a huge improvement.

This regulatory change has removed one of the biggest obstacles that was holding back spot XRP ETF approvals.

Also read: SEC Approval Incoming? XRP ETF Odds Soar

Filings Poised For Approval – On Hold Due To Shutdown

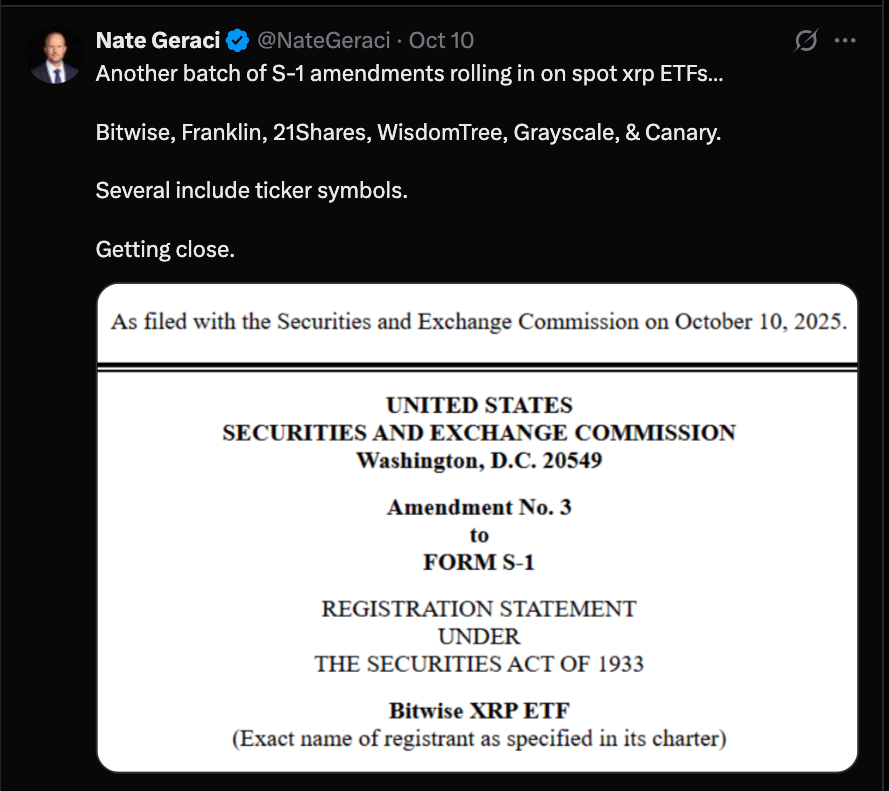

However, even with this new regulatory framework in place, it appeared the whole process still isn’t moving forward. Loads of issuers have submitted or amended spot XRP ETF registration statements (S-1/A) in the last few days. Firms like Grayscale, Bitwise, 21Shares, WisdomTree and Canary Capital are all waiting for the SEC to review them.

But, the SEC is working with a much-reduced team because of the shutdown, and as a result, routine processing, comment responses, and final sign-offs are all being held up.

In the meantime, the deadlines originally set for between October 18-25 are now pretty much seen as optional rather than set in stone, assuming that Washington doesn’t get its act together anytime soon.

Why The Flood Metaphor Is Starting To Make Sense

Geraci’s repeated metaphor about the floodgates opening once the shutdown ends isn’t just some empty talk. Industry insiders point to a few factors.

There’s a huge backlog; some experts reckon there are 16 crypto ETFs currently waiting for the SEC to make a decision.

Additionally, the regulatory terrain is now really favourable; with generic listing standards in place, the process is a lot more streamlined.

There is also a huge amount of demand from investors and institutions who are really keen to get hold of some regulated crypto exposure without the hassle of custody risk. When all these things come together; a whole lot of approvals may just come cascading.

What Happens When The Shutdown Finally Ends

Once the shutdown is over, here’s what’s expected to happen with spot XRP ETF launches: SEC teams will start working at full steam again, processing comment exchanges and all the final paperwork.

Exchanges will start listing approved funds quickly under the new framework. Issuers who included tickers in their S-1 amendments will be able to switch to full registration swiftly.

Capital will start flowing in as institutional and retail investors get access to regulated XRP exposure.

In short, the market is anticipating a whole lot of movement, possibly in a matter of days to weeks.

Also read: SEC Approves New Crypto ETF Rules Backing Nasdaq, Cboe, and NYSE

Conclusion

Based on the latest research; the spot XRP ETF opportunity might just be set up and ready by issuers. However, the final trigger is in Washington’s hands. Analyst Nate Geraci’s prediction that “the floodgates open” once the shutdown ends is the prevailing view.

With filings in place and demand waiting, the market is at the brink of a big moment; one that could change how digital assets intersect with mainstream finance.

For in-depth analysis and the latest trends in the crypto space, our platform offers expert content regularly.

Summary

Once the US government shutdown is over, a wave of spot XRP ETF approvals is expected. With regulatory rules streamlined and filings ready, the crypto sector waits for Washington to get back to full speed.

Glossary

ETF (Exchange-Traded Fund): A tradable fund on exchanges that holds assets (stocks, commodities or crypto) and tracks their value.

Spot ETF: An ETF that holds the basic asset (e.g. XRP) directly, not futures or derivatives.

S-1 Registration Statement: A filing submitted to the SEC to register a securities offering (ETF in this case).

Generic Listing Standard: A regulatory rule that allows exchanges to list certain products under pre-approved criteria instead of bespoke SEC review.

19b-4 Filing: A prior SEC process that required exchanges to file rule changes for listing new financial products (recently simplified).

Frequently Asked Questions About Spot XRP ETF Approvals

What’s different about this launch wave versus prior ETF efforts?

The regulatory change; the adoption of generic listing standards eliminates the need for customized SEC reviews, so spot XRP ETF products can be approved faster.

Can approvals happen before the shutdown ends?

Very unlikely. The SEC is only operating essential functions; non-essential processes like ETF reviews are on pause until full staffing resumes.

What should the market watch for?

Public acknowledgement letters from the SEC, S-1 statuses, announcements and exchange listing notices.

How many spot XRP ETFs are in the pipeline?

At least six major issuers: Grayscale, Bitwise, 21Shares, WisdomTree, Canary Capital and others; have active or amended filings.