This article was first published on Deythere.

Solana Hot Wallet Breach Turns Into Market Stress Test

A security breach at a leading Korean crypto exchange turned the Solana ecosystem into a stress test for market structure. After a hot wallet on the Solana network was drained of about $32 million in assets, trading in Solana based tokens on the venue changed within hours. Prices jumped, spreads widened, and Korean traders faced a market that looked very different from offshore trading.

Investigators report that the breach touched 24 assets tied to the Solana network, from DeFi platforms to meme coins. The exchange froze deposits and withdrawals and moved remaining funds to cold storage. That step protected customer balances, but it also cut off the normal flow of capital that keeps Solana-based tokens on the platform roughly aligned with global prices.

Arbitrage Freeze Creates Korean Premium

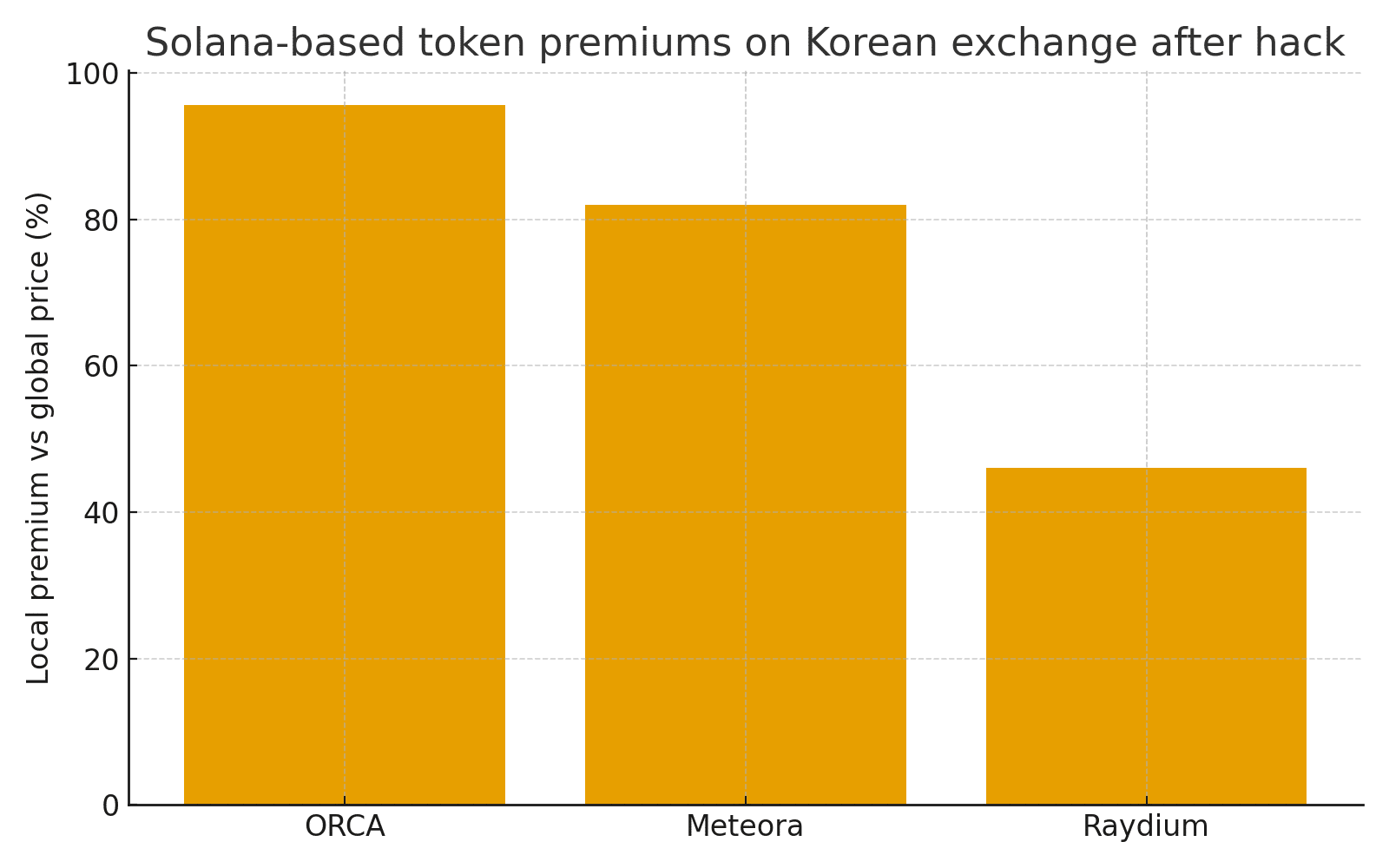

Once transfers stopped, the market disconnected from the rest of the world. Arbitrage firms that usually buy low on one venue and sell high on another could no longer move inventory. With liquidity trapped, Korean buyers started bidding more aggressively for their preferred Solana tokens, creating sharp premiums over dollar markets as some pairs traded at steep double-digit gaps.

Key Indicators For Solana Ecosystem Health

Spot volume and order book depth reveal how much demand sits at each price level, and both can thin out quickly when a hack hits Solana tokens. When liquidity providers step back, spreads widen and even small market orders can move price. Derivatives funding and futures basis then show how strongly traders are willing to pay to stay long or short, even when spot prices are clearly distorted by local factors rather than global sentiment.

On chain activity provides a second lens. Active addresses, transfer volumes, and DeFi liquidity linked to Solana based tokens help analysts judge whether a rally reflects real adoption or a venue specific shock. In this case, prices spiked mainly on one exchange while broader Solana metrics stayed relatively stable, a sign that the weakness lies in hot wallet controls rather than in the base protocol itself.

Regulatory Spotlight And Exchange Accountability

Regulators in South Korea are likely to scrutinize the breach. Local rules already treat major trading platforms as virtual asset service providers, with expectations on reserve ratios and basic risk controls. The hacked exchange has pledged to absorb the full loss from its own balance sheet, which supports user confidence but also raises questions about hot wallet design and risk limits for Solana tokens and other assets on centralized venues.

Lessons For Investors Watching The Solana Ecosystem

Exchange risk sits on top of protocol risk. Even when a blockchain works as intended, a compromise at a single platform can distort prices for Solana-based tokens and create short-lived winners and losers that have little relationship to long-term project value. Careful market participants spread exposure, monitor liquidity, and watch how exchanges and regulators respond after an incident, rather than focusing only on token narratives or headline price moves.

Conclusion

The hack that pushed Korean prices for Solana tokens to eye-catching premiums is more than a one-day headline. The event drew global attention. As investigations move forward and normal service returns, investors will watch how quickly liquidity snaps back and whether trust in both the exchange and the wider Solana ecosystem proves resilient.

If confidence holds and security controls improve, this incident may ultimately strengthen standards for how exchanges manage hot wallets and high velocity Solana markets.

Frequently Asked Questions (FAQ)

What caused the price spike in Solana ecosystem coins?

Halted deposits and withdrawals blocked arbitrage, which let local prices for Solana based tokens drift far above levels seen on global venues.

Are user funds safe after the hack?

The exchange states that it will reimburse the loss from its own reserves and that cold wallet holdings remain intact for customers.

Glossary of Key Terms

Arbitrage

Buying an asset where it is cheap and selling it where it is expensive to capture a price difference across markets.

Hot wallet

An online wallet that holds funds for active trading and withdrawals and carries higher security risk because it is connected to the internet.

Cold storage

An offline method of holding crypto assets, often in hardware or air gapped systems, to shield funds from remote attacks and exchange breaches.